How Tax Is Calculated On Income - Federal tax, state tax, medicare,. Here’s how that works for a single person with taxable income of $58,000 per year: Use this tool to estimate the federal income tax you want your employer to withhold from your paycheck. Use our united states salary tax calculator to determine how much tax will be paid on your annual salary. Find the current tax rates for other filing.

Find the current tax rates for other filing. Federal tax, state tax, medicare,. Here’s how that works for a single person with taxable income of $58,000 per year: Use our united states salary tax calculator to determine how much tax will be paid on your annual salary. Use this tool to estimate the federal income tax you want your employer to withhold from your paycheck.

Federal tax, state tax, medicare,. Use this tool to estimate the federal income tax you want your employer to withhold from your paycheck. Find the current tax rates for other filing. Here’s how that works for a single person with taxable income of $58,000 per year: Use our united states salary tax calculator to determine how much tax will be paid on your annual salary.

Tax Equation Tessshebaylo

Use our united states salary tax calculator to determine how much tax will be paid on your annual salary. Use this tool to estimate the federal income tax you want your employer to withhold from your paycheck. Federal tax, state tax, medicare,. Find the current tax rates for other filing. Here’s how that works for a single person with taxable.

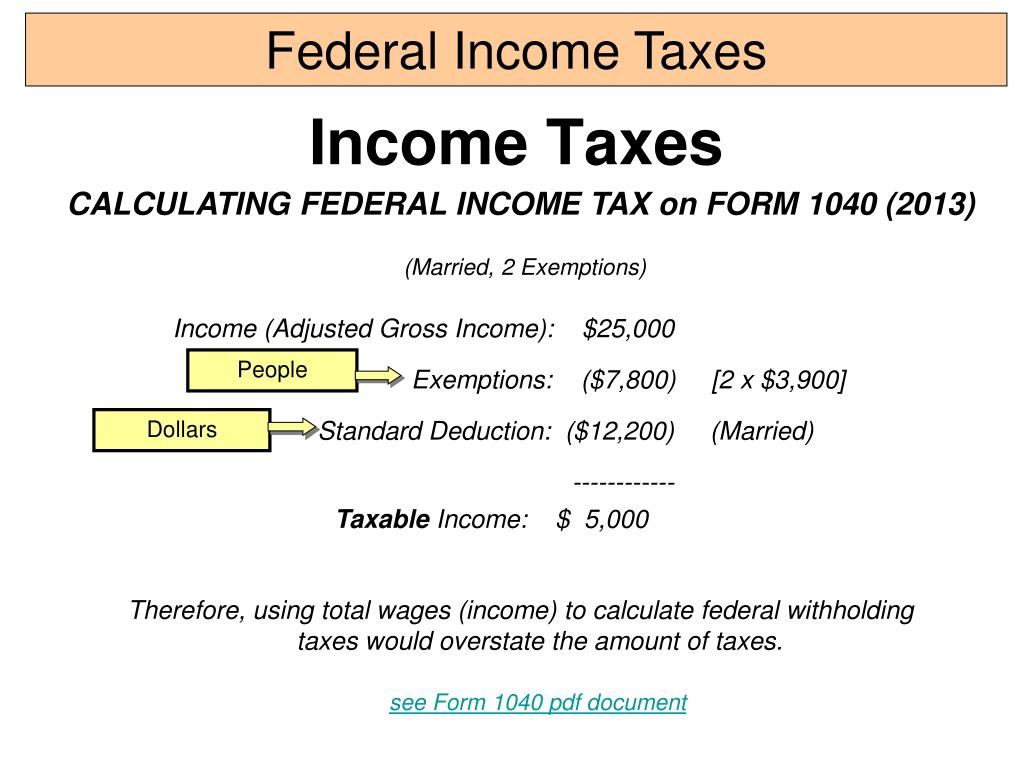

How Do You Calculate Federal Tax Withheld From Paycheck Tax Walls

Find the current tax rates for other filing. Federal tax, state tax, medicare,. Use our united states salary tax calculator to determine how much tax will be paid on your annual salary. Here’s how that works for a single person with taxable income of $58,000 per year: Use this tool to estimate the federal income tax you want your employer.

Tax Calculator 202424

Use our united states salary tax calculator to determine how much tax will be paid on your annual salary. Here’s how that works for a single person with taxable income of $58,000 per year: Federal tax, state tax, medicare,. Find the current tax rates for other filing. Use this tool to estimate the federal income tax you want your employer.

Monthly Tax Calculator 2024 Lola Sibbie

Use our united states salary tax calculator to determine how much tax will be paid on your annual salary. Here’s how that works for a single person with taxable income of $58,000 per year: Use this tool to estimate the federal income tax you want your employer to withhold from your paycheck. Federal tax, state tax, medicare,. Find the current.

What Is Tax and How Is It Calculated? FinanceBUM Financial

Use this tool to estimate the federal income tax you want your employer to withhold from your paycheck. Find the current tax rates for other filing. Here’s how that works for a single person with taxable income of $58,000 per year: Use our united states salary tax calculator to determine how much tax will be paid on your annual salary..

Individual Tax TaxEDU Glossary

Use this tool to estimate the federal income tax you want your employer to withhold from your paycheck. Find the current tax rates for other filing. Here’s how that works for a single person with taxable income of $58,000 per year: Use our united states salary tax calculator to determine how much tax will be paid on your annual salary..

Federal Tax Calculator 2021 Tax Withholding Estimator 2021

Use this tool to estimate the federal income tax you want your employer to withhold from your paycheck. Here’s how that works for a single person with taxable income of $58,000 per year: Use our united states salary tax calculator to determine how much tax will be paid on your annual salary. Federal tax, state tax, medicare,. Find the current.

Understand how the Federal Tax is Calculated

Federal tax, state tax, medicare,. Find the current tax rates for other filing. Use this tool to estimate the federal income tax you want your employer to withhold from your paycheck. Here’s how that works for a single person with taxable income of $58,000 per year: Use our united states salary tax calculator to determine how much tax will be.

How is my tax calculated? Bluewater Financial Planning

Here’s how that works for a single person with taxable income of $58,000 per year: Find the current tax rates for other filing. Use our united states salary tax calculator to determine how much tax will be paid on your annual salary. Federal tax, state tax, medicare,. Use this tool to estimate the federal income tax you want your employer.

Tax Equation Tessshebaylo

Federal tax, state tax, medicare,. Here’s how that works for a single person with taxable income of $58,000 per year: Use this tool to estimate the federal income tax you want your employer to withhold from your paycheck. Find the current tax rates for other filing. Use our united states salary tax calculator to determine how much tax will be.

Find The Current Tax Rates For Other Filing.

Federal tax, state tax, medicare,. Here’s how that works for a single person with taxable income of $58,000 per year: Use our united states salary tax calculator to determine how much tax will be paid on your annual salary. Use this tool to estimate the federal income tax you want your employer to withhold from your paycheck.