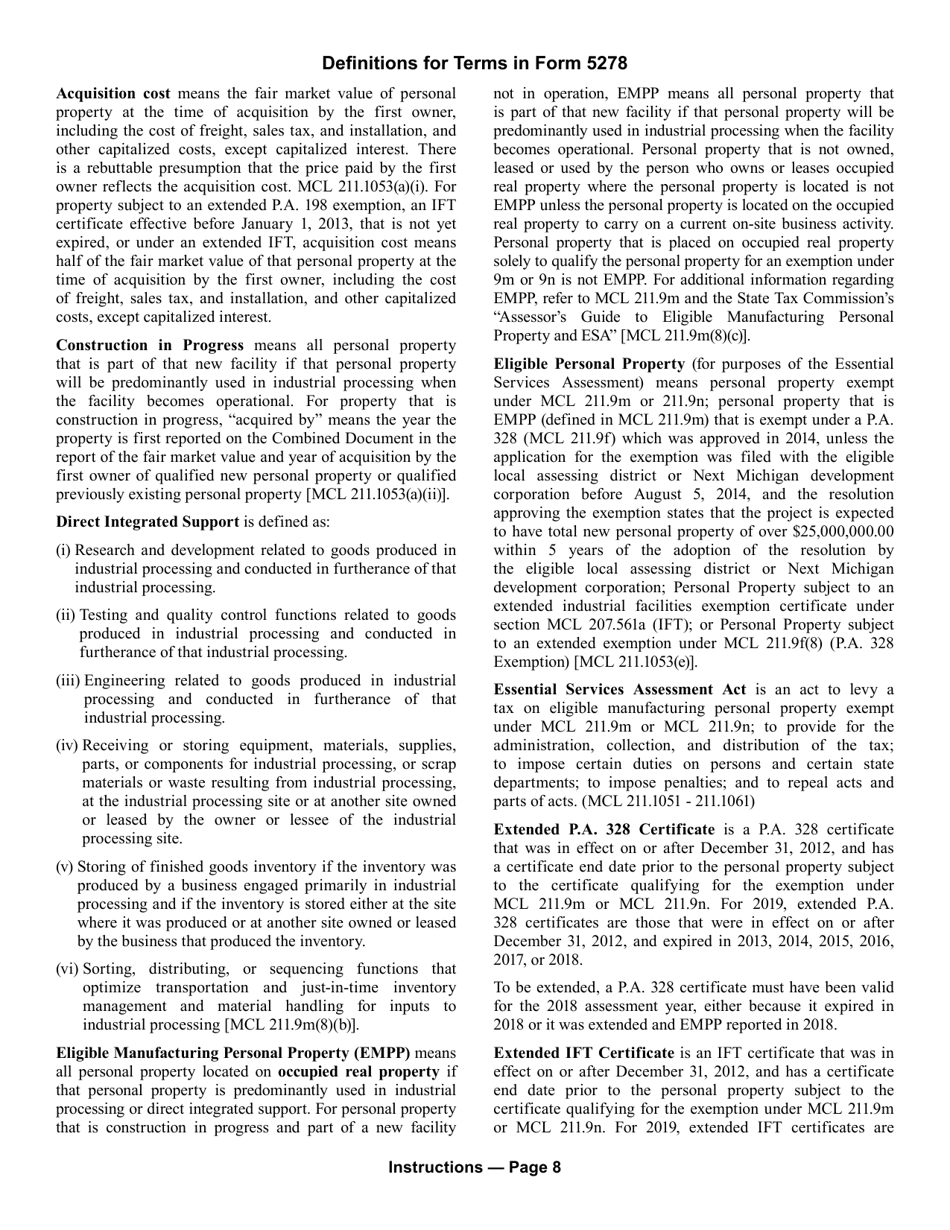

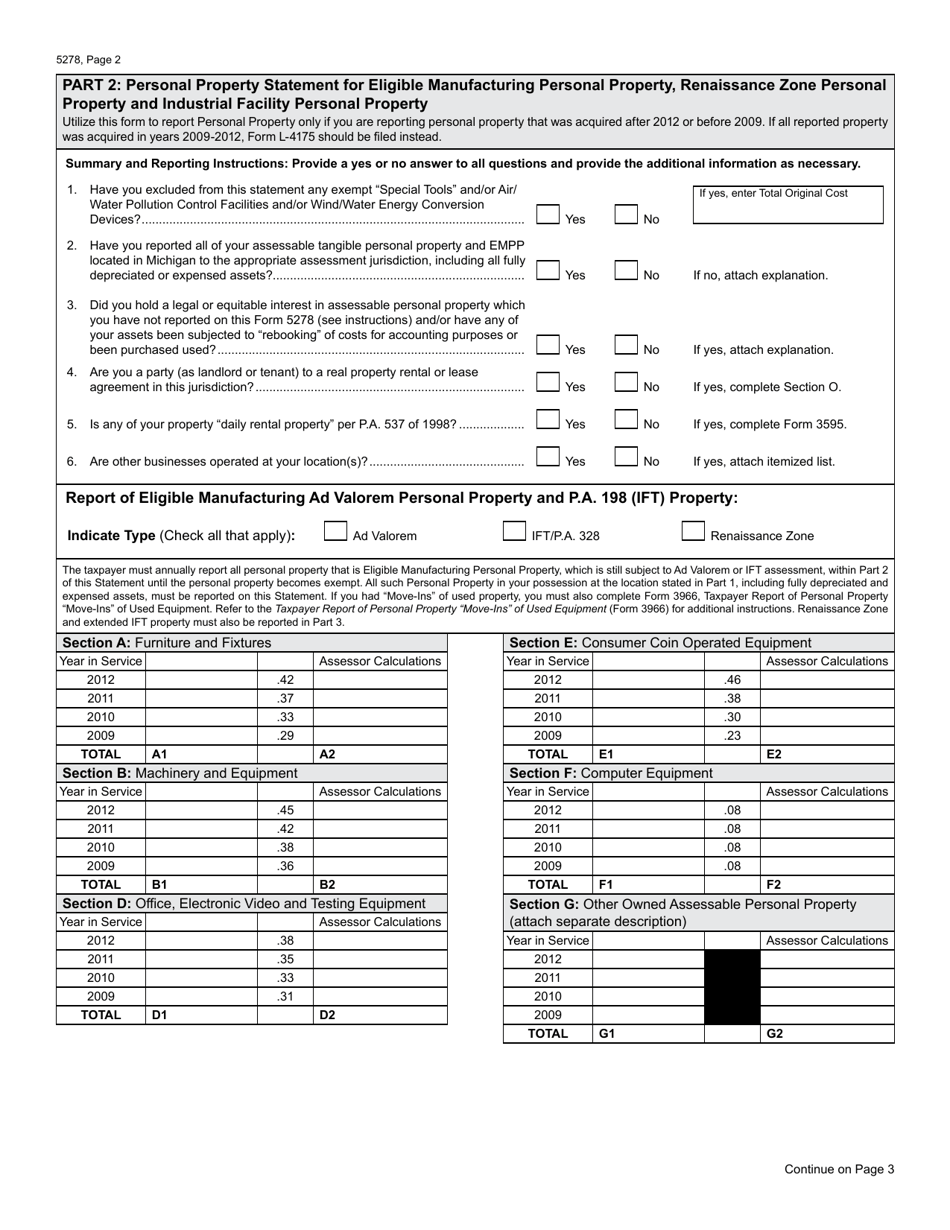

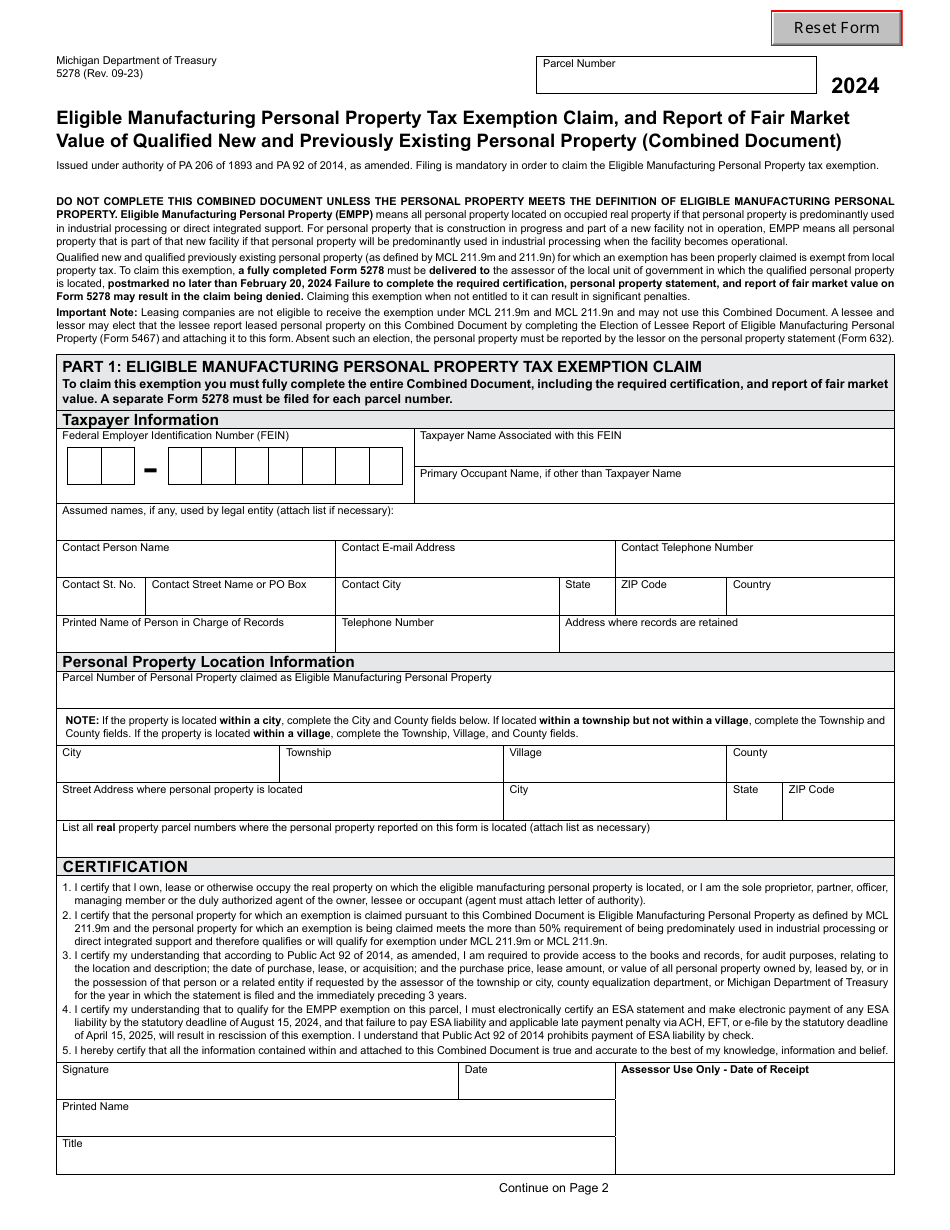

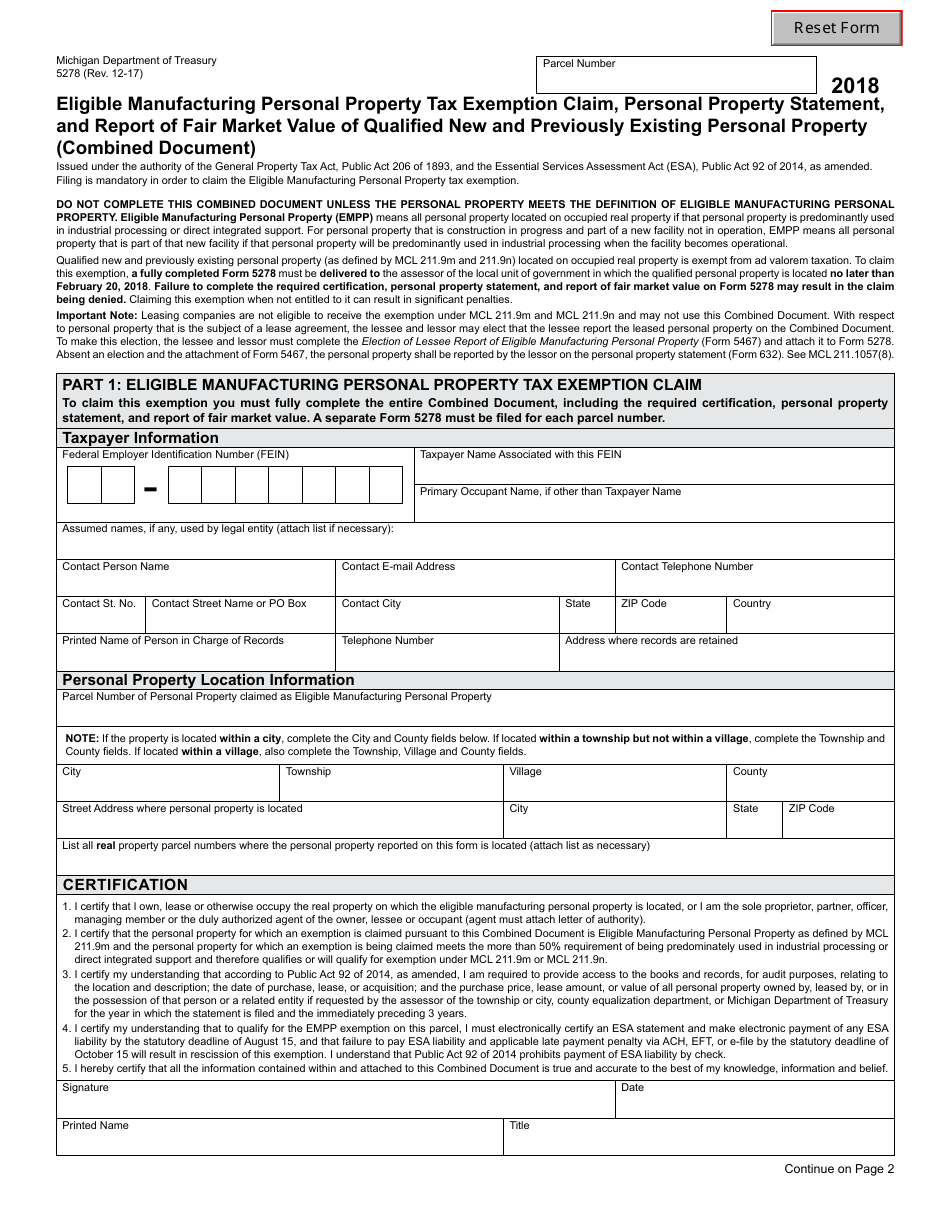

Mi Form 5278 - To claim this exemption, a fully completed form 5278 must be delivered to the assessor of the local unit of government in. To claim this exemption you must fully complete the entire combined document, including the required certification, and report of fair market. Failure to complete the required certification, personal property statement, and report of fair market value on form 5278 may result in the. To claim this exemption, a fully completed form 5278 must be received by the assessor of the local unit of government where the qualified. State of michigan form 5278: Beginning december 31, 2015 (for the 2016 assessment year), qualified new personal property and qualified previously existing personal. To claim this exemption, a fully completed form 5278 must be delivered to the assessor of the local unit of government in which the qualified. Browse through useful forms, brochures, and websites which are available to help you with taxes. Form 5278 (eligible manufacturing personal property tax exemption claim, and report of fair market value of qualified new and previously.

To claim this exemption, a fully completed form 5278 must be delivered to the assessor of the local unit of government in. Failure to complete the required certification, personal property statement, and report of fair market value on form 5278 may result in the. To claim this exemption you must fully complete the entire combined document, including the required certification, and report of fair market. To claim this exemption, a fully completed form 5278 must be delivered to the assessor of the local unit of government in which the qualified. State of michigan form 5278: Beginning december 31, 2015 (for the 2016 assessment year), qualified new personal property and qualified previously existing personal. To claim this exemption, a fully completed form 5278 must be received by the assessor of the local unit of government where the qualified. Browse through useful forms, brochures, and websites which are available to help you with taxes. Form 5278 (eligible manufacturing personal property tax exemption claim, and report of fair market value of qualified new and previously.

To claim this exemption, a fully completed form 5278 must be received by the assessor of the local unit of government where the qualified. Beginning december 31, 2015 (for the 2016 assessment year), qualified new personal property and qualified previously existing personal. Browse through useful forms, brochures, and websites which are available to help you with taxes. To claim this exemption, a fully completed form 5278 must be delivered to the assessor of the local unit of government in which the qualified. State of michigan form 5278: To claim this exemption, a fully completed form 5278 must be delivered to the assessor of the local unit of government in. Failure to complete the required certification, personal property statement, and report of fair market value on form 5278 may result in the. To claim this exemption you must fully complete the entire combined document, including the required certification, and report of fair market. Form 5278 (eligible manufacturing personal property tax exemption claim, and report of fair market value of qualified new and previously.

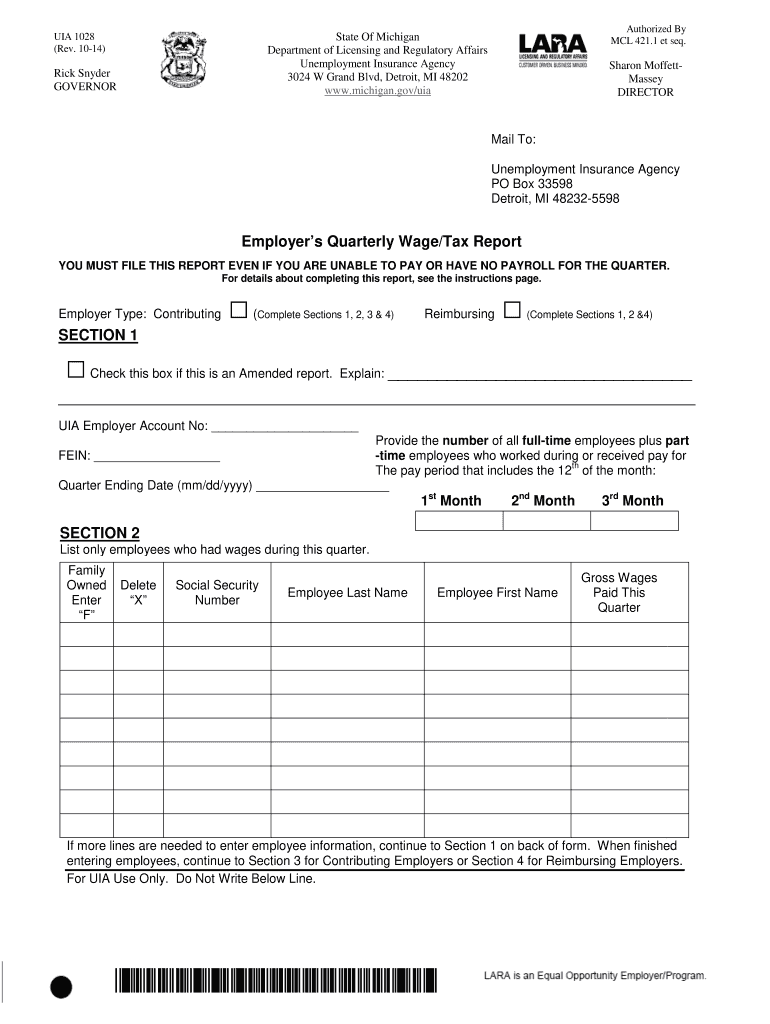

MI UIA 1028 20142022 Fill out Tax Template Online US Legal Forms

To claim this exemption, a fully completed form 5278 must be delivered to the assessor of the local unit of government in which the qualified. To claim this exemption, a fully completed form 5278 must be received by the assessor of the local unit of government where the qualified. To claim this exemption, a fully completed form 5278 must be.

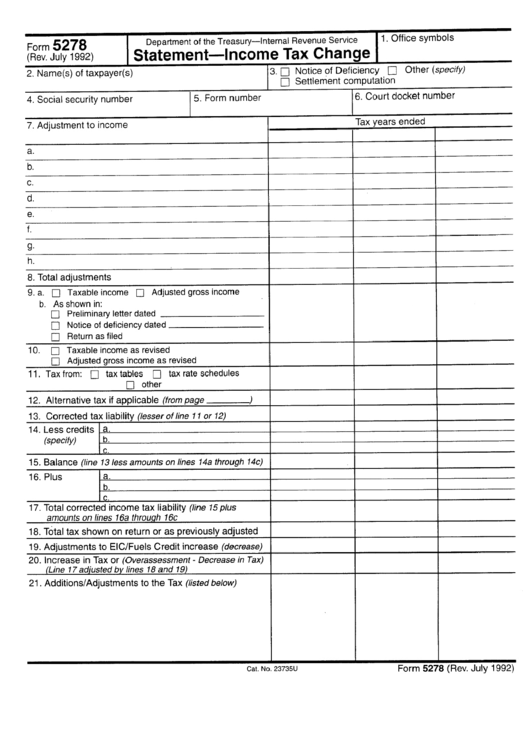

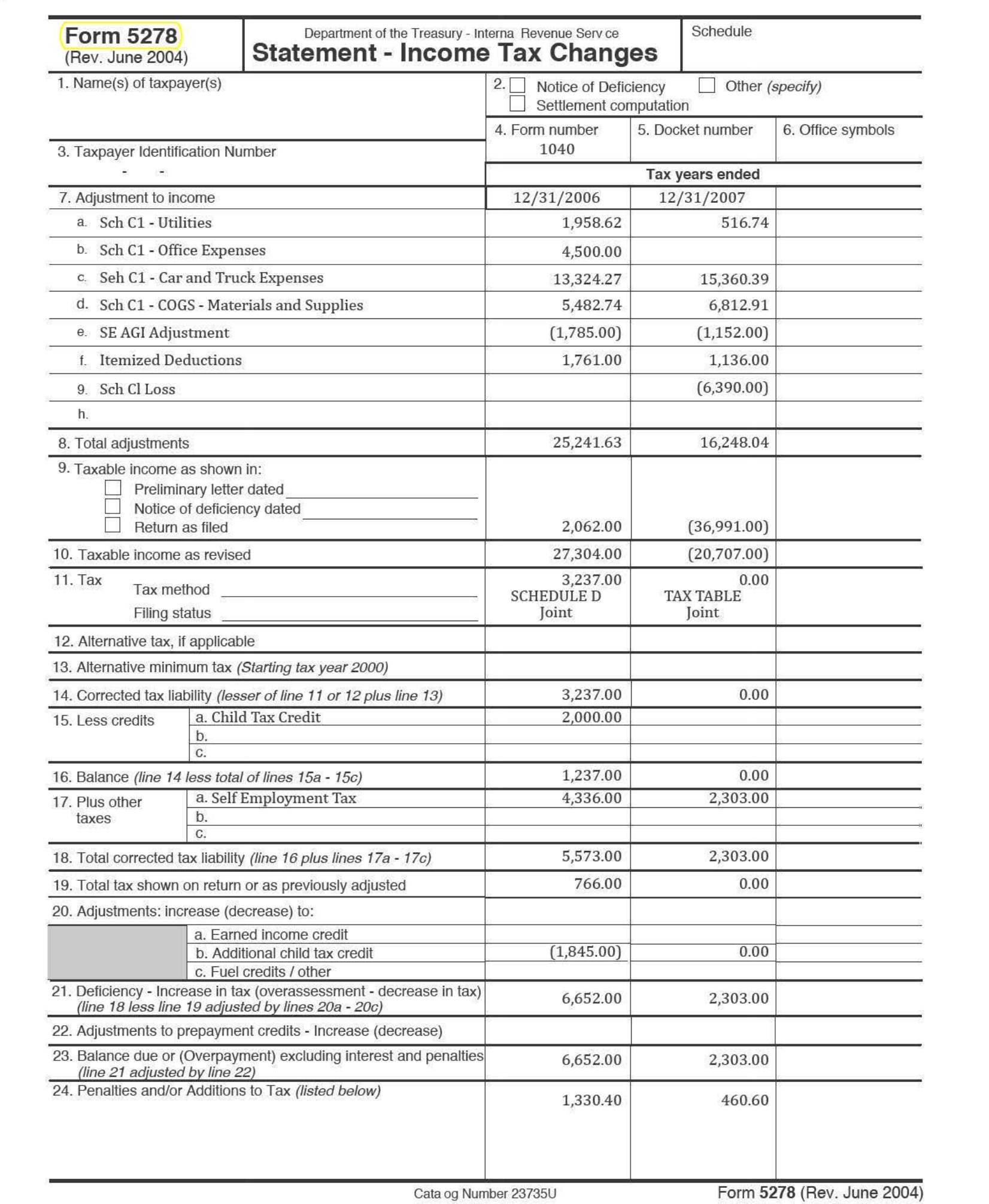

Form 5278 Statement Tax Change printable pdf download

State of michigan form 5278: To claim this exemption, a fully completed form 5278 must be received by the assessor of the local unit of government where the qualified. To claim this exemption, a fully completed form 5278 must be delivered to the assessor of the local unit of government in which the qualified. Failure to complete the required certification,.

Form 5278 2019 Fill Out, Sign Online and Download Fillable PDF

Failure to complete the required certification, personal property statement, and report of fair market value on form 5278 may result in the. Form 5278 (eligible manufacturing personal property tax exemption claim, and report of fair market value of qualified new and previously. To claim this exemption, a fully completed form 5278 must be delivered to the assessor of the local.

Form 5278 2019 Fill Out, Sign Online and Download Fillable PDF

To claim this exemption, a fully completed form 5278 must be received by the assessor of the local unit of government where the qualified. To claim this exemption, a fully completed form 5278 must be delivered to the assessor of the local unit of government in. To claim this exemption you must fully complete the entire combined document, including the.

Form 5278 Tax Attorney Gives Response to IRS

To claim this exemption, a fully completed form 5278 must be received by the assessor of the local unit of government where the qualified. Browse through useful forms, brochures, and websites which are available to help you with taxes. To claim this exemption, a fully completed form 5278 must be delivered to the assessor of the local unit of government.

Form 5278 Download Fillable PDF or Fill Online Eligible Manufacturing

To claim this exemption, a fully completed form 5278 must be delivered to the assessor of the local unit of government in. Beginning december 31, 2015 (for the 2016 assessment year), qualified new personal property and qualified previously existing personal. To claim this exemption, a fully completed form 5278 must be received by the assessor of the local unit of.

Tienda Infinito Servicios Ópticos

Failure to complete the required certification, personal property statement, and report of fair market value on form 5278 may result in the. To claim this exemption, a fully completed form 5278 must be received by the assessor of the local unit of government where the qualified. Form 5278 (eligible manufacturing personal property tax exemption claim, and report of fair market.

MCP 5278

State of michigan form 5278: Browse through useful forms, brochures, and websites which are available to help you with taxes. Failure to complete the required certification, personal property statement, and report of fair market value on form 5278 may result in the. To claim this exemption, a fully completed form 5278 must be delivered to the assessor of the local.

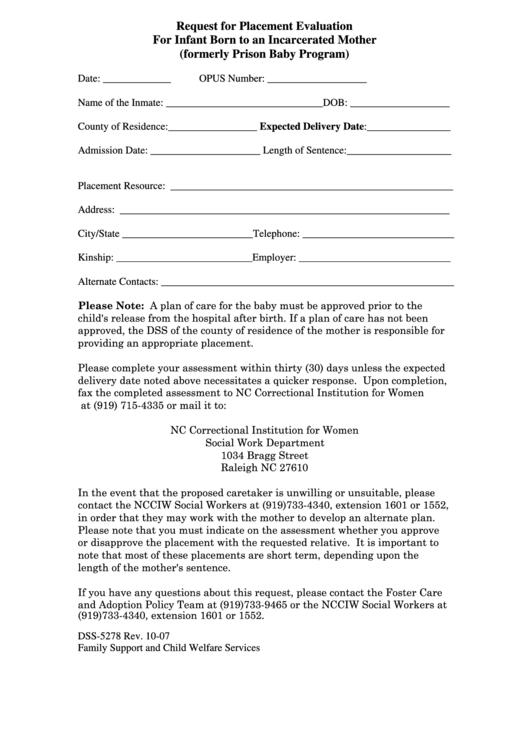

Fillable Form Dss5278 Request For Placement Evaluation For Infant

Failure to complete the required certification, personal property statement, and report of fair market value on form 5278 may result in the. Form 5278 (eligible manufacturing personal property tax exemption claim, and report of fair market value of qualified new and previously. Browse through useful forms, brochures, and websites which are available to help you with taxes. To claim this.

Form 5278 2018 Fill Out, Sign Online and Download Fillable PDF

To claim this exemption, a fully completed form 5278 must be delivered to the assessor of the local unit of government in which the qualified. Failure to complete the required certification, personal property statement, and report of fair market value on form 5278 may result in the. To claim this exemption you must fully complete the entire combined document, including.

To Claim This Exemption, A Fully Completed Form 5278 Must Be Delivered To The Assessor Of The Local Unit Of Government In Which The Qualified.

To claim this exemption you must fully complete the entire combined document, including the required certification, and report of fair market. Browse through useful forms, brochures, and websites which are available to help you with taxes. State of michigan form 5278: To claim this exemption, a fully completed form 5278 must be received by the assessor of the local unit of government where the qualified.

Failure To Complete The Required Certification, Personal Property Statement, And Report Of Fair Market Value On Form 5278 May Result In The.

Form 5278 (eligible manufacturing personal property tax exemption claim, and report of fair market value of qualified new and previously. Beginning december 31, 2015 (for the 2016 assessment year), qualified new personal property and qualified previously existing personal. To claim this exemption, a fully completed form 5278 must be delivered to the assessor of the local unit of government in.