Formweak Form Efficiency - The efficient market hypothesis (emh) theorizes that the market is generally efficient, but offers three forms of market. In weak form markets, prices reflect all historical information, leaving only new, unexpected information to drive future price changes.

In weak form markets, prices reflect all historical information, leaving only new, unexpected information to drive future price changes. The efficient market hypothesis (emh) theorizes that the market is generally efficient, but offers three forms of market.

The efficient market hypothesis (emh) theorizes that the market is generally efficient, but offers three forms of market. In weak form markets, prices reflect all historical information, leaving only new, unexpected information to drive future price changes.

(PDF) Test of Weak Form Efficiency in The Indian Stock Market

The efficient market hypothesis (emh) theorizes that the market is generally efficient, but offers three forms of market. In weak form markets, prices reflect all historical information, leaving only new, unexpected information to drive future price changes.

Weak Form Efficiency Finance Reference

In weak form markets, prices reflect all historical information, leaving only new, unexpected information to drive future price changes. The efficient market hypothesis (emh) theorizes that the market is generally efficient, but offers three forms of market.

SOLUTION Weak form efficiency in sports betting markets Studypool

In weak form markets, prices reflect all historical information, leaving only new, unexpected information to drive future price changes. The efficient market hypothesis (emh) theorizes that the market is generally efficient, but offers three forms of market.

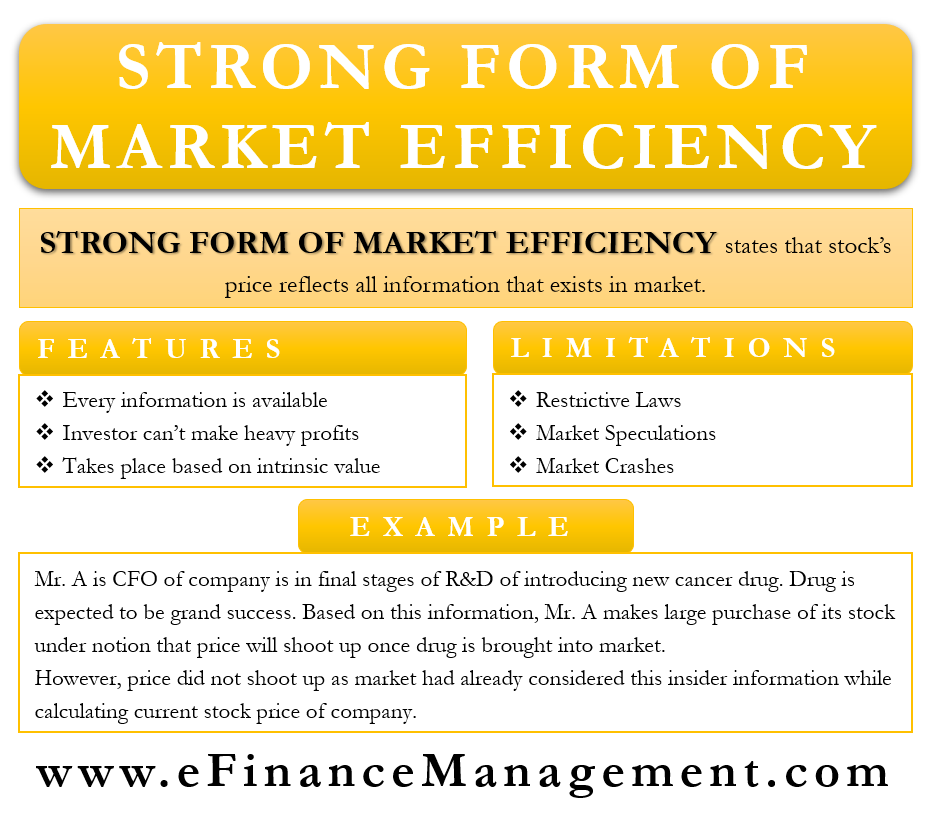

Strong form of market efficiency Meaning, EMH, Limitations, Example

In weak form markets, prices reflect all historical information, leaving only new, unexpected information to drive future price changes. The efficient market hypothesis (emh) theorizes that the market is generally efficient, but offers three forms of market.

semi strong form efficiency Stewart Langdon

The efficient market hypothesis (emh) theorizes that the market is generally efficient, but offers three forms of market. In weak form markets, prices reflect all historical information, leaving only new, unexpected information to drive future price changes.

Weak Form Efficiency What It Is, Examples, Vs SemiStrong Form

In weak form markets, prices reflect all historical information, leaving only new, unexpected information to drive future price changes. The efficient market hypothesis (emh) theorizes that the market is generally efficient, but offers three forms of market.

Enhanced Efficiency Minecraft Modpack

In weak form markets, prices reflect all historical information, leaving only new, unexpected information to drive future price changes. The efficient market hypothesis (emh) theorizes that the market is generally efficient, but offers three forms of market.

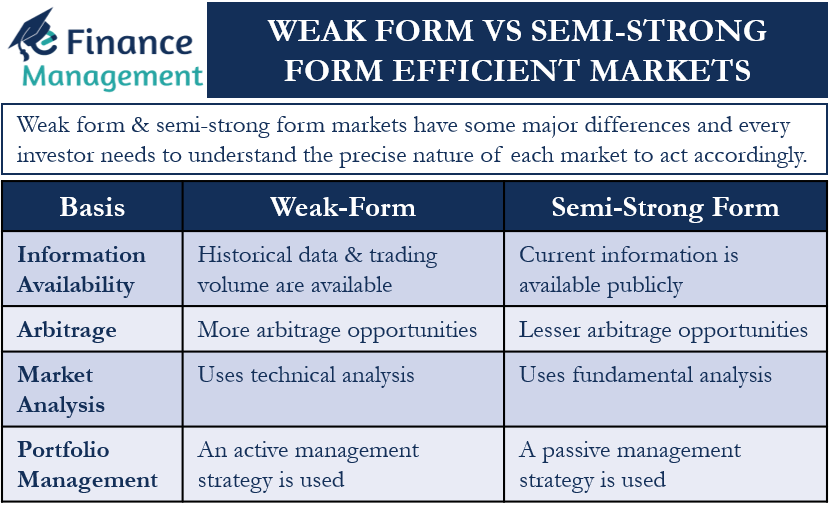

WeakForm vs SemiStrong Form Efficient Markets eFM

The efficient market hypothesis (emh) theorizes that the market is generally efficient, but offers three forms of market. In weak form markets, prices reflect all historical information, leaving only new, unexpected information to drive future price changes.

SemiStrong Form Efficiency Definition and Market Hypothesis LiveWell

The efficient market hypothesis (emh) theorizes that the market is generally efficient, but offers three forms of market. In weak form markets, prices reflect all historical information, leaving only new, unexpected information to drive future price changes.

SOLUTION Weak form efficiency in sports betting markets Studypool

The efficient market hypothesis (emh) theorizes that the market is generally efficient, but offers three forms of market. In weak form markets, prices reflect all historical information, leaving only new, unexpected information to drive future price changes.

In Weak Form Markets, Prices Reflect All Historical Information, Leaving Only New, Unexpected Information To Drive Future Price Changes.

The efficient market hypothesis (emh) theorizes that the market is generally efficient, but offers three forms of market.