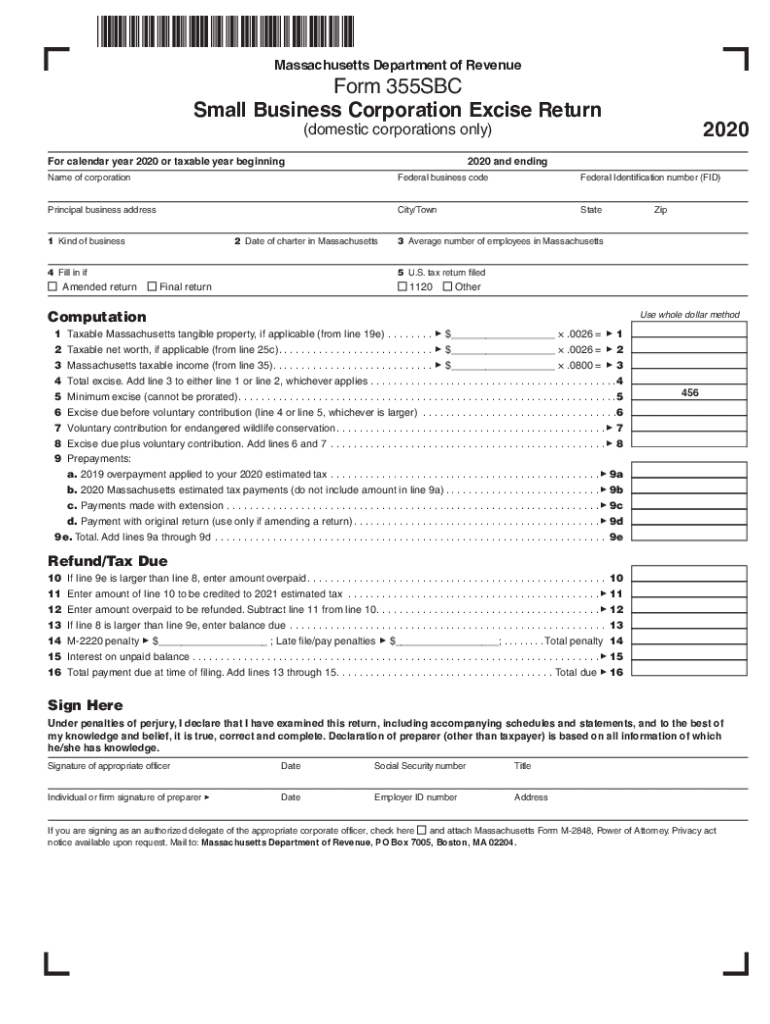

Ma Form 355 Instructions 2022 - Small business corporation excise return (domestic corporations only) 2022. For tax years beginning on or after january 1, 2022, estimated payments must be equal to the lesser of: This form is for income earned in tax year 2024, with tax returns due in april 2025. 1) 80% of current year pteet or 2). Download or print the 2024 massachusetts form 355 (massachusetts business or manufacturing corporation) for free from the massachusetts. The forms are subject to change only by federal or state legislative action. We will update this page with a new version of the form for. It includes sections on filing. Dor has released its 2022 ma corporate excise tax forms. Must be filed electronically through masstaxconnect.

Small business corporation excise return (domestic corporations only) 2022. Download or print the 2024 massachusetts form 355 (massachusetts business or manufacturing corporation) for free from the massachusetts. We will update this page with a new version of the form for. This file provides detailed instructions for completing the massachusetts corporation excise return form 355. This form is for income earned in tax year 2024, with tax returns due in april 2025. It includes sections on filing. Must be filed electronically through masstaxconnect. The forms are subject to change only by federal or state legislative action. 1) 80% of current year pteet or 2). For tax years beginning on or after january 1, 2022, estimated payments must be equal to the lesser of:

The forms are subject to change only by federal or state legislative action. Download or print the 2024 massachusetts form 355 (massachusetts business or manufacturing corporation) for free from the massachusetts. Must be filed electronically through masstaxconnect. We will update this page with a new version of the form for. Dor has released its 2022 ma corporate excise tax forms. This form is for income earned in tax year 2024, with tax returns due in april 2025. It includes sections on filing. This file provides detailed instructions for completing the massachusetts corporation excise return form 355. For tax years beginning on or after january 1, 2022, estimated payments must be equal to the lesser of: Small business corporation excise return (domestic corporations only) 2022.

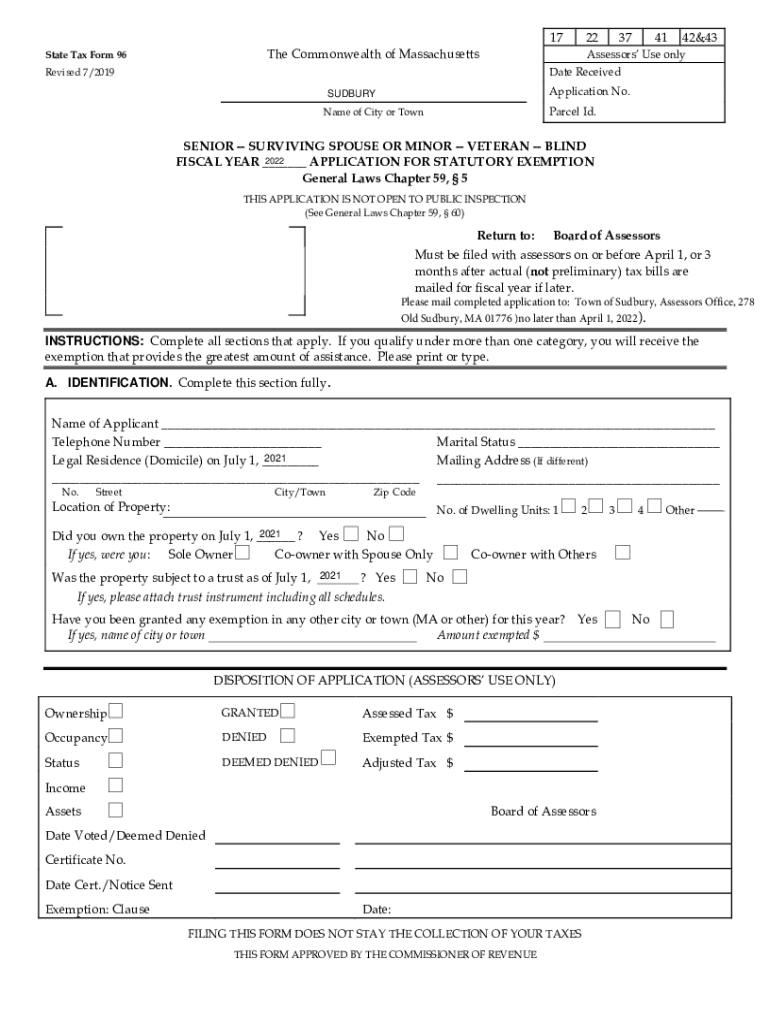

Fillable Online MA Form 965 20192022 Fill out Tax Template OnlineUS

1) 80% of current year pteet or 2). We will update this page with a new version of the form for. Small business corporation excise return (domestic corporations only) 2022. Must be filed electronically through masstaxconnect. This form is for income earned in tax year 2024, with tax returns due in april 2025.

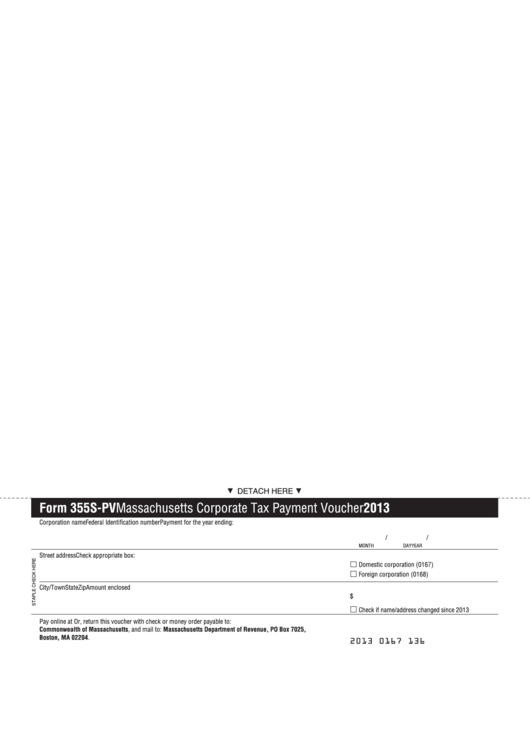

Form 355sPv Massachusetts Corporate Tax Payment Voucher 2013

Small business corporation excise return (domestic corporations only) 2022. For tax years beginning on or after january 1, 2022, estimated payments must be equal to the lesser of: 1) 80% of current year pteet or 2). We will update this page with a new version of the form for. This file provides detailed instructions for completing the massachusetts corporation excise.

20202023 Form MA DoR 355SBC Fill Online, Printable, Fillable, Blank

This form is for income earned in tax year 2024, with tax returns due in april 2025. We will update this page with a new version of the form for. This file provides detailed instructions for completing the massachusetts corporation excise return form 355. Dor has released its 2022 ma corporate excise tax forms. 1) 80% of current year pteet.

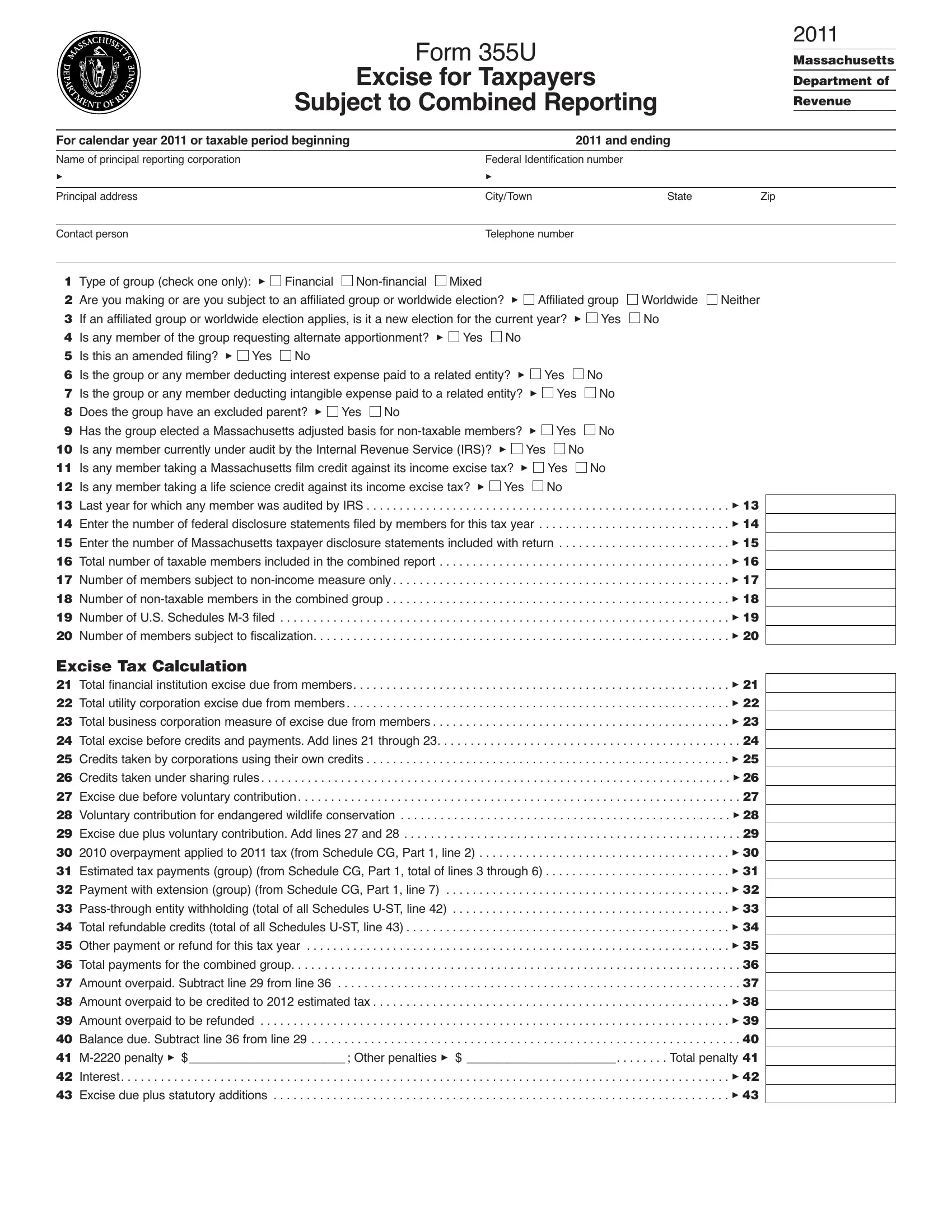

Massachusetts Form 355U ≡ Fill Out Printable PDF Forms Online

1) 80% of current year pteet or 2). Must be filed electronically through masstaxconnect. It includes sections on filing. We will update this page with a new version of the form for. The forms are subject to change only by federal or state legislative action.

Fillable Online Form 355 Instructions Fax Email Print pdfFiller

Must be filed electronically through masstaxconnect. This form is for income earned in tax year 2024, with tax returns due in april 2025. Download or print the 2024 massachusetts form 355 (massachusetts business or manufacturing corporation) for free from the massachusetts. It includes sections on filing. We will update this page with a new version of the form for.

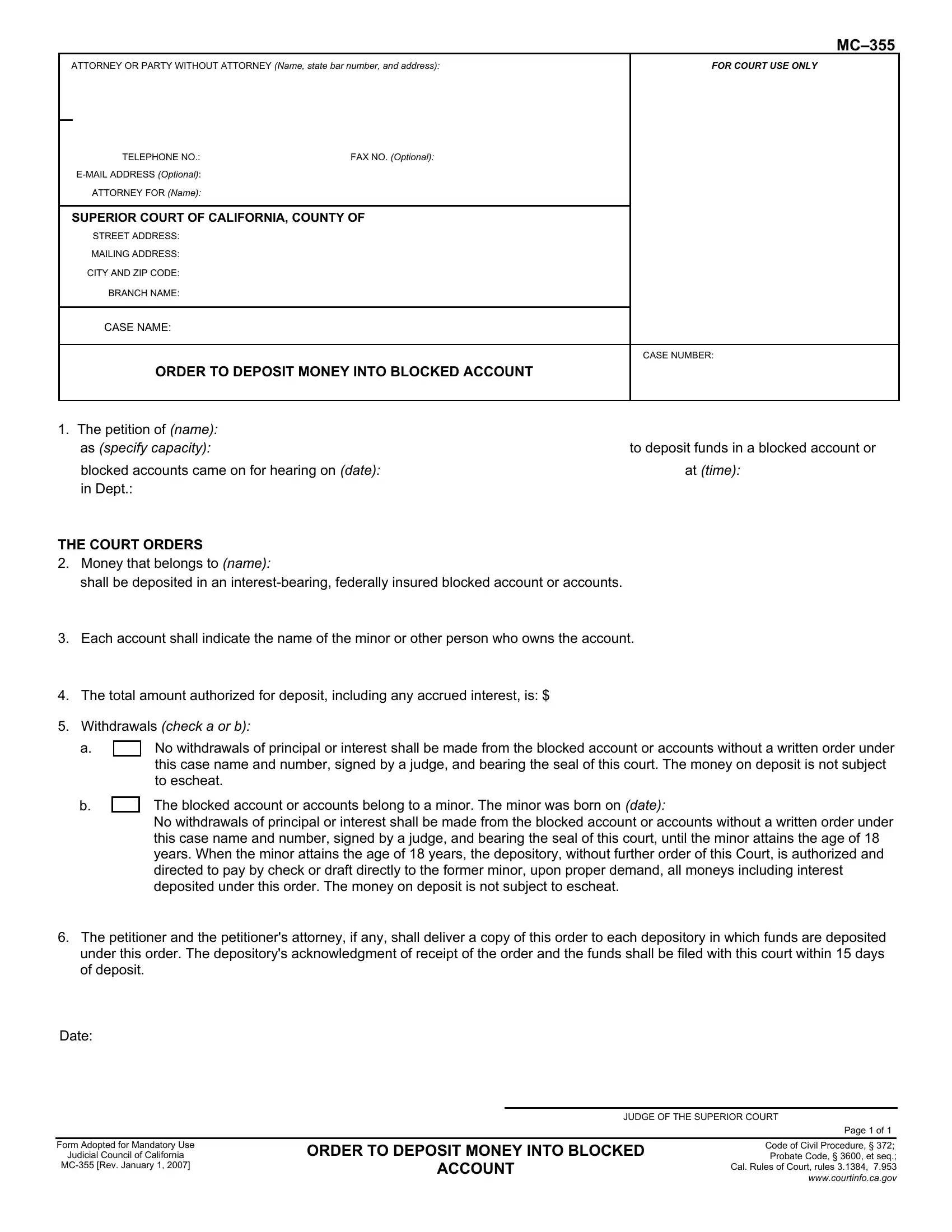

Form Mc 355 ≡ Fill Out Printable PDF Forms Online

For tax years beginning on or after january 1, 2022, estimated payments must be equal to the lesser of: Small business corporation excise return (domestic corporations only) 2022. It includes sections on filing. Dor has released its 2022 ma corporate excise tax forms. 1) 80% of current year pteet or 2).

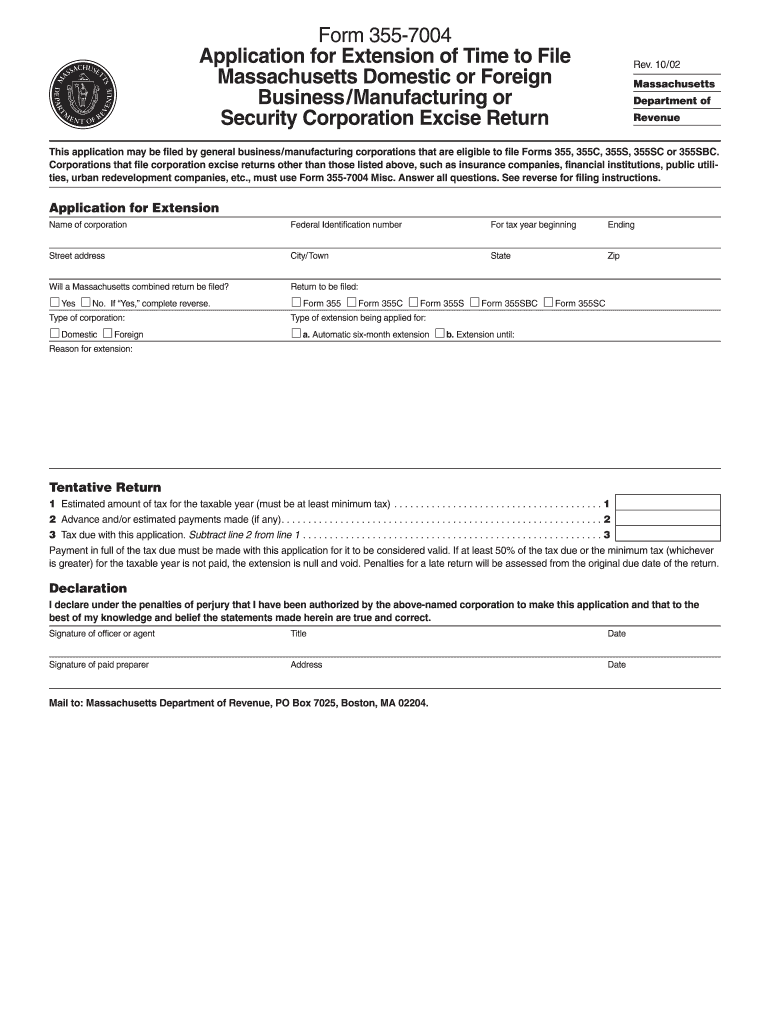

MA 3557004 2002 Fill out Tax Template Online US Legal Forms

It includes sections on filing. 1) 80% of current year pteet or 2). We will update this page with a new version of the form for. This file provides detailed instructions for completing the massachusetts corporation excise return form 355. This form is for income earned in tax year 2024, with tax returns due in april 2025.

MA DoR 355S 2016 Fill out Tax Template Online US Legal Forms

Small business corporation excise return (domestic corporations only) 2022. This file provides detailed instructions for completing the massachusetts corporation excise return form 355. Download or print the 2024 massachusetts form 355 (massachusetts business or manufacturing corporation) for free from the massachusetts. 1) 80% of current year pteet or 2). This form is for income earned in tax year 2024, with.

MA 3557004 2010 Fill out Tax Template Online US Legal Forms

The forms are subject to change only by federal or state legislative action. Dor has released its 2022 ma corporate excise tax forms. Must be filed electronically through masstaxconnect. For tax years beginning on or after january 1, 2022, estimated payments must be equal to the lesser of: Small business corporation excise return (domestic corporations only) 2022.

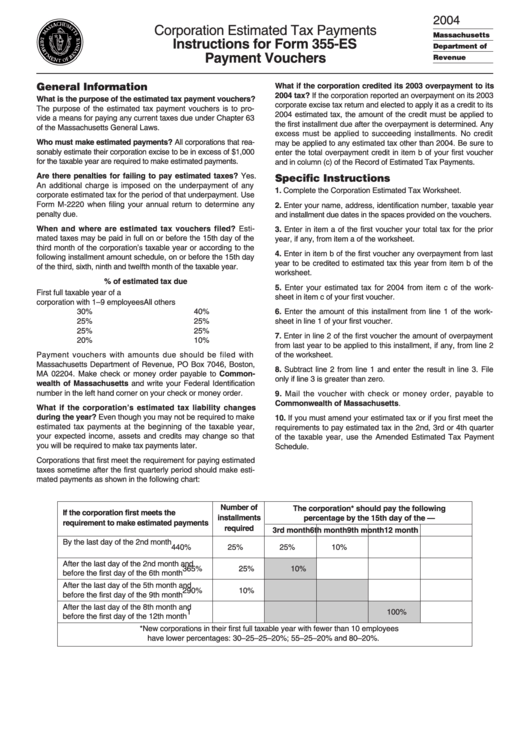

Instructions For Form 355Es Corporation Estimated Tax Payments

The forms are subject to change only by federal or state legislative action. Small business corporation excise return (domestic corporations only) 2022. Dor has released its 2022 ma corporate excise tax forms. It includes sections on filing. 1) 80% of current year pteet or 2).

1) 80% Of Current Year Pteet Or 2).

This form is for income earned in tax year 2024, with tax returns due in april 2025. We will update this page with a new version of the form for. Dor has released its 2022 ma corporate excise tax forms. The forms are subject to change only by federal or state legislative action.

Download Or Print The 2024 Massachusetts Form 355 (Massachusetts Business Or Manufacturing Corporation) For Free From The Massachusetts.

This file provides detailed instructions for completing the massachusetts corporation excise return form 355. Small business corporation excise return (domestic corporations only) 2022. It includes sections on filing. Must be filed electronically through masstaxconnect.