Irs Form 8278 - Multiple assessments of identical penalties for the same taxpayer in the same tax period may be consolidated on form 8278, assessment and. (1) the internal revenue service in certain circumstances obtains a judgment against a taxpayer or third party when collection. Form 8278, assessment and abatement of miscellaneous civil penalties, requires that both the originator and supervisor sign and date. This web page provides lmsb procedures for tax return preparer penalty cases and program action cases, including the use of.

(1) the internal revenue service in certain circumstances obtains a judgment against a taxpayer or third party when collection. This web page provides lmsb procedures for tax return preparer penalty cases and program action cases, including the use of. Multiple assessments of identical penalties for the same taxpayer in the same tax period may be consolidated on form 8278, assessment and. Form 8278, assessment and abatement of miscellaneous civil penalties, requires that both the originator and supervisor sign and date.

Multiple assessments of identical penalties for the same taxpayer in the same tax period may be consolidated on form 8278, assessment and. (1) the internal revenue service in certain circumstances obtains a judgment against a taxpayer or third party when collection. This web page provides lmsb procedures for tax return preparer penalty cases and program action cases, including the use of. Form 8278, assessment and abatement of miscellaneous civil penalties, requires that both the originator and supervisor sign and date.

IRS SS4 2019 Fill and Sign Printable Template Online US Legal Forms

This web page provides lmsb procedures for tax return preparer penalty cases and program action cases, including the use of. Multiple assessments of identical penalties for the same taxpayer in the same tax period may be consolidated on form 8278, assessment and. Form 8278, assessment and abatement of miscellaneous civil penalties, requires that both the originator and supervisor sign and.

IRS FORM 5498 Automated Systems, Inc.

Multiple assessments of identical penalties for the same taxpayer in the same tax period may be consolidated on form 8278, assessment and. This web page provides lmsb procedures for tax return preparer penalty cases and program action cases, including the use of. Form 8278, assessment and abatement of miscellaneous civil penalties, requires that both the originator and supervisor sign and.

Form 8332 Edit, Fill, Sign Online Handypdf

Multiple assessments of identical penalties for the same taxpayer in the same tax period may be consolidated on form 8278, assessment and. Form 8278, assessment and abatement of miscellaneous civil penalties, requires that both the originator and supervisor sign and date. (1) the internal revenue service in certain circumstances obtains a judgment against a taxpayer or third party when collection..

Form 8278 cl pen svdnrfm

(1) the internal revenue service in certain circumstances obtains a judgment against a taxpayer or third party when collection. Multiple assessments of identical penalties for the same taxpayer in the same tax period may be consolidated on form 8278, assessment and. This web page provides lmsb procedures for tax return preparer penalty cases and program action cases, including the use.

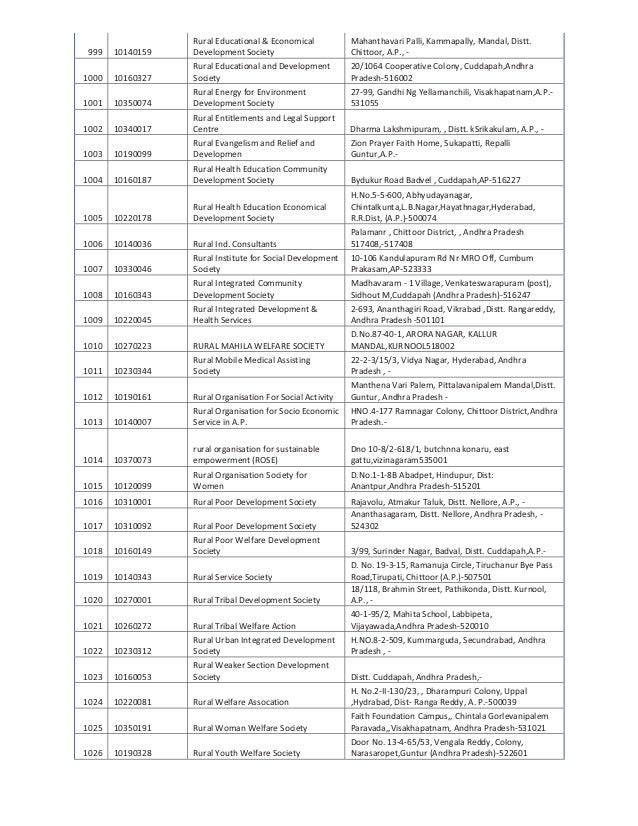

Irs Form 2848 Fillable Printable Forms Free Online

(1) the internal revenue service in certain circumstances obtains a judgment against a taxpayer or third party when collection. This web page provides lmsb procedures for tax return preparer penalty cases and program action cases, including the use of. Multiple assessments of identical penalties for the same taxpayer in the same tax period may be consolidated on form 8278, assessment.

Irs Form 8889 For 2024 Gwen Pietra

This web page provides lmsb procedures for tax return preparer penalty cases and program action cases, including the use of. Multiple assessments of identical penalties for the same taxpayer in the same tax period may be consolidated on form 8278, assessment and. Form 8278, assessment and abatement of miscellaneous civil penalties, requires that both the originator and supervisor sign and.

Irs Form 8937 Fillable Printable Forms Free Online

Multiple assessments of identical penalties for the same taxpayer in the same tax period may be consolidated on form 8278, assessment and. This web page provides lmsb procedures for tax return preparer penalty cases and program action cases, including the use of. (1) the internal revenue service in certain circumstances obtains a judgment against a taxpayer or third party when.

Irs Form 8857 Printable

(1) the internal revenue service in certain circumstances obtains a judgment against a taxpayer or third party when collection. This web page provides lmsb procedures for tax return preparer penalty cases and program action cases, including the use of. Form 8278, assessment and abatement of miscellaneous civil penalties, requires that both the originator and supervisor sign and date. Multiple assessments.

IRS Form 8821 Tax Information Authorization CaseFox

This web page provides lmsb procedures for tax return preparer penalty cases and program action cases, including the use of. Form 8278, assessment and abatement of miscellaneous civil penalties, requires that both the originator and supervisor sign and date. Multiple assessments of identical penalties for the same taxpayer in the same tax period may be consolidated on form 8278, assessment.

IRS Form 8832 Instructions to Fill Out and File On Time 1800Accountant

This web page provides lmsb procedures for tax return preparer penalty cases and program action cases, including the use of. (1) the internal revenue service in certain circumstances obtains a judgment against a taxpayer or third party when collection. Form 8278, assessment and abatement of miscellaneous civil penalties, requires that both the originator and supervisor sign and date. Multiple assessments.

(1) The Internal Revenue Service In Certain Circumstances Obtains A Judgment Against A Taxpayer Or Third Party When Collection.

Form 8278, assessment and abatement of miscellaneous civil penalties, requires that both the originator and supervisor sign and date. This web page provides lmsb procedures for tax return preparer penalty cases and program action cases, including the use of. Multiple assessments of identical penalties for the same taxpayer in the same tax period may be consolidated on form 8278, assessment and.