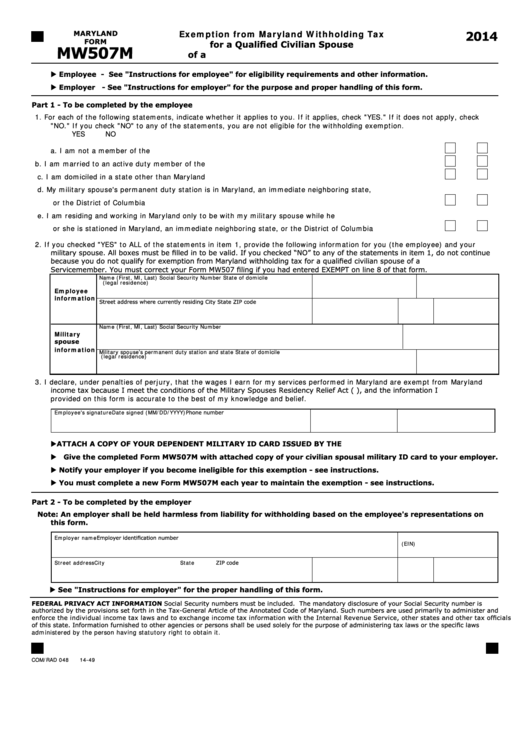

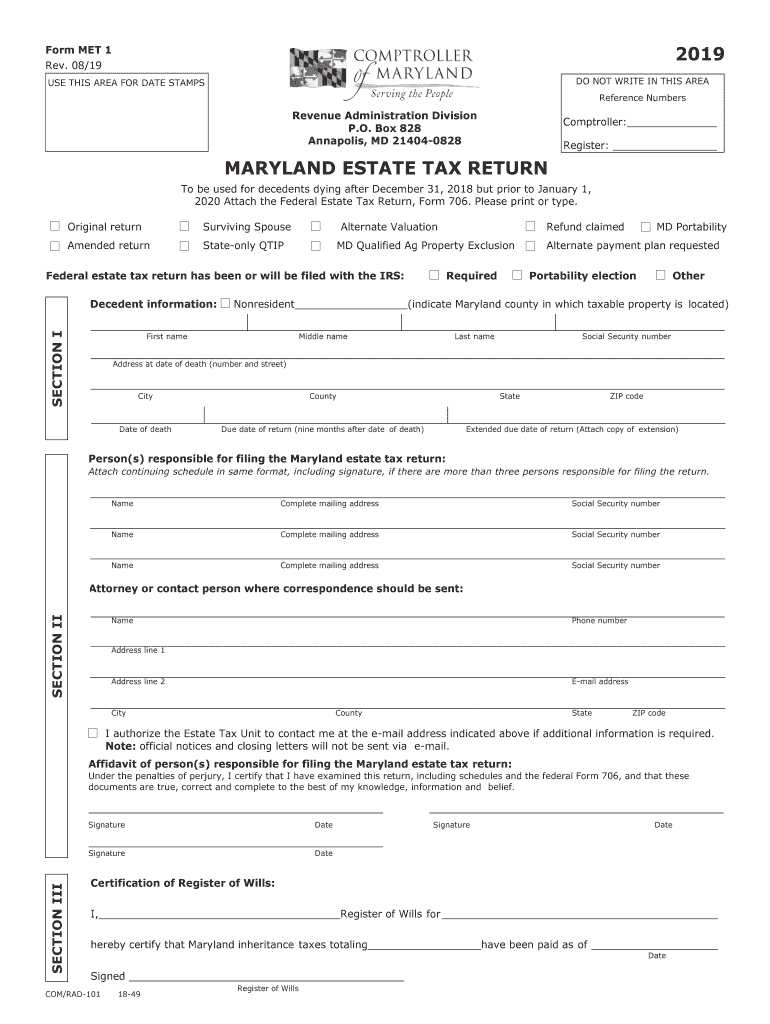

Maryland Withholding Form - Form used to determine the amount of income tax withholding due on the sale of property located in maryland and owned by nonresidents, and provide for tax collection at the time of the sale or. Maryland withholding based on itemized deductions, and certain other expenses that exceed your standard deduction and are not being claimed at another job or by your spouse. Complete form mw507 so that your employer can withhold the correct maryland income tax from your pay. Consider completing a new form mw507 each year and when your personal or financial. Employee's maryland withholding exemption certificate form used by individuals to direct their employer to withhold the correct amount of maryland income tax from their pay.

Complete form mw507 so that your employer can withhold the correct maryland income tax from your pay. Employee's maryland withholding exemption certificate form used by individuals to direct their employer to withhold the correct amount of maryland income tax from their pay. Form used to determine the amount of income tax withholding due on the sale of property located in maryland and owned by nonresidents, and provide for tax collection at the time of the sale or. Consider completing a new form mw507 each year and when your personal or financial. Maryland withholding based on itemized deductions, and certain other expenses that exceed your standard deduction and are not being claimed at another job or by your spouse.

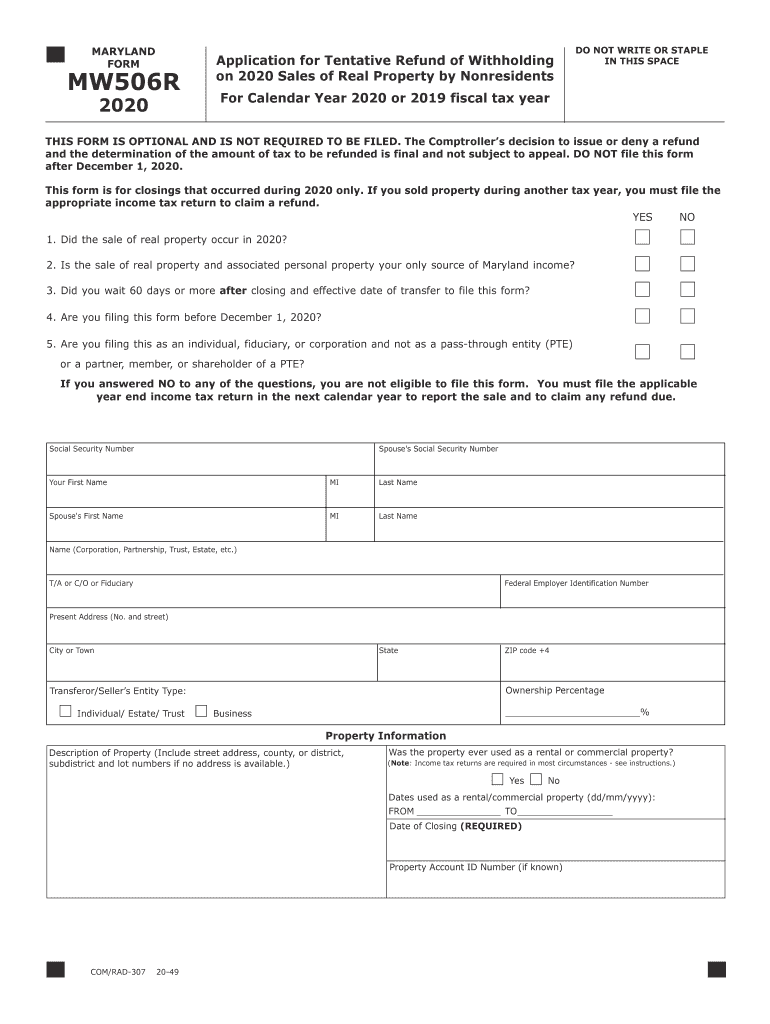

Form used to determine the amount of income tax withholding due on the sale of property located in maryland and owned by nonresidents, and provide for tax collection at the time of the sale or. Consider completing a new form mw507 each year and when your personal or financial. Complete form mw507 so that your employer can withhold the correct maryland income tax from your pay. Maryland withholding based on itemized deductions, and certain other expenses that exceed your standard deduction and are not being claimed at another job or by your spouse. Employee's maryland withholding exemption certificate form used by individuals to direct their employer to withhold the correct amount of maryland income tax from their pay.

2023 Md Withholding Form Printable Forms Free Online

Employee's maryland withholding exemption certificate form used by individuals to direct their employer to withhold the correct amount of maryland income tax from their pay. Consider completing a new form mw507 each year and when your personal or financial. Form used to determine the amount of income tax withholding due on the sale of property located in maryland and owned.

Fillable Form Mw 507 Employee S Maryland Withholding Exemption

Employee's maryland withholding exemption certificate form used by individuals to direct their employer to withhold the correct amount of maryland income tax from their pay. Form used to determine the amount of income tax withholding due on the sale of property located in maryland and owned by nonresidents, and provide for tax collection at the time of the sale or..

Maryland Withholding Tax Form

Employee's maryland withholding exemption certificate form used by individuals to direct their employer to withhold the correct amount of maryland income tax from their pay. Form used to determine the amount of income tax withholding due on the sale of property located in maryland and owned by nonresidents, and provide for tax collection at the time of the sale or..

Maryland Withholding Form 2024 Dani Millie

Employee's maryland withholding exemption certificate form used by individuals to direct their employer to withhold the correct amount of maryland income tax from their pay. Form used to determine the amount of income tax withholding due on the sale of property located in maryland and owned by nonresidents, and provide for tax collection at the time of the sale or..

2021 Maryland Withholding Taxes Tax Withholding Estimator 2021

Employee's maryland withholding exemption certificate form used by individuals to direct their employer to withhold the correct amount of maryland income tax from their pay. Form used to determine the amount of income tax withholding due on the sale of property located in maryland and owned by nonresidents, and provide for tax collection at the time of the sale or..

Maryland Withholding Form 2023 Printable Forms Free Online

Employee's maryland withholding exemption certificate form used by individuals to direct their employer to withhold the correct amount of maryland income tax from their pay. Form used to determine the amount of income tax withholding due on the sale of property located in maryland and owned by nonresidents, and provide for tax collection at the time of the sale or..

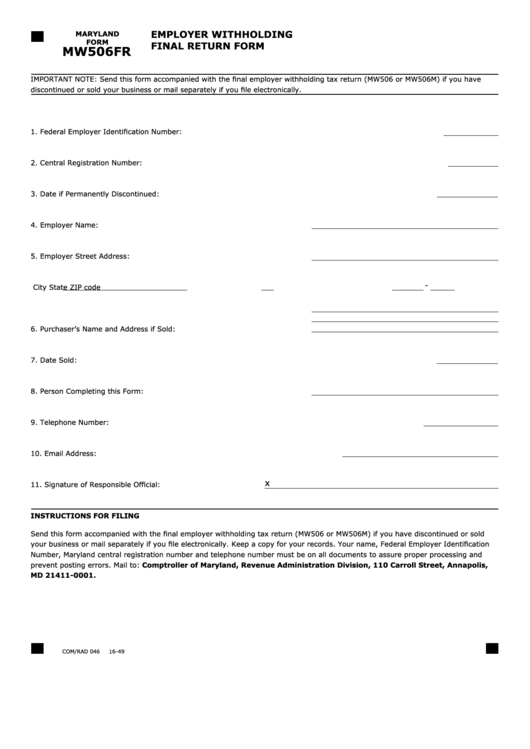

Fillable Maryland Form Mw506fr Employer Withholding Final Return Form

Form used to determine the amount of income tax withholding due on the sale of property located in maryland and owned by nonresidents, and provide for tax collection at the time of the sale or. Consider completing a new form mw507 each year and when your personal or financial. Maryland withholding based on itemized deductions, and certain other expenses that.

State Tax Withholding Form Maryland

Form used to determine the amount of income tax withholding due on the sale of property located in maryland and owned by nonresidents, and provide for tax collection at the time of the sale or. Complete form mw507 so that your employer can withhold the correct maryland income tax from your pay. Consider completing a new form mw507 each year.

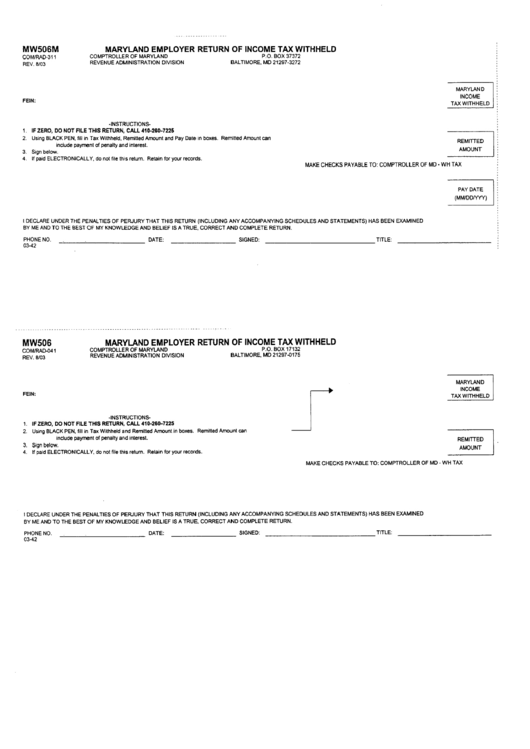

Form Mw506m Maryland Employer Return Of Tax Withheld printable

Employee's maryland withholding exemption certificate form used by individuals to direct their employer to withhold the correct amount of maryland income tax from their pay. Form used to determine the amount of income tax withholding due on the sale of property located in maryland and owned by nonresidents, and provide for tax collection at the time of the sale or..

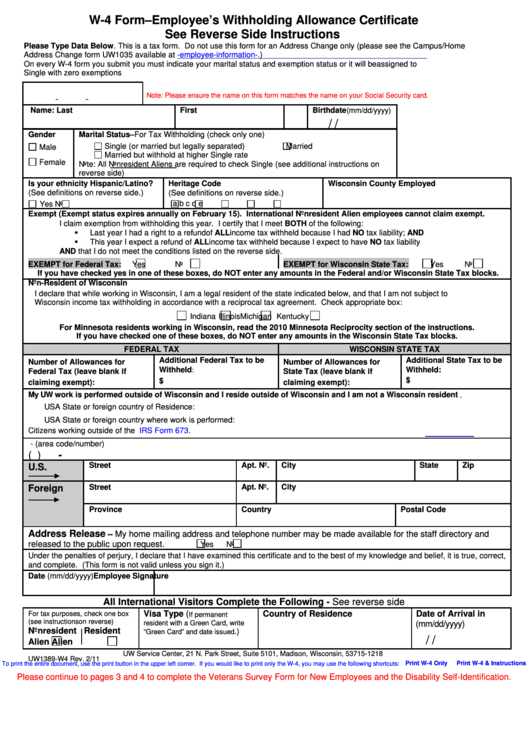

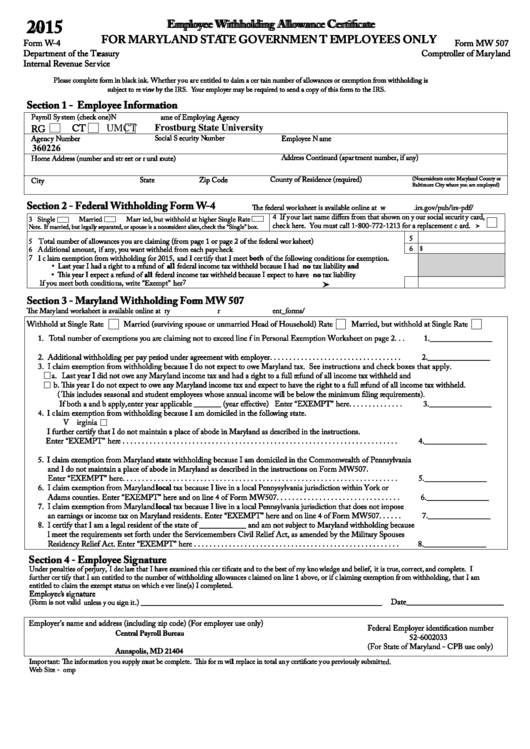

Form W4 Employee Withholding Allowance Certificate For Maryland

Maryland withholding based on itemized deductions, and certain other expenses that exceed your standard deduction and are not being claimed at another job or by your spouse. Consider completing a new form mw507 each year and when your personal or financial. Employee's maryland withholding exemption certificate form used by individuals to direct their employer to withhold the correct amount of.

Maryland Withholding Based On Itemized Deductions, And Certain Other Expenses That Exceed Your Standard Deduction And Are Not Being Claimed At Another Job Or By Your Spouse.

Consider completing a new form mw507 each year and when your personal or financial. Complete form mw507 so that your employer can withhold the correct maryland income tax from your pay. Form used to determine the amount of income tax withholding due on the sale of property located in maryland and owned by nonresidents, and provide for tax collection at the time of the sale or. Employee's maryland withholding exemption certificate form used by individuals to direct their employer to withhold the correct amount of maryland income tax from their pay.