Nebraska Inheritance Tax Worksheet - Nebraska law requires the petitioner in a proceeding to determine inheritance tax to submit a report to the county treasurer of the county in which the order determining. Nebraska law requires the the personal representative of an estate to submit a report summarizing inheritance taxes by class of beneficiary upon the distribution of any. This excel file assists lawyers with calculating inheritance tax. Distribution of proceeds from estate; Nebraska imposes an inheritance tax on a beneficiary’s right to receive property from a deceased individual (a “decedent”). With certain exceptions discussed below,. Last updated on september 21, 2023

Last updated on september 21, 2023 This excel file assists lawyers with calculating inheritance tax. Distribution of proceeds from estate; Nebraska law requires the petitioner in a proceeding to determine inheritance tax to submit a report to the county treasurer of the county in which the order determining. With certain exceptions discussed below,. Nebraska law requires the the personal representative of an estate to submit a report summarizing inheritance taxes by class of beneficiary upon the distribution of any. Nebraska imposes an inheritance tax on a beneficiary’s right to receive property from a deceased individual (a “decedent”).

Nebraska imposes an inheritance tax on a beneficiary’s right to receive property from a deceased individual (a “decedent”). Last updated on september 21, 2023 Distribution of proceeds from estate; With certain exceptions discussed below,. This excel file assists lawyers with calculating inheritance tax. Nebraska law requires the the personal representative of an estate to submit a report summarizing inheritance taxes by class of beneficiary upon the distribution of any. Nebraska law requires the petitioner in a proceeding to determine inheritance tax to submit a report to the county treasurer of the county in which the order determining.

PSV05 Creating the Tax Worksheet Worksheets Library

Last updated on september 21, 2023 Distribution of proceeds from estate; Nebraska law requires the the personal representative of an estate to submit a report summarizing inheritance taxes by class of beneficiary upon the distribution of any. Nebraska law requires the petitioner in a proceeding to determine inheritance tax to submit a report to the county treasurer of the county.

Nebraska Inheritance Tax Worksheet

Nebraska imposes an inheritance tax on a beneficiary’s right to receive property from a deceased individual (a “decedent”). Last updated on september 21, 2023 Distribution of proceeds from estate; With certain exceptions discussed below,. Nebraska law requires the the personal representative of an estate to submit a report summarizing inheritance taxes by class of beneficiary upon the distribution of any.

Nebraska Inheritance Tax Worksheet Manual

Nebraska law requires the the personal representative of an estate to submit a report summarizing inheritance taxes by class of beneficiary upon the distribution of any. Last updated on september 21, 2023 Distribution of proceeds from estate; With certain exceptions discussed below,. Nebraska law requires the petitioner in a proceeding to determine inheritance tax to submit a report to the.

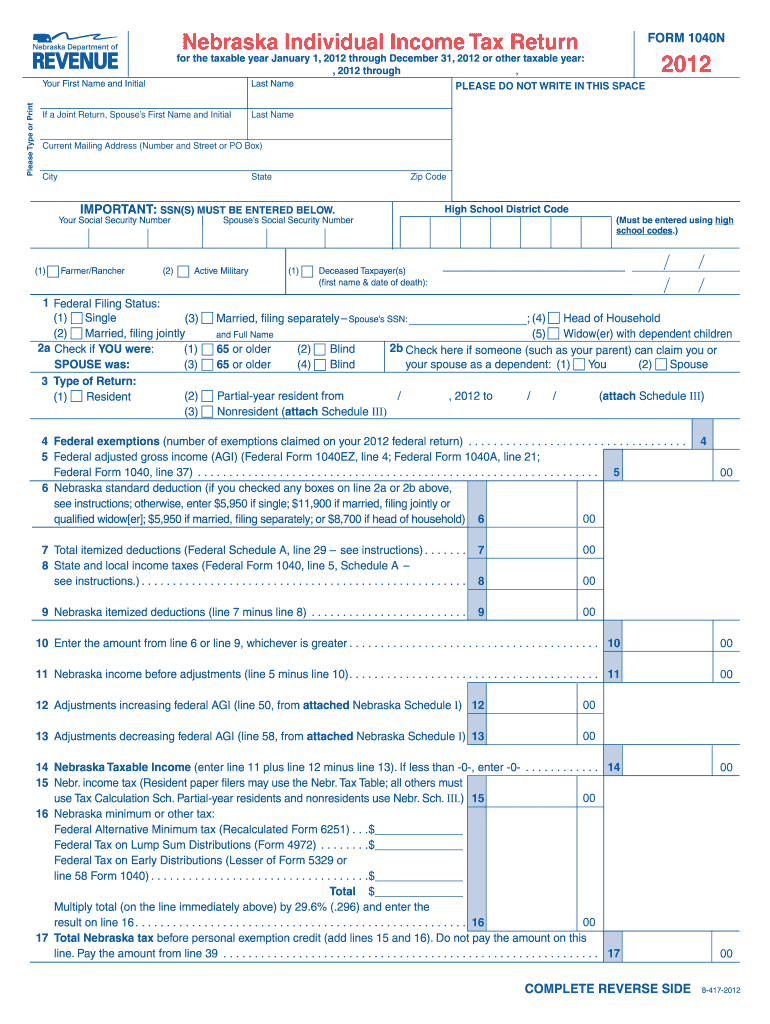

20222024 Form NE DoR 20 Fill Online, Printable, Fillable, Blank

Nebraska law requires the the personal representative of an estate to submit a report summarizing inheritance taxes by class of beneficiary upon the distribution of any. Distribution of proceeds from estate; Last updated on september 21, 2023 Nebraska law requires the petitioner in a proceeding to determine inheritance tax to submit a report to the county treasurer of the county.

Nebraska Inheritance Tax Worksheet 2021

Distribution of proceeds from estate; Last updated on september 21, 2023 This excel file assists lawyers with calculating inheritance tax. Nebraska law requires the the personal representative of an estate to submit a report summarizing inheritance taxes by class of beneficiary upon the distribution of any. Nebraska law requires the petitioner in a proceeding to determine inheritance tax to submit.

Nebraska Inheritance Tax Worksheet 2023

This excel file assists lawyers with calculating inheritance tax. Nebraska imposes an inheritance tax on a beneficiary’s right to receive property from a deceased individual (a “decedent”). Nebraska law requires the the personal representative of an estate to submit a report summarizing inheritance taxes by class of beneficiary upon the distribution of any. Distribution of proceeds from estate; Nebraska law.

Death and Taxes Nebraskas Inheritance Tax Worksheets Library

Nebraska law requires the the personal representative of an estate to submit a report summarizing inheritance taxes by class of beneficiary upon the distribution of any. This excel file assists lawyers with calculating inheritance tax. Nebraska imposes an inheritance tax on a beneficiary’s right to receive property from a deceased individual (a “decedent”). Last updated on september 21, 2023 Distribution.

Death and Taxes Nebraskas Inheritance Tax Worksheets Library

With certain exceptions discussed below,. Nebraska imposes an inheritance tax on a beneficiary’s right to receive property from a deceased individual (a “decedent”). Last updated on september 21, 2023 Distribution of proceeds from estate; This excel file assists lawyers with calculating inheritance tax.

Nebraska Inheritance Tax Worksheet Form 500

Nebraska law requires the the personal representative of an estate to submit a report summarizing inheritance taxes by class of beneficiary upon the distribution of any. With certain exceptions discussed below,. Nebraska imposes an inheritance tax on a beneficiary’s right to receive property from a deceased individual (a “decedent”). Distribution of proceeds from estate; Nebraska law requires the petitioner in.

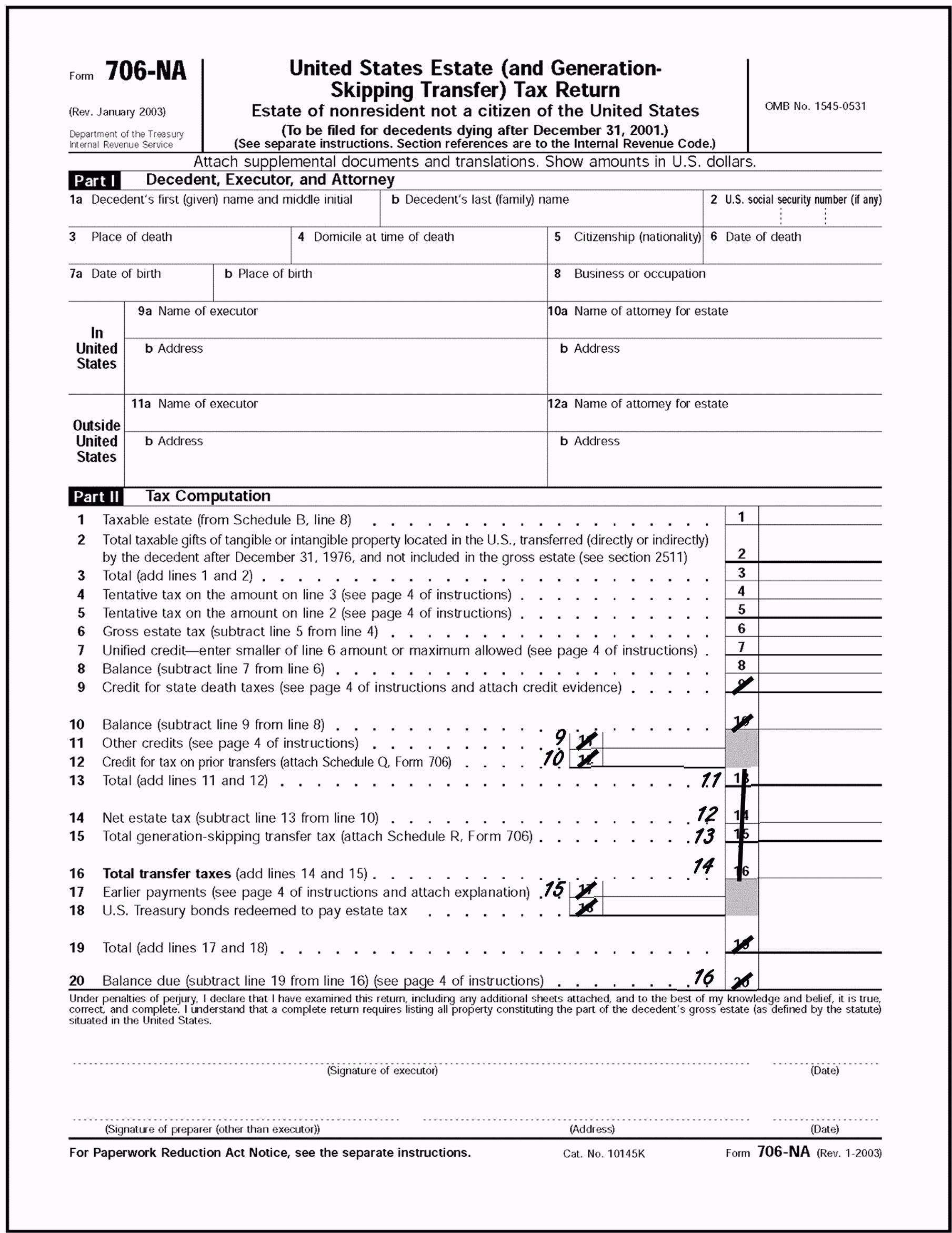

Nebraska Inheritance Tax Return

With certain exceptions discussed below,. Nebraska imposes an inheritance tax on a beneficiary’s right to receive property from a deceased individual (a “decedent”). Distribution of proceeds from estate; Nebraska law requires the the personal representative of an estate to submit a report summarizing inheritance taxes by class of beneficiary upon the distribution of any. Last updated on september 21, 2023

Distribution Of Proceeds From Estate;

Nebraska law requires the the personal representative of an estate to submit a report summarizing inheritance taxes by class of beneficiary upon the distribution of any. This excel file assists lawyers with calculating inheritance tax. Nebraska law requires the petitioner in a proceeding to determine inheritance tax to submit a report to the county treasurer of the county in which the order determining. Nebraska imposes an inheritance tax on a beneficiary’s right to receive property from a deceased individual (a “decedent”).

Last Updated On September 21, 2023

With certain exceptions discussed below,.