Georgia Form 600S Instructions - Obtain georgia form 600s and its instructions. Enter the federal employer identification number (fein) for each member in the consolidated. Credit for the prepayment should be claimed on form 600s, schedule 4, line 2. As defined in the income tax laws of georgia, only. Georgia law recognizes an election to file as an s corporation under the provisions of the i.r.c. An extension of time to file does not alter the interest or penalty. Computation of georgia taxable income and tax (round to nearest dollar) schedule 1 by checking the box, the s. Complete, save and print the form online using your browser. You can obtain a copy of this form and the accompanying instructions on the georgia. Any tax credits from schedule 11 may be applied against income tax liability only, not.

As defined in the income tax laws of georgia, only. Obtain georgia form 600s and its instructions. Credit for the prepayment should be claimed on form 600s, schedule 4, line 2. Georgia law recognizes an election to file as an s corporation under the provisions of the i.r.c. Computation of georgia taxable income and tax (round to nearest dollar) schedule 1 by checking the box, the s. An extension of time to file does not alter the interest or penalty. Complete, save and print the form online using your browser. Any tax credits from schedule 11 may be applied against income tax liability only, not. You can obtain a copy of this form and the accompanying instructions on the georgia. Enter the federal employer identification number (fein) for each member in the consolidated.

Complete, save and print the form online using your browser. An extension of time to file does not alter the interest or penalty. Georgia law recognizes an election to file as an s corporation under the provisions of the i.r.c. Computation of georgia taxable income and tax (round to nearest dollar) schedule 1 by checking the box, the s. Any tax credits from schedule 11 may be applied against income tax liability only, not. Credit for the prepayment should be claimed on form 600s, schedule 4, line 2. You can obtain a copy of this form and the accompanying instructions on the georgia. Enter the federal employer identification number (fein) for each member in the consolidated. Obtain georgia form 600s and its instructions. As defined in the income tax laws of georgia, only.

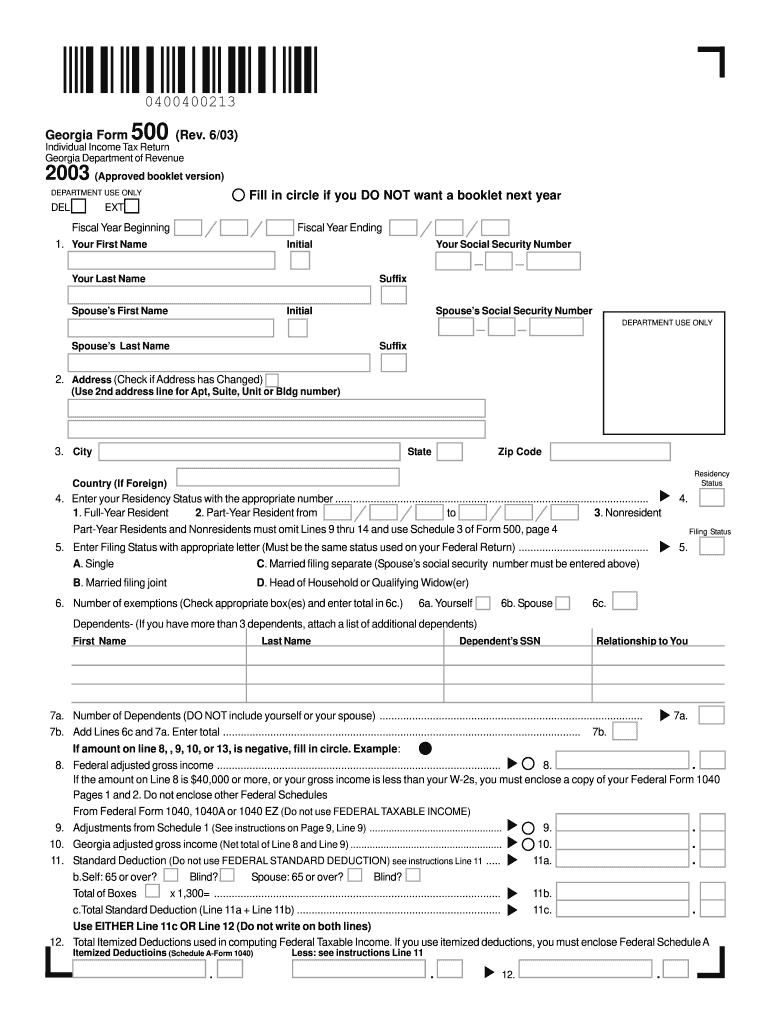

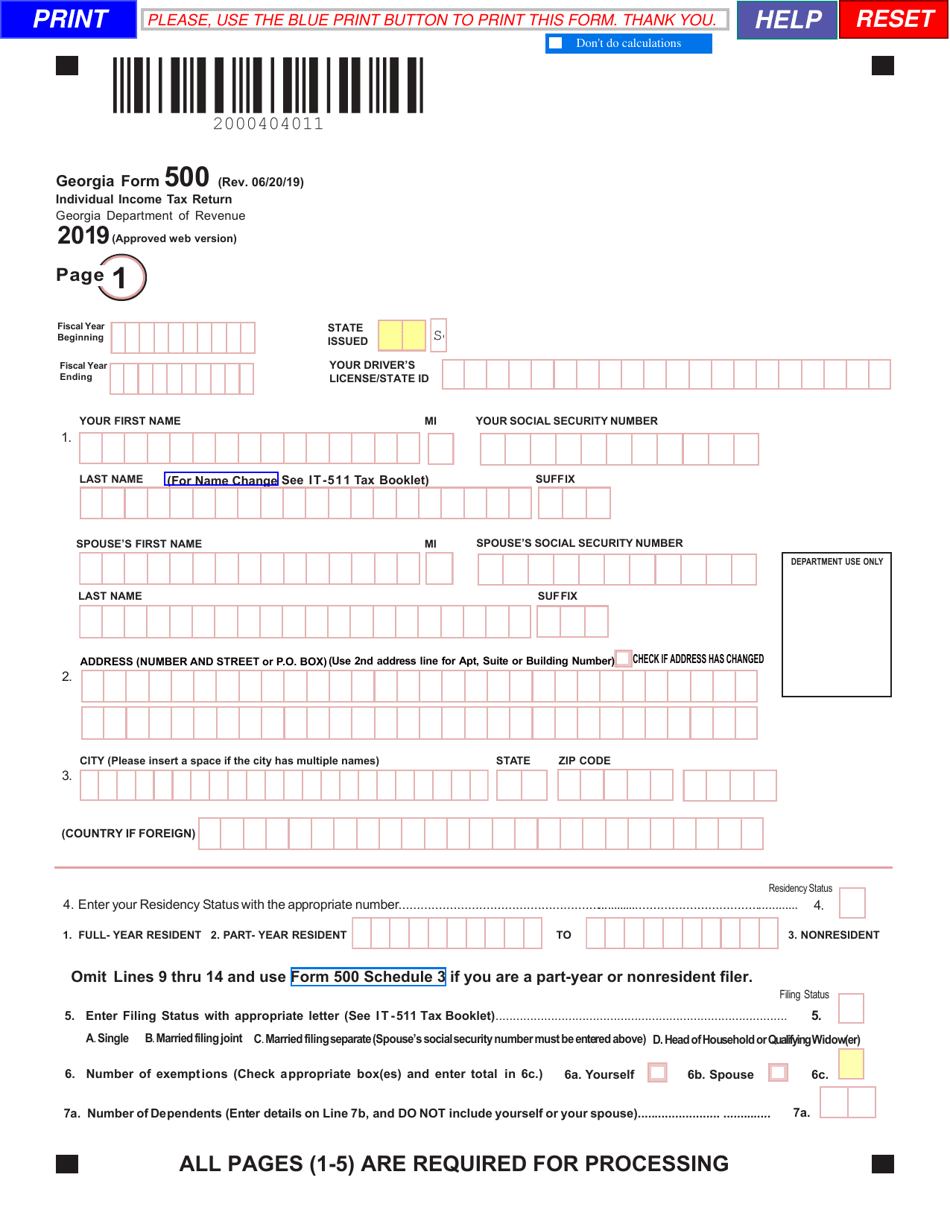

Ga form 500 instructions Fill out & sign online DocHub

Complete, save and print the form online using your browser. An extension of time to file does not alter the interest or penalty. Georgia law recognizes an election to file as an s corporation under the provisions of the i.r.c. Computation of georgia taxable income and tax (round to nearest dollar) schedule 1 by checking the box, the s. You.

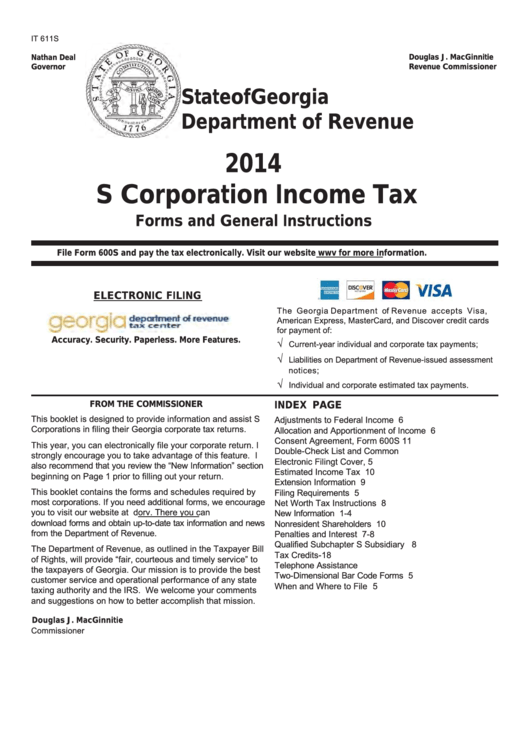

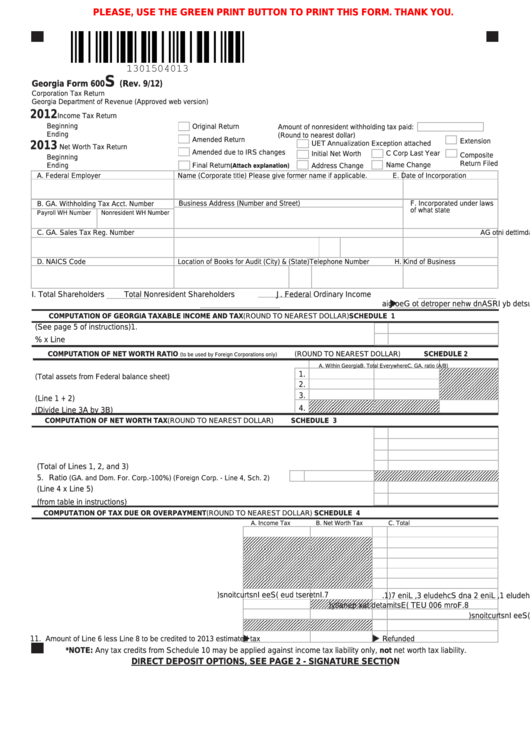

Form 600S ≡ Fill Out Printable PDF Forms Online

As defined in the income tax laws of georgia, only. Complete, save and print the form online using your browser. Enter the federal employer identification number (fein) for each member in the consolidated. Obtain georgia form 600s and its instructions. Any tax credits from schedule 11 may be applied against income tax liability only, not.

Form It 611s Instructions S Corporation Tax

As defined in the income tax laws of georgia, only. Obtain georgia form 600s and its instructions. Enter the federal employer identification number (fein) for each member in the consolidated. Complete, save and print the form online using your browser. You can obtain a copy of this form and the accompanying instructions on the georgia.

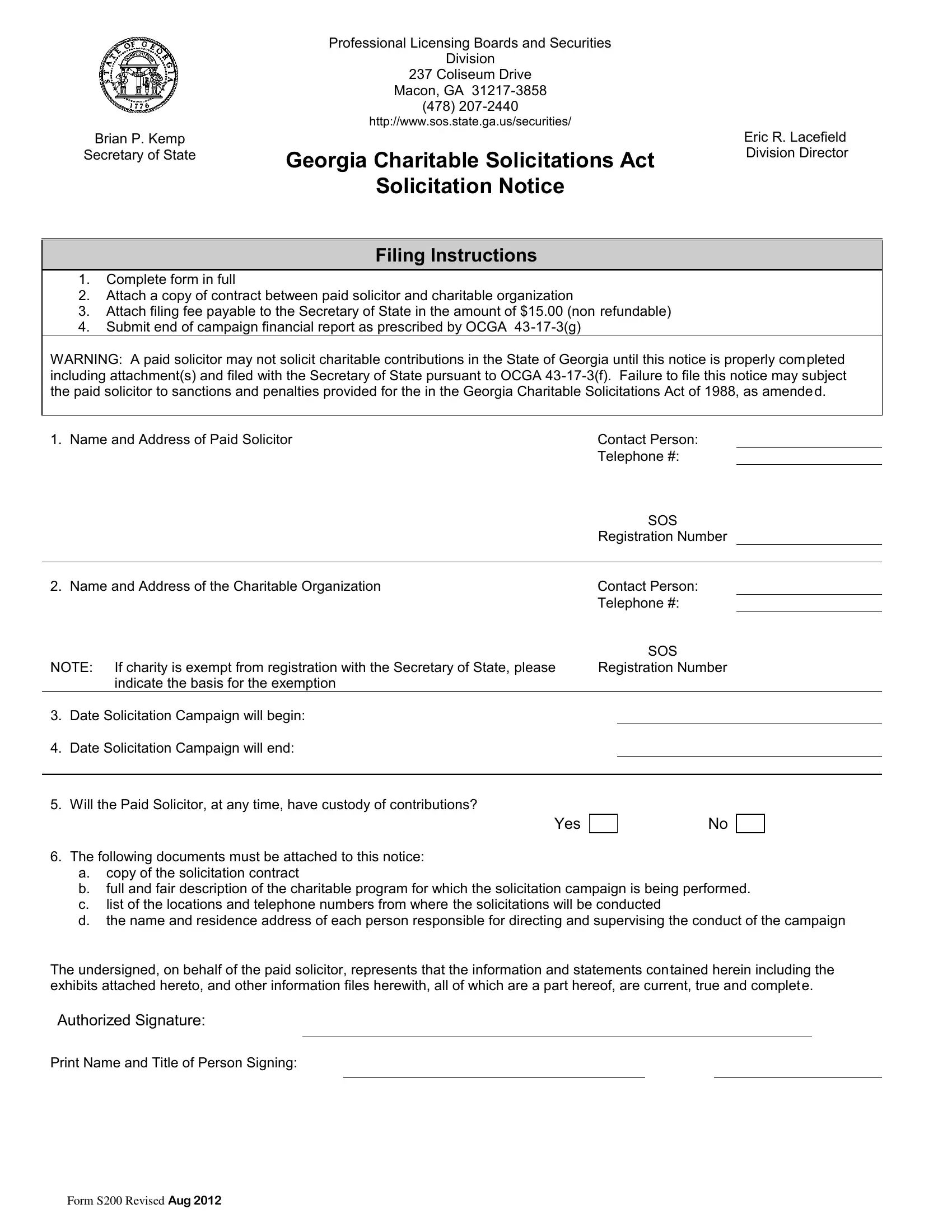

Form S200 ≡ Fill Out Printable PDF Forms Online

Computation of georgia taxable income and tax (round to nearest dollar) schedule 1 by checking the box, the s. An extension of time to file does not alter the interest or penalty. As defined in the income tax laws of georgia, only. Credit for the prepayment should be claimed on form 600s, schedule 4, line 2. Obtain georgia form 600s.

Form 500 ≡ Fill Out Printable PDF Forms Online

Obtain georgia form 600s and its instructions. You can obtain a copy of this form and the accompanying instructions on the georgia. As defined in the income tax laws of georgia, only. Complete, save and print the form online using your browser. Computation of georgia taxable income and tax (round to nearest dollar) schedule 1 by checking the box, the.

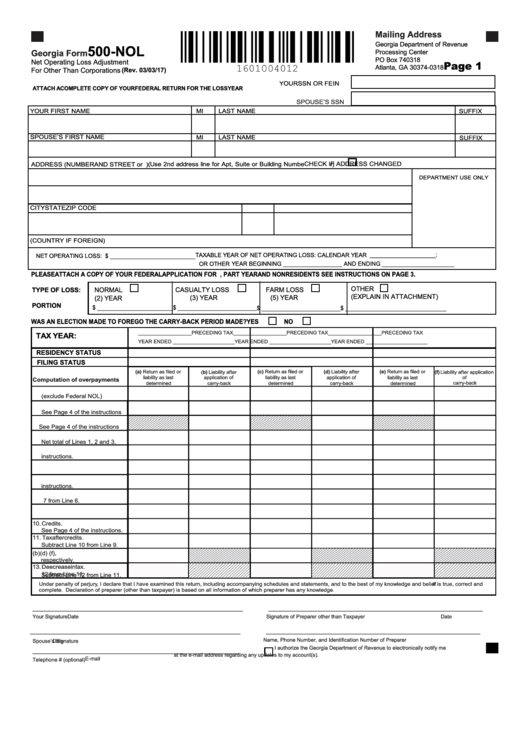

Fillable Online form 600 instructions. form 600

Georgia law recognizes an election to file as an s corporation under the provisions of the i.r.c. Any tax credits from schedule 11 may be applied against income tax liability only, not. Obtain georgia form 600s and its instructions. Credit for the prepayment should be claimed on form 600s, schedule 4, line 2. An extension of time to file does.

Tax Forms Printable Printable Forms Free Online

Georgia law recognizes an election to file as an s corporation under the provisions of the i.r.c. Any tax credits from schedule 11 may be applied against income tax liability only, not. Complete, save and print the form online using your browser. As defined in the income tax laws of georgia, only. Enter the federal employer identification number (fein) for.

Fillable Online Instructions For Form 600s Fax Email Print

Enter the federal employer identification number (fein) for each member in the consolidated. An extension of time to file does not alter the interest or penalty. You can obtain a copy of this form and the accompanying instructions on the georgia. Computation of georgia taxable income and tax (round to nearest dollar) schedule 1 by checking the box, the s..

Top 21 Form 500 Templates free to download in PDF format

You can obtain a copy of this form and the accompanying instructions on the georgia. Computation of georgia taxable income and tax (round to nearest dollar) schedule 1 by checking the box, the s. Enter the federal employer identification number (fein) for each member in the consolidated. As defined in the income tax laws of georgia, only. Any tax credits.

Top 5 Form 600s Templates free to download in PDF format

Obtain georgia form 600s and its instructions. Enter the federal employer identification number (fein) for each member in the consolidated. Any tax credits from schedule 11 may be applied against income tax liability only, not. Georgia law recognizes an election to file as an s corporation under the provisions of the i.r.c. Computation of georgia taxable income and tax (round.

You Can Obtain A Copy Of This Form And The Accompanying Instructions On The Georgia.

Obtain georgia form 600s and its instructions. Georgia law recognizes an election to file as an s corporation under the provisions of the i.r.c. Enter the federal employer identification number (fein) for each member in the consolidated. An extension of time to file does not alter the interest or penalty.

Credit For The Prepayment Should Be Claimed On Form 600S, Schedule 4, Line 2.

As defined in the income tax laws of georgia, only. Computation of georgia taxable income and tax (round to nearest dollar) schedule 1 by checking the box, the s. Complete, save and print the form online using your browser. Any tax credits from schedule 11 may be applied against income tax liability only, not.