Ny State Solar Tax Credit Form - The new york solar tax credit can reduce your state tax bill by 25%, up to. New york solar energy system equipment credit. The credit is equal to 25% of your qualified solar energy system equipment expenditures and is limited to $5,000. The credit is allowed for certain solar energy system.

The credit is equal to 25% of your qualified solar energy system equipment expenditures and is limited to $5,000. The credit is allowed for certain solar energy system. New york solar energy system equipment credit. The new york solar tax credit can reduce your state tax bill by 25%, up to.

The credit is allowed for certain solar energy system. New york solar energy system equipment credit. The new york solar tax credit can reduce your state tax bill by 25%, up to. The credit is equal to 25% of your qualified solar energy system equipment expenditures and is limited to $5,000.

Filing For The Solar Tax Credit Wells Solar

The credit is equal to 25% of your qualified solar energy system equipment expenditures and is limited to $5,000. The credit is allowed for certain solar energy system. New york solar energy system equipment credit. The new york solar tax credit can reduce your state tax bill by 25%, up to.

Federal Solar Tax Credit » Certasun

New york solar energy system equipment credit. The credit is allowed for certain solar energy system. The credit is equal to 25% of your qualified solar energy system equipment expenditures and is limited to $5,000. The new york solar tax credit can reduce your state tax bill by 25%, up to.

Solar Tax Credit A Guide for Residential Solar Energy Incentives

The new york solar tax credit can reduce your state tax bill by 25%, up to. The credit is allowed for certain solar energy system. New york solar energy system equipment credit. The credit is equal to 25% of your qualified solar energy system equipment expenditures and is limited to $5,000.

New York State Solar Tax Credit 2020 Harvest Power Solar

The credit is equal to 25% of your qualified solar energy system equipment expenditures and is limited to $5,000. The new york solar tax credit can reduce your state tax bill by 25%, up to. The credit is allowed for certain solar energy system. New york solar energy system equipment credit.

New York State Solar Tax Credit Guide Brooklyn SolarWorks

The new york solar tax credit can reduce your state tax bill by 25%, up to. New york solar energy system equipment credit. The credit is allowed for certain solar energy system. The credit is equal to 25% of your qualified solar energy system equipment expenditures and is limited to $5,000.

Federal Solar Tax Credit Ecohouse Solar, LLC

New york solar energy system equipment credit. The new york solar tax credit can reduce your state tax bill by 25%, up to. The credit is allowed for certain solar energy system. The credit is equal to 25% of your qualified solar energy system equipment expenditures and is limited to $5,000.

Solar Tax Credit A Guide for Residential Solar Energy Incentives

The credit is equal to 25% of your qualified solar energy system equipment expenditures and is limited to $5,000. New york solar energy system equipment credit. The credit is allowed for certain solar energy system. The new york solar tax credit can reduce your state tax bill by 25%, up to.

Solar Tax Credit

The credit is equal to 25% of your qualified solar energy system equipment expenditures and is limited to $5,000. The credit is allowed for certain solar energy system. The new york solar tax credit can reduce your state tax bill by 25%, up to. New york solar energy system equipment credit.

Fillable Online Ny School Tax Credit Form. Ny School Tax Credit Form

The new york solar tax credit can reduce your state tax bill by 25%, up to. The credit is equal to 25% of your qualified solar energy system equipment expenditures and is limited to $5,000. The credit is allowed for certain solar energy system. New york solar energy system equipment credit.

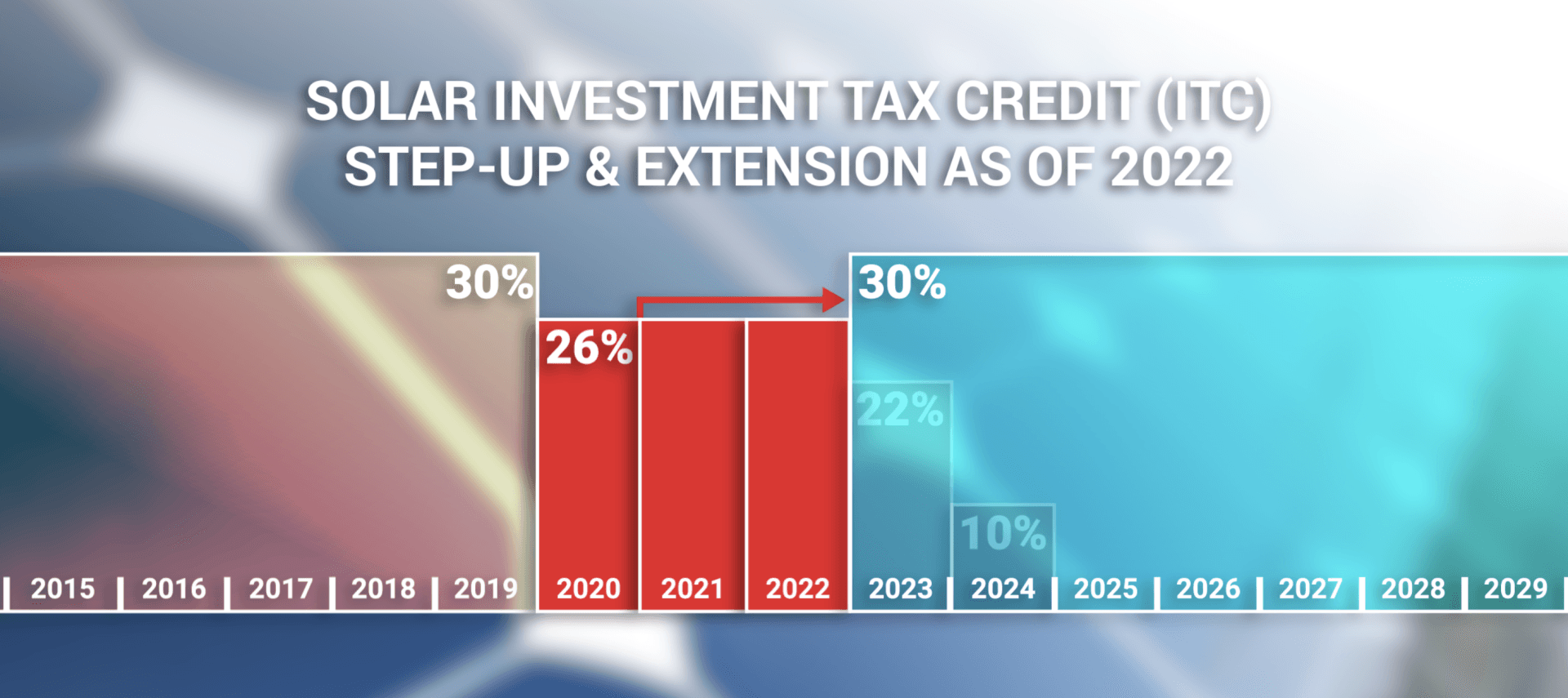

Federal Solar Tax Credit Take 30 Off Your Solar Cost

The credit is equal to 25% of your qualified solar energy system equipment expenditures and is limited to $5,000. The new york solar tax credit can reduce your state tax bill by 25%, up to. The credit is allowed for certain solar energy system. New york solar energy system equipment credit.

New York Solar Energy System Equipment Credit.

The new york solar tax credit can reduce your state tax bill by 25%, up to. The credit is allowed for certain solar energy system. The credit is equal to 25% of your qualified solar energy system equipment expenditures and is limited to $5,000.