Georgia Form 500 Schedule 3 Instructions - Include copies of applicable returns and schedules with your georgia return. Enter your residency status with the appropriate number. Part year and nonresidents note: Before entering the nol carryforward, you must recalculate the income from the previous year using form schedule at the top of page 3 of. Enter the number on line 7a_ from form 500 or 500x 2 multiply by $3,000. Omit lines 9 thru 14 and. Enter your residency status with the appropriate number.

Enter your residency status with the appropriate number. Enter your residency status with the appropriate number. Omit lines 9 thru 14 and. Include copies of applicable returns and schedules with your georgia return. Part year and nonresidents note: Before entering the nol carryforward, you must recalculate the income from the previous year using form schedule at the top of page 3 of. Enter the number on line 7a_ from form 500 or 500x 2 multiply by $3,000.

Enter the number on line 7a_ from form 500 or 500x 2 multiply by $3,000. Enter your residency status with the appropriate number. Include copies of applicable returns and schedules with your georgia return. Enter your residency status with the appropriate number. Part year and nonresidents note: Omit lines 9 thru 14 and. Before entering the nol carryforward, you must recalculate the income from the previous year using form schedule at the top of page 3 of.

500 Ez Form Printable Printable Forms Free Online

Enter the number on line 7a_ from form 500 or 500x 2 multiply by $3,000. Include copies of applicable returns and schedules with your georgia return. Before entering the nol carryforward, you must recalculate the income from the previous year using form schedule at the top of page 3 of. Enter your residency status with the appropriate number. Omit lines.

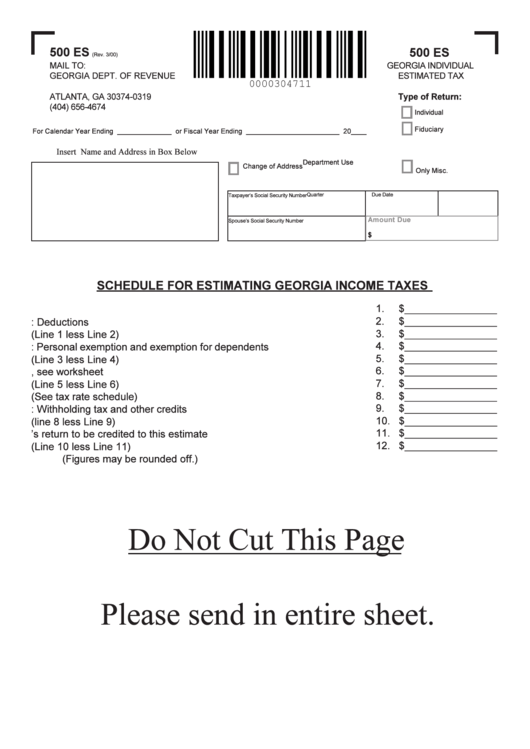

Form 500 Es Schedule For Estimating Taxes printable

Include copies of applicable returns and schedules with your georgia return. Enter the number on line 7a_ from form 500 or 500x 2 multiply by $3,000. Before entering the nol carryforward, you must recalculate the income from the previous year using form schedule at the top of page 3 of. Omit lines 9 thru 14 and. Enter your residency status.

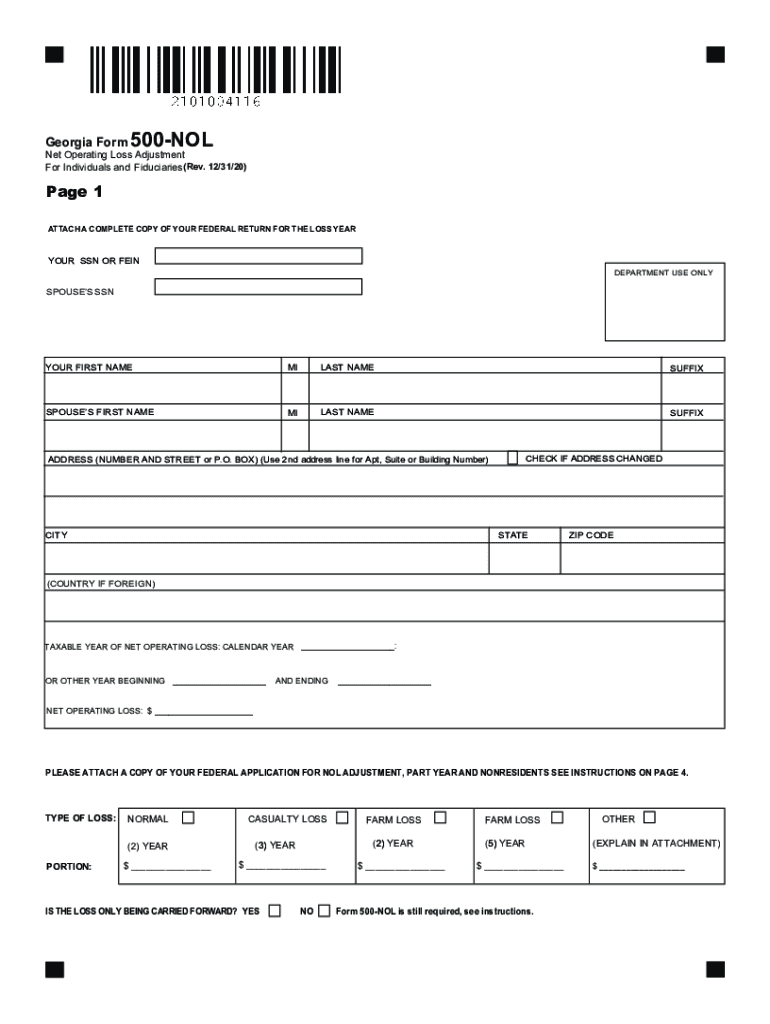

Ga form 500 nol instructions Fill out & sign online DocHub

Enter your residency status with the appropriate number. Part year and nonresidents note: Omit lines 9 thru 14 and. Include copies of applicable returns and schedules with your georgia return. Before entering the nol carryforward, you must recalculate the income from the previous year using form schedule at the top of page 3 of.

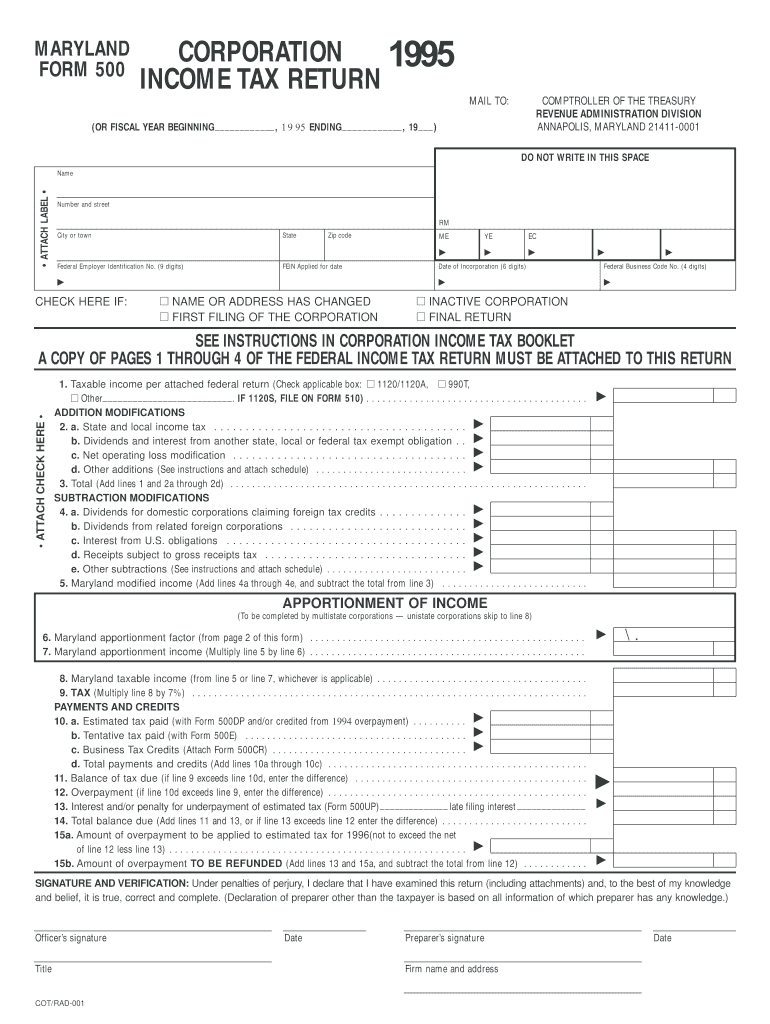

MD Form 500 1995 Fill out Tax Template Online US Legal Forms

Include copies of applicable returns and schedules with your georgia return. Before entering the nol carryforward, you must recalculate the income from the previous year using form schedule at the top of page 3 of. Part year and nonresidents note: Enter the number on line 7a_ from form 500 or 500x 2 multiply by $3,000. Enter your residency status with.

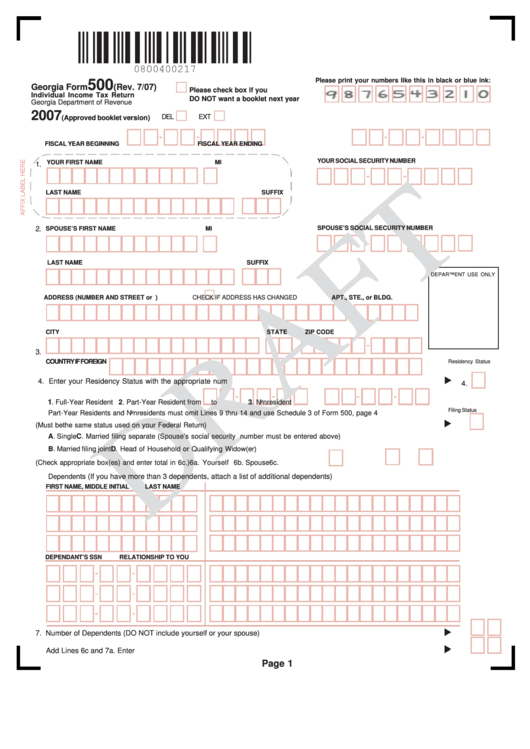

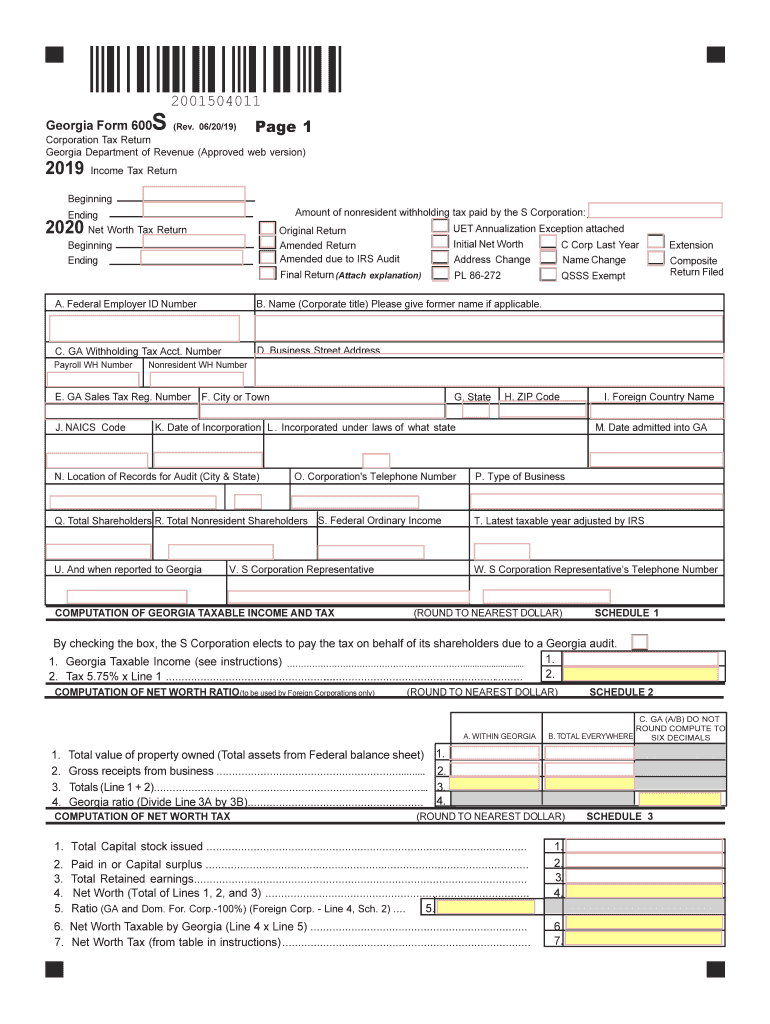

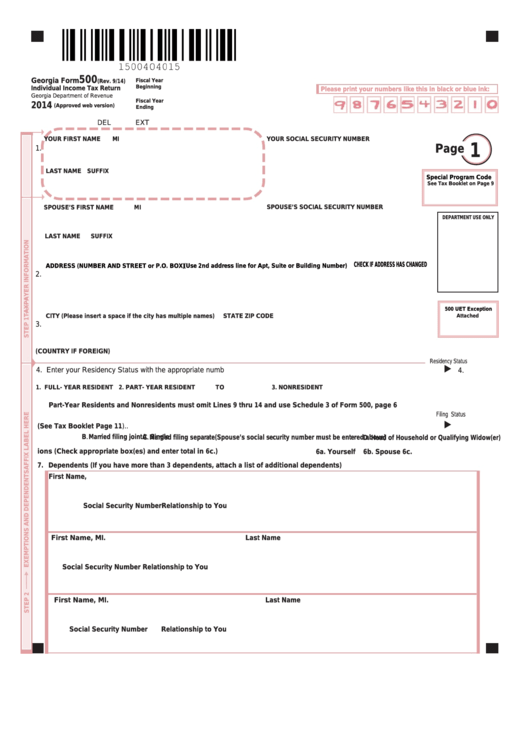

Form 500 Fill out & sign online DocHub

Enter your residency status with the appropriate number. Enter your residency status with the appropriate number. Omit lines 9 thru 14 and. Include copies of applicable returns and schedules with your georgia return. Enter the number on line 7a_ from form 500 or 500x 2 multiply by $3,000.

Printable 500 Ez Tax Form Printable Form 2024

Include copies of applicable returns and schedules with your georgia return. Part year and nonresidents note: Omit lines 9 thru 14 and. Enter your residency status with the appropriate number. Before entering the nol carryforward, you must recalculate the income from the previous year using form schedule at the top of page 3 of.

Printable Blank Form 500 Fillable Form 2024

Part year and nonresidents note: Enter your residency status with the appropriate number. Enter your residency status with the appropriate number. Enter the number on line 7a_ from form 500 or 500x 2 multiply by $3,000. Include copies of applicable returns and schedules with your georgia return.

Free Printable Tax Form 500 Printable Forms Free Online

Enter the number on line 7a_ from form 500 or 500x 2 multiply by $3,000. Before entering the nol carryforward, you must recalculate the income from the previous year using form schedule at the top of page 3 of. Enter your residency status with the appropriate number. Omit lines 9 thru 14 and. Enter your residency status with the appropriate.

Form 500 ≡ Fill Out Printable PDF Forms Online

Before entering the nol carryforward, you must recalculate the income from the previous year using form schedule at the top of page 3 of. Include copies of applicable returns and schedules with your georgia return. Part year and nonresidents note: Enter your residency status with the appropriate number. Enter your residency status with the appropriate number.

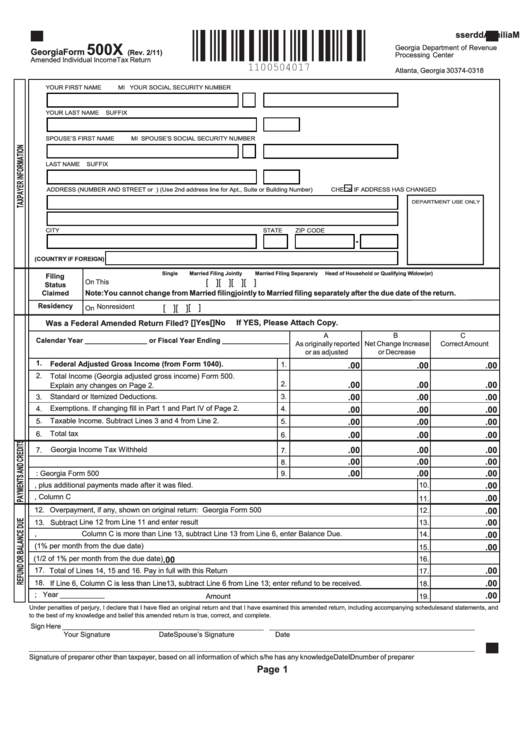

Fillable Form 500x Amended Individual Tax Return

Enter the number on line 7a_ from form 500 or 500x 2 multiply by $3,000. Omit lines 9 thru 14 and. Before entering the nol carryforward, you must recalculate the income from the previous year using form schedule at the top of page 3 of. Include copies of applicable returns and schedules with your georgia return. Part year and nonresidents.

Enter Your Residency Status With The Appropriate Number.

Include copies of applicable returns and schedules with your georgia return. Part year and nonresidents note: Enter your residency status with the appropriate number. Omit lines 9 thru 14 and.

Enter The Number On Line 7A_ From Form 500 Or 500X 2 Multiply By $3,000.

Before entering the nol carryforward, you must recalculate the income from the previous year using form schedule at the top of page 3 of.