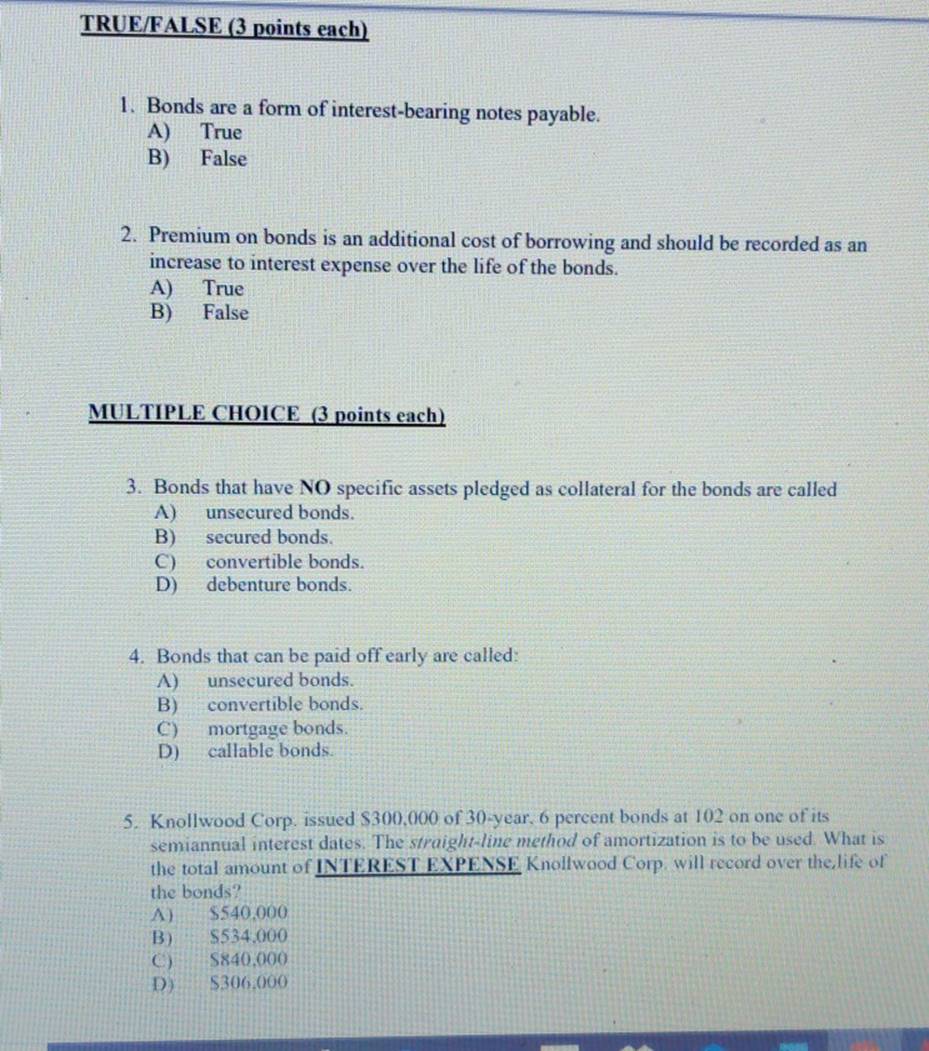

Formbonds Are A Form Of Interest Bearing Notes Payable - Bond interest paid by a corporation is an expense, whereas dividends paid are not an expense of the corporation (t/f) This means they represent a loan made by an investor to a borrower (the. Study with quizlet and memorize. Bonds definitely fit this description as they require the issuer to pay interest over time. T/f the rate used to determine the amount of cash interest the borrower pays is.

Bonds definitely fit this description as they require the issuer to pay interest over time. Study with quizlet and memorize. Bond interest paid by a corporation is an expense, whereas dividends paid are not an expense of the corporation (t/f) This means they represent a loan made by an investor to a borrower (the. T/f the rate used to determine the amount of cash interest the borrower pays is.

Bond interest paid by a corporation is an expense, whereas dividends paid are not an expense of the corporation (t/f) This means they represent a loan made by an investor to a borrower (the. T/f the rate used to determine the amount of cash interest the borrower pays is. Bonds definitely fit this description as they require the issuer to pay interest over time. Study with quizlet and memorize.

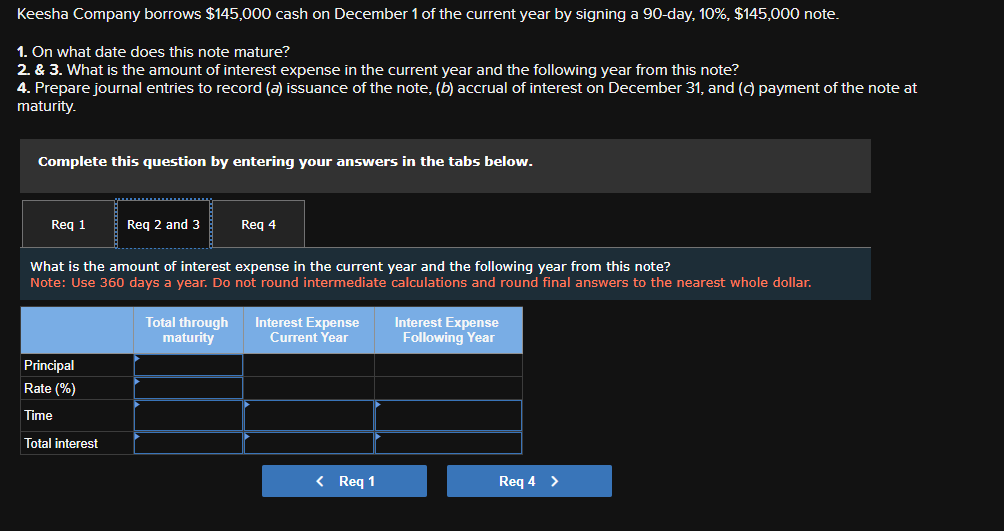

Solved Exercise 95 Interestbearing notes payable with

Bonds definitely fit this description as they require the issuer to pay interest over time. Bond interest paid by a corporation is an expense, whereas dividends paid are not an expense of the corporation (t/f) This means they represent a loan made by an investor to a borrower (the. T/f the rate used to determine the amount of cash interest.

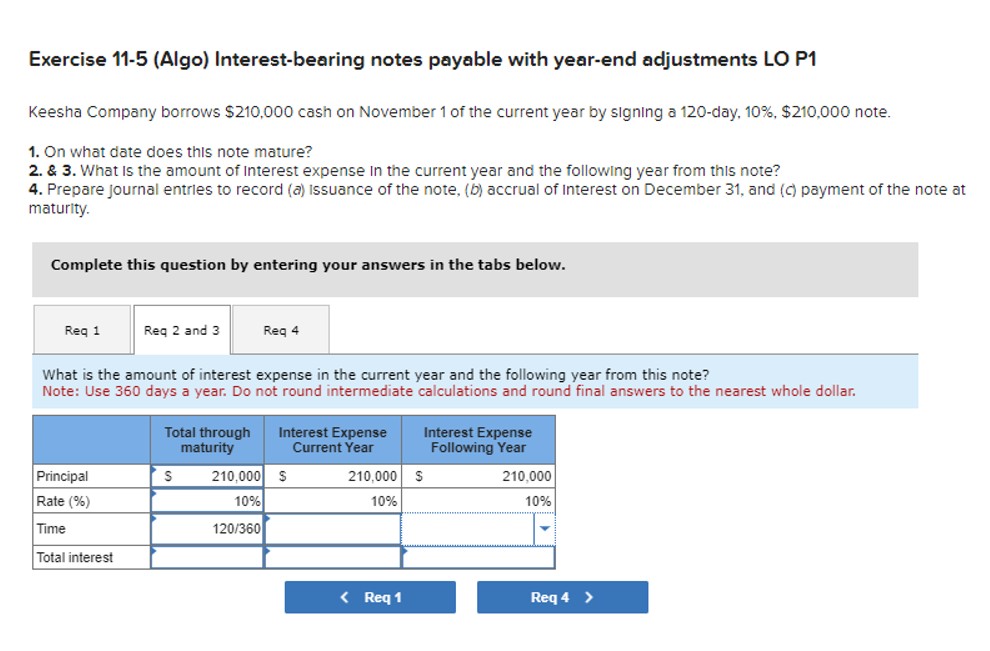

Solved Exercise 95 (Algo) Interestbearing notes payable

T/f the rate used to determine the amount of cash interest the borrower pays is. Bond interest paid by a corporation is an expense, whereas dividends paid are not an expense of the corporation (t/f) Study with quizlet and memorize. This means they represent a loan made by an investor to a borrower (the. Bonds definitely fit this description as.

Solved Check m Exercise 94 Interestbearing notes payable

T/f the rate used to determine the amount of cash interest the borrower pays is. Bonds definitely fit this description as they require the issuer to pay interest over time. Study with quizlet and memorize. Bond interest paid by a corporation is an expense, whereas dividends paid are not an expense of the corporation (t/f) This means they represent a.

Are bonds a form of interest bearing notes payable? Leia aqui Is a

Bond interest paid by a corporation is an expense, whereas dividends paid are not an expense of the corporation (t/f) Study with quizlet and memorize. This means they represent a loan made by an investor to a borrower (the. T/f the rate used to determine the amount of cash interest the borrower pays is. Bonds definitely fit this description as.

Are bonds a form of interest bearing notes payable? Leia aqui Is a

This means they represent a loan made by an investor to a borrower (the. Bonds definitely fit this description as they require the issuer to pay interest over time. Study with quizlet and memorize. T/f the rate used to determine the amount of cash interest the borrower pays is. Bond interest paid by a corporation is an expense, whereas dividends.

Solved Exercise 115 (Algo) Interestbearing notes payable

Study with quizlet and memorize. Bonds definitely fit this description as they require the issuer to pay interest over time. This means they represent a loan made by an investor to a borrower (the. T/f the rate used to determine the amount of cash interest the borrower pays is. Bond interest paid by a corporation is an expense, whereas dividends.

Non Interest Bearing Note Double Entry Bookkeeping

T/f the rate used to determine the amount of cash interest the borrower pays is. Study with quizlet and memorize. Bond interest paid by a corporation is an expense, whereas dividends paid are not an expense of the corporation (t/f) This means they represent a loan made by an investor to a borrower (the. Bonds definitely fit this description as.

NonInterestBearing Notes Payable

Study with quizlet and memorize. Bonds definitely fit this description as they require the issuer to pay interest over time. T/f the rate used to determine the amount of cash interest the borrower pays is. This means they represent a loan made by an investor to a borrower (the. Bond interest paid by a corporation is an expense, whereas dividends.

(Get Answer) Bonds Are A Form Of InterestBearing Notes Payable. A

This means they represent a loan made by an investor to a borrower (the. Bond interest paid by a corporation is an expense, whereas dividends paid are not an expense of the corporation (t/f) T/f the rate used to determine the amount of cash interest the borrower pays is. Bonds definitely fit this description as they require the issuer to.

Notes Payable Archives Double Entry Bookkeeping

This means they represent a loan made by an investor to a borrower (the. Bond interest paid by a corporation is an expense, whereas dividends paid are not an expense of the corporation (t/f) T/f the rate used to determine the amount of cash interest the borrower pays is. Study with quizlet and memorize. Bonds definitely fit this description as.

Bonds Definitely Fit This Description As They Require The Issuer To Pay Interest Over Time.

This means they represent a loan made by an investor to a borrower (the. Bond interest paid by a corporation is an expense, whereas dividends paid are not an expense of the corporation (t/f) T/f the rate used to determine the amount of cash interest the borrower pays is. Study with quizlet and memorize.