How To Fill Out Form 3115 For Missed Depreciation - Form 3115 will have to be filed, with the entire amount of incorrect or overlooked depreciation deducted in full in the year of correction via. To get irs approval to change an accounting method, you'll need to file form 3115, application for change in accounting method. File this form to request a change in either: You need to attach a copy of form 3115 to your return and you also need to send a signed copy to the irs national office (see the. The accounting treatment of any item.

To get irs approval to change an accounting method, you'll need to file form 3115, application for change in accounting method. File this form to request a change in either: Form 3115 will have to be filed, with the entire amount of incorrect or overlooked depreciation deducted in full in the year of correction via. You need to attach a copy of form 3115 to your return and you also need to send a signed copy to the irs national office (see the. The accounting treatment of any item.

File this form to request a change in either: You need to attach a copy of form 3115 to your return and you also need to send a signed copy to the irs national office (see the. The accounting treatment of any item. Form 3115 will have to be filed, with the entire amount of incorrect or overlooked depreciation deducted in full in the year of correction via. To get irs approval to change an accounting method, you'll need to file form 3115, application for change in accounting method.

Form 3115

You need to attach a copy of form 3115 to your return and you also need to send a signed copy to the irs national office (see the. Form 3115 will have to be filed, with the entire amount of incorrect or overlooked depreciation deducted in full in the year of correction via. File this form to request a change.

Correcting Depreciation Form 3115 LinebyLine

You need to attach a copy of form 3115 to your return and you also need to send a signed copy to the irs national office (see the. To get irs approval to change an accounting method, you'll need to file form 3115, application for change in accounting method. Form 3115 will have to be filed, with the entire amount.

Fillable Form 3115 Printable Forms Free Online

The accounting treatment of any item. Form 3115 will have to be filed, with the entire amount of incorrect or overlooked depreciation deducted in full in the year of correction via. You need to attach a copy of form 3115 to your return and you also need to send a signed copy to the irs national office (see the. To.

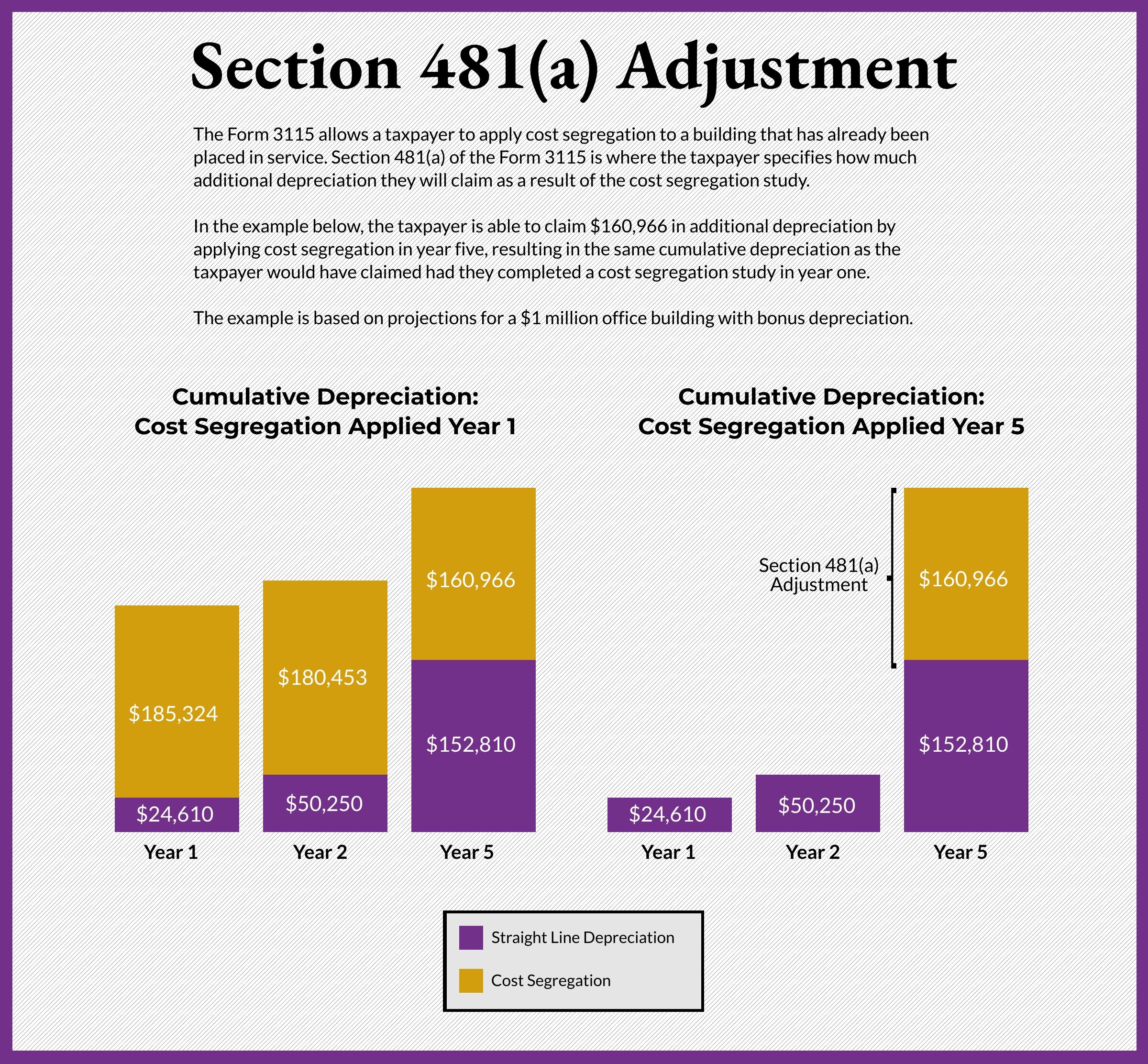

IRS Form 3115 How to Apply Cost Segregation to Existing Property

File this form to request a change in either: The accounting treatment of any item. You need to attach a copy of form 3115 to your return and you also need to send a signed copy to the irs national office (see the. To get irs approval to change an accounting method, you'll need to file form 3115, application for.

Form 3115 Instructions (Application for Change in Accounting Method)

You need to attach a copy of form 3115 to your return and you also need to send a signed copy to the irs national office (see the. To get irs approval to change an accounting method, you'll need to file form 3115, application for change in accounting method. Form 3115 will have to be filed, with the entire amount.

Maximize Tax Savings Guide to Filing Form 3115 for Depreciation

To get irs approval to change an accounting method, you'll need to file form 3115, application for change in accounting method. The accounting treatment of any item. File this form to request a change in either: You need to attach a copy of form 3115 to your return and you also need to send a signed copy to the irs.

Form 3115 Correcting Depreciation LinebyLine Brass Tax Presentations

Form 3115 will have to be filed, with the entire amount of incorrect or overlooked depreciation deducted in full in the year of correction via. The accounting treatment of any item. You need to attach a copy of form 3115 to your return and you also need to send a signed copy to the irs national office (see the. File.

Form 3115 Missed Depreciation printable pdf download

You need to attach a copy of form 3115 to your return and you also need to send a signed copy to the irs national office (see the. Form 3115 will have to be filed, with the entire amount of incorrect or overlooked depreciation deducted in full in the year of correction via. The accounting treatment of any item. File.

a man sitting at a desk writing on paper

You need to attach a copy of form 3115 to your return and you also need to send a signed copy to the irs national office (see the. The accounting treatment of any item. Form 3115 will have to be filed, with the entire amount of incorrect or overlooked depreciation deducted in full in the year of correction via. File.

Webinar Correcting Depreciation and Form 3115 by Tax Practice Pro, Inc

The accounting treatment of any item. You need to attach a copy of form 3115 to your return and you also need to send a signed copy to the irs national office (see the. Form 3115 will have to be filed, with the entire amount of incorrect or overlooked depreciation deducted in full in the year of correction via. To.

File This Form To Request A Change In Either:

To get irs approval to change an accounting method, you'll need to file form 3115, application for change in accounting method. The accounting treatment of any item. Form 3115 will have to be filed, with the entire amount of incorrect or overlooked depreciation deducted in full in the year of correction via. You need to attach a copy of form 3115 to your return and you also need to send a signed copy to the irs national office (see the.