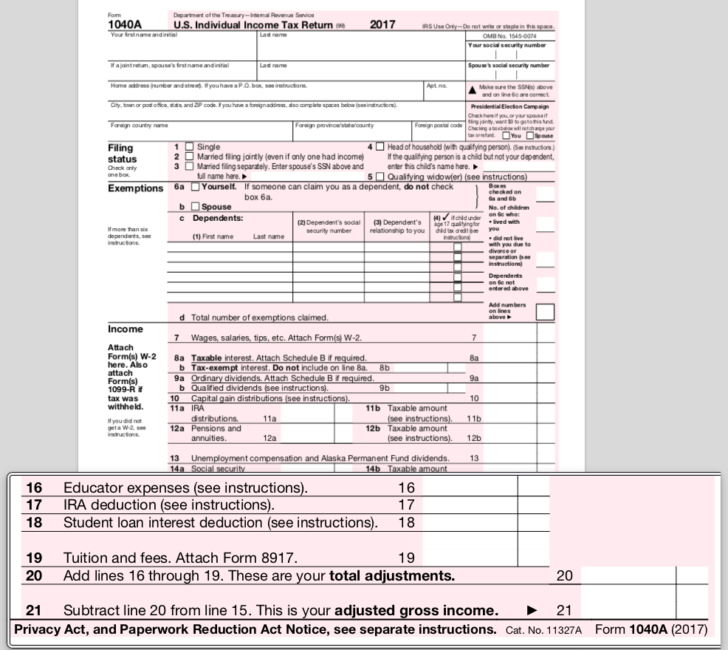

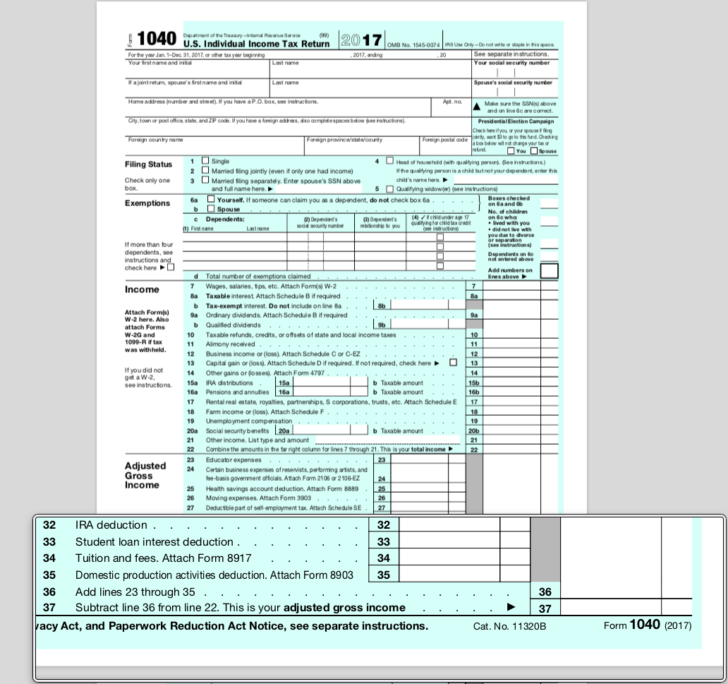

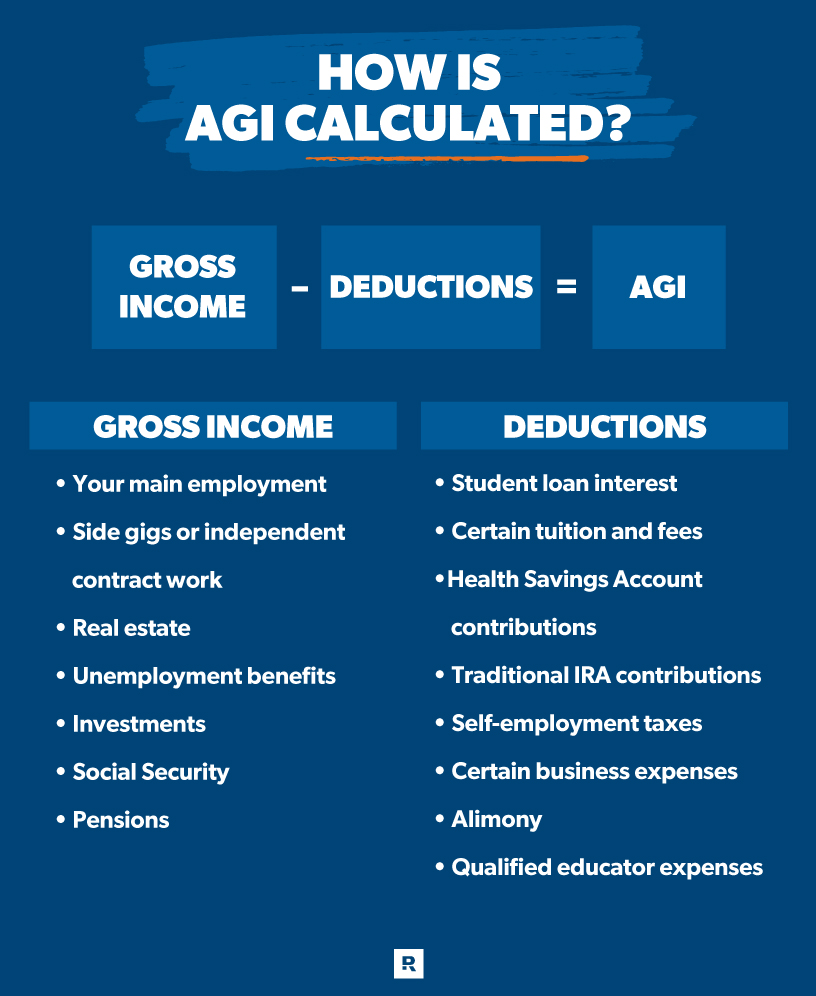

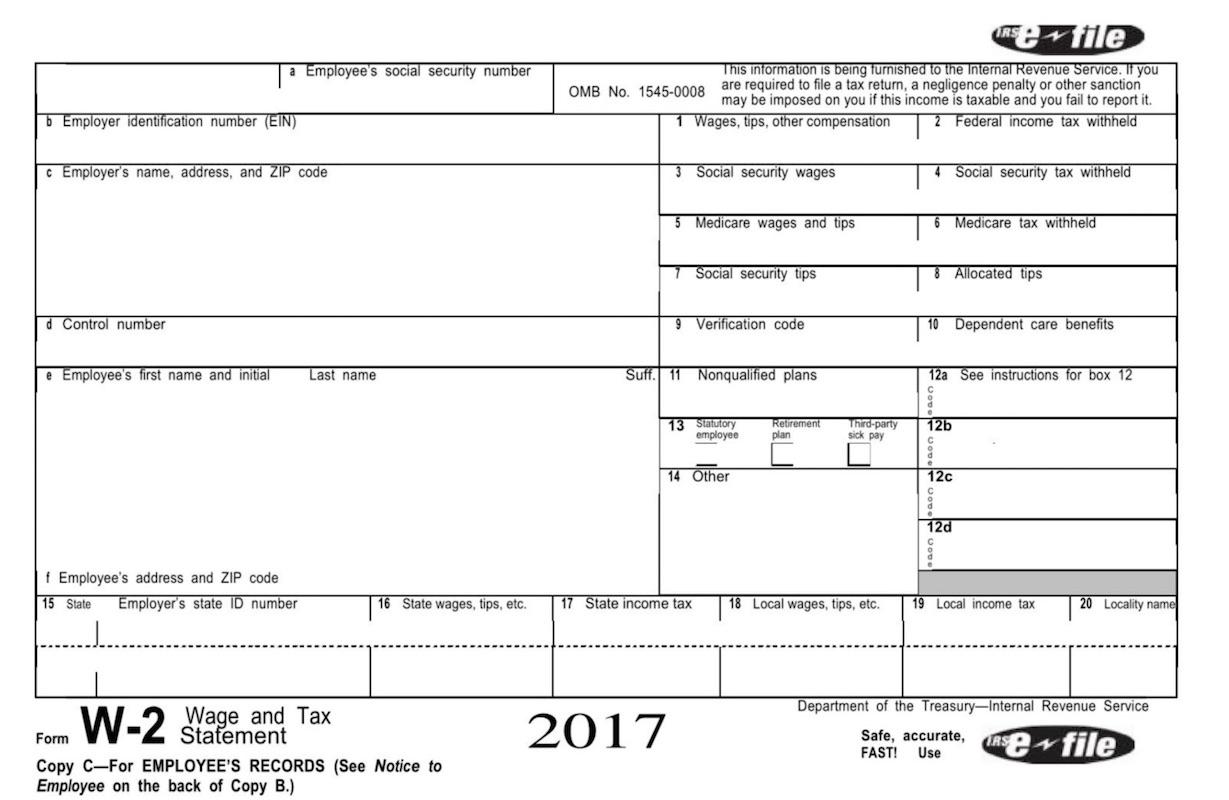

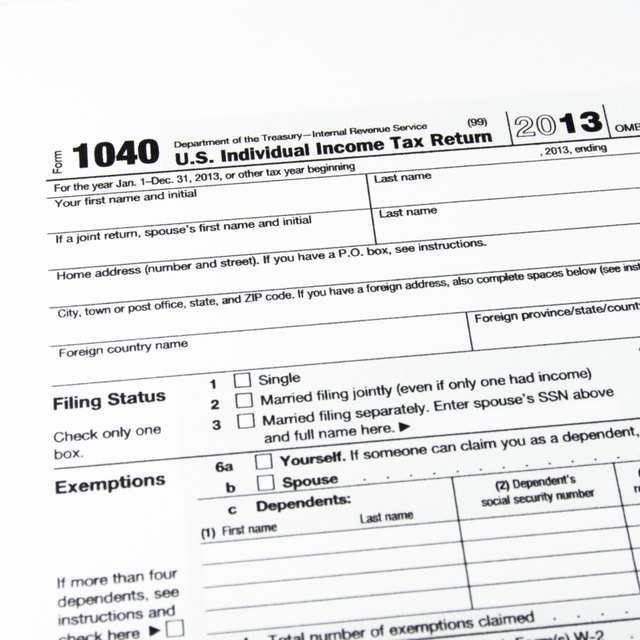

How To Find Agi On Tax Form - You can find your agi: Individual income tax return, line 11. Start with your total income shown on your w2 form. You can find last year’s agi: 4.5/5 (13k) Where to find your agi. Depending upon your filing status, this step will ask you to enter your adjusted gross income (agi), your total combined household agi, or. Where to find your agi. Your agi is on form 1040, u.s. Learn how to find and calculate your agi on form 1040, understand its components, and see how it affects tax credits.

Where to find your agi. You can find last year’s agi: Learn how to find and calculate your agi on form 1040, understand its components, and see how it affects tax credits. Individual income tax return, line 11. Depending upon your filing status, this step will ask you to enter your adjusted gross income (agi), your total combined household agi, or. You can find your agi: 4.5/5 (13k) Your agi is on form 1040, u.s. Your agi is entered on line 11 of form 1040, u.s. Finding your adjusted gross income (agi) involves several steps.

You can find last year’s agi: Depending upon your filing status, this step will ask you to enter your adjusted gross income (agi), your total combined household agi, or. Where to find your agi. Learn how to find and calculate your agi on form 1040, understand its components, and see how it affects tax credits. You can find your agi: Start with your total income shown on your w2 form. Your agi is on form 1040, u.s. 4.5/5 (13k) Where to find your agi. Individual income tax return, line 11.

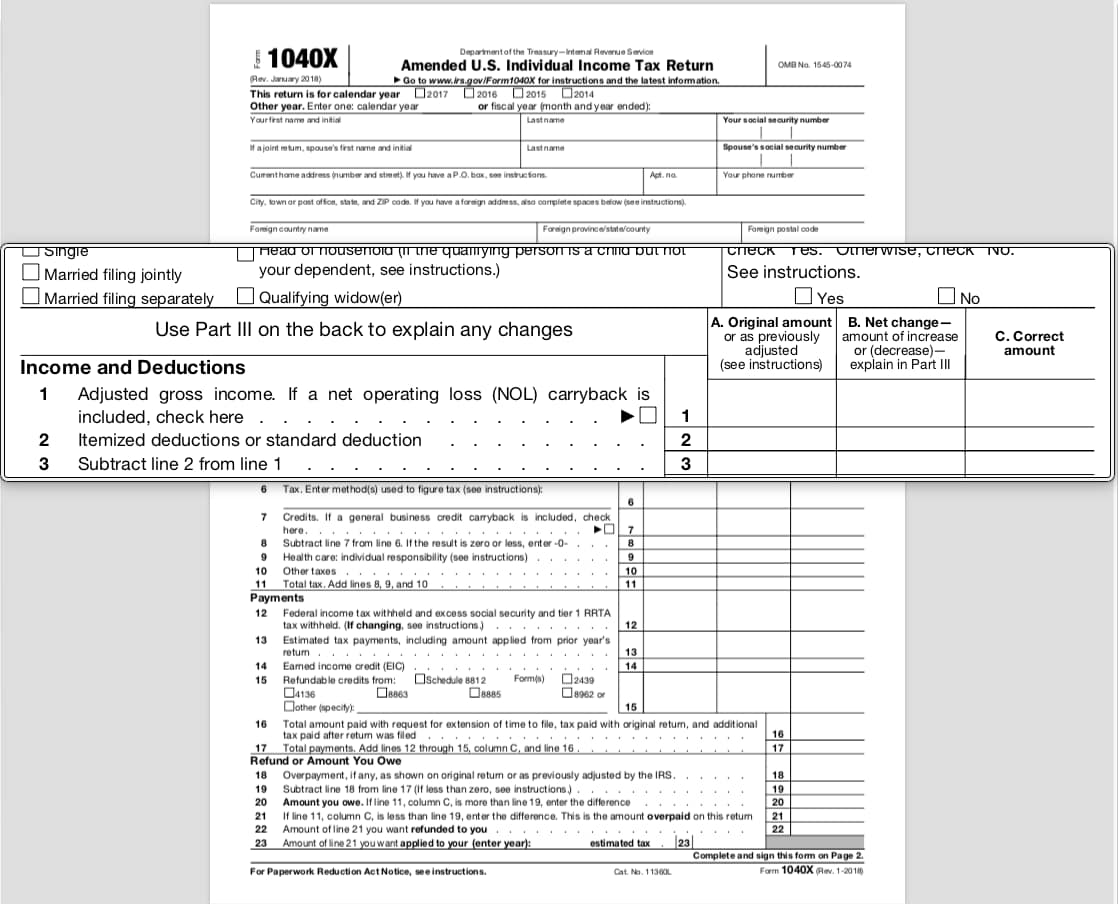

Agi On Form 3x 3 Agi On Form 3x That Had Gone Way Too Far 2021 Tax

Depending upon your filing status, this step will ask you to enter your adjusted gross income (agi), your total combined household agi, or. You can find last year’s agi: Start with your total income shown on your w2 form. You can find your agi: Your agi is on form 1040, u.s.

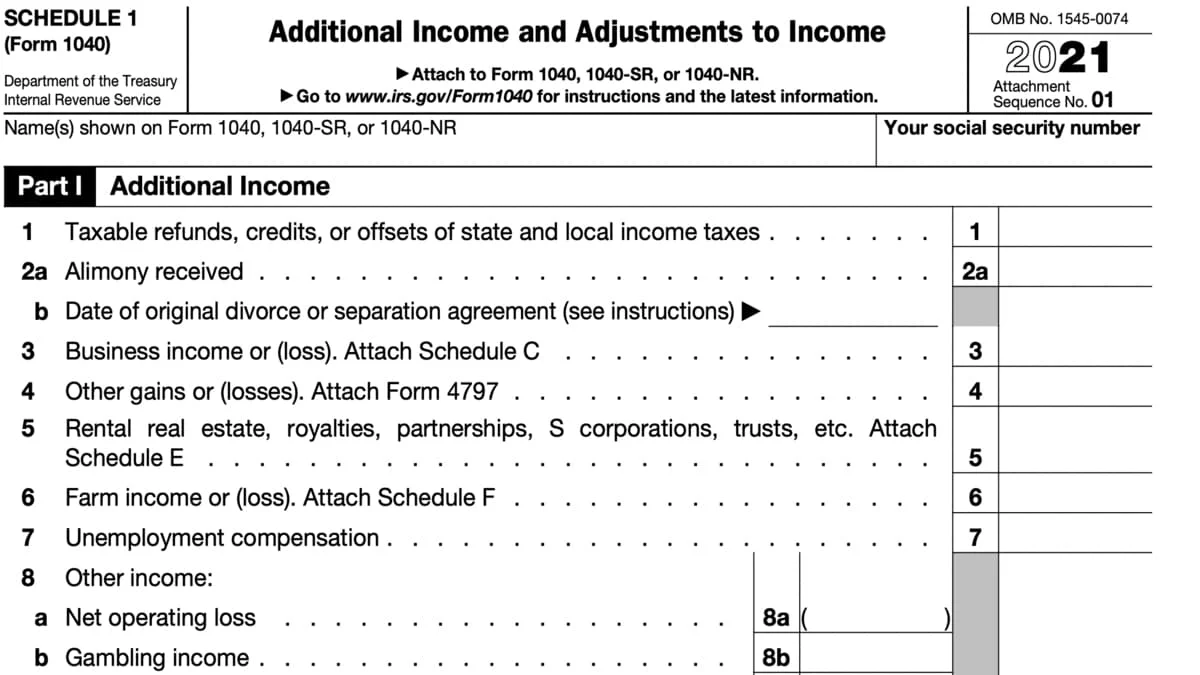

I Am Trying To Find My Agi Number Please Help TurboTax 2021 Tax Forms

Start with your total income shown on your w2 form. Depending upon your filing status, this step will ask you to enter your adjusted gross income (agi), your total combined household agi, or. You can find your agi: Your agi is entered on line 11 of form 1040, u.s. Finding your adjusted gross income (agi) involves several steps.

What Is Adjusted Gross (AGI)? Where to find AGI on Your Form

Your agi is entered on line 11 of form 1040, u.s. Start with your total income shown on your w2 form. You can find last year’s agi: 4.5/5 (13k) Finding your adjusted gross income (agi) involves several steps.

2024 Agi Tax Calculator Corri Michelina

Where to find your agi. Learn how to find and calculate your agi on form 1040, understand its components, and see how it affects tax credits. Finding your adjusted gross income (agi) involves several steps. Your agi is entered on line 11 of form 1040, u.s. Start with your total income shown on your w2 form.

How to Calculate AGI from W2? The Handy Tax Guy

4.5/5 (13k) Where to find your agi. Where to find your agi. Finding your adjusted gross income (agi) involves several steps. Individual income tax return, line 11.

Where To Find Your Prior Year Agi Priortax Images and Photos finder

Learn how to find and calculate your agi on form 1040, understand its components, and see how it affects tax credits. Where to find your agi. Individual income tax return, line 11. Where to find your agi. Your agi is on form 1040, u.s.

Where to Find Adjusted Gross (AGI) on Form 1040?

Finding your adjusted gross income (agi) involves several steps. 4.5/5 (13k) Your agi is on form 1040, u.s. Where to find your agi. Individual income tax return, line 11.

Where can I find spouse's AGI on 2016 tax forms. TurboTax® Support

You can find last year’s agi: Individual income tax return, line 11. Depending upon your filing status, this step will ask you to enter your adjusted gross income (agi), your total combined household agi, or. Learn how to find and calculate your agi on form 1040, understand its components, and see how it affects tax credits. You can find your.

AGI Amount H&R Block

Depending upon your filing status, this step will ask you to enter your adjusted gross income (agi), your total combined household agi, or. Your agi is entered on line 11 of form 1040, u.s. Where to find your agi. Where to find your agi. Your agi is on form 1040, u.s.

Finding Your Adjusted Gross Income (Agi) Involves Several Steps.

Start with your total income shown on your w2 form. You can find your agi: You can find last year’s agi: Depending upon your filing status, this step will ask you to enter your adjusted gross income (agi), your total combined household agi, or.

Where To Find Your Agi.

Individual income tax return, line 11. Your agi is on form 1040, u.s. 4.5/5 (13k) Your agi is entered on line 11 of form 1040, u.s.

Learn How To Find And Calculate Your Agi On Form 1040, Understand Its Components, And See How It Affects Tax Credits.

Where to find your agi.