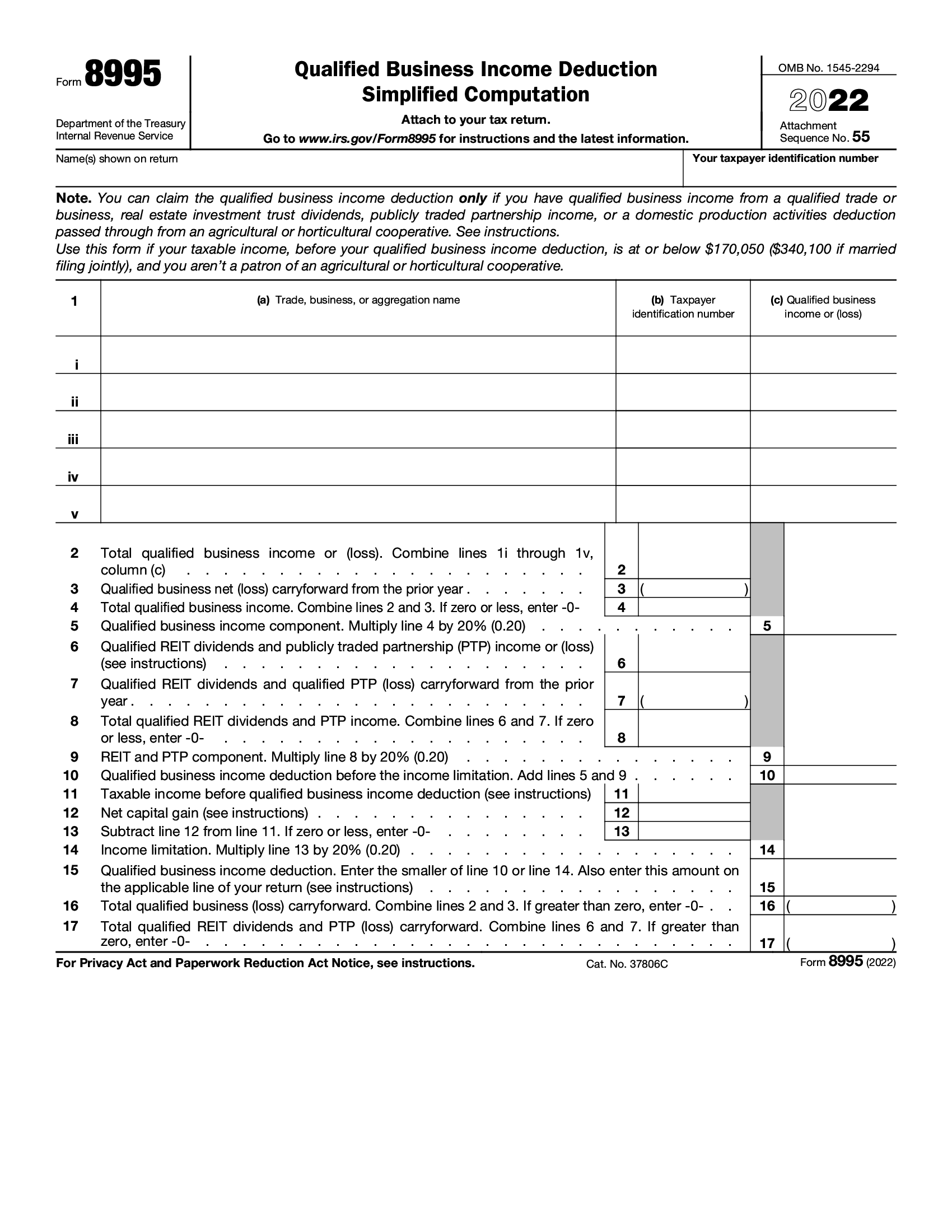

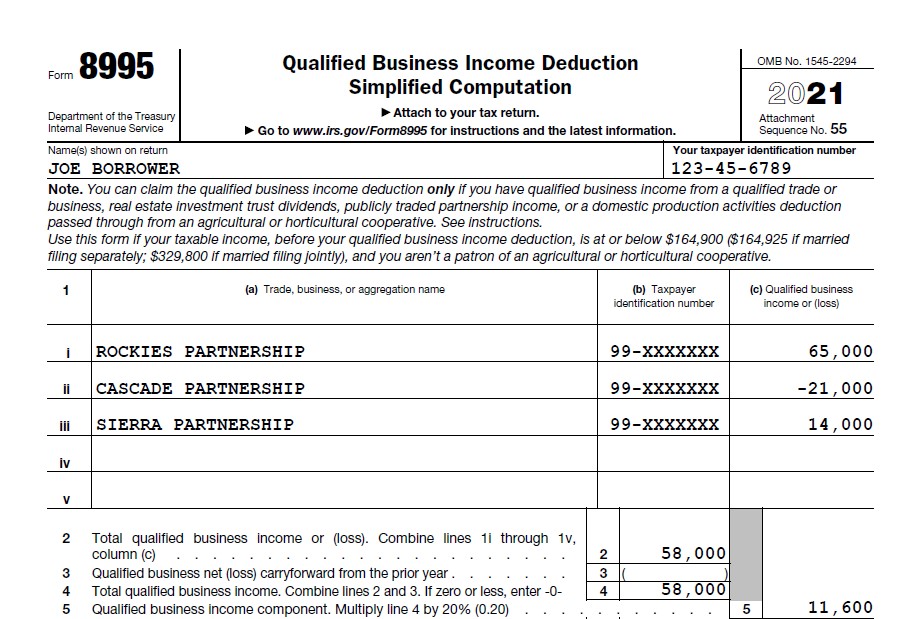

Form 8995 Instruction - This article walks you through how to use irs form 8995 to determine: Use this form if your taxable income, before your qualified business income deduction, is at or below $191,950 ($383,900 if married filing. Information about form 8995, qualified business income deduction simplified computation, including recent updates, related forms and. Use form 8995 to figure your qualified business income (qbi) deduction. Whether you are eligible to take the qbi deduction on your.

Use this form if your taxable income, before your qualified business income deduction, is at or below $191,950 ($383,900 if married filing. Information about form 8995, qualified business income deduction simplified computation, including recent updates, related forms and. Use form 8995 to figure your qualified business income (qbi) deduction. This article walks you through how to use irs form 8995 to determine: Whether you are eligible to take the qbi deduction on your.

Information about form 8995, qualified business income deduction simplified computation, including recent updates, related forms and. This article walks you through how to use irs form 8995 to determine: Use form 8995 to figure your qualified business income (qbi) deduction. Use this form if your taxable income, before your qualified business income deduction, is at or below $191,950 ($383,900 if married filing. Whether you are eligible to take the qbi deduction on your.

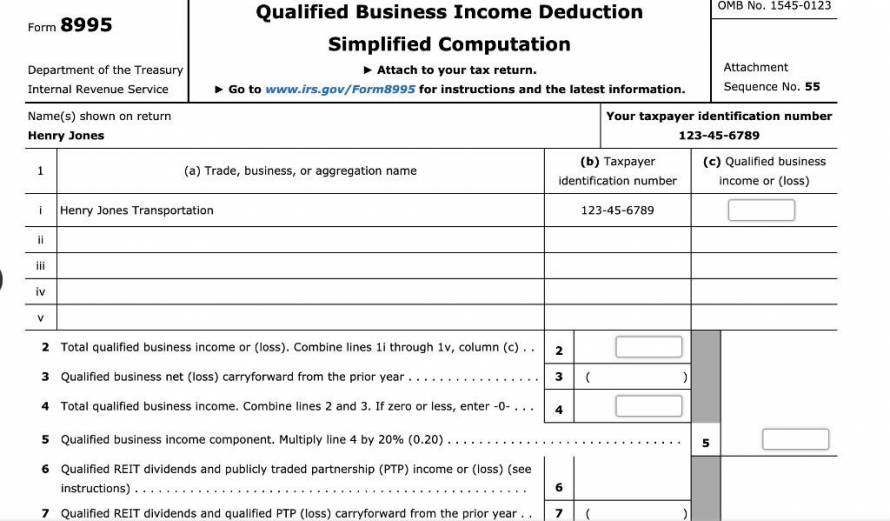

2023 Form 8995 Printable Forms Free Online

Whether you are eligible to take the qbi deduction on your. Information about form 8995, qualified business income deduction simplified computation, including recent updates, related forms and. Use form 8995 to figure your qualified business income (qbi) deduction. Use this form if your taxable income, before your qualified business income deduction, is at or below $191,950 ($383,900 if married filing..

8995 Form 📝 IRS Form 8995 for Instructions Printable Sample With PDF

Information about form 8995, qualified business income deduction simplified computation, including recent updates, related forms and. Use this form if your taxable income, before your qualified business income deduction, is at or below $191,950 ($383,900 if married filing. Whether you are eligible to take the qbi deduction on your. This article walks you through how to use irs form 8995.

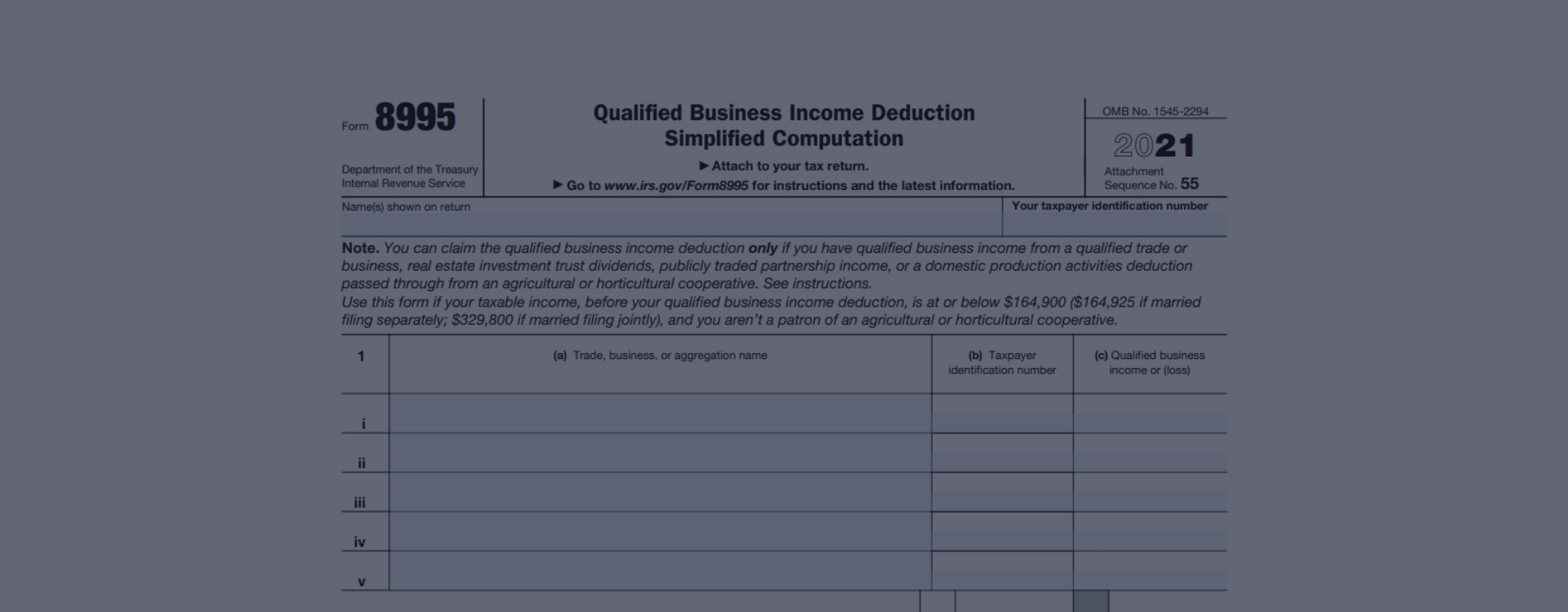

Printable Form 8995 Blog 8995 Form Website

Use form 8995 to figure your qualified business income (qbi) deduction. Use this form if your taxable income, before your qualified business income deduction, is at or below $191,950 ($383,900 if married filing. Information about form 8995, qualified business income deduction simplified computation, including recent updates, related forms and. Whether you are eligible to take the qbi deduction on your..

2023 Form 8995 Printable Forms Free Online

Use this form if your taxable income, before your qualified business income deduction, is at or below $191,950 ($383,900 if married filing. Use form 8995 to figure your qualified business income (qbi) deduction. Information about form 8995, qualified business income deduction simplified computation, including recent updates, related forms and. Whether you are eligible to take the qbi deduction on your..

Form 8995 2024 2025

Use this form if your taxable income, before your qualified business income deduction, is at or below $191,950 ($383,900 if married filing. Use form 8995 to figure your qualified business income (qbi) deduction. This article walks you through how to use irs form 8995 to determine: Whether you are eligible to take the qbi deduction on your. Information about form.

Online Form 8995 Blog 8995 Form Website

Whether you are eligible to take the qbi deduction on your. Use this form if your taxable income, before your qualified business income deduction, is at or below $191,950 ($383,900 if married filing. This article walks you through how to use irs form 8995 to determine: Information about form 8995, qualified business income deduction simplified computation, including recent updates, related.

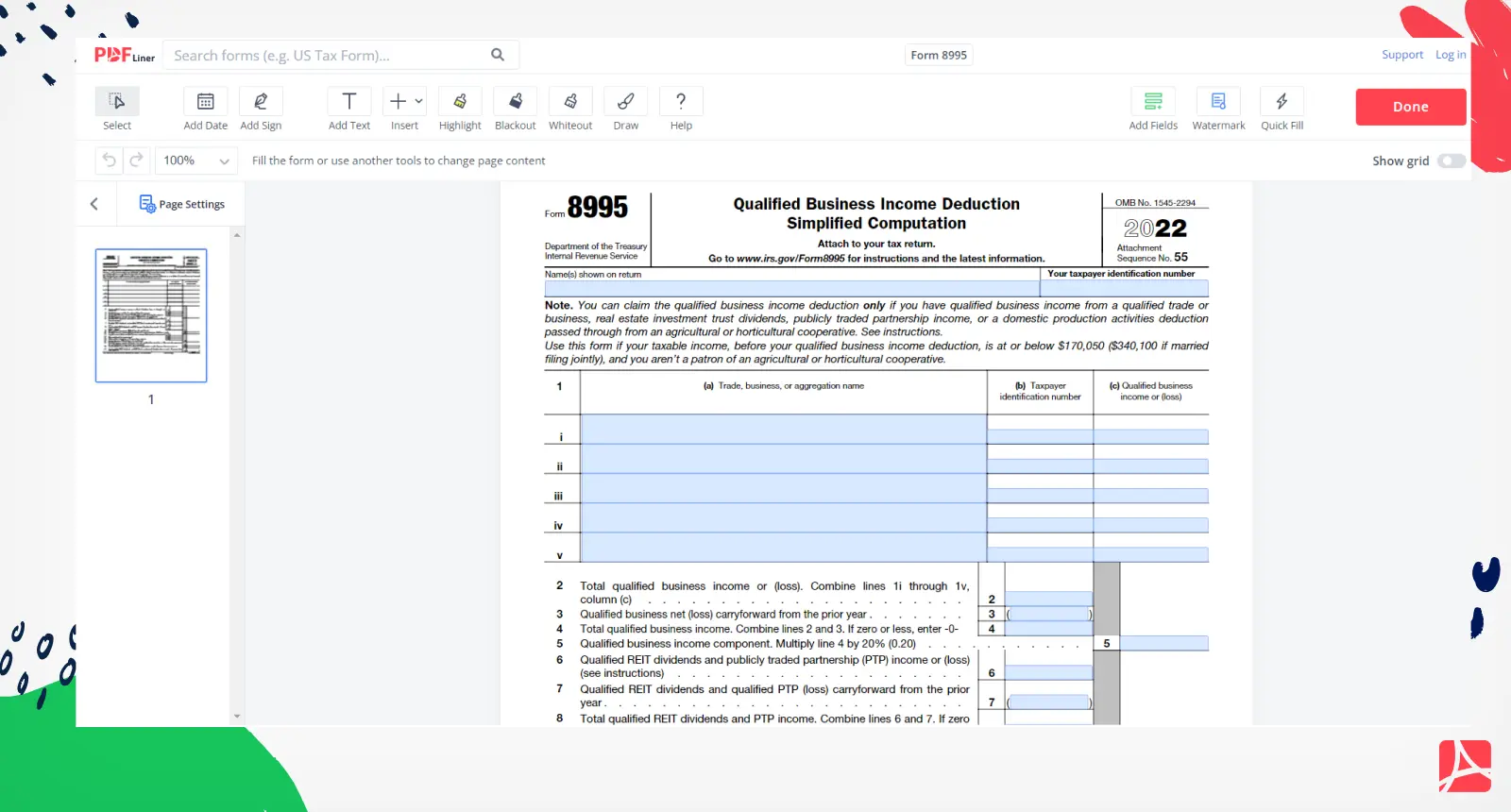

IRS Form 8995 Printable Form 8995 blank, sign form online — PDFliner

Information about form 8995, qualified business income deduction simplified computation, including recent updates, related forms and. Whether you are eligible to take the qbi deduction on your. Use form 8995 to figure your qualified business income (qbi) deduction. Use this form if your taxable income, before your qualified business income deduction, is at or below $191,950 ($383,900 if married filing..

8995 Form 📝 IRS Form 8995 for Instructions Printable Sample With PDF

Whether you are eligible to take the qbi deduction on your. This article walks you through how to use irs form 8995 to determine: Use form 8995 to figure your qualified business income (qbi) deduction. Use this form if your taxable income, before your qualified business income deduction, is at or below $191,950 ($383,900 if married filing. Information about form.

IRS Form 8995 2022 Federal 8995 Tax Form PDF & Instructions for

Use this form if your taxable income, before your qualified business income deduction, is at or below $191,950 ($383,900 if married filing. Information about form 8995, qualified business income deduction simplified computation, including recent updates, related forms and. This article walks you through how to use irs form 8995 to determine: Use form 8995 to figure your qualified business income.

IRS Form 8995 Walkthrough (QBI Deduction Simplified, 57 OFF

Whether you are eligible to take the qbi deduction on your. Use this form if your taxable income, before your qualified business income deduction, is at or below $191,950 ($383,900 if married filing. Use form 8995 to figure your qualified business income (qbi) deduction. This article walks you through how to use irs form 8995 to determine: Information about form.

Information About Form 8995, Qualified Business Income Deduction Simplified Computation, Including Recent Updates, Related Forms And.

Whether you are eligible to take the qbi deduction on your. This article walks you through how to use irs form 8995 to determine: Use this form if your taxable income, before your qualified business income deduction, is at or below $191,950 ($383,900 if married filing. Use form 8995 to figure your qualified business income (qbi) deduction.