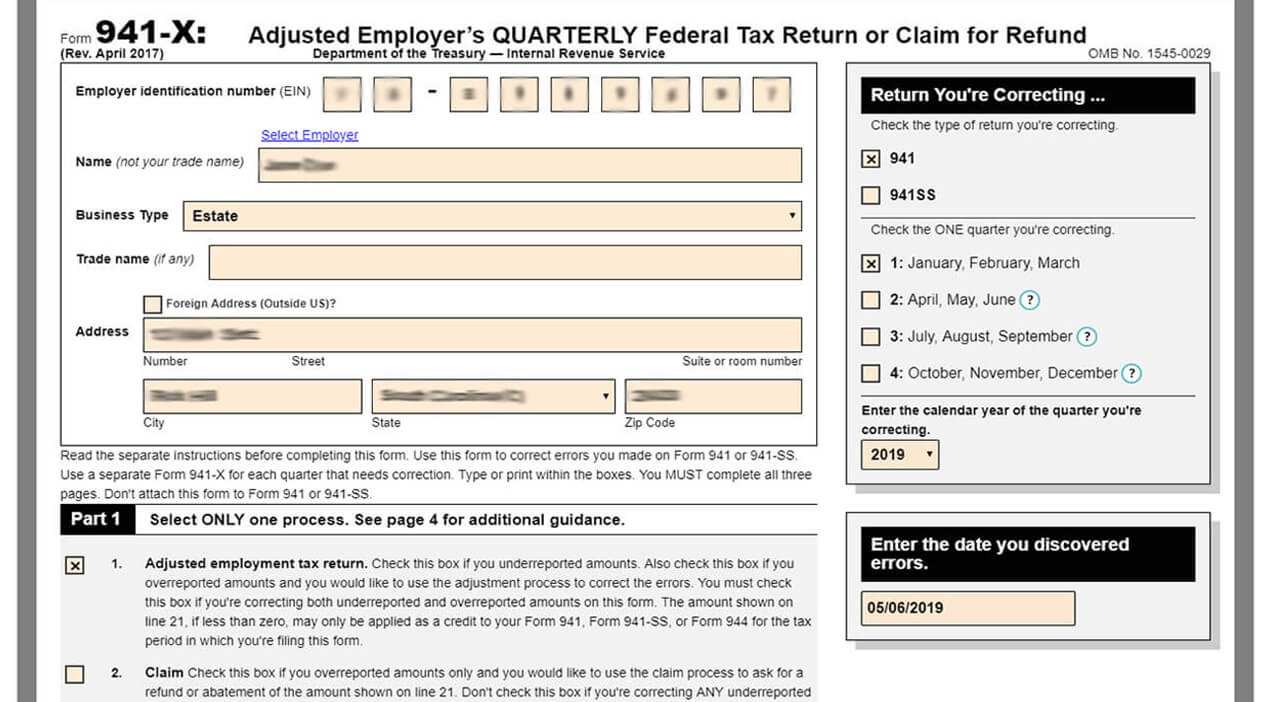

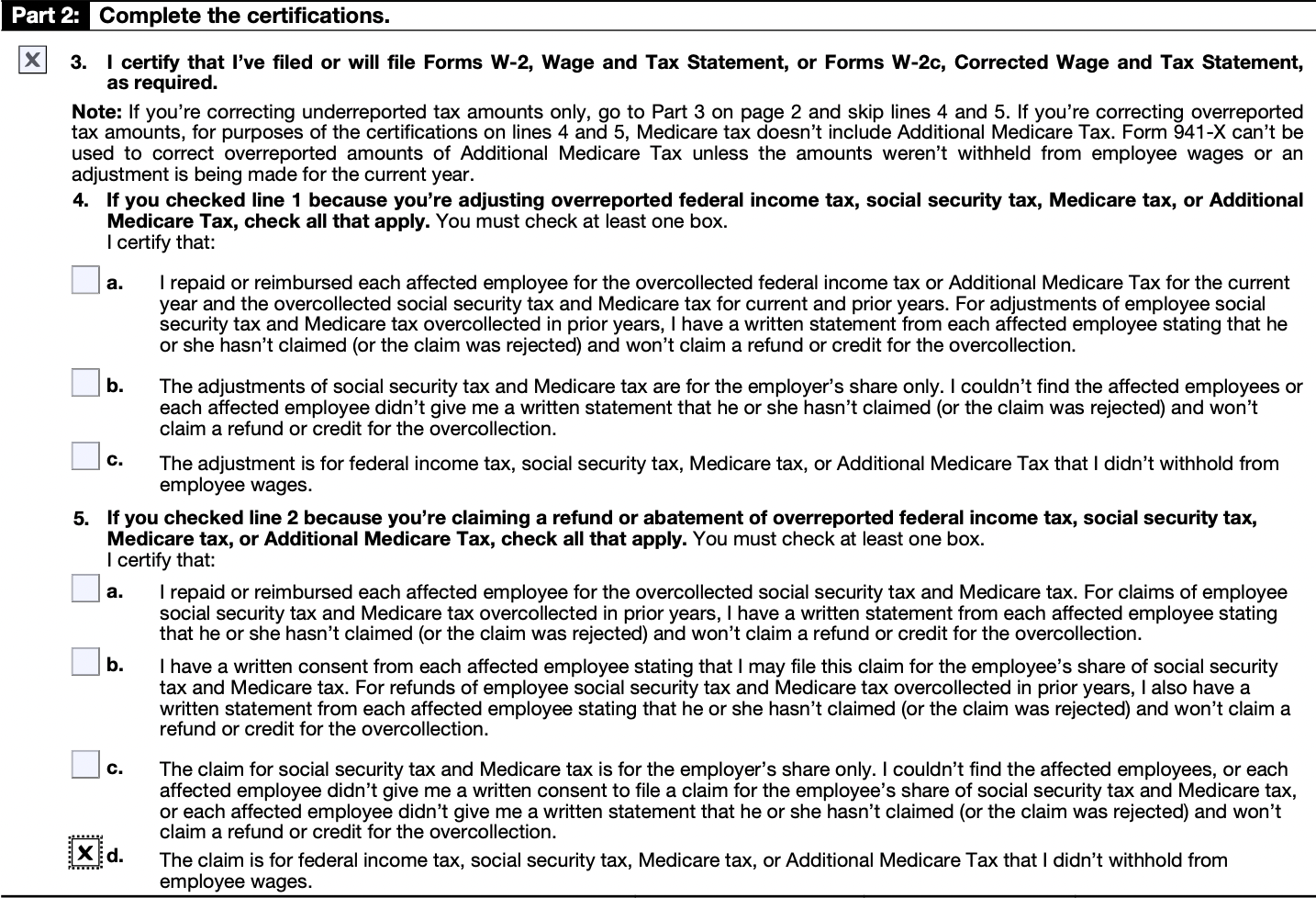

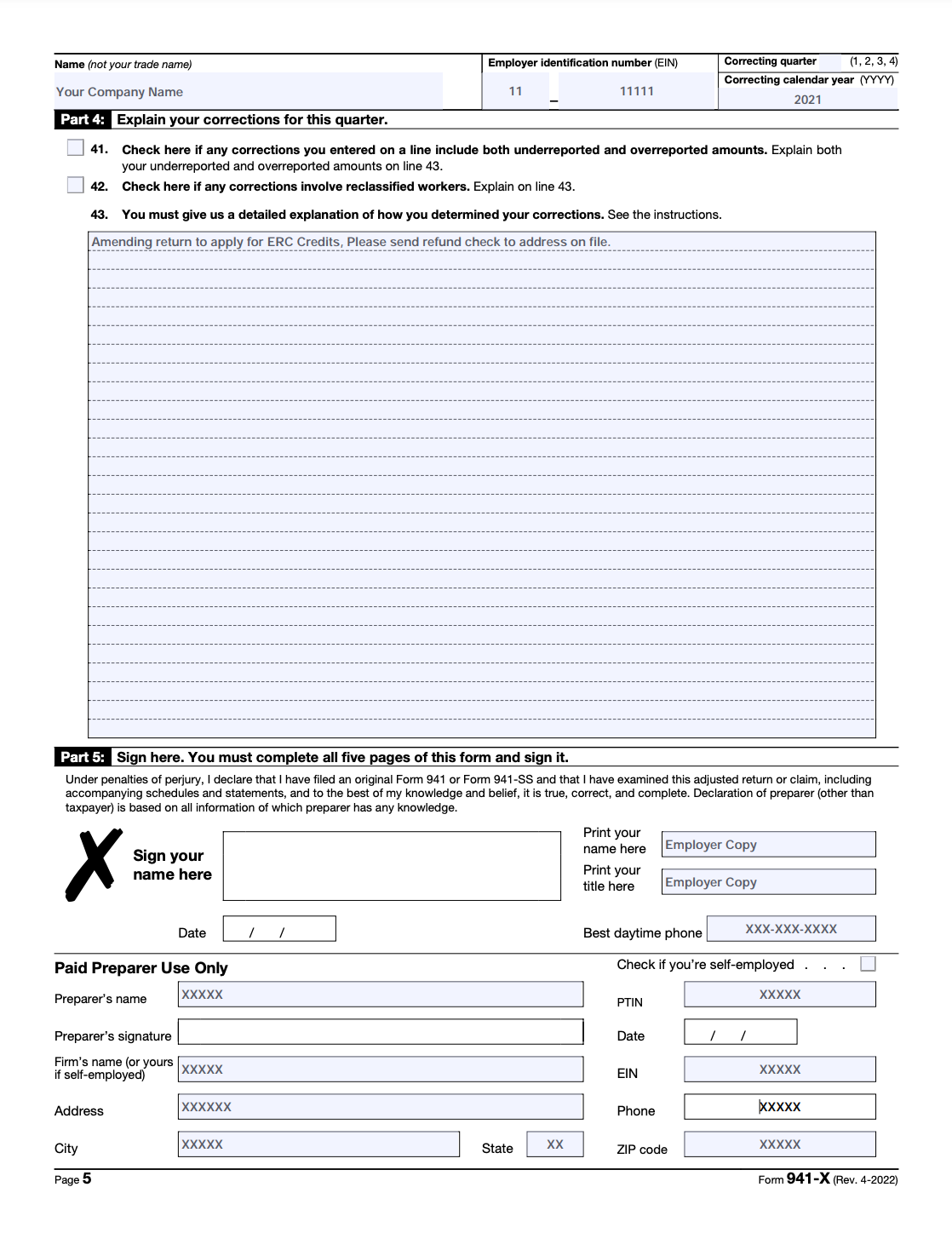

How To Fill Out Form 941 X For Employee Retention Credit - Eligible employers can claim the erc on an original or adjusted employment tax return for a period within those dates. If you claimed the employee retention credit.

If you claimed the employee retention credit. Eligible employers can claim the erc on an original or adjusted employment tax return for a period within those dates.

Eligible employers can claim the erc on an original or adjusted employment tax return for a period within those dates. If you claimed the employee retention credit.

How to Fill Out 941X for Employee Retention Credit? by Employee

Eligible employers can claim the erc on an original or adjusted employment tax return for a period within those dates. If you claimed the employee retention credit.

How To Fill Out 941X For Employee Retention Credit [Stepwise Guide

Eligible employers can claim the erc on an original or adjusted employment tax return for a period within those dates. If you claimed the employee retention credit.

How To Fill Out 941 X To Claim Employee Retention Credit TAX

If you claimed the employee retention credit. Eligible employers can claim the erc on an original or adjusted employment tax return for a period within those dates.

How To Fill Out 941X For Employee Retention Credit [Stepwise Guide

Eligible employers can claim the erc on an original or adjusted employment tax return for a period within those dates. If you claimed the employee retention credit.

How To Fill Out Form 941 X For Employee Retention Credit In 2020 Form

Eligible employers can claim the erc on an original or adjusted employment tax return for a period within those dates. If you claimed the employee retention credit.

How To Fill Out Form 941 X For Employee Retention Credit In 2020 Form

If you claimed the employee retention credit. Eligible employers can claim the erc on an original or adjusted employment tax return for a period within those dates.

How To Fill Out 941X For Employee Retention Credit [Stepwise Guide

Eligible employers can claim the erc on an original or adjusted employment tax return for a period within those dates. If you claimed the employee retention credit.

How To Fill Out 941X For Employee Retention Credit Essential Steps

Eligible employers can claim the erc on an original or adjusted employment tax return for a period within those dates. If you claimed the employee retention credit.

How To Fill Out 941X For Employee Retention Credit LiveWell

Eligible employers can claim the erc on an original or adjusted employment tax return for a period within those dates. If you claimed the employee retention credit.

Eligible Employers Can Claim The Erc On An Original Or Adjusted Employment Tax Return For A Period Within Those Dates.

If you claimed the employee retention credit.