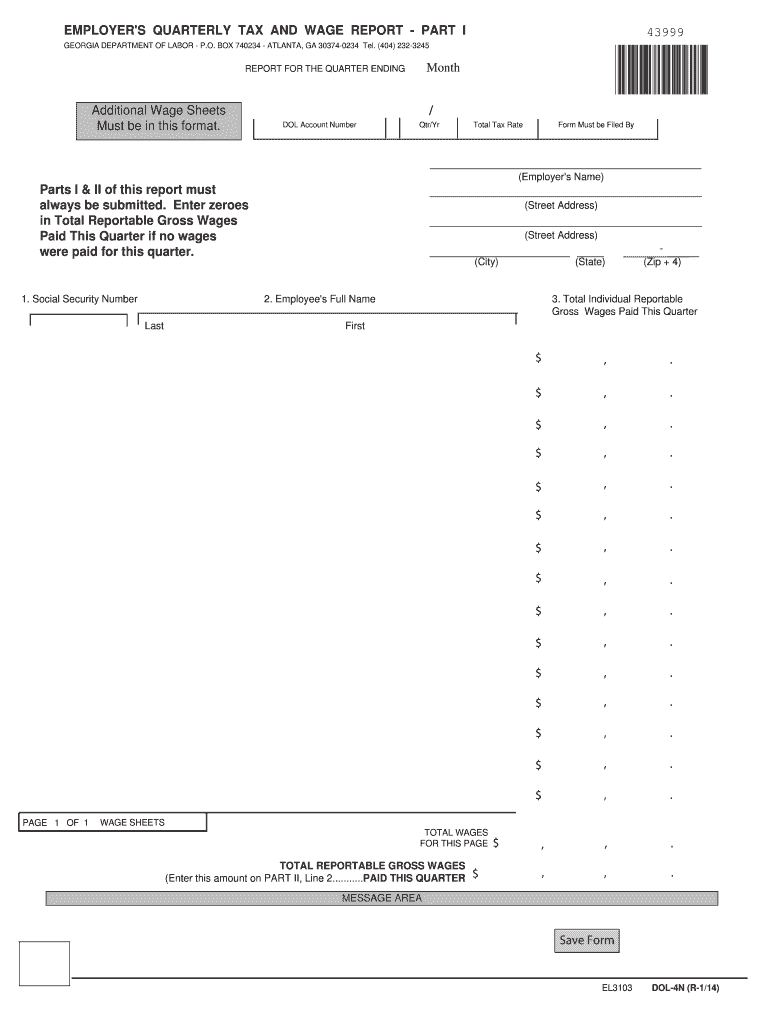

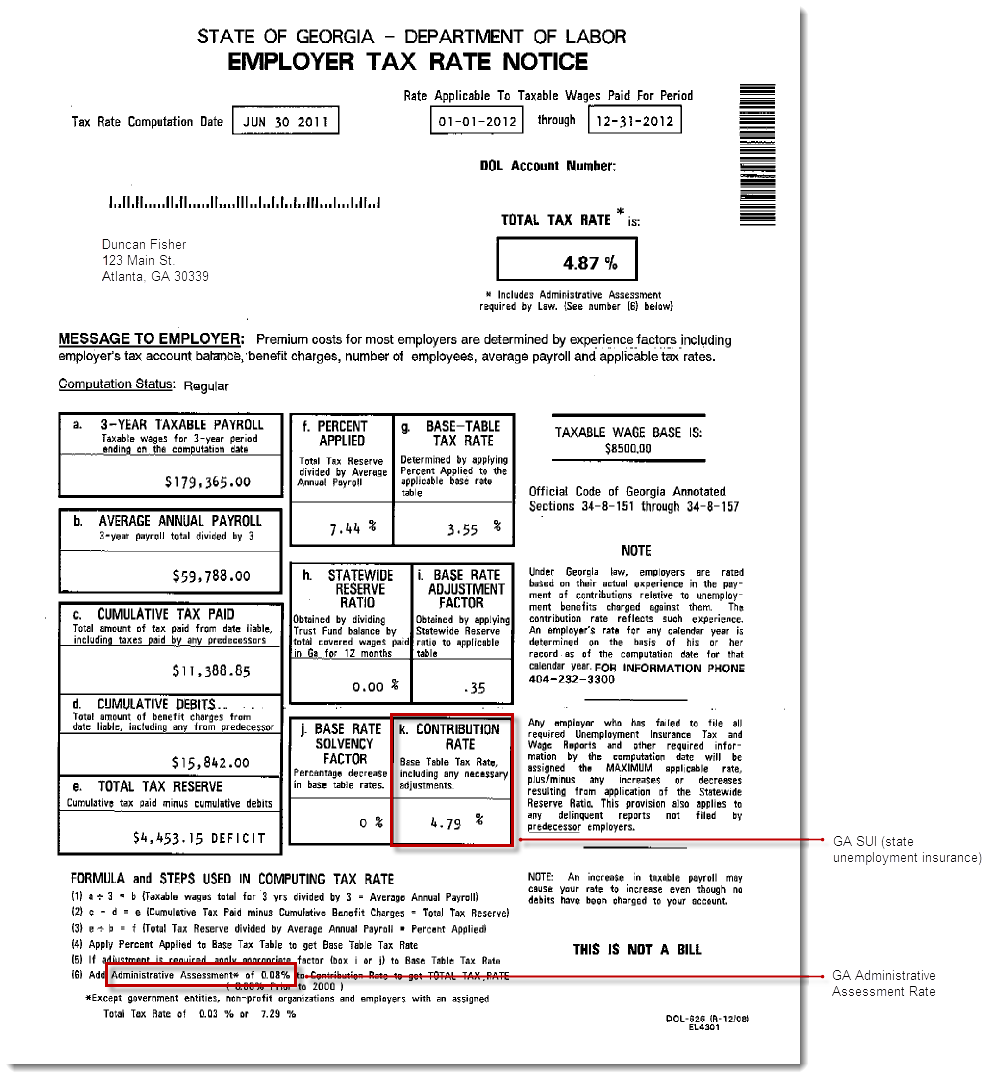

Georgia Form Dol 4N - If the principal location of your business operations in georgia has changed, enter the correct address below (do not use a p.o. Box number for principal location): Quarterly wage and tax reports may be submitted electronically. See the file an appeal. Beginning september 2023, the state accounting office (sao) will use a new automated process to submit the ui tax and wage reports to the georgia department of labor (ga dol) for all. The annual report and any payment due must be filed on or before january 31st of the. Employers are required to file their quarterly wage and tax reports electronically when reporting more than 100 employees.

Beginning september 2023, the state accounting office (sao) will use a new automated process to submit the ui tax and wage reports to the georgia department of labor (ga dol) for all. Employers are required to file their quarterly wage and tax reports electronically when reporting more than 100 employees. If the principal location of your business operations in georgia has changed, enter the correct address below (do not use a p.o. The annual report and any payment due must be filed on or before january 31st of the. See the file an appeal. Box number for principal location): Quarterly wage and tax reports may be submitted electronically.

See the file an appeal. Box number for principal location): Employers are required to file their quarterly wage and tax reports electronically when reporting more than 100 employees. The annual report and any payment due must be filed on or before january 31st of the. Quarterly wage and tax reports may be submitted electronically. If the principal location of your business operations in georgia has changed, enter the correct address below (do not use a p.o. Beginning september 2023, the state accounting office (sao) will use a new automated process to submit the ui tax and wage reports to the georgia department of labor (ga dol) for all.

department of labor Fill out & sign online DocHub

Box number for principal location): See the file an appeal. If the principal location of your business operations in georgia has changed, enter the correct address below (do not use a p.o. Beginning september 2023, the state accounting office (sao) will use a new automated process to submit the ui tax and wage reports to the georgia department of labor.

Separation Notice Pdf Fill Online, Printable, Fillable, Blank

Beginning september 2023, the state accounting office (sao) will use a new automated process to submit the ui tax and wage reports to the georgia department of labor (ga dol) for all. See the file an appeal. The annual report and any payment due must be filed on or before january 31st of the. Employers are required to file their.

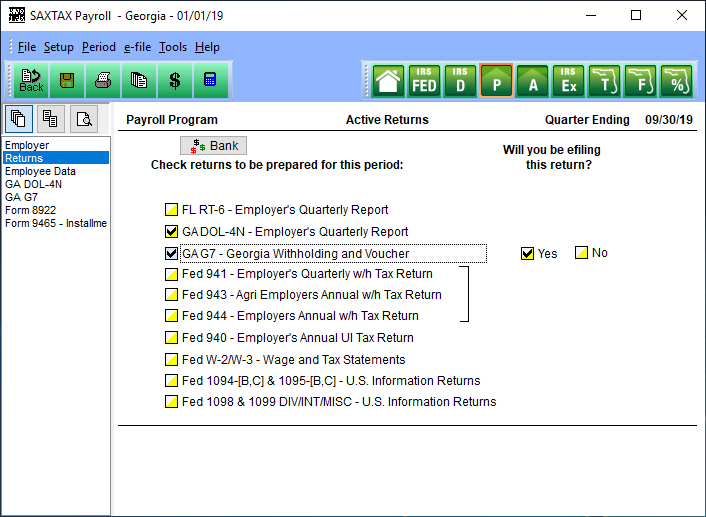

DOL4N Employer’s Tax and Wage Report SAXTAX

Beginning september 2023, the state accounting office (sao) will use a new automated process to submit the ui tax and wage reports to the georgia department of labor (ga dol) for all. See the file an appeal. The annual report and any payment due must be filed on or before january 31st of the. If the principal location of your.

Dol gov login my account Fill out & sign online DocHub

The annual report and any payment due must be filed on or before january 31st of the. Box number for principal location): See the file an appeal. Quarterly wage and tax reports may be submitted electronically. Beginning september 2023, the state accounting office (sao) will use a new automated process to submit the ui tax and wage reports to the.

Form Dol4n instructions Fill online, Printable, Fillable Blank

Quarterly wage and tax reports may be submitted electronically. If the principal location of your business operations in georgia has changed, enter the correct address below (do not use a p.o. Beginning september 2023, the state accounting office (sao) will use a new automated process to submit the ui tax and wage reports to the georgia department of labor (ga.

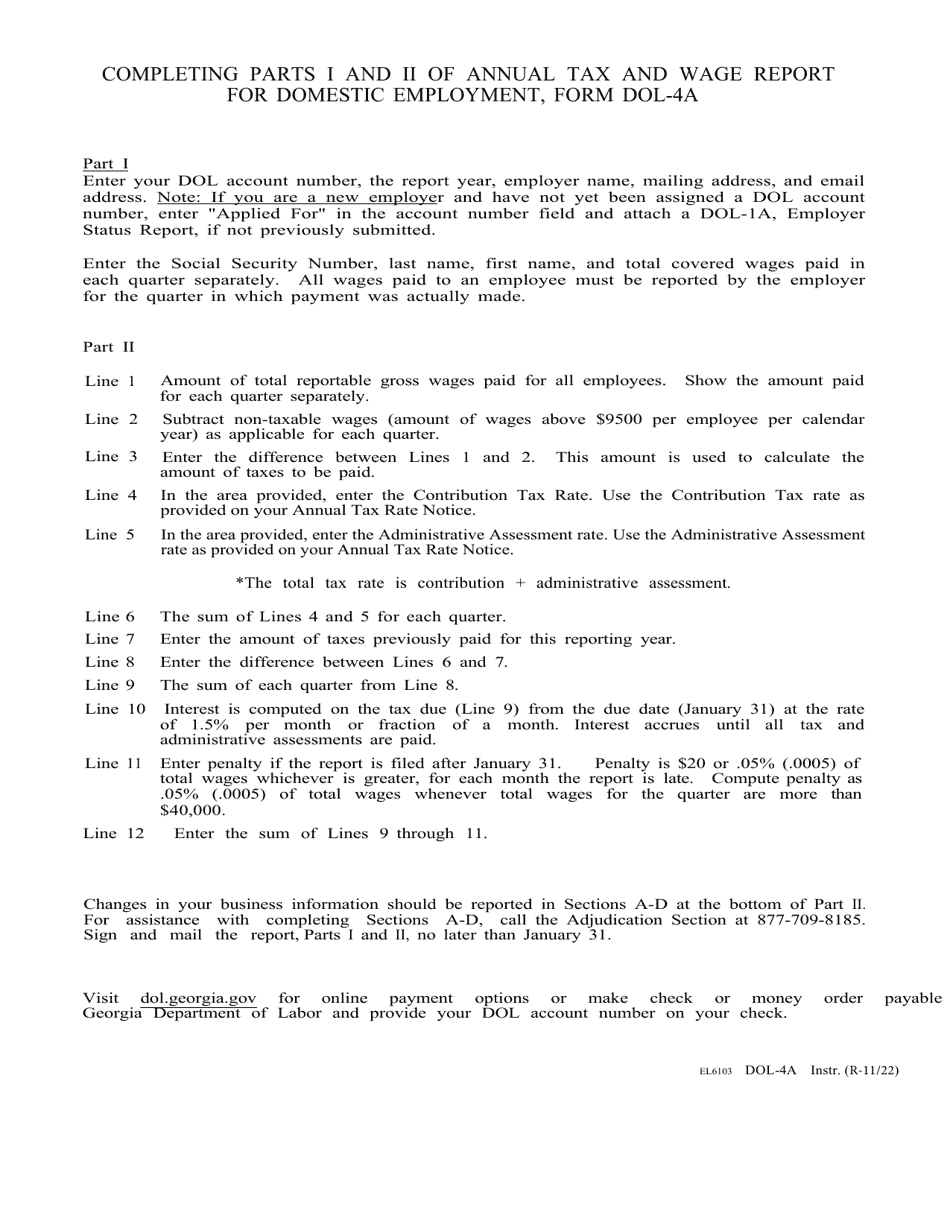

Form DOL4A Fill Out, Sign Online and Download Fillable PDF,

Box number for principal location): Quarterly wage and tax reports may be submitted electronically. If the principal location of your business operations in georgia has changed, enter the correct address below (do not use a p.o. The annual report and any payment due must be filed on or before january 31st of the. Employers are required to file their quarterly.

Form DOL4A Download Fillable PDF or Fill Online Annual Tax and Wage

Quarterly wage and tax reports may be submitted electronically. If the principal location of your business operations in georgia has changed, enter the correct address below (do not use a p.o. Beginning september 2023, the state accounting office (sao) will use a new automated process to submit the ui tax and wage reports to the georgia department of labor (ga.

Form DOL1N Fill Out, Sign Online and Download Fillable PDF,

If the principal location of your business operations in georgia has changed, enter the correct address below (do not use a p.o. Employers are required to file their quarterly wage and tax reports electronically when reporting more than 100 employees. The annual report and any payment due must be filed on or before january 31st of the. See the file.

The Peach State

See the file an appeal. If the principal location of your business operations in georgia has changed, enter the correct address below (do not use a p.o. Quarterly wage and tax reports may be submitted electronically. Beginning september 2023, the state accounting office (sao) will use a new automated process to submit the ui tax and wage reports to the.

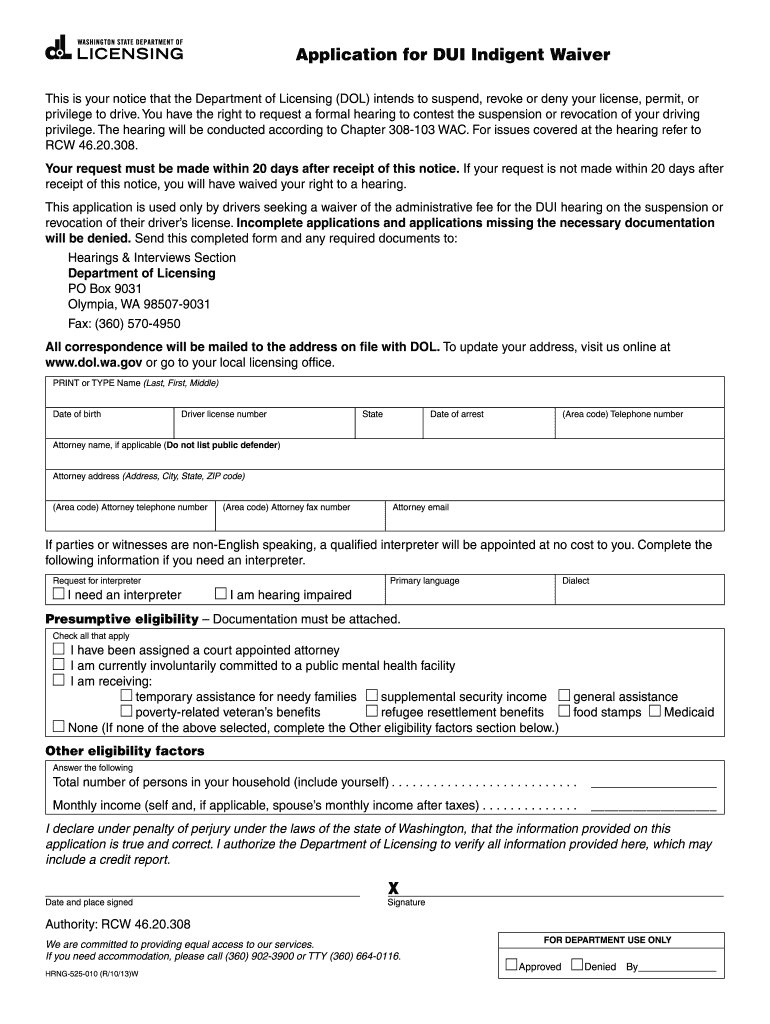

Dol Indigent Application 20202022 Fill and Sign Printable Template

See the file an appeal. Beginning september 2023, the state accounting office (sao) will use a new automated process to submit the ui tax and wage reports to the georgia department of labor (ga dol) for all. If the principal location of your business operations in georgia has changed, enter the correct address below (do not use a p.o. The.

Box Number For Principal Location):

Beginning september 2023, the state accounting office (sao) will use a new automated process to submit the ui tax and wage reports to the georgia department of labor (ga dol) for all. The annual report and any payment due must be filed on or before january 31st of the. See the file an appeal. Quarterly wage and tax reports may be submitted electronically.

Employers Are Required To File Their Quarterly Wage And Tax Reports Electronically When Reporting More Than 100 Employees.

If the principal location of your business operations in georgia has changed, enter the correct address below (do not use a p.o.