Maryland Form 500 Instructions - Every maryland corporation must file a corporation income tax return, using form 500, even if the corporation has no taxable income or is. Learn about the new single sales. Download and print the booklet for filing form 500, the multipurpose form for corporations in maryland. The guidance provides comprehensive information for corporations to file their income tax returns for the tax year 2024,. Income must file form 500 to report the income and pay the tax. The corporation income tax applies to every maryland corporation , even if it has no taxable income or the corporation is inactive. Whether or not required to file form 500, nonprofit organizations operating in.

Whether or not required to file form 500, nonprofit organizations operating in. Learn about the new single sales. The corporation income tax applies to every maryland corporation , even if it has no taxable income or the corporation is inactive. Income must file form 500 to report the income and pay the tax. Every maryland corporation must file a corporation income tax return, using form 500, even if the corporation has no taxable income or is. The guidance provides comprehensive information for corporations to file their income tax returns for the tax year 2024,. Download and print the booklet for filing form 500, the multipurpose form for corporations in maryland.

Download and print the booklet for filing form 500, the multipurpose form for corporations in maryland. Every maryland corporation must file a corporation income tax return, using form 500, even if the corporation has no taxable income or is. Income must file form 500 to report the income and pay the tax. The corporation income tax applies to every maryland corporation , even if it has no taxable income or the corporation is inactive. Whether or not required to file form 500, nonprofit organizations operating in. The guidance provides comprehensive information for corporations to file their income tax returns for the tax year 2024,. Learn about the new single sales.

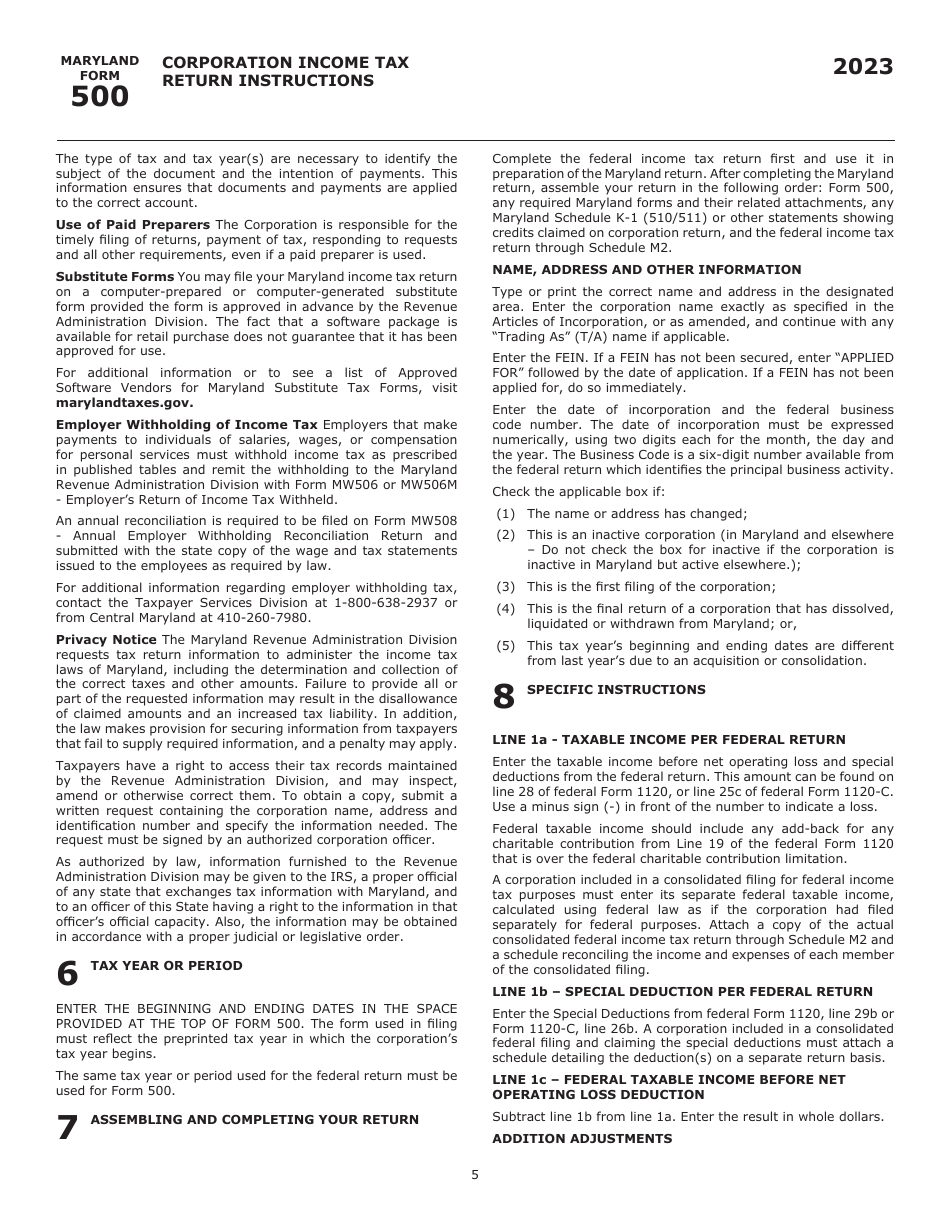

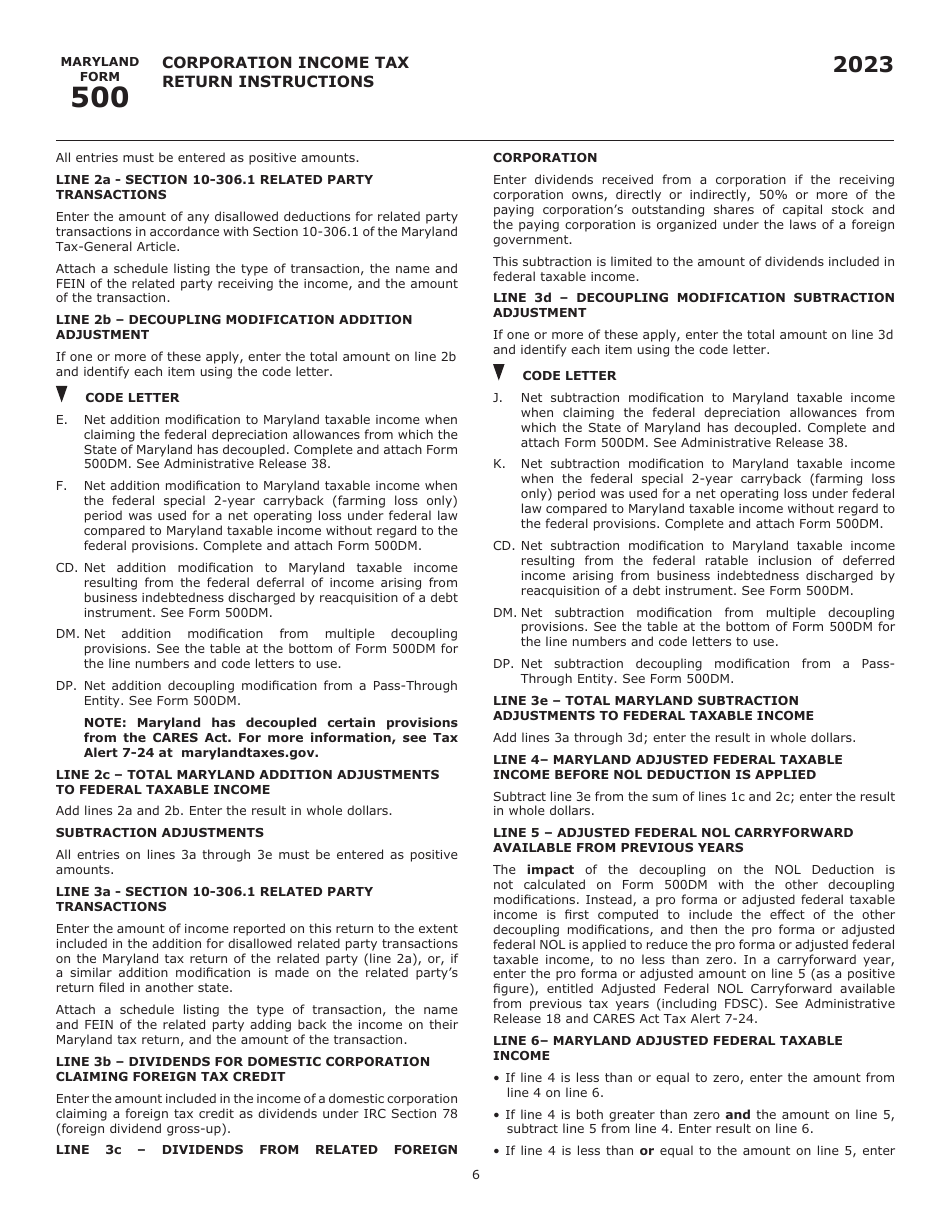

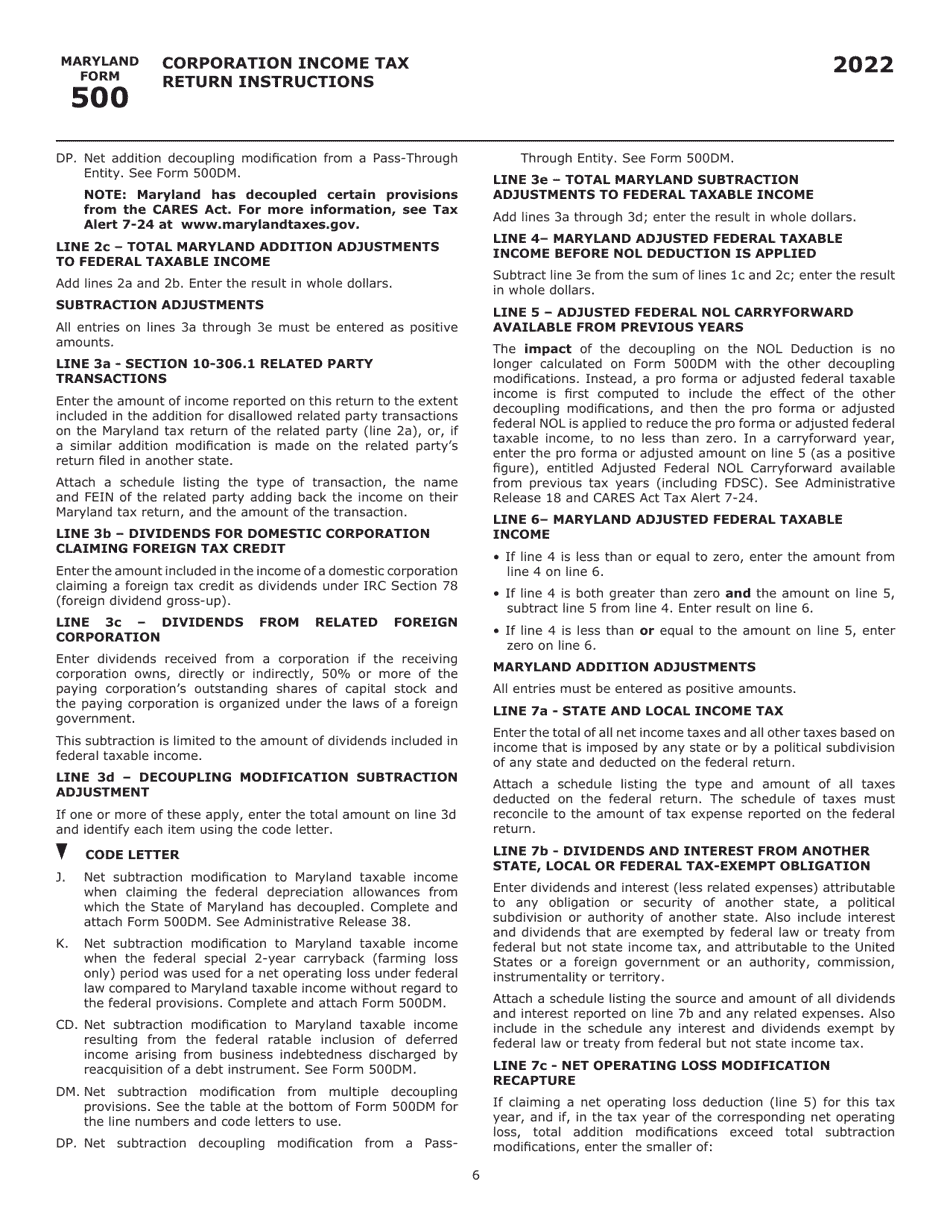

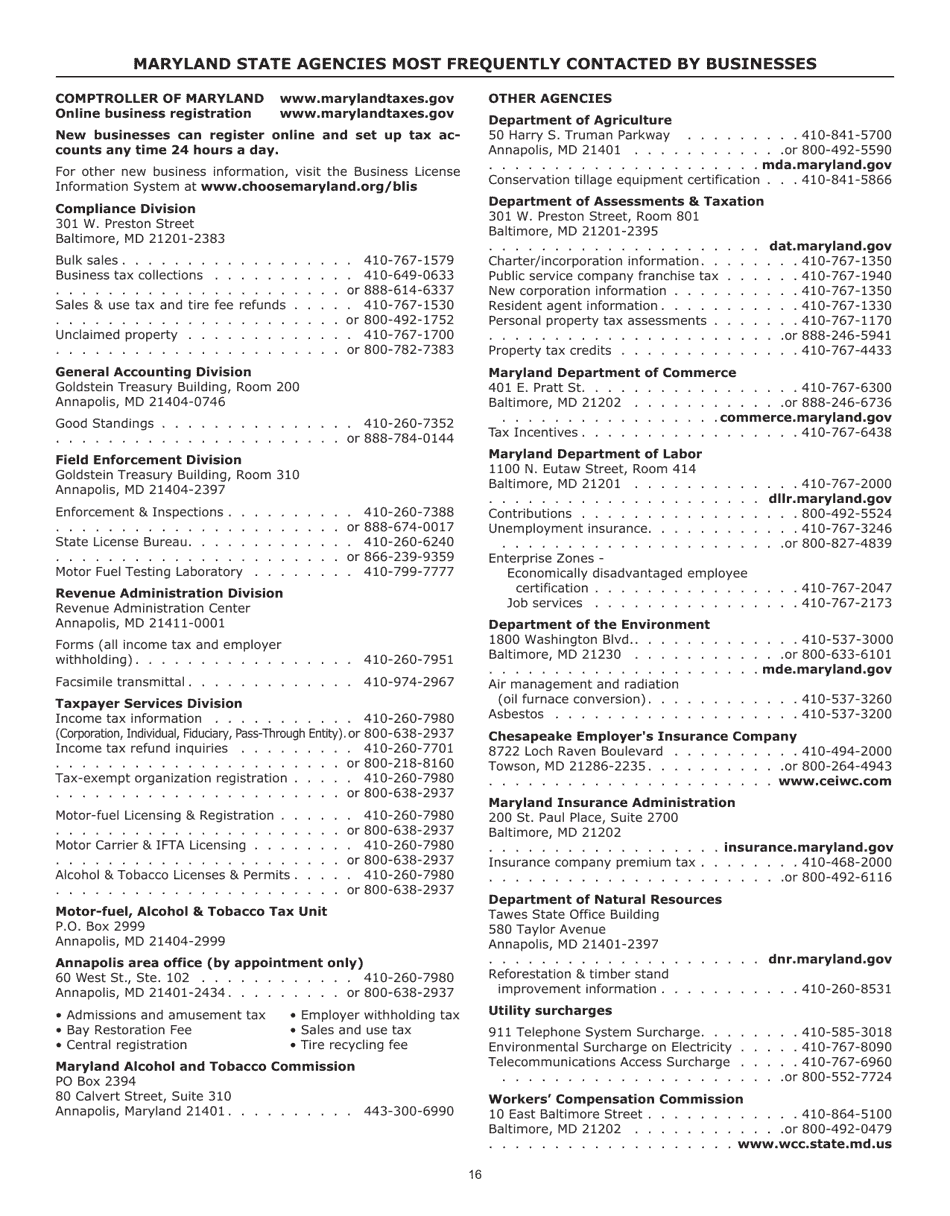

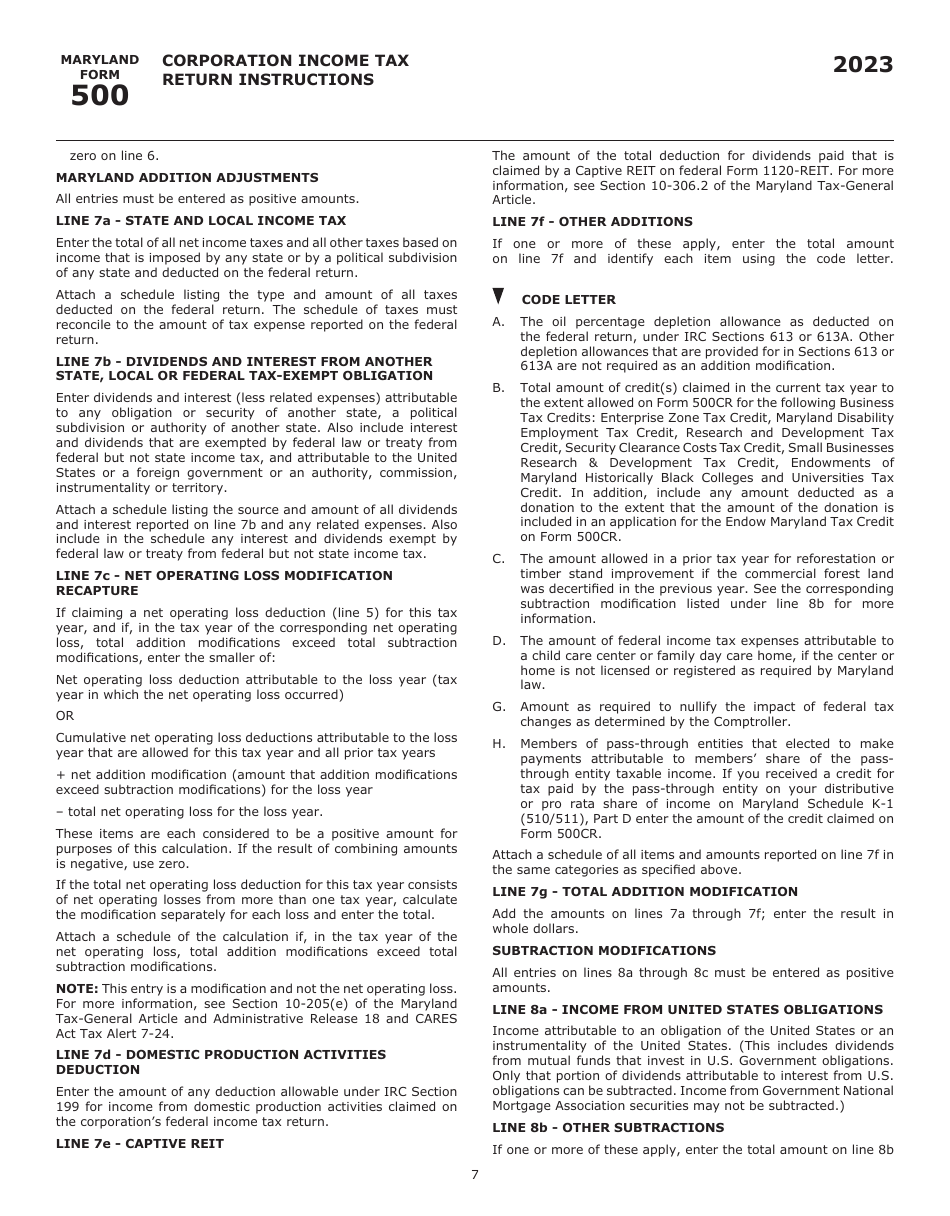

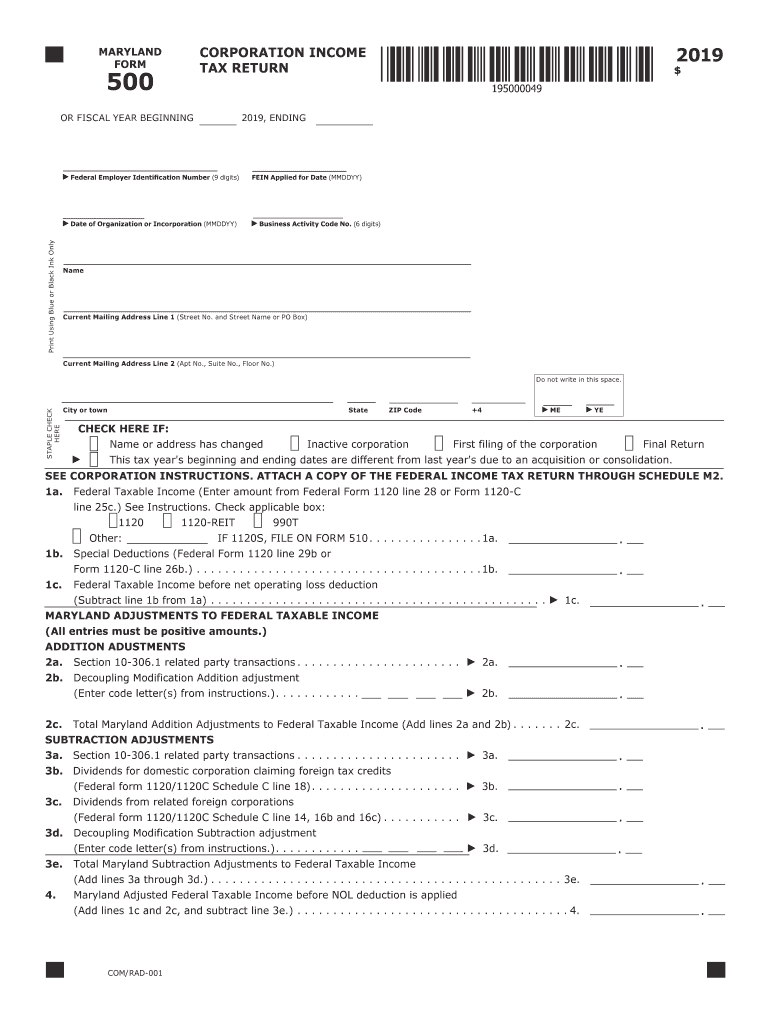

Download Instructions for Maryland Form 500, COM/RAD001 Corporation

The guidance provides comprehensive information for corporations to file their income tax returns for the tax year 2024,. Every maryland corporation must file a corporation income tax return, using form 500, even if the corporation has no taxable income or is. Income must file form 500 to report the income and pay the tax. Whether or not required to file.

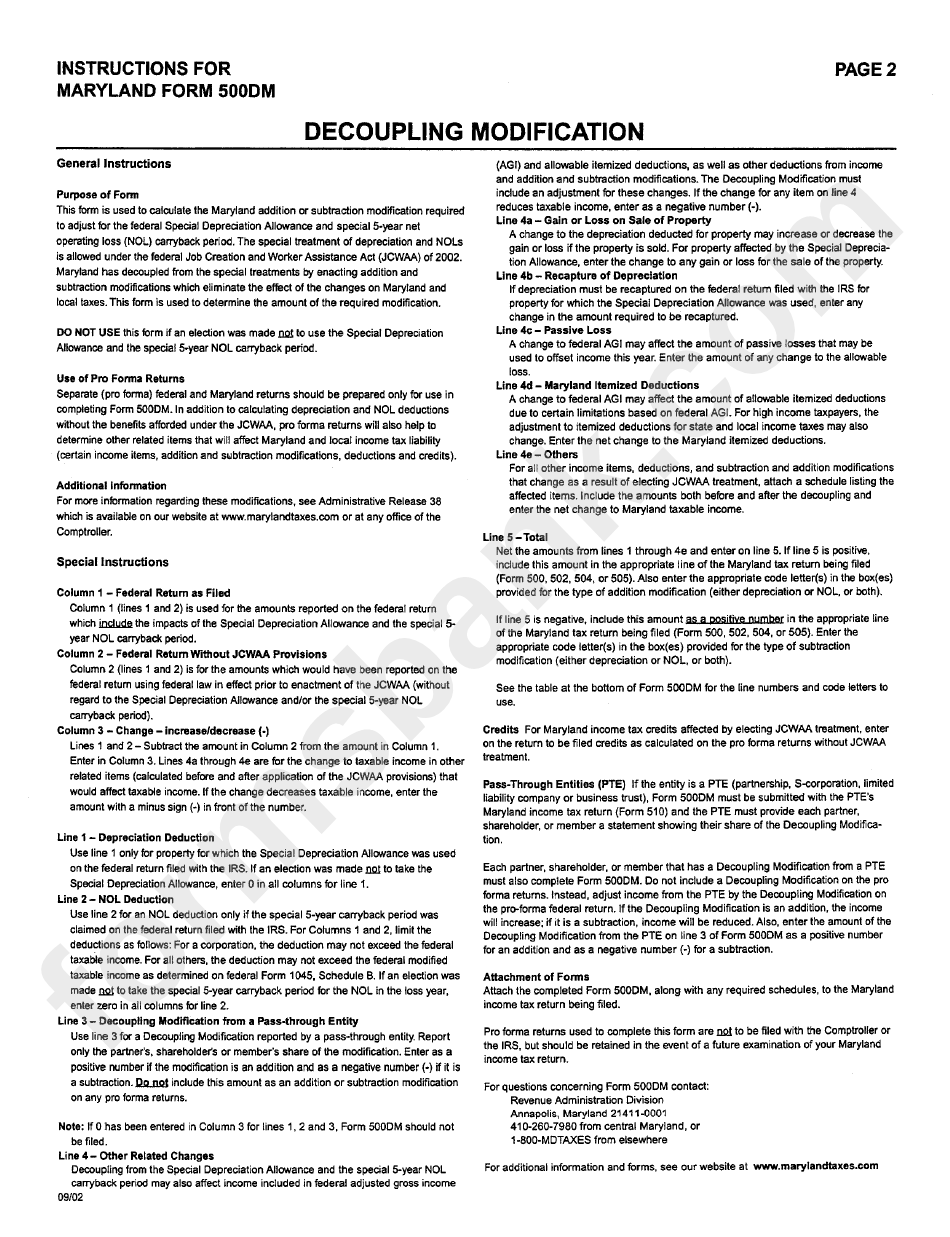

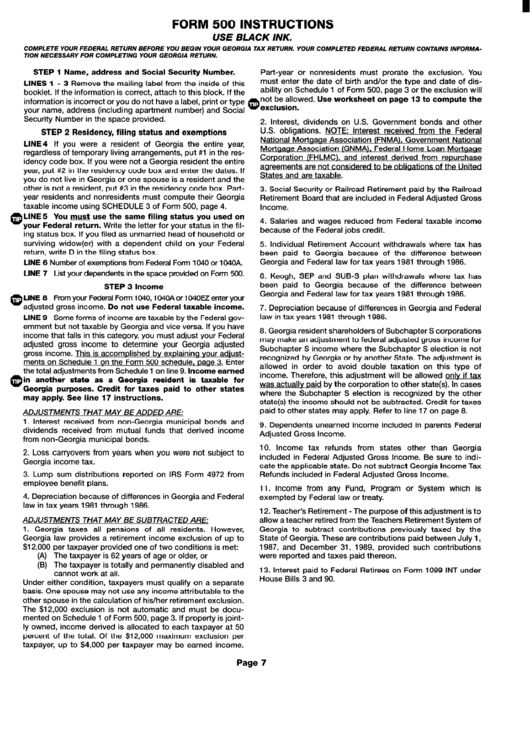

Instructions For Maryland Form 500dm printable pdf download

Learn about the new single sales. Every maryland corporation must file a corporation income tax return, using form 500, even if the corporation has no taxable income or is. The corporation income tax applies to every maryland corporation , even if it has no taxable income or the corporation is inactive. The guidance provides comprehensive information for corporations to file.

Download Instructions for Maryland Form 500, COM/RAD001 Corporation

Whether or not required to file form 500, nonprofit organizations operating in. Income must file form 500 to report the income and pay the tax. Download and print the booklet for filing form 500, the multipurpose form for corporations in maryland. Learn about the new single sales. The guidance provides comprehensive information for corporations to file their income tax returns.

Download Instructions for Maryland Form 500, COM/RAD001 Corporation

Every maryland corporation must file a corporation income tax return, using form 500, even if the corporation has no taxable income or is. Whether or not required to file form 500, nonprofit organizations operating in. Income must file form 500 to report the income and pay the tax. Learn about the new single sales. The corporation income tax applies to.

Download Instructions for Maryland Form 500, COM/RAD001 Corporation

The guidance provides comprehensive information for corporations to file their income tax returns for the tax year 2024,. Every maryland corporation must file a corporation income tax return, using form 500, even if the corporation has no taxable income or is. Whether or not required to file form 500, nonprofit organizations operating in. Download and print the booklet for filing.

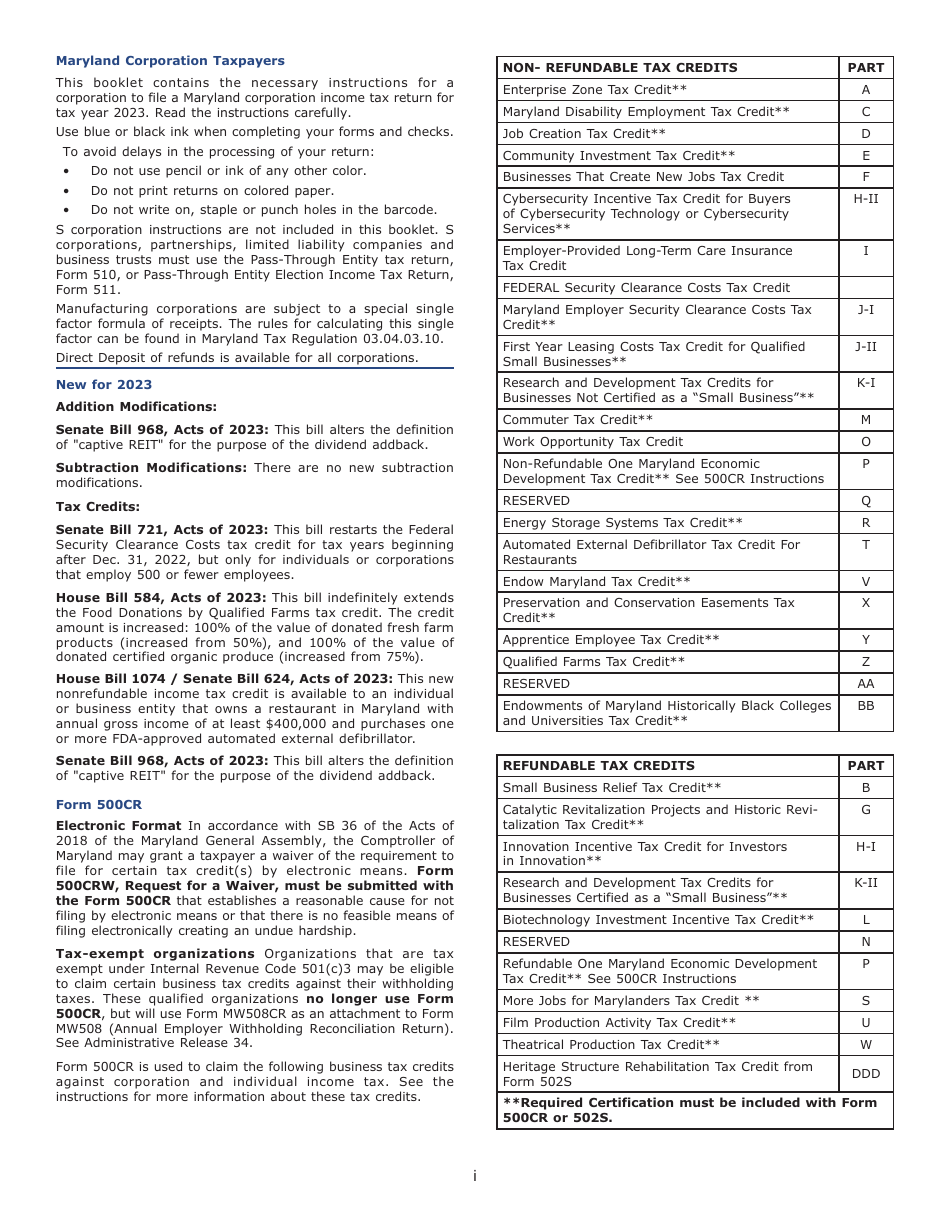

Form 500 Instructions printable pdf download

Every maryland corporation must file a corporation income tax return, using form 500, even if the corporation has no taxable income or is. The guidance provides comprehensive information for corporations to file their income tax returns for the tax year 2024,. Income must file form 500 to report the income and pay the tax. Whether or not required to file.

Download Instructions for Maryland Form 500, COM/RAD001 Corporation

The guidance provides comprehensive information for corporations to file their income tax returns for the tax year 2024,. Every maryland corporation must file a corporation income tax return, using form 500, even if the corporation has no taxable income or is. Learn about the new single sales. The corporation income tax applies to every maryland corporation , even if it.

Download Instructions for Maryland Form 500, COM/RAD001 Corporation

Income must file form 500 to report the income and pay the tax. Whether or not required to file form 500, nonprofit organizations operating in. Every maryland corporation must file a corporation income tax return, using form 500, even if the corporation has no taxable income or is. The guidance provides comprehensive information for corporations to file their income tax.

Download Instructions for Maryland Form 500, COM/RAD001 Corporation

Every maryland corporation must file a corporation income tax return, using form 500, even if the corporation has no taxable income or is. Income must file form 500 to report the income and pay the tax. Learn about the new single sales. The guidance provides comprehensive information for corporations to file their income tax returns for the tax year 2024,..

20192021 MD Form 500 Fill Online, Printable, Fillable, Blank pdfFiller

Income must file form 500 to report the income and pay the tax. Whether or not required to file form 500, nonprofit organizations operating in. The corporation income tax applies to every maryland corporation , even if it has no taxable income or the corporation is inactive. Learn about the new single sales. Download and print the booklet for filing.

Income Must File Form 500 To Report The Income And Pay The Tax.

The corporation income tax applies to every maryland corporation , even if it has no taxable income or the corporation is inactive. Download and print the booklet for filing form 500, the multipurpose form for corporations in maryland. Whether or not required to file form 500, nonprofit organizations operating in. Learn about the new single sales.

The Guidance Provides Comprehensive Information For Corporations To File Their Income Tax Returns For The Tax Year 2024,.

Every maryland corporation must file a corporation income tax return, using form 500, even if the corporation has no taxable income or is.