Form 8958 Explained - Use form 8958 to allocate tax amounts between spouses or registered domestic partners (rdps) with community property rights, who file. Once you have completed the steps above, please complete the married filing separately allocations form 8958. Form 8958, officially titled allocation of tax amounts between certain individuals in community property states, is an internal. Learn how to use form 8958 to divide tax amounts between married filing separate spouses or rdps with community. Form 8958, also known as the allocation of tax amounts between certain individuals in community property. This form will explain to the irs.

Once you have completed the steps above, please complete the married filing separately allocations form 8958. Use form 8958 to allocate tax amounts between spouses or registered domestic partners (rdps) with community property rights, who file. This form will explain to the irs. Learn how to use form 8958 to divide tax amounts between married filing separate spouses or rdps with community. Form 8958, also known as the allocation of tax amounts between certain individuals in community property. Form 8958, officially titled allocation of tax amounts between certain individuals in community property states, is an internal.

Form 8958, officially titled allocation of tax amounts between certain individuals in community property states, is an internal. Learn how to use form 8958 to divide tax amounts between married filing separate spouses or rdps with community. Form 8958, also known as the allocation of tax amounts between certain individuals in community property. This form will explain to the irs. Once you have completed the steps above, please complete the married filing separately allocations form 8958. Use form 8958 to allocate tax amounts between spouses or registered domestic partners (rdps) with community property rights, who file.

Complete Form 8958 on Windows OS pdfFiller

This form will explain to the irs. Once you have completed the steps above, please complete the married filing separately allocations form 8958. Learn how to use form 8958 to divide tax amounts between married filing separate spouses or rdps with community. Form 8958, also known as the allocation of tax amounts between certain individuals in community property. Form 8958,.

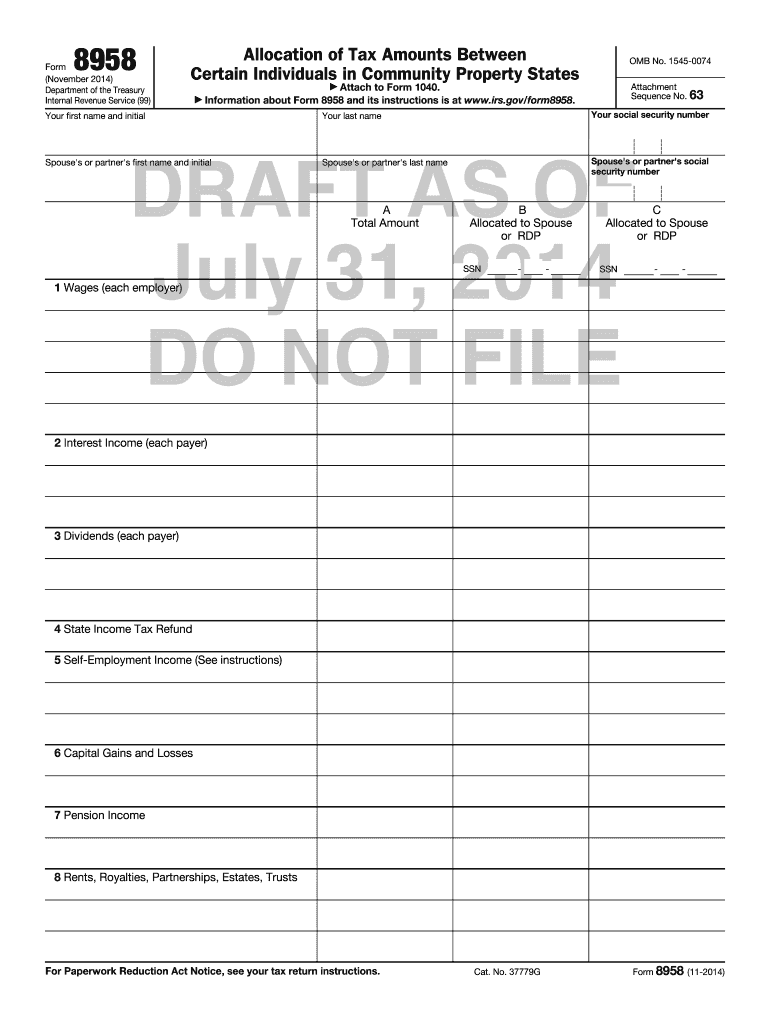

Fillable Form 8958 Allocation Of Tax Amounts Between Certain

Use form 8958 to allocate tax amounts between spouses or registered domestic partners (rdps) with community property rights, who file. Learn how to use form 8958 to divide tax amounts between married filing separate spouses or rdps with community. Form 8958, also known as the allocation of tax amounts between certain individuals in community property. Once you have completed the.

IRS Form 8958 Fill Out, Sign Online and Download Fillable PDF

Once you have completed the steps above, please complete the married filing separately allocations form 8958. Learn how to use form 8958 to divide tax amounts between married filing separate spouses or rdps with community. Form 8958, officially titled allocation of tax amounts between certain individuals in community property states, is an internal. Use form 8958 to allocate tax amounts.

Form 8958 Allocation of Tax Amounts between Certain Individuals in

Once you have completed the steps above, please complete the married filing separately allocations form 8958. Learn how to use form 8958 to divide tax amounts between married filing separate spouses or rdps with community. Form 8958, also known as the allocation of tax amounts between certain individuals in community property. Form 8958, officially titled allocation of tax amounts between.

Free Fillable Form 8958 Printable Forms Free Online

Form 8958, officially titled allocation of tax amounts between certain individuals in community property states, is an internal. Once you have completed the steps above, please complete the married filing separately allocations form 8958. This form will explain to the irs. Learn how to use form 8958 to divide tax amounts between married filing separate spouses or rdps with community..

Fill Free fillable Form 8958 Allocation of Tax Amounts 2014 PDF form

Use form 8958 to allocate tax amounts between spouses or registered domestic partners (rdps) with community property rights, who file. Form 8958, also known as the allocation of tax amounts between certain individuals in community property. This form will explain to the irs. Form 8958, officially titled allocation of tax amounts between certain individuals in community property states, is an.

Form 8958 Fill Online, Printable, Fillable, Blank pdfFiller

Use form 8958 to allocate tax amounts between spouses or registered domestic partners (rdps) with community property rights, who file. Form 8958, also known as the allocation of tax amounts between certain individuals in community property. Once you have completed the steps above, please complete the married filing separately allocations form 8958. Form 8958, officially titled allocation of tax amounts.

Fill Free fillable Form 8958 2019 Allocation of Tax Amounts PDF form

Form 8958, officially titled allocation of tax amounts between certain individuals in community property states, is an internal. Form 8958, also known as the allocation of tax amounts between certain individuals in community property. Learn how to use form 8958 to divide tax amounts between married filing separate spouses or rdps with community. Use form 8958 to allocate tax amounts.

Fillable Online Information about Form 8958 and its instructions is at

Learn how to use form 8958 to divide tax amounts between married filing separate spouses or rdps with community. Form 8958, officially titled allocation of tax amounts between certain individuals in community property states, is an internal. This form will explain to the irs. Use form 8958 to allocate tax amounts between spouses or registered domestic partners (rdps) with community.

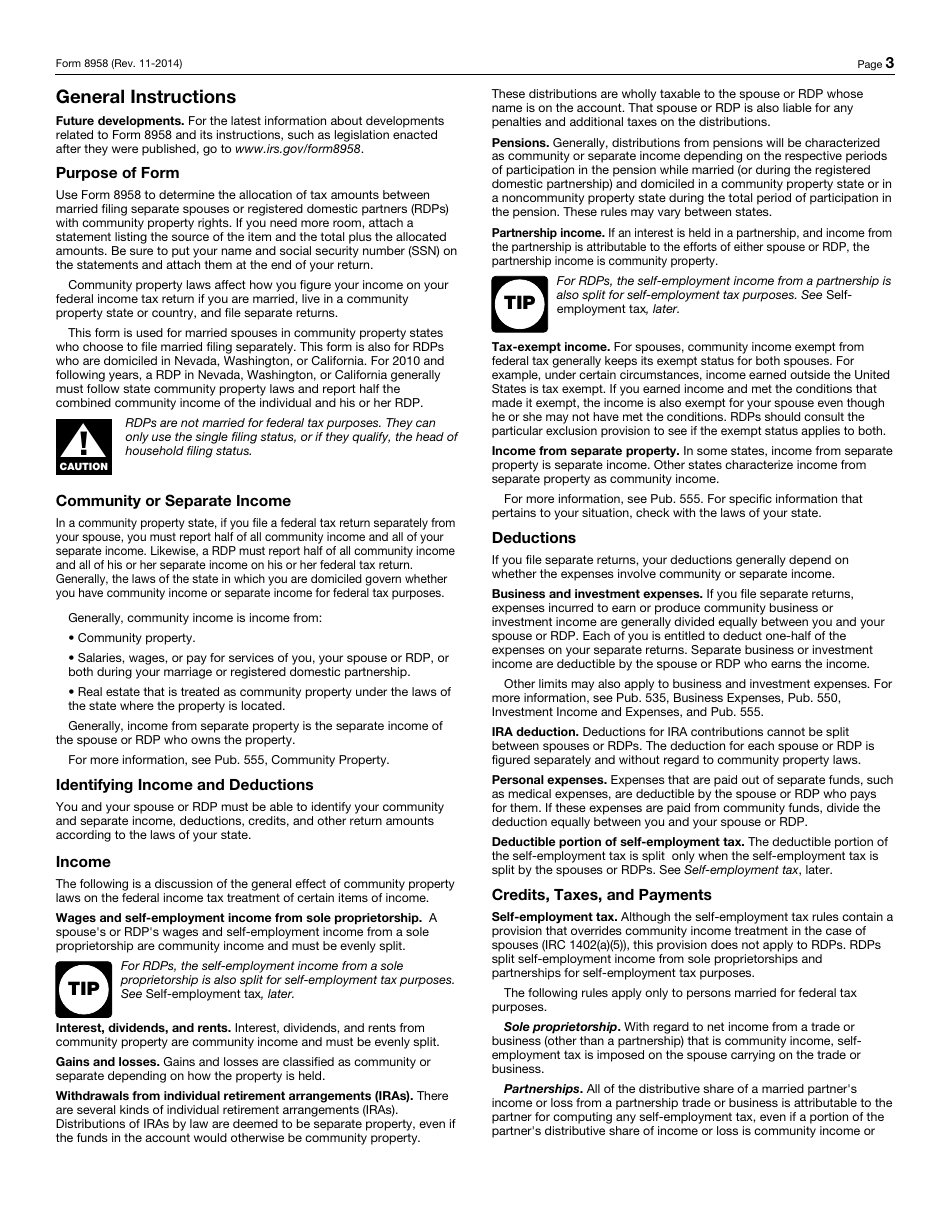

IRS Form 8958 Instructions Community Property Allocation

Form 8958, also known as the allocation of tax amounts between certain individuals in community property. Use form 8958 to allocate tax amounts between spouses or registered domestic partners (rdps) with community property rights, who file. Form 8958, officially titled allocation of tax amounts between certain individuals in community property states, is an internal. Once you have completed the steps.

Form 8958, Officially Titled Allocation Of Tax Amounts Between Certain Individuals In Community Property States, Is An Internal.

Learn how to use form 8958 to divide tax amounts between married filing separate spouses or rdps with community. This form will explain to the irs. Use form 8958 to allocate tax amounts between spouses or registered domestic partners (rdps) with community property rights, who file. Once you have completed the steps above, please complete the married filing separately allocations form 8958.