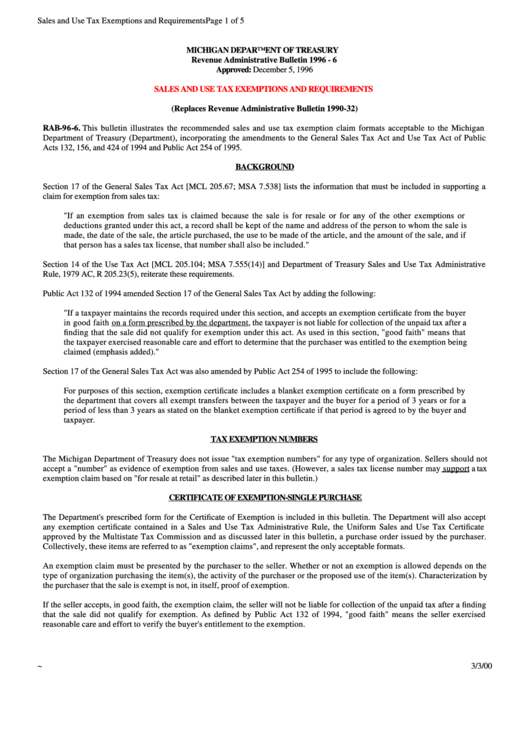

Michigan Tax Exempt Form - Purchasers may use this form to claim exemption from michigan sales and use tax on qualified transactions. All fields must be completed; It is the purchaser’s responsibility to ensure the eligibility of the exemption being. However, if provided to the purchaser in. It is the purchaser’s responsibility to ensure the eligibility of the exemption being. The customer must provide to the seller a completed form 3372, michigan sales and use tax certificate of exemption, or the required information in another acceptable format. Purchasers may use this form to claim exemption from michigan sales and use tax on qualied transactions. Currently, there is no computation, validation, or verification of the information you enter, and you are still. Purchasers may use this form to claim exemption from michigan sales and use tax on qualifi ed transactions.

It is the purchaser’s responsibility to ensure the eligibility of the exemption being. Purchasers may use this form to claim exemption from michigan sales and use tax on qualifi ed transactions. Purchasers may use this form to claim exemption from michigan sales and use tax on qualied transactions. Purchasers may use this form to claim exemption from michigan sales and use tax on qualified transactions. The customer must provide to the seller a completed form 3372, michigan sales and use tax certificate of exemption, or the required information in another acceptable format. All fields must be completed; It is the purchaser’s responsibility to ensure the eligibility of the exemption being. However, if provided to the purchaser in. Currently, there is no computation, validation, or verification of the information you enter, and you are still.

Purchasers may use this form to claim exemption from michigan sales and use tax on qualied transactions. Purchasers may use this form to claim exemption from michigan sales and use tax on qualifi ed transactions. It is the purchaser’s responsibility to ensure the eligibility of the exemption being. However, if provided to the purchaser in. The customer must provide to the seller a completed form 3372, michigan sales and use tax certificate of exemption, or the required information in another acceptable format. Currently, there is no computation, validation, or verification of the information you enter, and you are still. All fields must be completed; It is the purchaser’s responsibility to ensure the eligibility of the exemption being. Purchasers may use this form to claim exemption from michigan sales and use tax on qualified transactions.

Printable Michigan Sales Tax Exemption Certificates

Currently, there is no computation, validation, or verification of the information you enter, and you are still. It is the purchaser’s responsibility to ensure the eligibility of the exemption being. All fields must be completed; Purchasers may use this form to claim exemption from michigan sales and use tax on qualified transactions. It is the purchaser’s responsibility to ensure the.

Michigan Sales And Use Tax Certificate Of Exemption printable pdf download

The customer must provide to the seller a completed form 3372, michigan sales and use tax certificate of exemption, or the required information in another acceptable format. Purchasers may use this form to claim exemption from michigan sales and use tax on qualied transactions. Currently, there is no computation, validation, or verification of the information you enter, and you are.

Michigan Tax Exempt Form 2024 Orsa Trenna

Currently, there is no computation, validation, or verification of the information you enter, and you are still. The customer must provide to the seller a completed form 3372, michigan sales and use tax certificate of exemption, or the required information in another acceptable format. However, if provided to the purchaser in. Purchasers may use this form to claim exemption from.

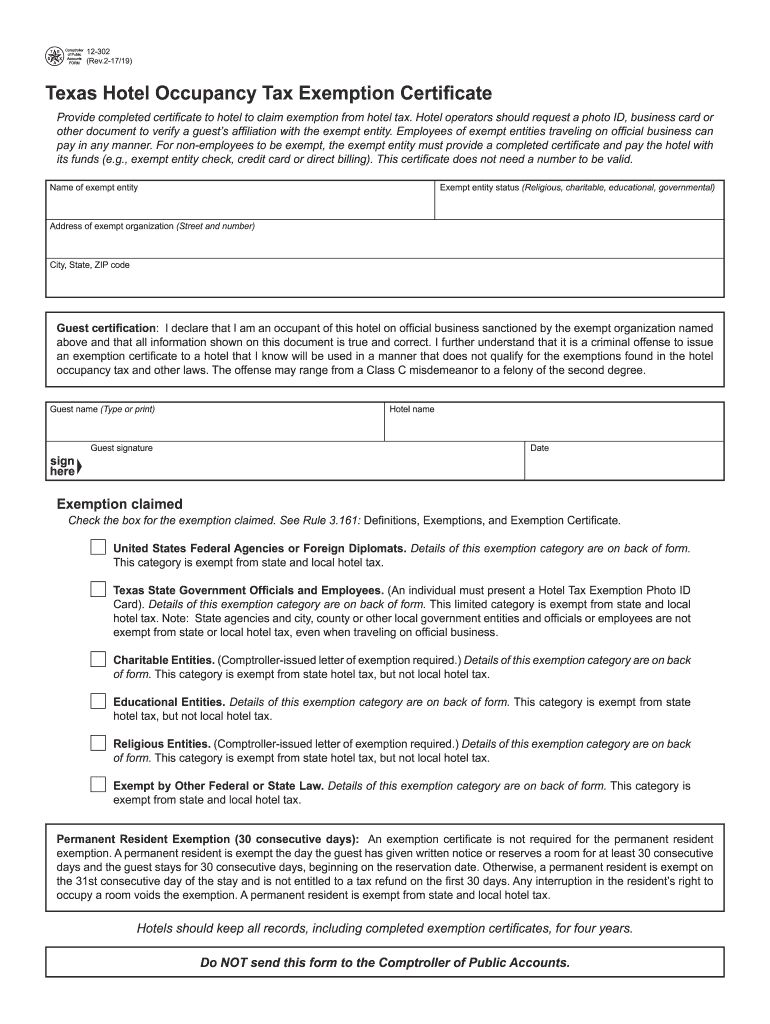

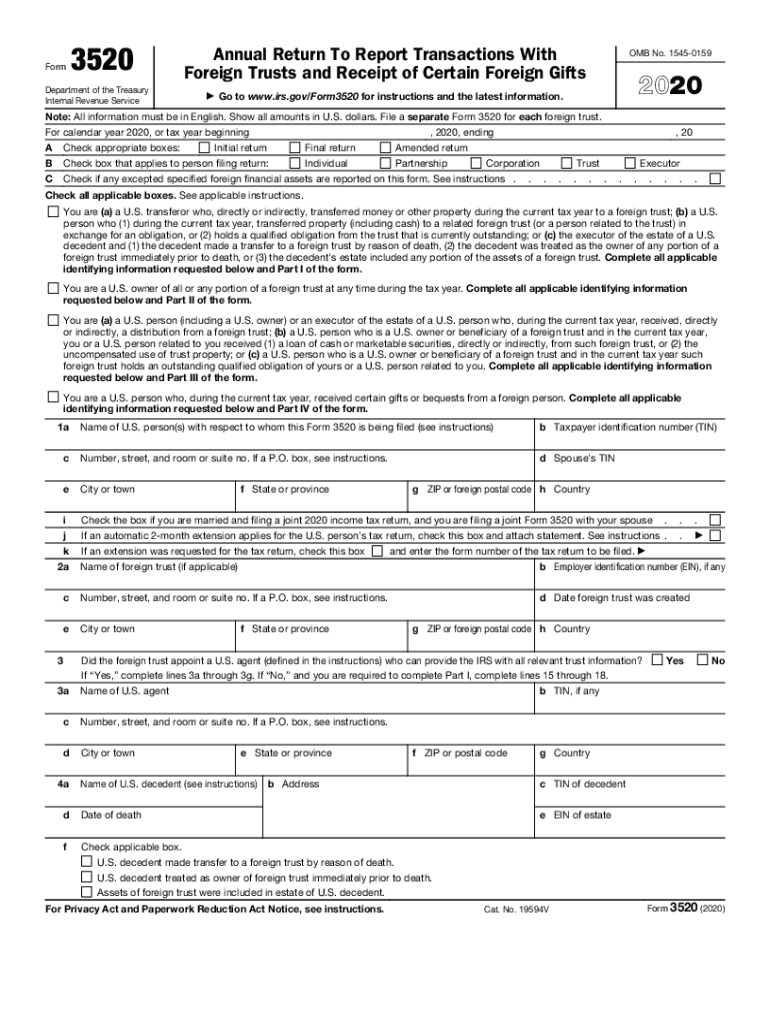

Michigan Tax Exempt Form 3520

All fields must be completed; The customer must provide to the seller a completed form 3372, michigan sales and use tax certificate of exemption, or the required information in another acceptable format. However, if provided to the purchaser in. Purchasers may use this form to claim exemption from michigan sales and use tax on qualied transactions. Currently, there is no.

Michigan Tax Exempt Form Spring Meadow Nursery

All fields must be completed; Purchasers may use this form to claim exemption from michigan sales and use tax on qualifi ed transactions. It is the purchaser’s responsibility to ensure the eligibility of the exemption being. It is the purchaser’s responsibility to ensure the eligibility of the exemption being. However, if provided to the purchaser in.

How To Fill Out A Michigan Sales Tax Exemption Form

All fields must be completed; Purchasers may use this form to claim exemption from michigan sales and use tax on qualied transactions. The customer must provide to the seller a completed form 3372, michigan sales and use tax certificate of exemption, or the required information in another acceptable format. It is the purchaser’s responsibility to ensure the eligibility of the.

State Of Michigan Tax Exempt Form 2024 Fredia Susanne

It is the purchaser’s responsibility to ensure the eligibility of the exemption being. Purchasers may use this form to claim exemption from michigan sales and use tax on qualifi ed transactions. Purchasers may use this form to claim exemption from michigan sales and use tax on qualified transactions. The customer must provide to the seller a completed form 3372, michigan.

Tax Exempt Form Michigan 2024 Vivi Alvinia

Currently, there is no computation, validation, or verification of the information you enter, and you are still. All fields must be completed; Purchasers may use this form to claim exemption from michigan sales and use tax on qualifi ed transactions. The customer must provide to the seller a completed form 3372, michigan sales and use tax certificate of exemption, or.

State Of Michigan Tax Exempt Form 2024 Wynn Amelina

Purchasers may use this form to claim exemption from michigan sales and use tax on qualified transactions. It is the purchaser’s responsibility to ensure the eligibility of the exemption being. Purchasers may use this form to claim exemption from michigan sales and use tax on qualifi ed transactions. Purchasers may use this form to claim exemption from michigan sales and.

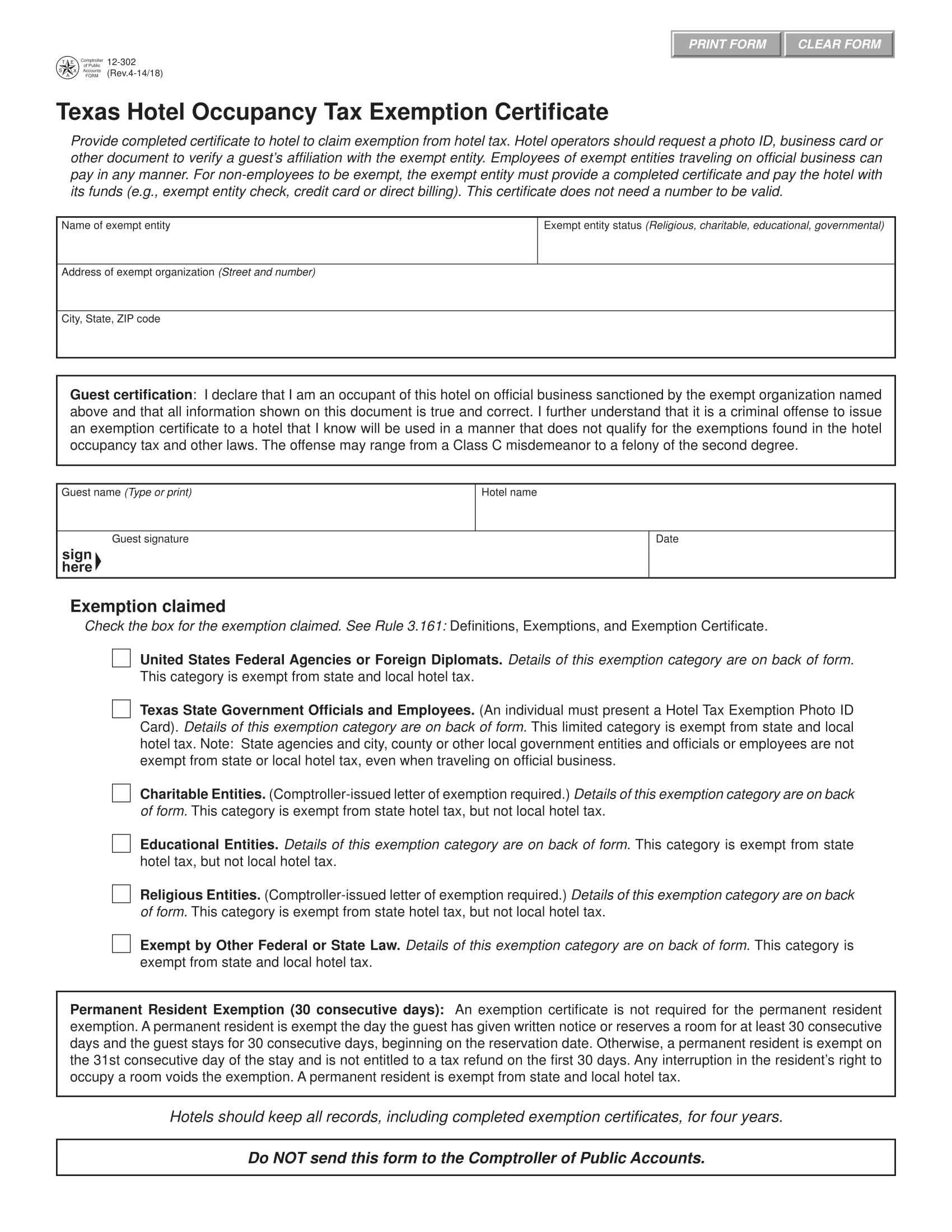

Tax Exempt Form Michigan 2024 Vivi Alvinia

However, if provided to the purchaser in. Purchasers may use this form to claim exemption from michigan sales and use tax on qualied transactions. All fields must be completed; Purchasers may use this form to claim exemption from michigan sales and use tax on qualifi ed transactions. The customer must provide to the seller a completed form 3372, michigan sales.

All Fields Must Be Completed;

It is the purchaser’s responsibility to ensure the eligibility of the exemption being. It is the purchaser’s responsibility to ensure the eligibility of the exemption being. However, if provided to the purchaser in. The customer must provide to the seller a completed form 3372, michigan sales and use tax certificate of exemption, or the required information in another acceptable format.

Purchasers May Use This Form To Claim Exemption From Michigan Sales And Use Tax On Qualied Transactions.

Purchasers may use this form to claim exemption from michigan sales and use tax on qualifi ed transactions. Currently, there is no computation, validation, or verification of the information you enter, and you are still. Purchasers may use this form to claim exemption from michigan sales and use tax on qualified transactions.