Iowa State Tax Form - The state login process is transitioning to id.iowa.gov. Taxpayers provide confidential tax information to the iowa department of revenue (idr) in the form of individual income tax returns and other iowa schedules, forms, and supporting. For most individual taxpayers, this page contains all the information you need, including links to forms, expanded instructions, electronic filing options, and where's my refund. The ia 2210 penalty is calculated as a per day interest charge based upon the number of days that an estimated income tax payment is made after the required. If you're asked to log in with. Learn about the ia 2210 form. Many state systems today use the enterprise authentication and authorization (entaa) process.

Taxpayers provide confidential tax information to the iowa department of revenue (idr) in the form of individual income tax returns and other iowa schedules, forms, and supporting. The ia 2210 penalty is calculated as a per day interest charge based upon the number of days that an estimated income tax payment is made after the required. If you're asked to log in with. The state login process is transitioning to id.iowa.gov. Many state systems today use the enterprise authentication and authorization (entaa) process. For most individual taxpayers, this page contains all the information you need, including links to forms, expanded instructions, electronic filing options, and where's my refund. Learn about the ia 2210 form.

For most individual taxpayers, this page contains all the information you need, including links to forms, expanded instructions, electronic filing options, and where's my refund. The state login process is transitioning to id.iowa.gov. The ia 2210 penalty is calculated as a per day interest charge based upon the number of days that an estimated income tax payment is made after the required. Learn about the ia 2210 form. Taxpayers provide confidential tax information to the iowa department of revenue (idr) in the form of individual income tax returns and other iowa schedules, forms, and supporting. If you're asked to log in with. Many state systems today use the enterprise authentication and authorization (entaa) process.

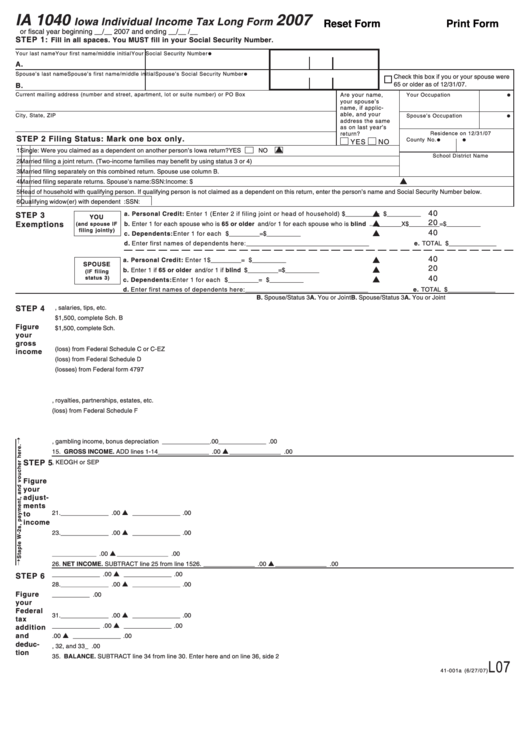

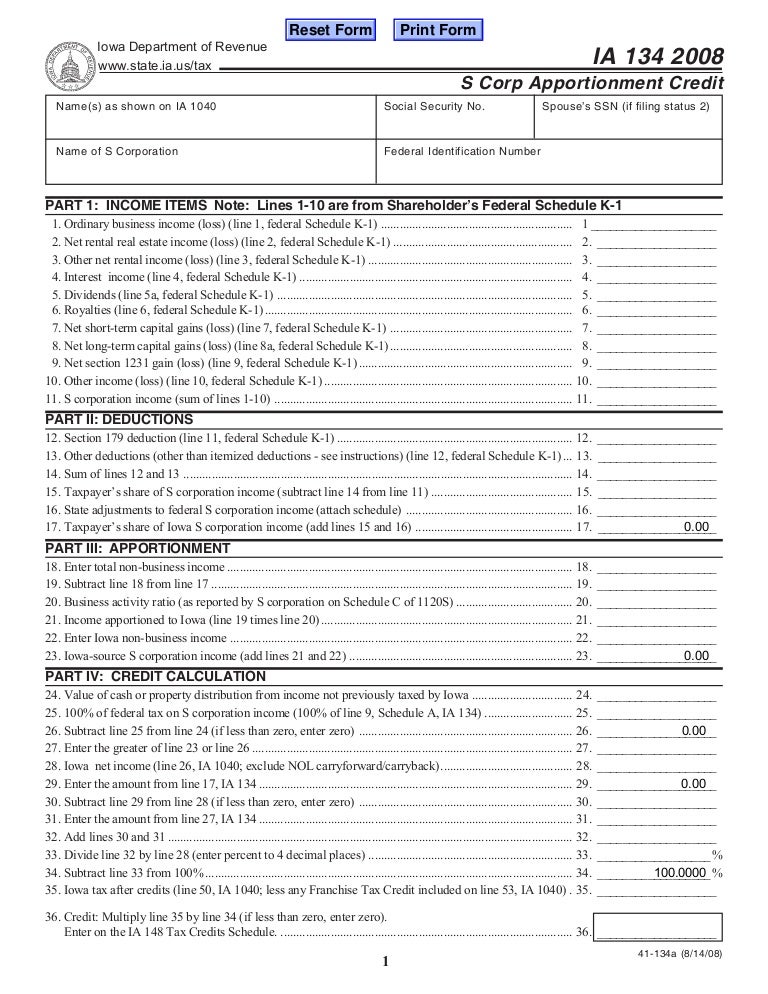

Iowa State Fillable Tax Forms Printable Forms Free Online

Learn about the ia 2210 form. The ia 2210 penalty is calculated as a per day interest charge based upon the number of days that an estimated income tax payment is made after the required. If you're asked to log in with. Taxpayers provide confidential tax information to the iowa department of revenue (idr) in the form of individual income.

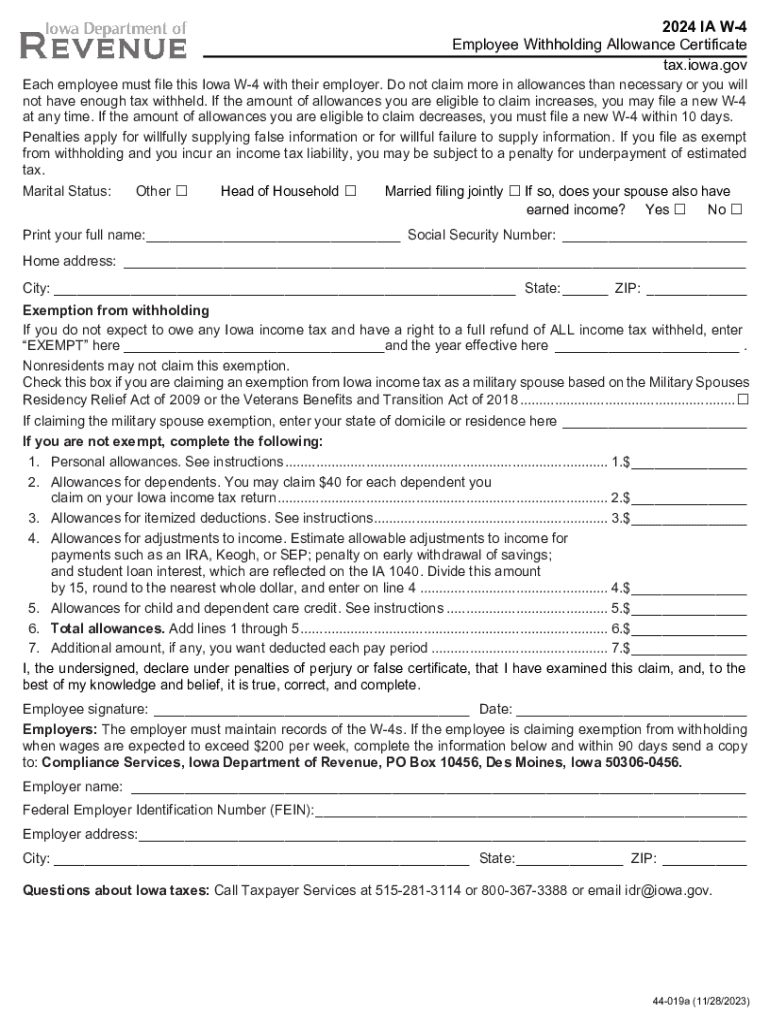

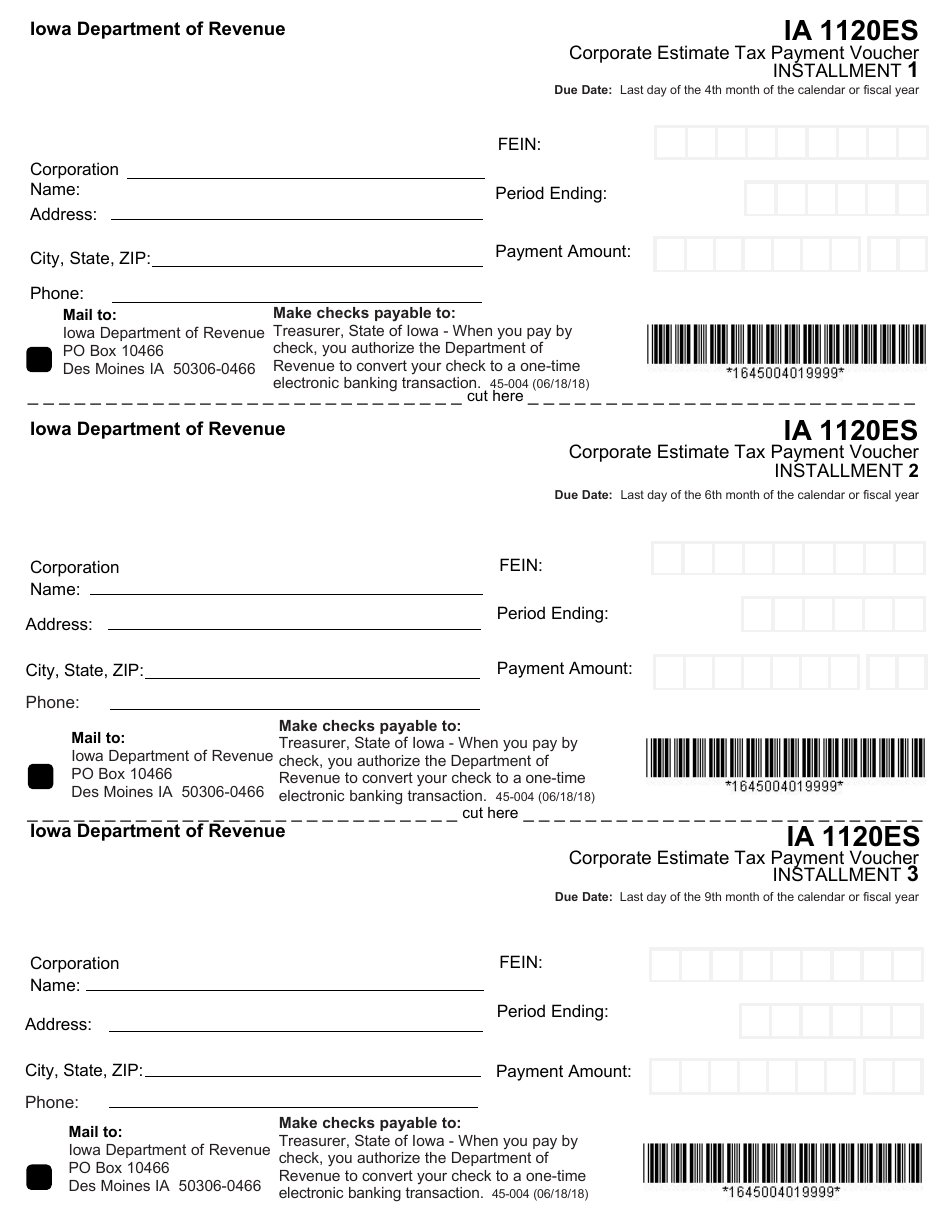

Iowa state tax withholding form Fill out & sign online DocHub

Taxpayers provide confidential tax information to the iowa department of revenue (idr) in the form of individual income tax returns and other iowa schedules, forms, and supporting. The ia 2210 penalty is calculated as a per day interest charge based upon the number of days that an estimated income tax payment is made after the required. The state login process.

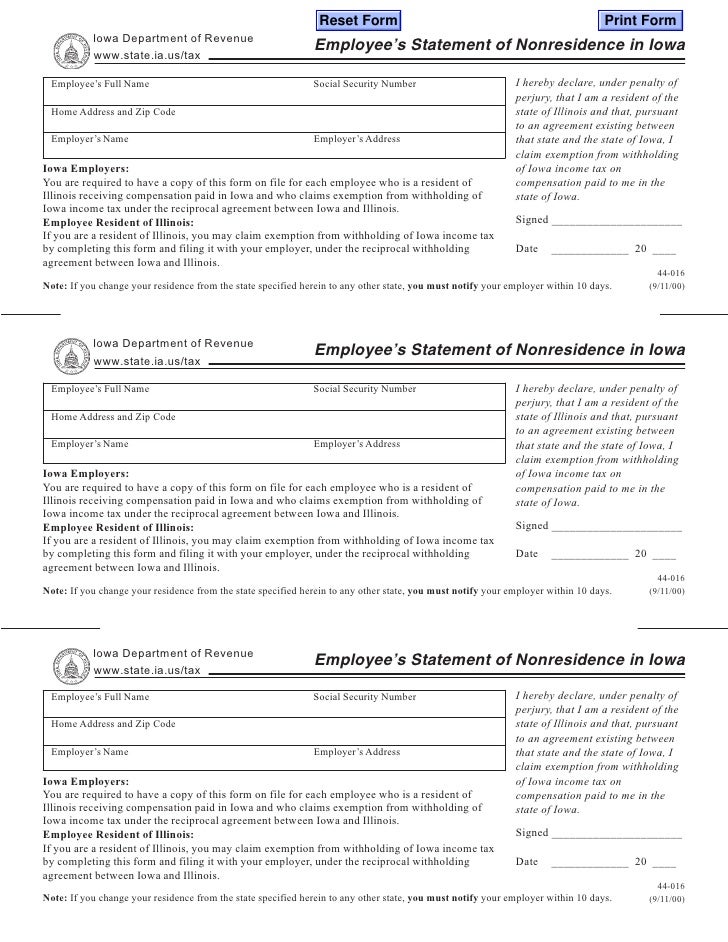

44016 state.ia.us tax forms

The ia 2210 penalty is calculated as a per day interest charge based upon the number of days that an estimated income tax payment is made after the required. Learn about the ia 2210 form. Many state systems today use the enterprise authentication and authorization (entaa) process. Taxpayers provide confidential tax information to the iowa department of revenue (idr) in.

California State Tax Withholding Form 2024 Printable Briana Emmalyn

The state login process is transitioning to id.iowa.gov. For most individual taxpayers, this page contains all the information you need, including links to forms, expanded instructions, electronic filing options, and where's my refund. Taxpayers provide confidential tax information to the iowa department of revenue (idr) in the form of individual income tax returns and other iowa schedules, forms, and supporting..

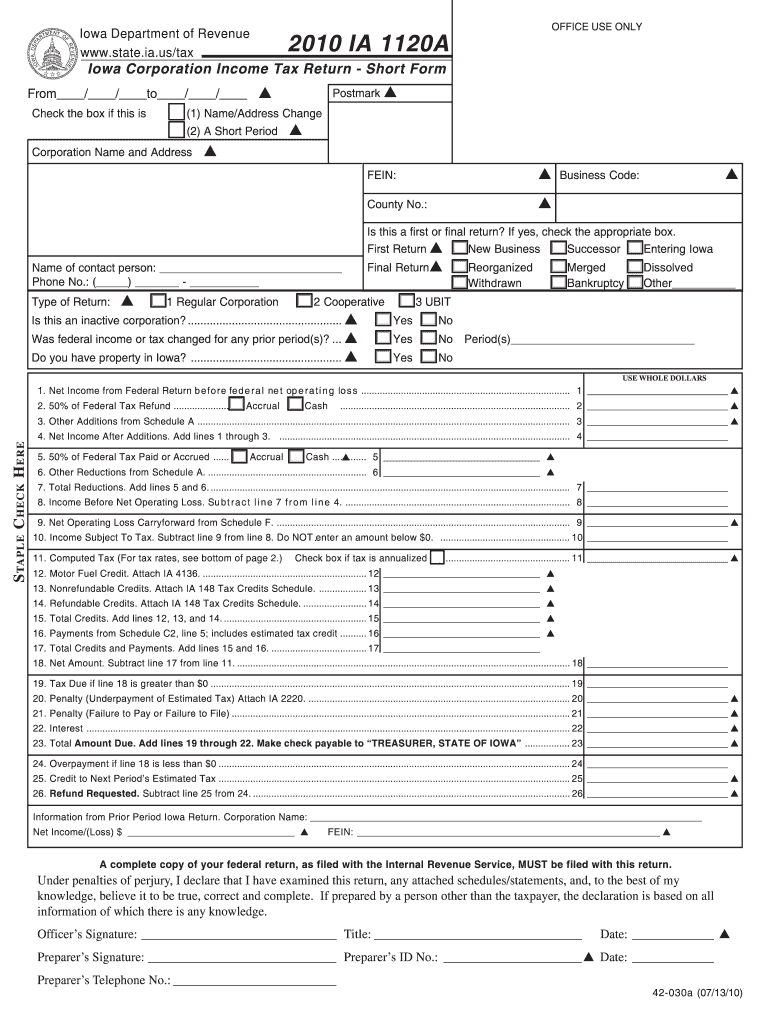

Iowa Tax Form 2023 Printable Forms Free Online

Learn about the ia 2210 form. The state login process is transitioning to id.iowa.gov. If you're asked to log in with. For most individual taxpayers, this page contains all the information you need, including links to forms, expanded instructions, electronic filing options, and where's my refund. Many state systems today use the enterprise authentication and authorization (entaa) process.

state.ia.us tax forms 0841134f

Many state systems today use the enterprise authentication and authorization (entaa) process. If you're asked to log in with. The state login process is transitioning to id.iowa.gov. The ia 2210 penalty is calculated as a per day interest charge based upon the number of days that an estimated income tax payment is made after the required. Learn about the ia.

Iowa State Tax Deadline 2024 Gene Peggie

The state login process is transitioning to id.iowa.gov. If you're asked to log in with. The ia 2210 penalty is calculated as a per day interest charge based upon the number of days that an estimated income tax payment is made after the required. Many state systems today use the enterprise authentication and authorization (entaa) process. Learn about the ia.

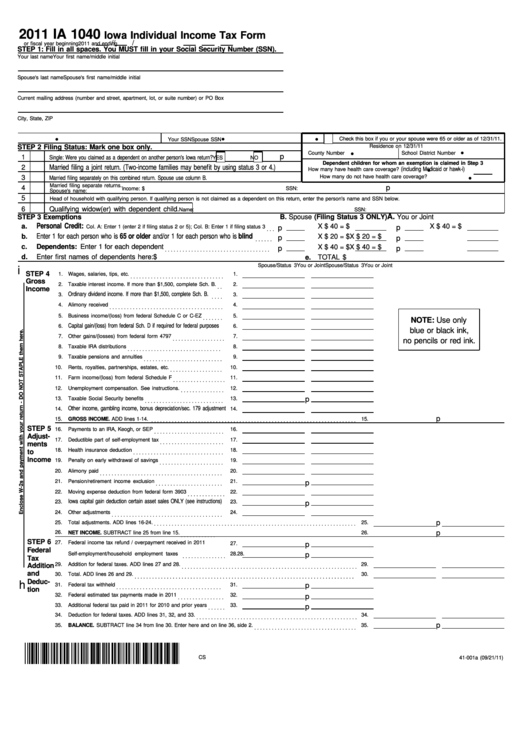

Form Ia 1040 Iowa Individual Tax Form 2011 printable pdf

If you're asked to log in with. The ia 2210 penalty is calculated as a per day interest charge based upon the number of days that an estimated income tax payment is made after the required. For most individual taxpayers, this page contains all the information you need, including links to forms, expanded instructions, electronic filing options, and where's my.

Iowa State Tax 2025 Isaac Gray

If you're asked to log in with. Learn about the ia 2210 form. The ia 2210 penalty is calculated as a per day interest charge based upon the number of days that an estimated income tax payment is made after the required. The state login process is transitioning to id.iowa.gov. Taxpayers provide confidential tax information to the iowa department of.

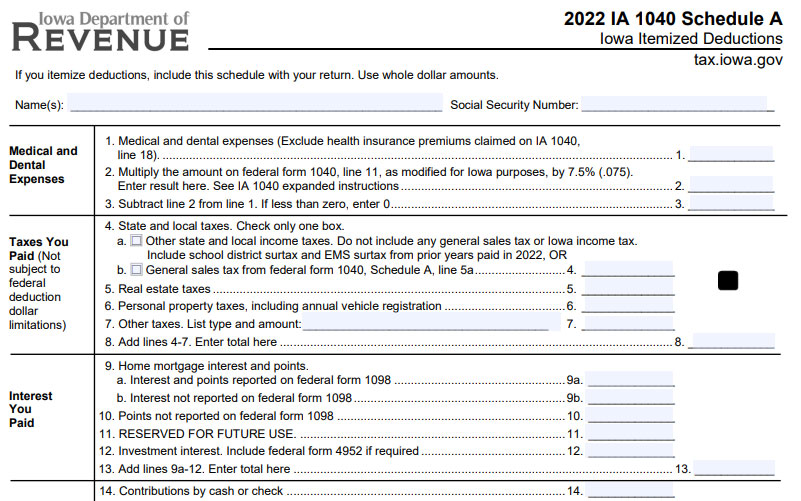

Iowa State Tax Form 2023 Printable Forms Free Online

Learn about the ia 2210 form. The state login process is transitioning to id.iowa.gov. Many state systems today use the enterprise authentication and authorization (entaa) process. Taxpayers provide confidential tax information to the iowa department of revenue (idr) in the form of individual income tax returns and other iowa schedules, forms, and supporting. If you're asked to log in with.

The State Login Process Is Transitioning To Id.iowa.gov.

Many state systems today use the enterprise authentication and authorization (entaa) process. For most individual taxpayers, this page contains all the information you need, including links to forms, expanded instructions, electronic filing options, and where's my refund. If you're asked to log in with. Taxpayers provide confidential tax information to the iowa department of revenue (idr) in the form of individual income tax returns and other iowa schedules, forms, and supporting.

Learn About The Ia 2210 Form.

The ia 2210 penalty is calculated as a per day interest charge based upon the number of days that an estimated income tax payment is made after the required.