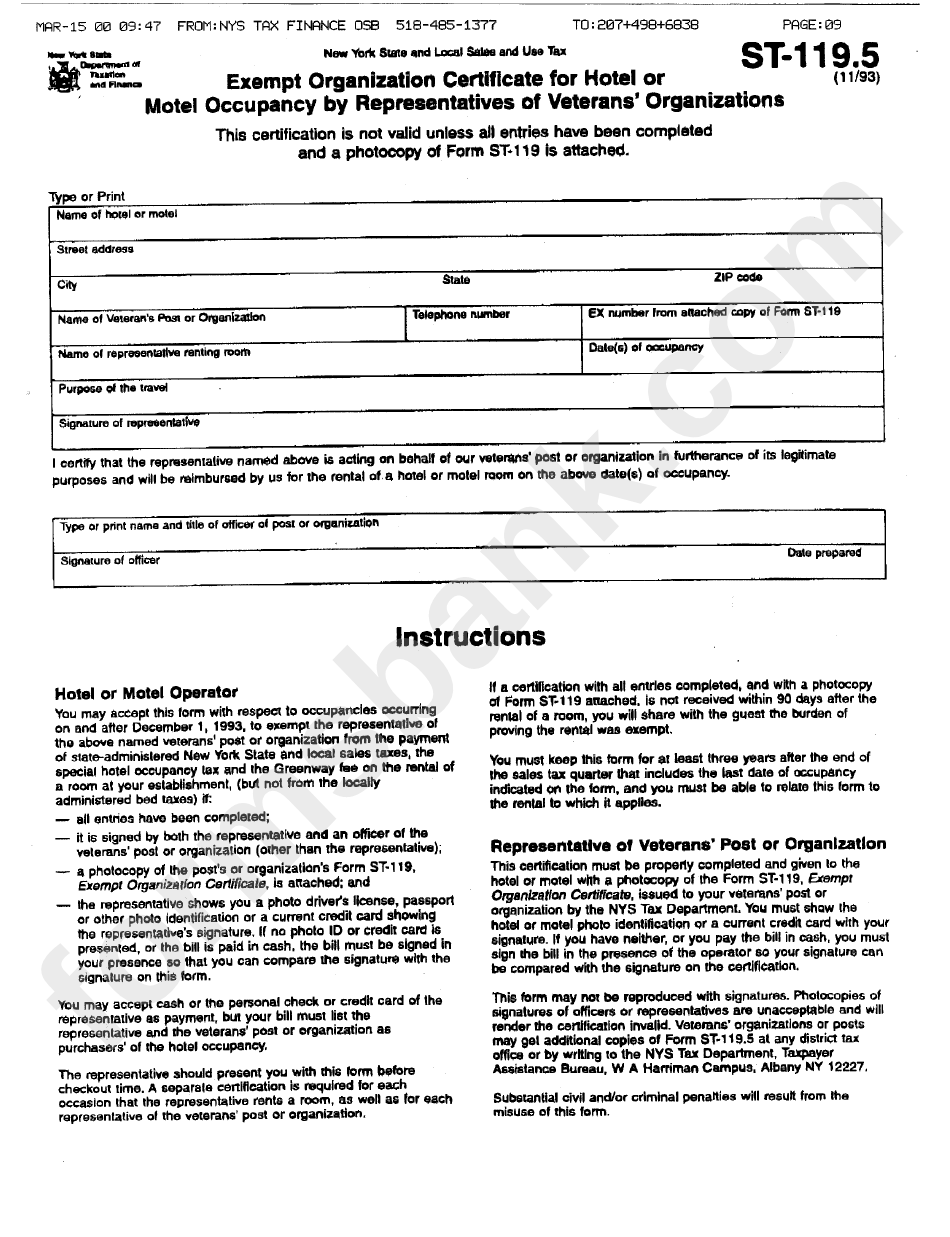

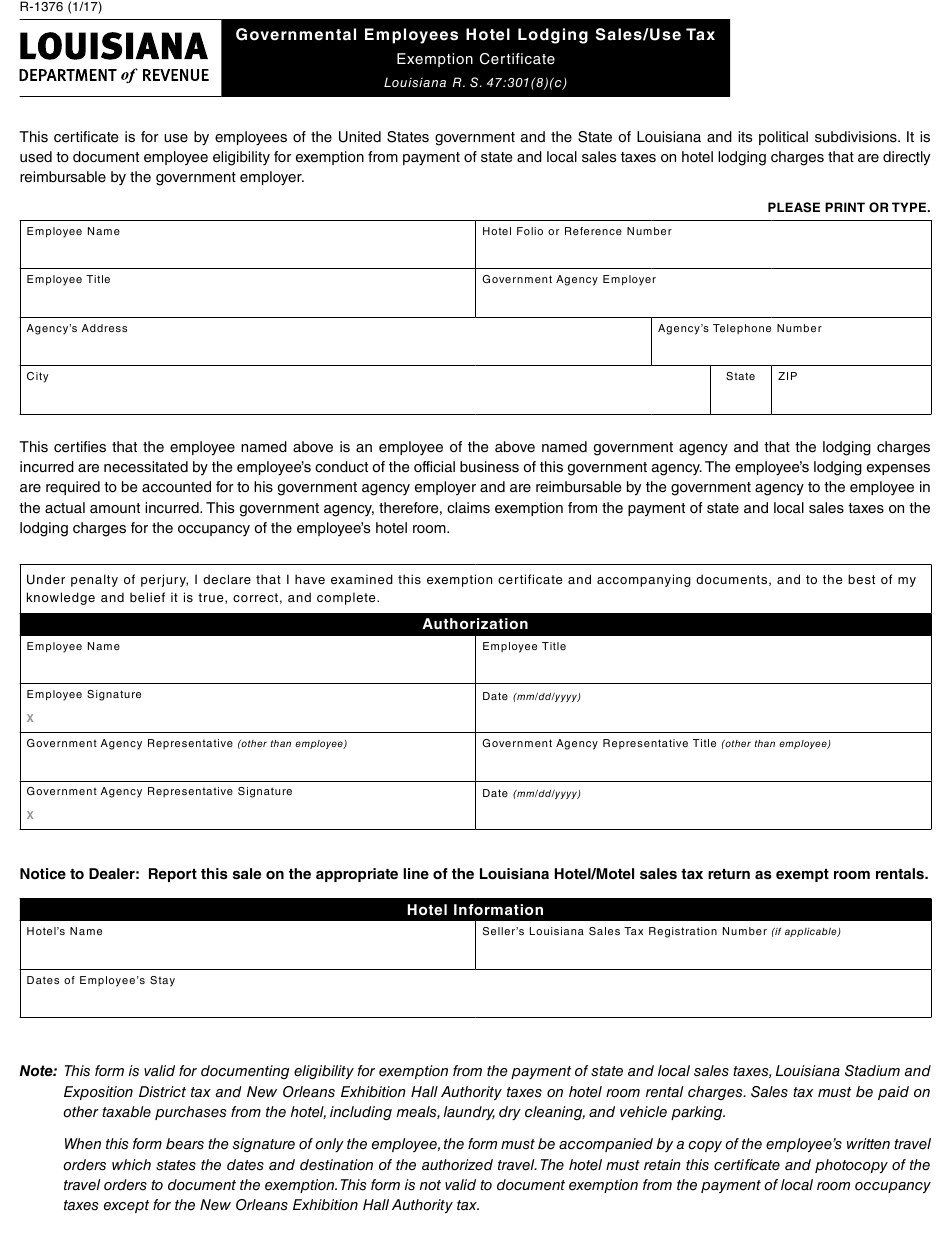

Louisiana Hotel Tax Exempt Form - This form is valid for documenting eligibility for exemption from the payment of state and local sales taxes, louisiana stadium and exposition district tax and new orleans exhibition hall. This form is valid for documenting eligibility for exemption from the payment of state and local sales taxes, louisiana stadium and exposition district tax and new orleans exhibition hall. To document employee eligibility for exemption from payment of state sales taxes on hotel lodging charges that are directly reimbursable by the government employer. This certificate is for use by employees of the united states government and the state of louisiana and its political subdivisions. It is used to document employee eligibility for exemption. For hotel room rental charges (hotel/lodging costs), this form is also valid for an exemption from the payment of louisiana stadium and exposition district and new orleans exhibition.

This certificate is for use by employees of the united states government and the state of louisiana and its political subdivisions. It is used to document employee eligibility for exemption. This form is valid for documenting eligibility for exemption from the payment of state and local sales taxes, louisiana stadium and exposition district tax and new orleans exhibition hall. This form is valid for documenting eligibility for exemption from the payment of state and local sales taxes, louisiana stadium and exposition district tax and new orleans exhibition hall. For hotel room rental charges (hotel/lodging costs), this form is also valid for an exemption from the payment of louisiana stadium and exposition district and new orleans exhibition. To document employee eligibility for exemption from payment of state sales taxes on hotel lodging charges that are directly reimbursable by the government employer.

This form is valid for documenting eligibility for exemption from the payment of state and local sales taxes, louisiana stadium and exposition district tax and new orleans exhibition hall. It is used to document employee eligibility for exemption. This certificate is for use by employees of the united states government and the state of louisiana and its political subdivisions. This form is valid for documenting eligibility for exemption from the payment of state and local sales taxes, louisiana stadium and exposition district tax and new orleans exhibition hall. For hotel room rental charges (hotel/lodging costs), this form is also valid for an exemption from the payment of louisiana stadium and exposition district and new orleans exhibition. To document employee eligibility for exemption from payment of state sales taxes on hotel lodging charges that are directly reimbursable by the government employer.

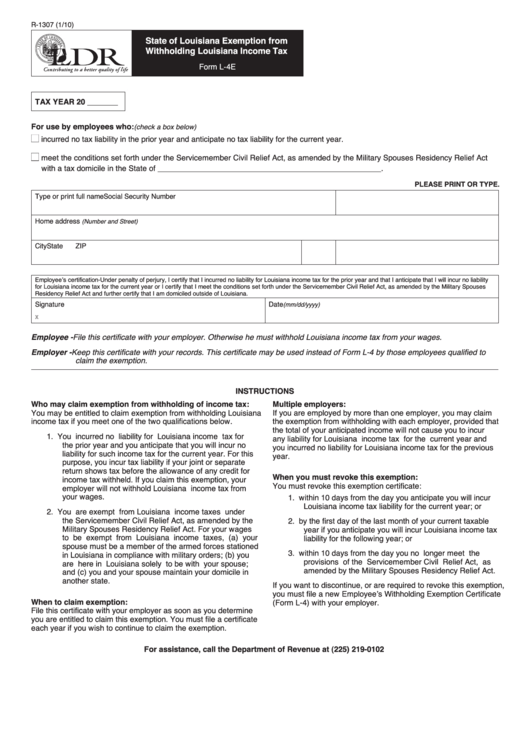

Louisiana Tax Exempt Form

It is used to document employee eligibility for exemption. To document employee eligibility for exemption from payment of state sales taxes on hotel lodging charges that are directly reimbursable by the government employer. This form is valid for documenting eligibility for exemption from the payment of state and local sales taxes, louisiana stadium and exposition district tax and new orleans.

Fillable Dc Tax Forms Printable Forms Free Online

To document employee eligibility for exemption from payment of state sales taxes on hotel lodging charges that are directly reimbursable by the government employer. For hotel room rental charges (hotel/lodging costs), this form is also valid for an exemption from the payment of louisiana stadium and exposition district and new orleans exhibition. This form is valid for documenting eligibility for.

California Hotel Tax Exempt Form Pdf

To document employee eligibility for exemption from payment of state sales taxes on hotel lodging charges that are directly reimbursable by the government employer. This certificate is for use by employees of the united states government and the state of louisiana and its political subdivisions. It is used to document employee eligibility for exemption. This form is valid for documenting.

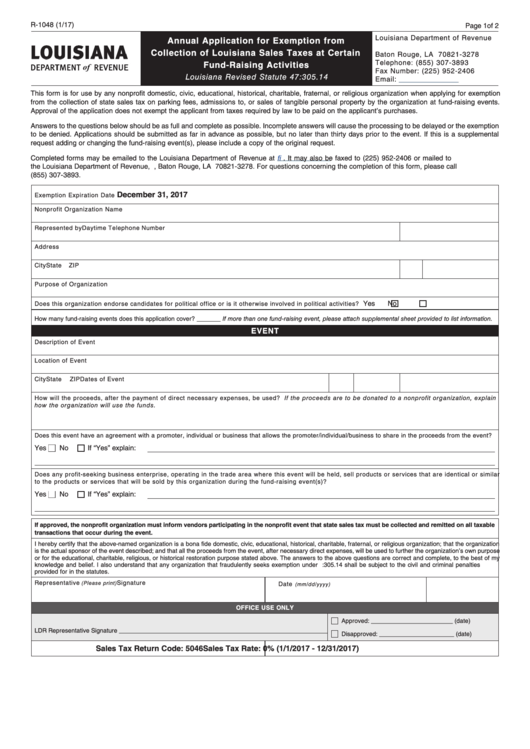

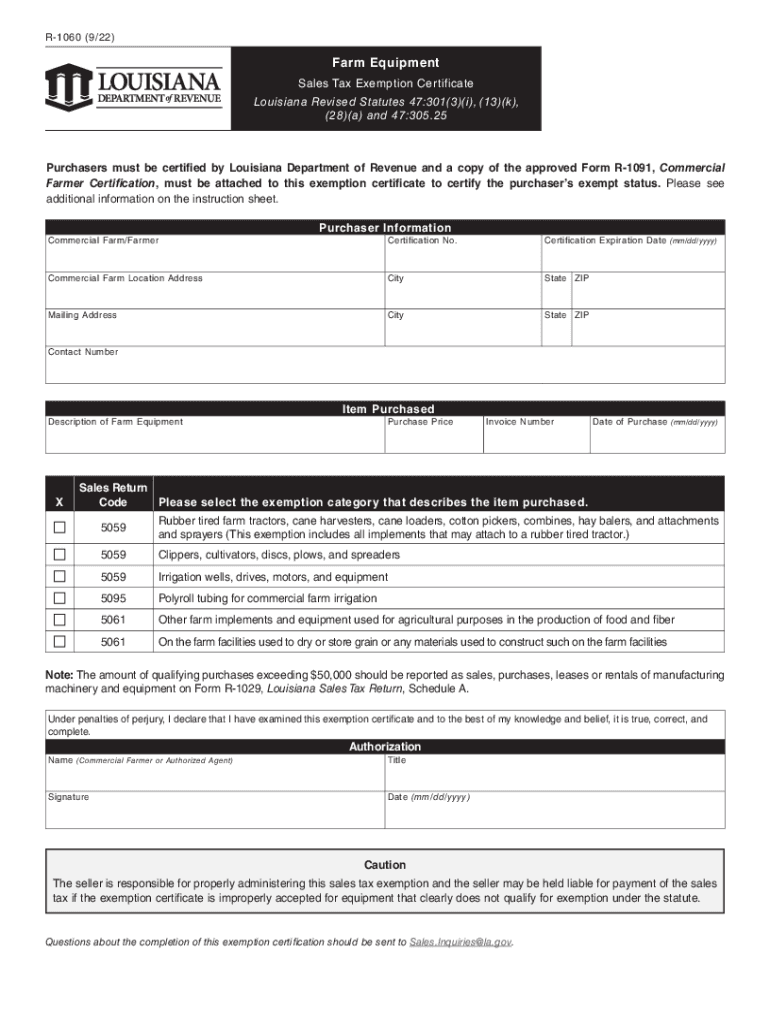

Louisiana Sales Tax Exemption Application Form

To document employee eligibility for exemption from payment of state sales taxes on hotel lodging charges that are directly reimbursable by the government employer. For hotel room rental charges (hotel/lodging costs), this form is also valid for an exemption from the payment of louisiana stadium and exposition district and new orleans exhibition. It is used to document employee eligibility for.

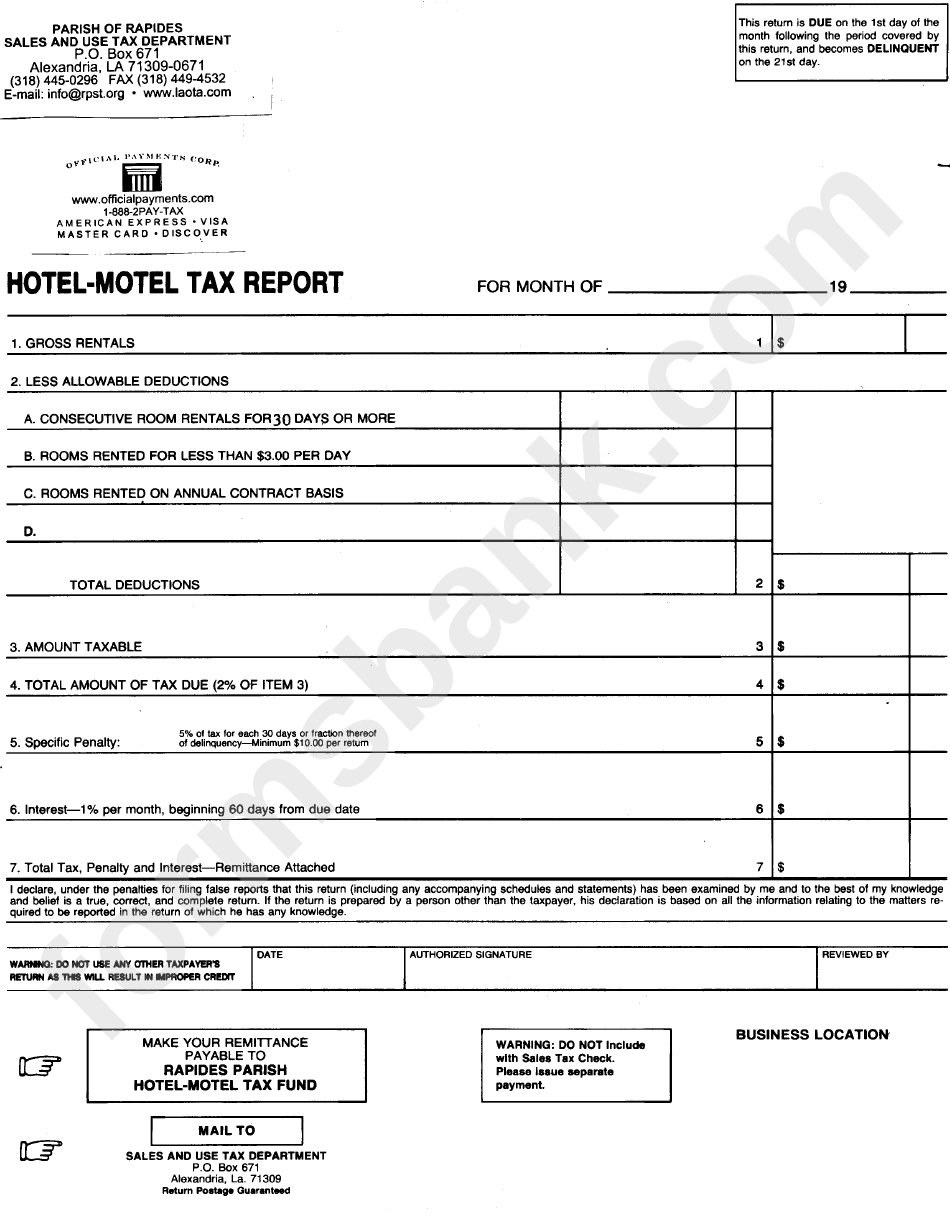

HotelMotel Tax Report Form Louisiana Sales And Use Tax Department

To document employee eligibility for exemption from payment of state sales taxes on hotel lodging charges that are directly reimbursable by the government employer. This form is valid for documenting eligibility for exemption from the payment of state and local sales taxes, louisiana stadium and exposition district tax and new orleans exhibition hall. For hotel room rental charges (hotel/lodging costs),.

Hotel tax exempt after 30 days Fill out & sign online DocHub

This form is valid for documenting eligibility for exemption from the payment of state and local sales taxes, louisiana stadium and exposition district tax and new orleans exhibition hall. This certificate is for use by employees of the united states government and the state of louisiana and its political subdivisions. It is used to document employee eligibility for exemption. For.

Louisiana Hotel Tax Exempt Form 2023

This form is valid for documenting eligibility for exemption from the payment of state and local sales taxes, louisiana stadium and exposition district tax and new orleans exhibition hall. To document employee eligibility for exemption from payment of state sales taxes on hotel lodging charges that are directly reimbursable by the government employer. This form is valid for documenting eligibility.

Fillable Online HOTEL TAX EXEMPTION CERTIFICATE Fax Email Print pdfFiller

This certificate is for use by employees of the united states government and the state of louisiana and its political subdivisions. This form is valid for documenting eligibility for exemption from the payment of state and local sales taxes, louisiana stadium and exposition district tax and new orleans exhibition hall. This form is valid for documenting eligibility for exemption from.

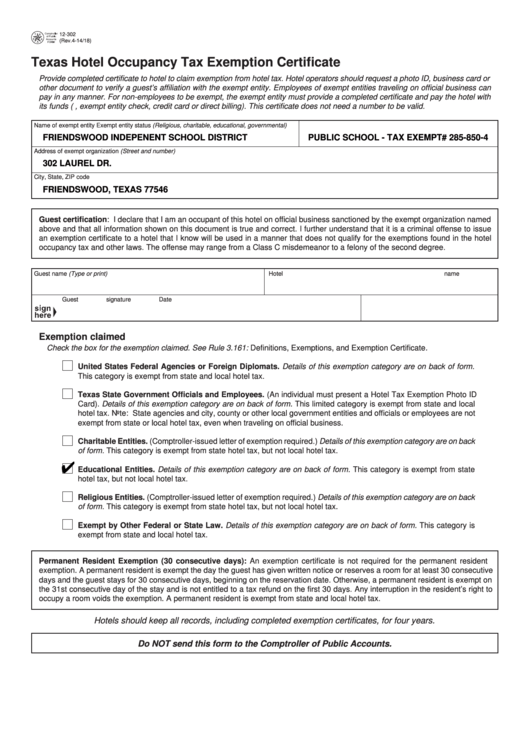

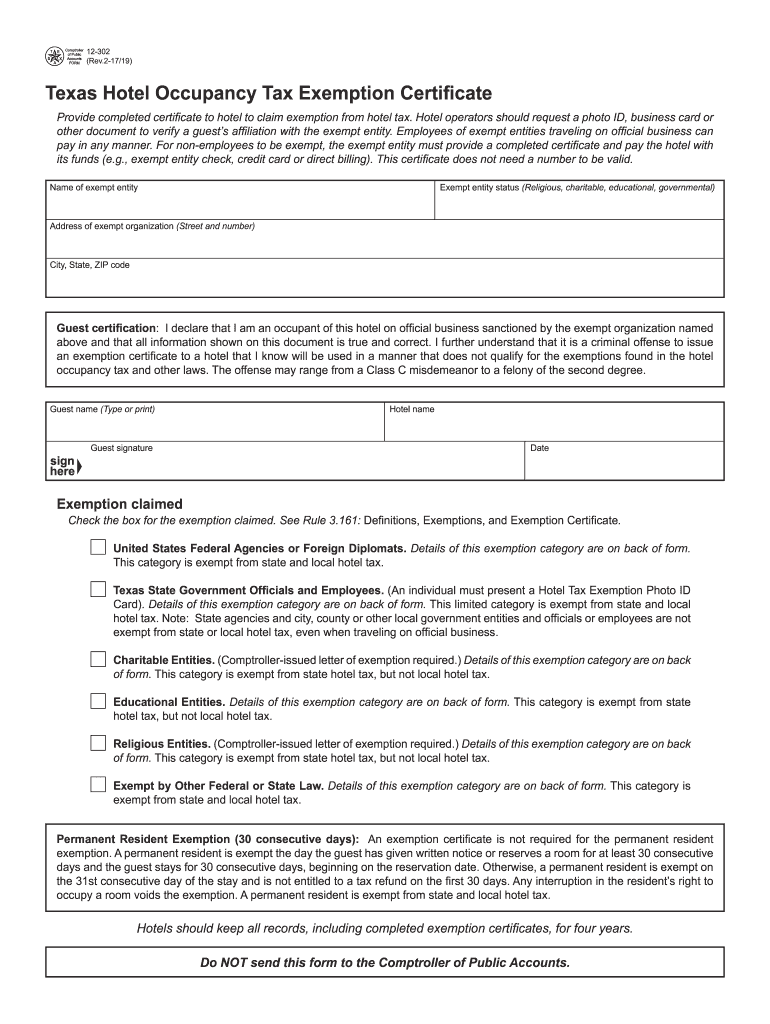

2023 Texas Tax Exempt Form

This form is valid for documenting eligibility for exemption from the payment of state and local sales taxes, louisiana stadium and exposition district tax and new orleans exhibition hall. It is used to document employee eligibility for exemption. This certificate is for use by employees of the united states government and the state of louisiana and its political subdivisions. For.

R 5 20222024 Form Fill Out and Sign Printable PDF Template

This form is valid for documenting eligibility for exemption from the payment of state and local sales taxes, louisiana stadium and exposition district tax and new orleans exhibition hall. For hotel room rental charges (hotel/lodging costs), this form is also valid for an exemption from the payment of louisiana stadium and exposition district and new orleans exhibition. This certificate is.

This Form Is Valid For Documenting Eligibility For Exemption From The Payment Of State And Local Sales Taxes, Louisiana Stadium And Exposition District Tax And New Orleans Exhibition Hall.

This certificate is for use by employees of the united states government and the state of louisiana and its political subdivisions. This form is valid for documenting eligibility for exemption from the payment of state and local sales taxes, louisiana stadium and exposition district tax and new orleans exhibition hall. For hotel room rental charges (hotel/lodging costs), this form is also valid for an exemption from the payment of louisiana stadium and exposition district and new orleans exhibition. To document employee eligibility for exemption from payment of state sales taxes on hotel lodging charges that are directly reimbursable by the government employer.