Irs Form 931 - Notice 931 (9/2020) dated oct. Irs notice 931 provides essential guidance for employers on depositing withheld employment taxes. Employers must adhere to either the. The 2022 revision of notice 931, deposit requirements for employment taxes, was released this week by the internal revenue. Companies use irs form 941 to calculate and record certain taxes they’ve withheld from employee paychecks over the. Irs releases notice 931 (9/2020), deposit requirements for employment taxes. Information about notice 931, deposit requirements for employment taxes, including recent updates, related forms and instructions.

The 2022 revision of notice 931, deposit requirements for employment taxes, was released this week by the internal revenue. Notice 931 (9/2020) dated oct. Employers must adhere to either the. Irs notice 931 provides essential guidance for employers on depositing withheld employment taxes. Irs releases notice 931 (9/2020), deposit requirements for employment taxes. Companies use irs form 941 to calculate and record certain taxes they’ve withheld from employee paychecks over the. Information about notice 931, deposit requirements for employment taxes, including recent updates, related forms and instructions.

The 2022 revision of notice 931, deposit requirements for employment taxes, was released this week by the internal revenue. Notice 931 (9/2020) dated oct. Irs notice 931 provides essential guidance for employers on depositing withheld employment taxes. Companies use irs form 941 to calculate and record certain taxes they’ve withheld from employee paychecks over the. Employers must adhere to either the. Information about notice 931, deposit requirements for employment taxes, including recent updates, related forms and instructions. Irs releases notice 931 (9/2020), deposit requirements for employment taxes.

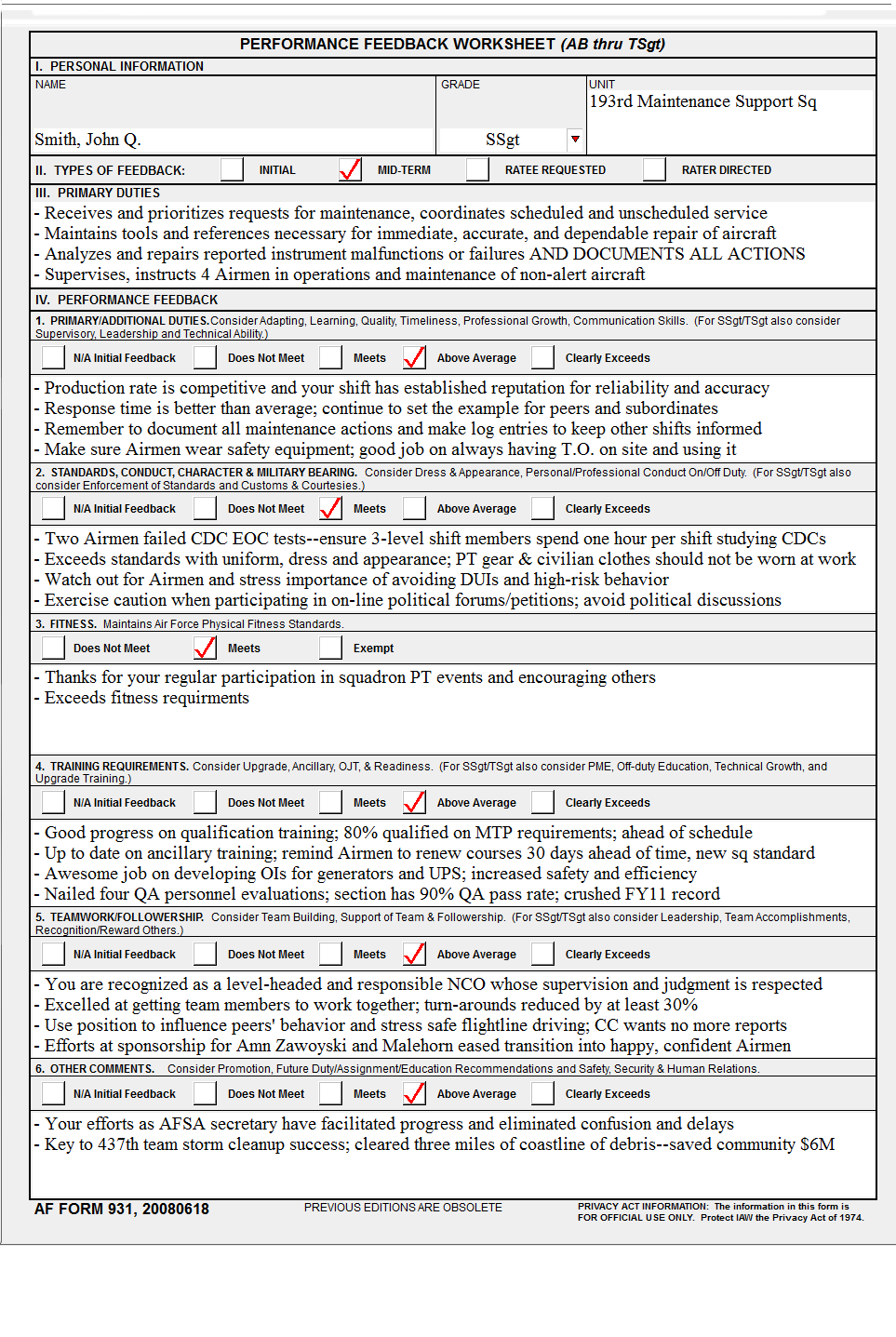

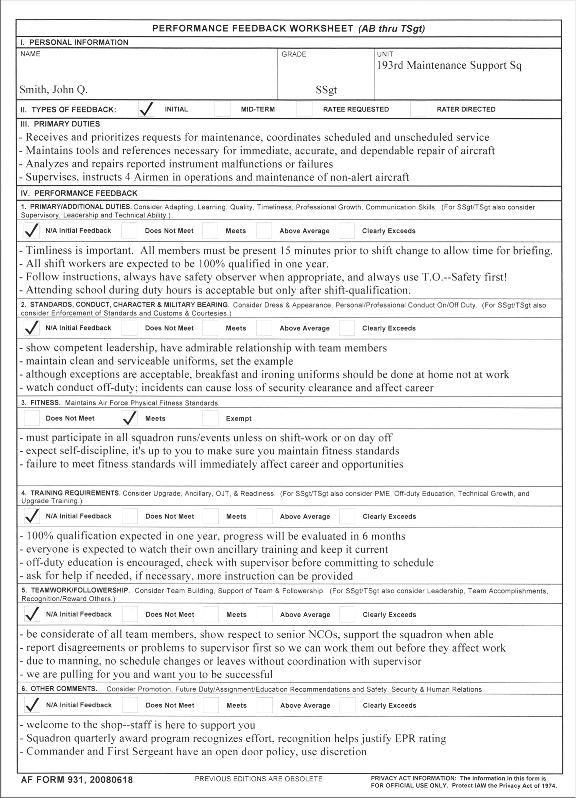

AF Form 931 Fill Out, Sign Online and Download Fillable PDF

Employers must adhere to either the. Information about notice 931, deposit requirements for employment taxes, including recent updates, related forms and instructions. Notice 931 (9/2020) dated oct. The 2022 revision of notice 931, deposit requirements for employment taxes, was released this week by the internal revenue. Companies use irs form 941 to calculate and record certain taxes they’ve withheld from.

Af Form 931 ≡ Fill Out Printable PDF Forms Online

Companies use irs form 941 to calculate and record certain taxes they’ve withheld from employee paychecks over the. Employers must adhere to either the. Irs releases notice 931 (9/2020), deposit requirements for employment taxes. Irs notice 931 provides essential guidance for employers on depositing withheld employment taxes. The 2022 revision of notice 931, deposit requirements for employment taxes, was released.

20142020 Form AF 931 Fill Online, Printable, Fillable, Blank pdfFiller

Companies use irs form 941 to calculate and record certain taxes they’ve withheld from employee paychecks over the. The 2022 revision of notice 931, deposit requirements for employment taxes, was released this week by the internal revenue. Notice 931 (9/2020) dated oct. Irs releases notice 931 (9/2020), deposit requirements for employment taxes. Information about notice 931, deposit requirements for employment.

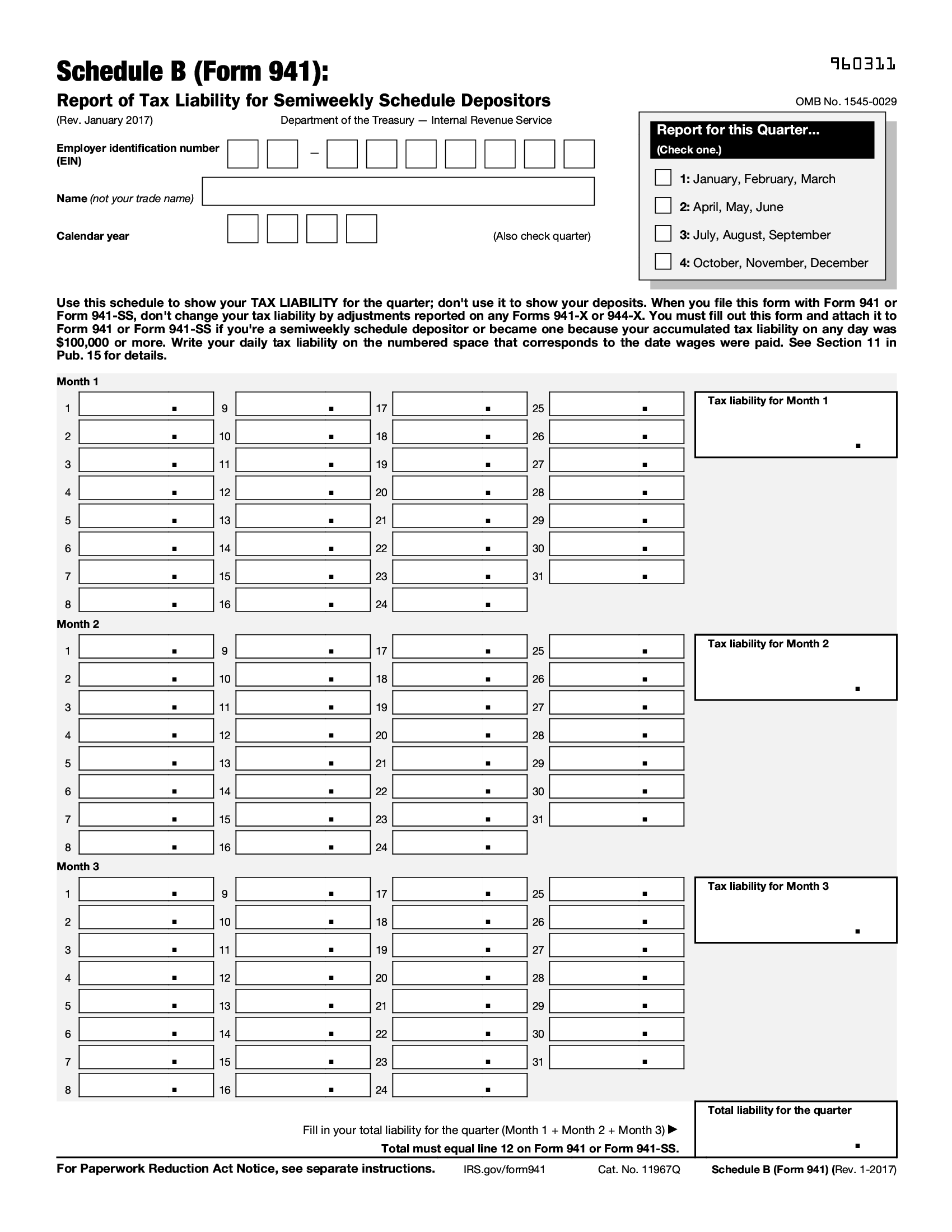

IRS Form 941 The Lookback Period and Deposit Schedules

Irs notice 931 provides essential guidance for employers on depositing withheld employment taxes. Notice 931 (9/2020) dated oct. Information about notice 931, deposit requirements for employment taxes, including recent updates, related forms and instructions. The 2022 revision of notice 931, deposit requirements for employment taxes, was released this week by the internal revenue. Companies use irs form 941 to calculate.

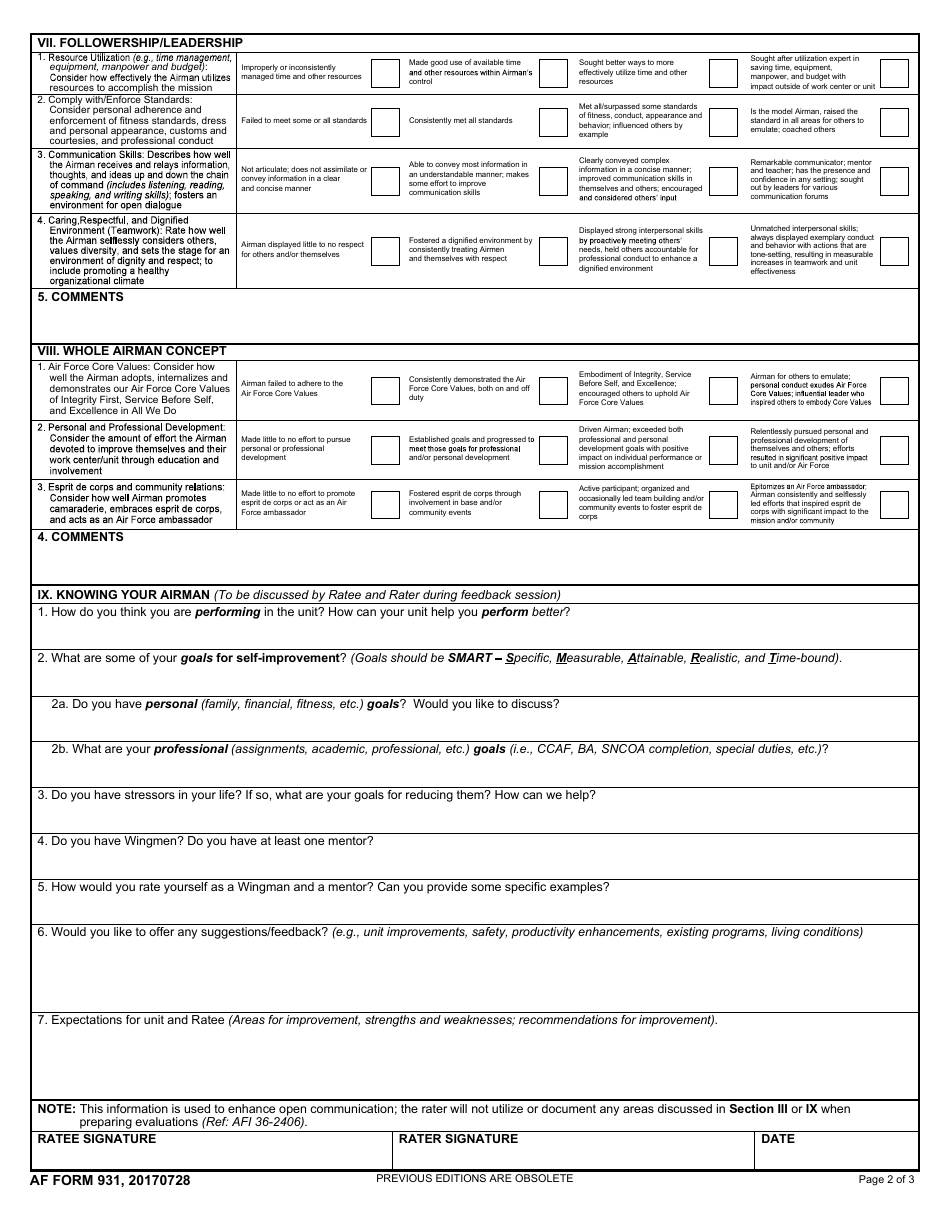

AF Form 931 MidTerm Feedback

The 2022 revision of notice 931, deposit requirements for employment taxes, was released this week by the internal revenue. Information about notice 931, deposit requirements for employment taxes, including recent updates, related forms and instructions. Notice 931 (9/2020) dated oct. Companies use irs form 941 to calculate and record certain taxes they’ve withheld from employee paychecks over the. Irs releases.

IRS Form 941 Schedule B. Report of Tax Liability for Semiweekly

The 2022 revision of notice 931, deposit requirements for employment taxes, was released this week by the internal revenue. Employers must adhere to either the. Irs releases notice 931 (9/2020), deposit requirements for employment taxes. Companies use irs form 941 to calculate and record certain taxes they’ve withheld from employee paychecks over the. Notice 931 (9/2020) dated oct.

931 Wine & Spirits Clarksville, TN

Irs releases notice 931 (9/2020), deposit requirements for employment taxes. Companies use irs form 941 to calculate and record certain taxes they’ve withheld from employee paychecks over the. Notice 931 (9/2020) dated oct. Employers must adhere to either the. Irs notice 931 provides essential guidance for employers on depositing withheld employment taxes.

AF Form 931 Performance Feedback Worksheet

Employers must adhere to either the. The 2022 revision of notice 931, deposit requirements for employment taxes, was released this week by the internal revenue. Companies use irs form 941 to calculate and record certain taxes they’ve withheld from employee paychecks over the. Irs notice 931 provides essential guidance for employers on depositing withheld employment taxes. Information about notice 931,.

Formulario Afip 931 2024

Companies use irs form 941 to calculate and record certain taxes they’ve withheld from employee paychecks over the. The 2022 revision of notice 931, deposit requirements for employment taxes, was released this week by the internal revenue. Notice 931 (9/2020) dated oct. Employers must adhere to either the. Irs notice 931 provides essential guidance for employers on depositing withheld employment.

Irs Form 941 Fillable Printable Forms Free Online

Irs releases notice 931 (9/2020), deposit requirements for employment taxes. Employers must adhere to either the. Notice 931 (9/2020) dated oct. Companies use irs form 941 to calculate and record certain taxes they’ve withheld from employee paychecks over the. Information about notice 931, deposit requirements for employment taxes, including recent updates, related forms and instructions.

Employers Must Adhere To Either The.

Irs notice 931 provides essential guidance for employers on depositing withheld employment taxes. Companies use irs form 941 to calculate and record certain taxes they’ve withheld from employee paychecks over the. Information about notice 931, deposit requirements for employment taxes, including recent updates, related forms and instructions. Irs releases notice 931 (9/2020), deposit requirements for employment taxes.

The 2022 Revision Of Notice 931, Deposit Requirements For Employment Taxes, Was Released This Week By The Internal Revenue.

Notice 931 (9/2020) dated oct.