Inheritance Tax Waiver Form California - No form exists or needed. In california, there is no requirement for an inheritance tax waiver form, a legal. California has no inheritance tax. When filing an estate return, the executor follows the due dates for estates. Is there a california inheritance tax waiver form? Learn about the history and current status of california estate tax, inheritance tax, and gift tax. However, if the gift or inheritance later produces income, you will. File form 541 in order to: California does not impose a state inheritance tax. This means that beneficiaries inheriting assets from a decedent who was a.

Find out how to file a return, request a. Learn about the history and current status of california estate tax, inheritance tax, and gift tax. Is there a california inheritance tax waiver form? When filing an estate return, the executor follows the due dates for estates. However, if the gift or inheritance later produces income, you will. This means that beneficiaries inheriting assets from a decedent who was a. If you received a gift or inheritance, do not include it in your income. Visit forms to get older forms. Federal inheritance tax only applies to estates exceeding $11,4 million. No form exists or needed.

Visit forms to get older forms. If you received a gift or inheritance, do not include it in your income. California does not impose a state inheritance tax. California has no inheritance tax. However, if the gift or inheritance later produces income, you will. When filing an estate return, the executor follows the due dates for estates. Federal inheritance tax only applies to estates exceeding $11,4 million. In california, there is no requirement for an inheritance tax waiver form, a legal. No form exists or needed. This means that beneficiaries inheriting assets from a decedent who was a.

Inheritance Tax Waiver Form California Form Resume Examples 3q9JWRvYAr

Learn about the history and current status of california estate tax, inheritance tax, and gift tax. File form 541 in order to: Is there a california inheritance tax waiver form? Federal inheritance tax only applies to estates exceeding $11,4 million. If you received a gift or inheritance, do not include it in your income.

Inheritance Tax Waiver Form California Form Resume Examples 3q9JWRvYAr

File form 541 in order to: Federal inheritance tax only applies to estates exceeding $11,4 million. No form exists or needed. If you received a gift or inheritance, do not include it in your income. California has no inheritance tax.

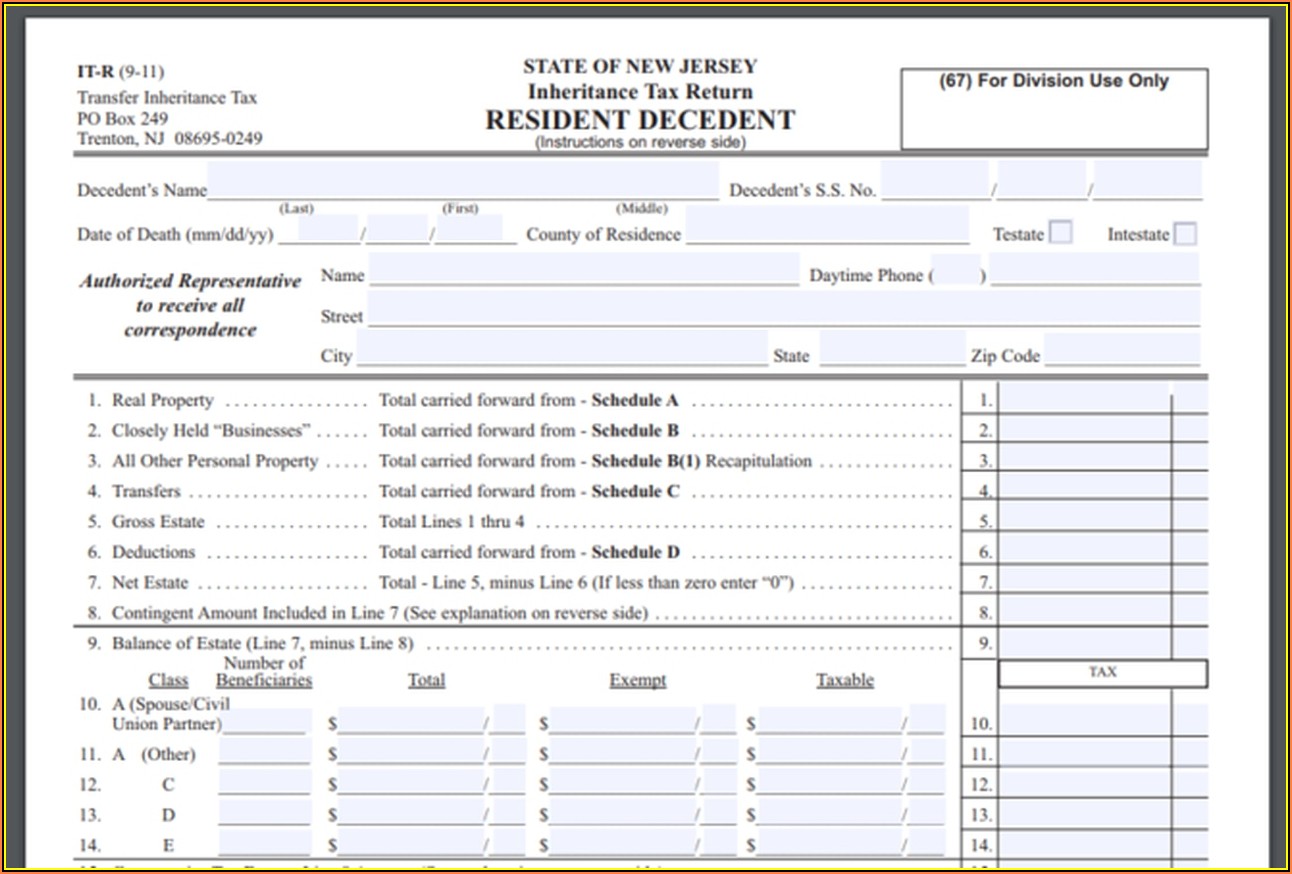

Inheritance Tax Waiver Form Illinois Form Resume Examples XV8o6xN3zD

Find out how to file a return, request a. Learn about the history and current status of california estate tax, inheritance tax, and gift tax. Federal inheritance tax only applies to estates exceeding $11,4 million. California has no inheritance tax. Visit forms to get older forms.

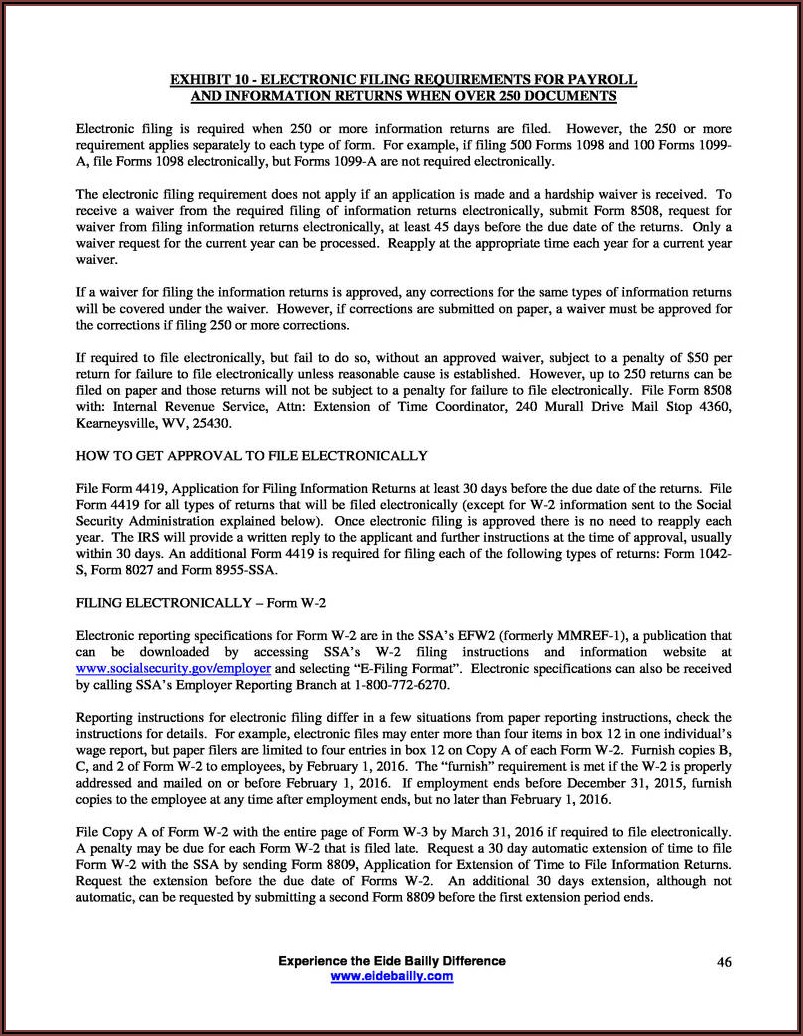

Inheritance Tax Waiver Form Form Resume Examples l6YNqRm93z

Is there a california inheritance tax waiver form? Visit forms to get older forms. Find out how to file a return, request a. Learn about the history and current status of california estate tax, inheritance tax, and gift tax. No form exists or needed.

Inheritance Tax Waiver Form Ohio Form Resume Examples v19xB3bV7E

California does not impose a state inheritance tax. Is there a california inheritance tax waiver form? When filing an estate return, the executor follows the due dates for estates. If you received a gift or inheritance, do not include it in your income. However, if the gift or inheritance later produces income, you will.

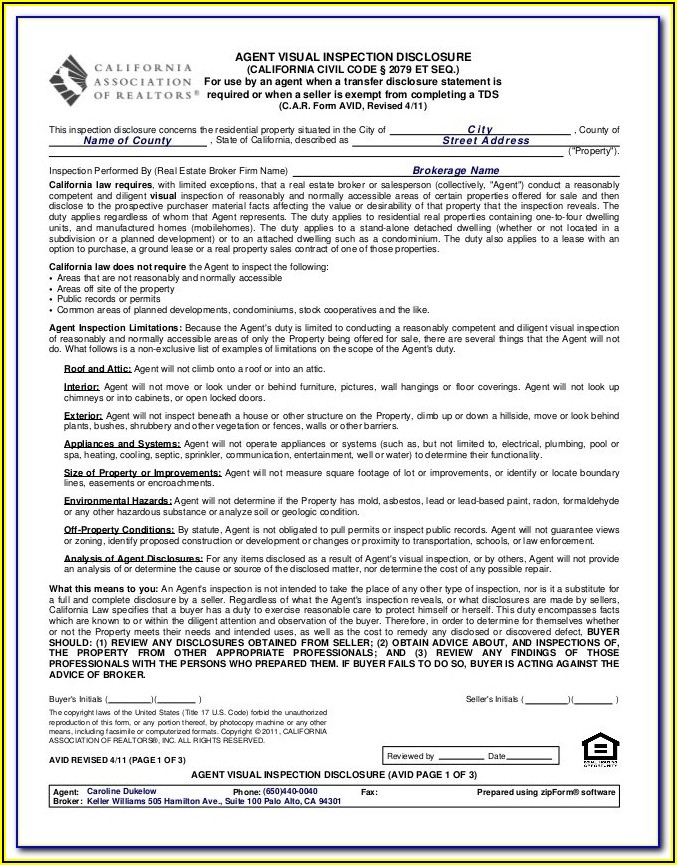

Inheritance Tax Waiver Form Form Resume Examples XV8o6xo3zD

Find out how to file a return, request a. In california, there is no requirement for an inheritance tax waiver form, a legal. Visit forms to get older forms. However, if the gift or inheritance later produces income, you will. If you received a gift or inheritance, do not include it in your income.

Inheritance Tax Waiver Form Nebraska

However, if the gift or inheritance later produces income, you will. Is there a california inheritance tax waiver form? No form exists or needed. File form 541 in order to: California has no inheritance tax.

Inheritance Tax Waiver Form Pa Form Resume Examples kLYrL0326a

Is there a california inheritance tax waiver form? However, if the gift or inheritance later produces income, you will. California does not impose a state inheritance tax. Federal inheritance tax only applies to estates exceeding $11,4 million. Visit forms to get older forms.

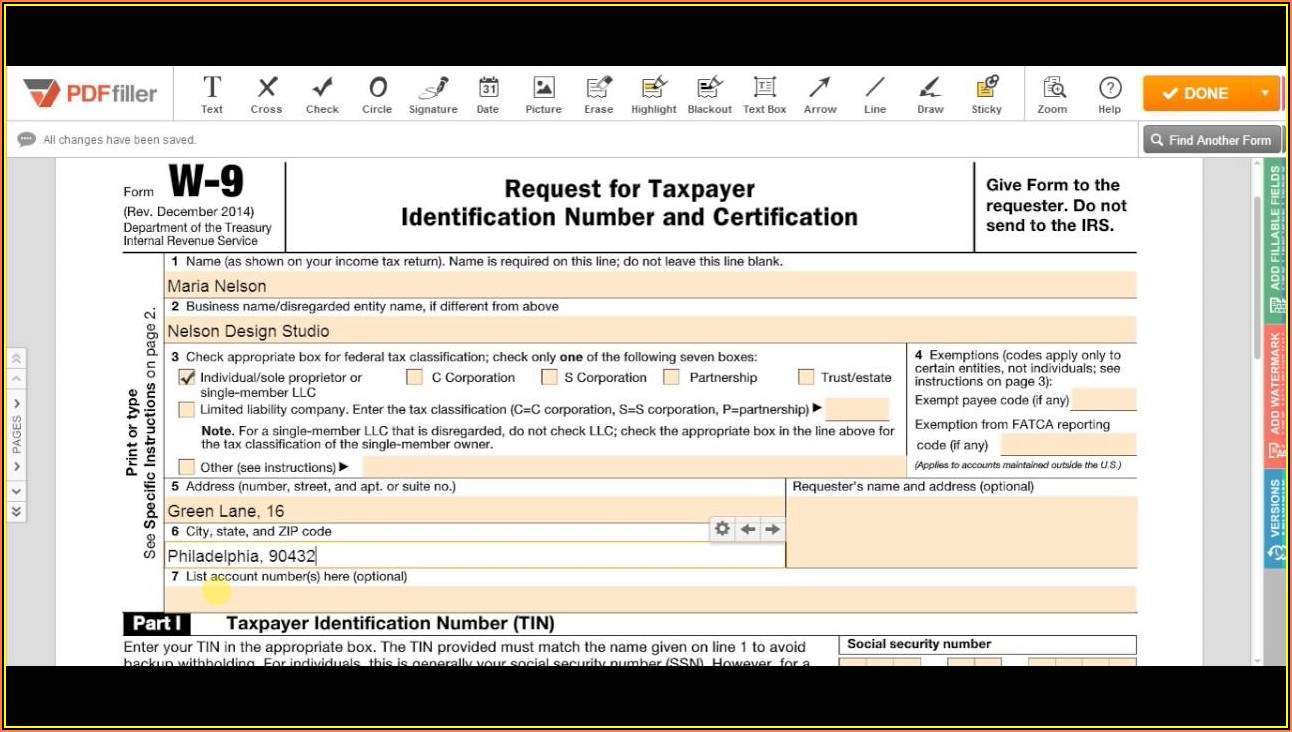

California inheritance tax waiver form Fill out & sign online DocHub

File form 541 in order to: Learn about the history and current status of california estate tax, inheritance tax, and gift tax. When filing an estate return, the executor follows the due dates for estates. California has no inheritance tax. Federal inheritance tax only applies to estates exceeding $11,4 million.

Fillable Online Inheritance Tax Waiver Form Irs. Inheritance Tax Waiver

File form 541 in order to: No form exists or needed. Is there a california inheritance tax waiver form? This means that beneficiaries inheriting assets from a decedent who was a. However, if the gift or inheritance later produces income, you will.

Is There A California Inheritance Tax Waiver Form?

California has no inheritance tax. Learn about the history and current status of california estate tax, inheritance tax, and gift tax. However, if the gift or inheritance later produces income, you will. File form 541 in order to:

California Does Not Impose A State Inheritance Tax.

If you received a gift or inheritance, do not include it in your income. Find out how to file a return, request a. Visit forms to get older forms. This means that beneficiaries inheriting assets from a decedent who was a.

No Form Exists Or Needed.

Federal inheritance tax only applies to estates exceeding $11,4 million. In california, there is no requirement for an inheritance tax waiver form, a legal. When filing an estate return, the executor follows the due dates for estates.