Form 941 Late Filing Penalty No Tax Due - The penalty amounts don’t add up. We calculate the amount of the failure to deposit penalty based on the number of calendar days your deposit is late, starting from. The penalties for not filing form 941 on time are as. Pay your 941 taxes before due to avoid late payment penalties. You will be subject to penalties if you fail to file your form 941 within the filing deadline. For example, if the tax. Learn how to file form 941 or 944 to report wages and taxes, and when to pay the penalties for late filing or underpayment.

The penalties for not filing form 941 on time are as. The penalty amounts don’t add up. You will be subject to penalties if you fail to file your form 941 within the filing deadline. We calculate the amount of the failure to deposit penalty based on the number of calendar days your deposit is late, starting from. For example, if the tax. Learn how to file form 941 or 944 to report wages and taxes, and when to pay the penalties for late filing or underpayment. Pay your 941 taxes before due to avoid late payment penalties.

Learn how to file form 941 or 944 to report wages and taxes, and when to pay the penalties for late filing or underpayment. You will be subject to penalties if you fail to file your form 941 within the filing deadline. The penalties for not filing form 941 on time are as. The penalty amounts don’t add up. For example, if the tax. We calculate the amount of the failure to deposit penalty based on the number of calendar days your deposit is late, starting from. Pay your 941 taxes before due to avoid late payment penalties.

Failure To Deposit IRS 941 Late Payment Penalties Tax Relief Center

The penalty amounts don’t add up. For example, if the tax. You will be subject to penalties if you fail to file your form 941 within the filing deadline. We calculate the amount of the failure to deposit penalty based on the number of calendar days your deposit is late, starting from. Learn how to file form 941 or 944.

Failure To Deposit IRS 941 Late Payment Penalties Tax Relief Center

We calculate the amount of the failure to deposit penalty based on the number of calendar days your deposit is late, starting from. Learn how to file form 941 or 944 to report wages and taxes, and when to pay the penalties for late filing or underpayment. Pay your 941 taxes before due to avoid late payment penalties. The penalties.

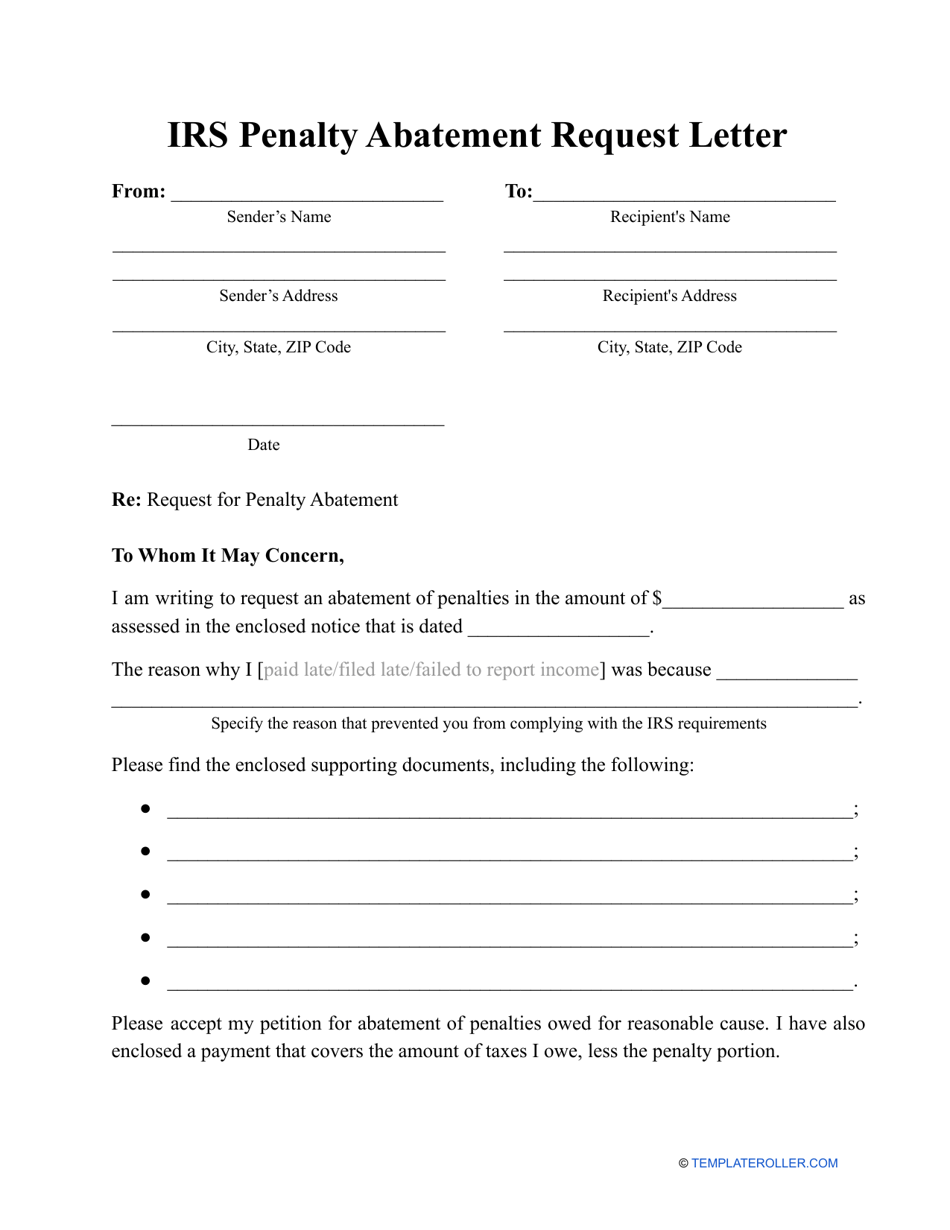

Irs Late Filing Penalty Abatement Letter Sle

The penalty amounts don’t add up. For example, if the tax. Pay your 941 taxes before due to avoid late payment penalties. We calculate the amount of the failure to deposit penalty based on the number of calendar days your deposit is late, starting from. You will be subject to penalties if you fail to file your form 941 within.

Failure To Deposit IRS 941 Late Payment Penalties Tax Relief Center

The penalties for not filing form 941 on time are as. The penalty amounts don’t add up. For example, if the tax. Pay your 941 taxes before due to avoid late payment penalties. You will be subject to penalties if you fail to file your form 941 within the filing deadline.

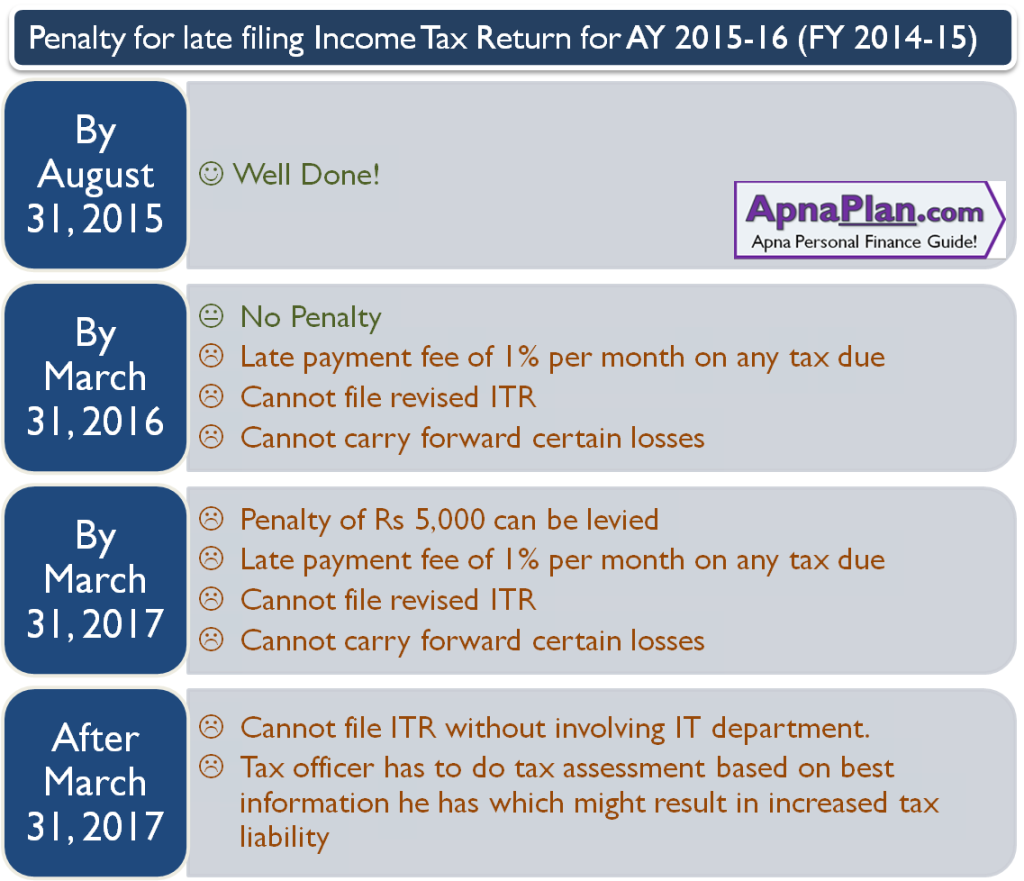

Penalty for Late Filing of Tax Return

The penalty amounts don’t add up. Pay your 941 taxes before due to avoid late payment penalties. Learn how to file form 941 or 944 to report wages and taxes, and when to pay the penalties for late filing or underpayment. The penalties for not filing form 941 on time are as. For example, if the tax.

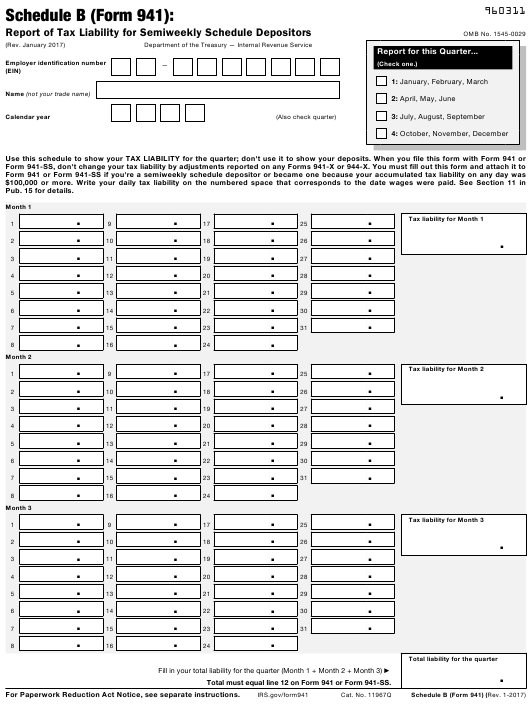

Form 941 Due Dates 2024 Dara Felecia

You will be subject to penalties if you fail to file your form 941 within the filing deadline. The penalties for not filing form 941 on time are as. We calculate the amount of the failure to deposit penalty based on the number of calendar days your deposit is late, starting from. Learn how to file form 941 or 944.

Form 941 Due Date 2024 Pam Lavina

We calculate the amount of the failure to deposit penalty based on the number of calendar days your deposit is late, starting from. For example, if the tax. Learn how to file form 941 or 944 to report wages and taxes, and when to pay the penalties for late filing or underpayment. The penalty amounts don’t add up. Pay your.

Penalty for Late Filing of Tax Return(ITR) 5paisa

The penalties for not filing form 941 on time are as. Learn how to file form 941 or 944 to report wages and taxes, and when to pay the penalties for late filing or underpayment. We calculate the amount of the failure to deposit penalty based on the number of calendar days your deposit is late, starting from. For example,.

SuperCA

The penalties for not filing form 941 on time are as. You will be subject to penalties if you fail to file your form 941 within the filing deadline. Pay your 941 taxes before due to avoid late payment penalties. We calculate the amount of the failure to deposit penalty based on the number of calendar days your deposit is.

Penalty Under Section 234F of the Tax Act

We calculate the amount of the failure to deposit penalty based on the number of calendar days your deposit is late, starting from. You will be subject to penalties if you fail to file your form 941 within the filing deadline. Learn how to file form 941 or 944 to report wages and taxes, and when to pay the penalties.

You Will Be Subject To Penalties If You Fail To File Your Form 941 Within The Filing Deadline.

Learn how to file form 941 or 944 to report wages and taxes, and when to pay the penalties for late filing or underpayment. The penalty amounts don’t add up. For example, if the tax. We calculate the amount of the failure to deposit penalty based on the number of calendar days your deposit is late, starting from.

Pay Your 941 Taxes Before Due To Avoid Late Payment Penalties.

The penalties for not filing form 941 on time are as.