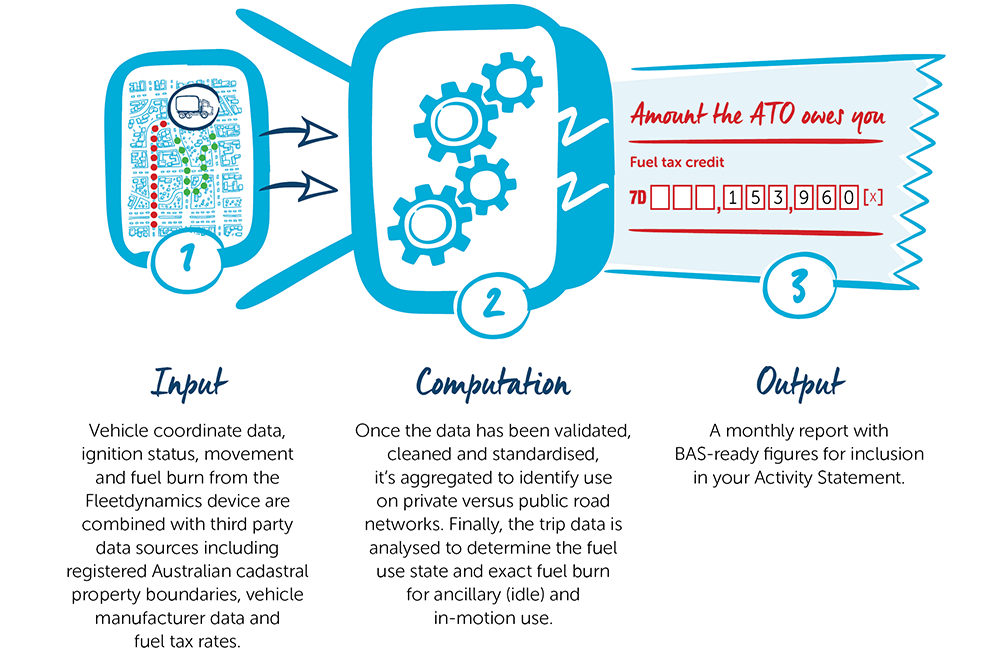

Fuel Tax Credits Calculation Worksheet - When using the fuel tax credits. There are three steps to calculate your fuel tax credits using our worksheet step 1: ** this rate accounts for the road user charge (which is subject to change) and applies to fuel used in a heavy vehicle for travelling on public. Use the fuel tax credit calculator online, to work out your fuel tax credits and get your claim right. Work out your eligible quantities work out how much fuel. Learn how to calculate and claim fuel tax credits for your business activity statement using this worksheet. Use this worksheet to help you calculate your fuel tax credits and claim them on your bas. You must be registered for gst and. Accurately calculating fuel tax credits requires a thorough understanding of the applicable tax.

Use this worksheet to help you calculate your fuel tax credits and claim them on your bas. There are three steps to calculate your fuel tax credits using our worksheet step 1: Learn how to calculate and claim fuel tax credits for your business activity statement using this worksheet. You must be registered for gst and. Accurately calculating fuel tax credits requires a thorough understanding of the applicable tax. When using the fuel tax credits. Work out your eligible quantities work out how much fuel. Use the fuel tax credit calculator online, to work out your fuel tax credits and get your claim right. ** this rate accounts for the road user charge (which is subject to change) and applies to fuel used in a heavy vehicle for travelling on public.

Use this worksheet to help you calculate your fuel tax credits and claim them on your bas. Accurately calculating fuel tax credits requires a thorough understanding of the applicable tax. There are three steps to calculate your fuel tax credits using our worksheet step 1: When using the fuel tax credits. Learn how to calculate and claim fuel tax credits for your business activity statement using this worksheet. Work out your eligible quantities work out how much fuel. Use the fuel tax credit calculator online, to work out your fuel tax credits and get your claim right. You must be registered for gst and. ** this rate accounts for the road user charge (which is subject to change) and applies to fuel used in a heavy vehicle for travelling on public.

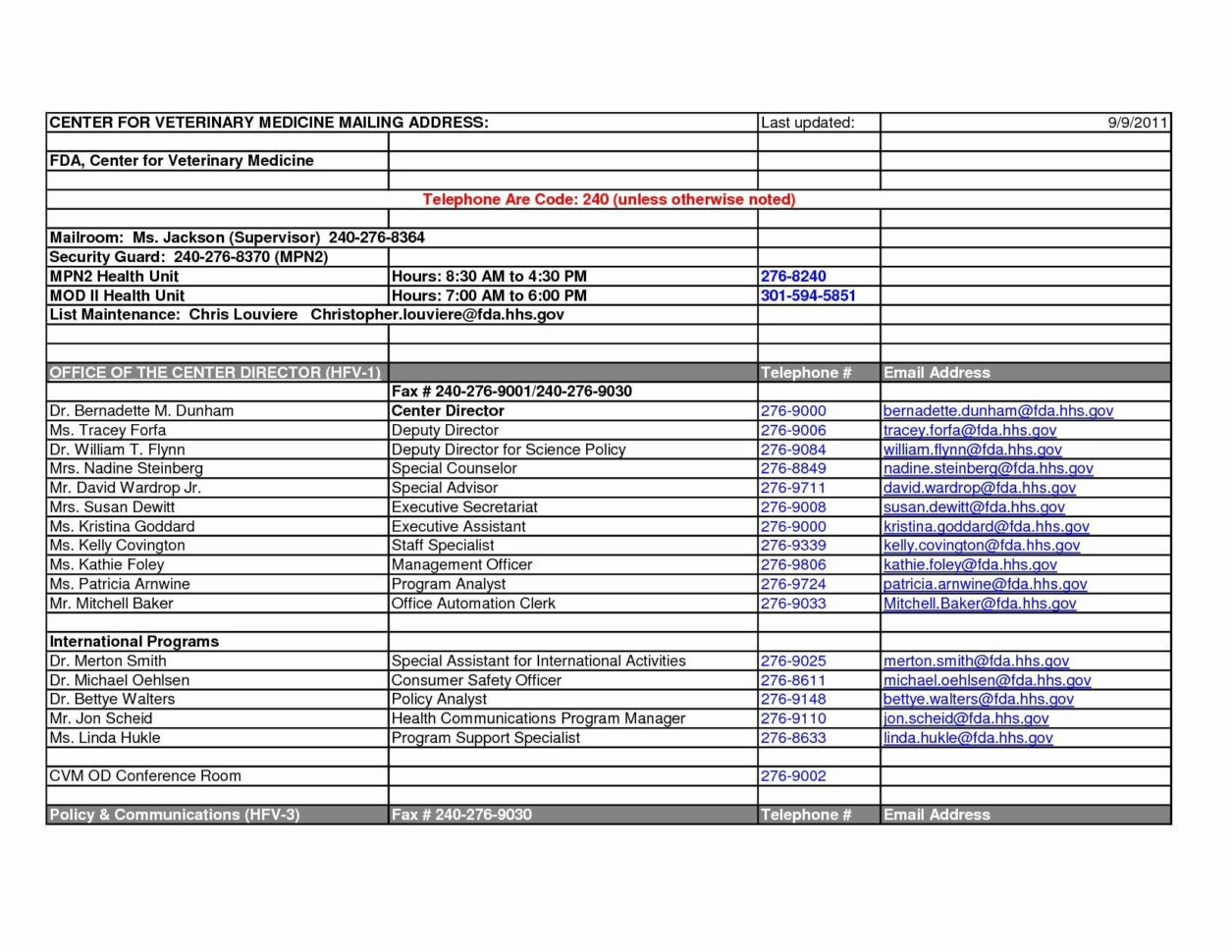

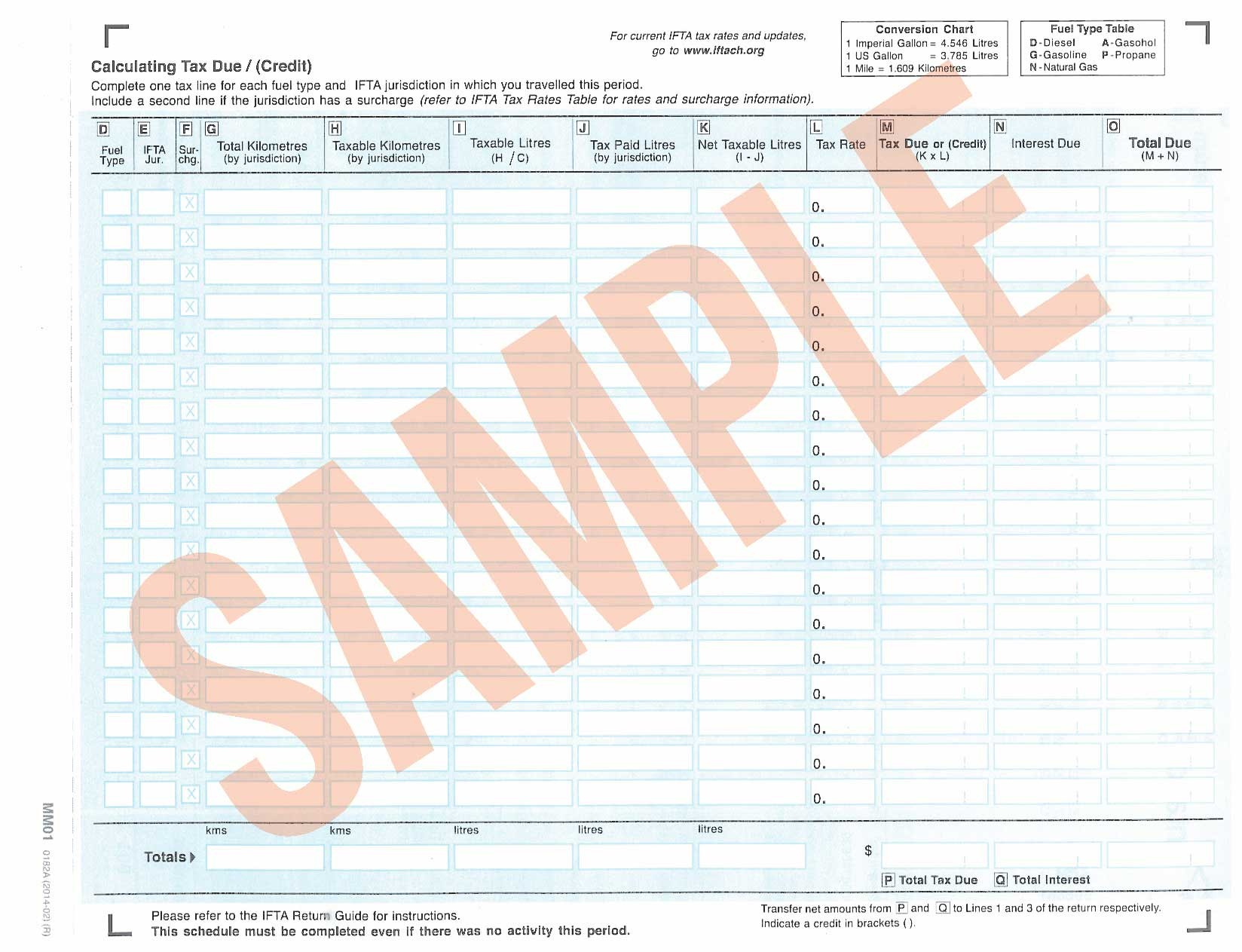

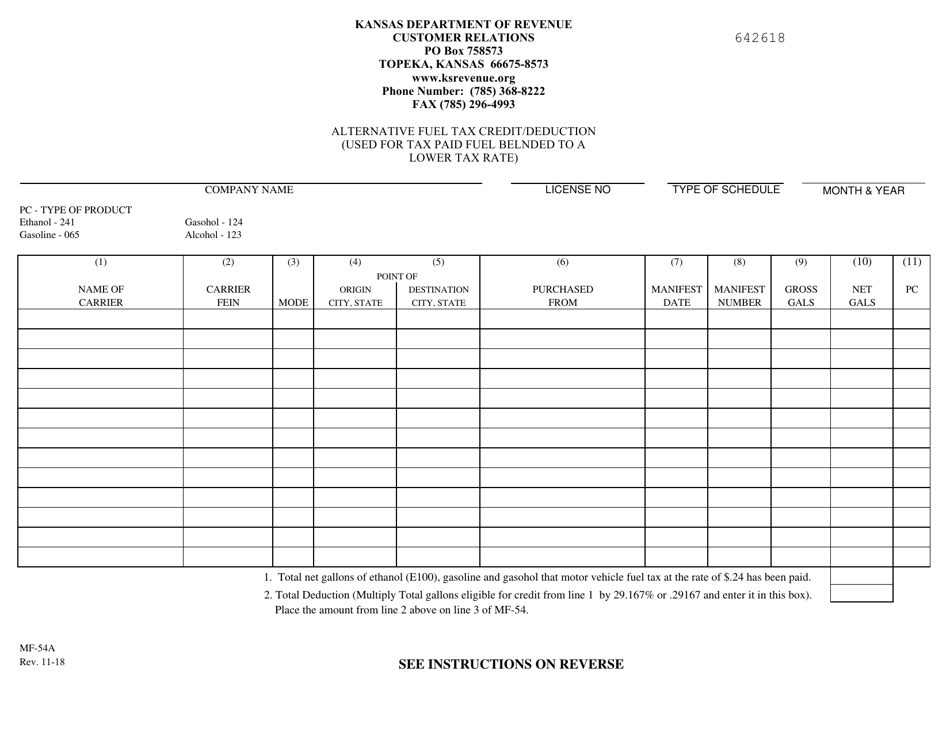

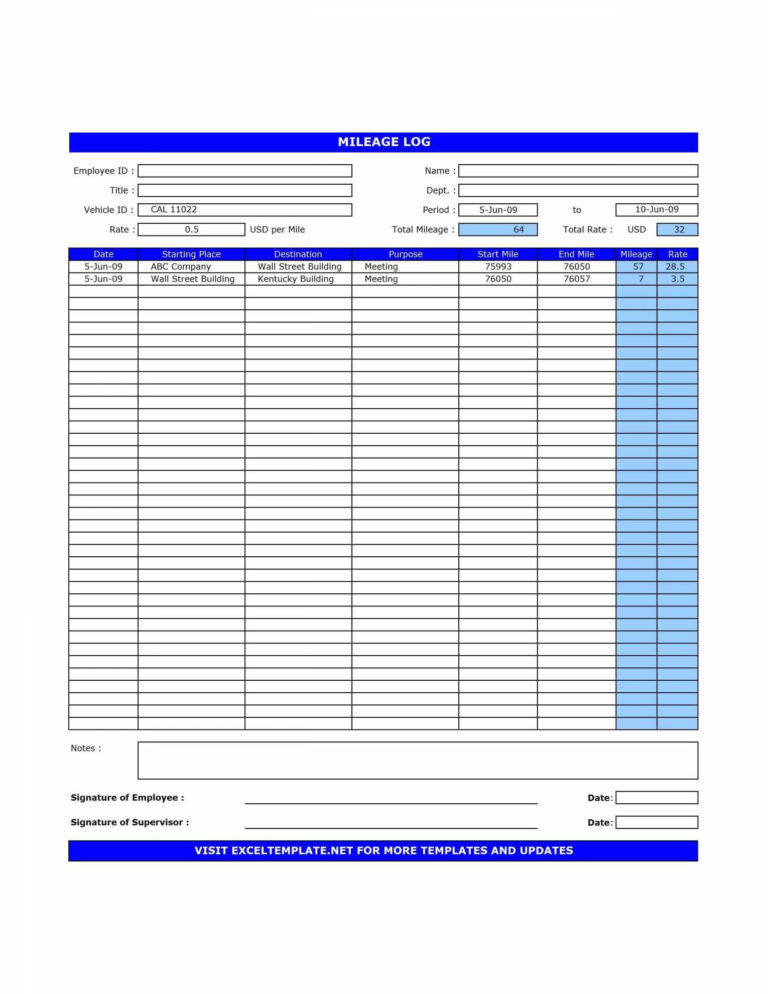

Ifta Fuel Tax Spreadsheet regarding Tax Calculation Spreadsheet Then

There are three steps to calculate your fuel tax credits using our worksheet step 1: Learn how to calculate and claim fuel tax credits for your business activity statement using this worksheet. Accurately calculating fuel tax credits requires a thorough understanding of the applicable tax. ** this rate accounts for the road user charge (which is subject to change) and.

Fuel Tax Credit Calculation Worksheet

Learn how to calculate and claim fuel tax credits for your business activity statement using this worksheet. ** this rate accounts for the road user charge (which is subject to change) and applies to fuel used in a heavy vehicle for travelling on public. There are three steps to calculate your fuel tax credits using our worksheet step 1: Accurately.

Fuel Tax Credits Calculation Worksheet Ato

Work out your eligible quantities work out how much fuel. Learn how to calculate and claim fuel tax credits for your business activity statement using this worksheet. ** this rate accounts for the road user charge (which is subject to change) and applies to fuel used in a heavy vehicle for travelling on public. Accurately calculating fuel tax credits requires.

Fuel Tax Credit Calculation Worksheet

** this rate accounts for the road user charge (which is subject to change) and applies to fuel used in a heavy vehicle for travelling on public. Use this worksheet to help you calculate your fuel tax credits and claim them on your bas. When using the fuel tax credits. Learn how to calculate and claim fuel tax credits for.

Fuel Tax Credits Calculation Worksheet

Use the fuel tax credit calculator online, to work out your fuel tax credits and get your claim right. ** this rate accounts for the road user charge (which is subject to change) and applies to fuel used in a heavy vehicle for travelling on public. When using the fuel tax credits. Use this worksheet to help you calculate your.

Fuel Tax Credits Calculation Worksheet

Use the fuel tax credit calculator online, to work out your fuel tax credits and get your claim right. Work out your eligible quantities work out how much fuel. ** this rate accounts for the road user charge (which is subject to change) and applies to fuel used in a heavy vehicle for travelling on public. Learn how to calculate.

Fuel Tax Credits Calculation Worksheet

When using the fuel tax credits. Use the fuel tax credit calculator online, to work out your fuel tax credits and get your claim right. There are three steps to calculate your fuel tax credits using our worksheet step 1: ** this rate accounts for the road user charge (which is subject to change) and applies to fuel used in.

Ifta Fuel Tax Spreadsheet for Tax Worksheet Excel New Fuel Tax

** this rate accounts for the road user charge (which is subject to change) and applies to fuel used in a heavy vehicle for travelling on public. When using the fuel tax credits. Accurately calculating fuel tax credits requires a thorough understanding of the applicable tax. You must be registered for gst and. Use this worksheet to help you calculate.

Fuel Tax Credits Eligibility, Calculation, and Compliance Guide

Learn how to calculate and claim fuel tax credits for your business activity statement using this worksheet. Work out your eligible quantities work out how much fuel. Use this worksheet to help you calculate your fuel tax credits and claim them on your bas. ** this rate accounts for the road user charge (which is subject to change) and applies.

Fuel Tax Credits Calculation Worksheet

There are three steps to calculate your fuel tax credits using our worksheet step 1: Use the fuel tax credit calculator online, to work out your fuel tax credits and get your claim right. Work out your eligible quantities work out how much fuel. You must be registered for gst and. Accurately calculating fuel tax credits requires a thorough understanding.

When Using The Fuel Tax Credits.

Use this worksheet to help you calculate your fuel tax credits and claim them on your bas. Use the fuel tax credit calculator online, to work out your fuel tax credits and get your claim right. ** this rate accounts for the road user charge (which is subject to change) and applies to fuel used in a heavy vehicle for travelling on public. You must be registered for gst and.

There Are Three Steps To Calculate Your Fuel Tax Credits Using Our Worksheet Step 1:

Learn how to calculate and claim fuel tax credits for your business activity statement using this worksheet. Accurately calculating fuel tax credits requires a thorough understanding of the applicable tax. Work out your eligible quantities work out how much fuel.