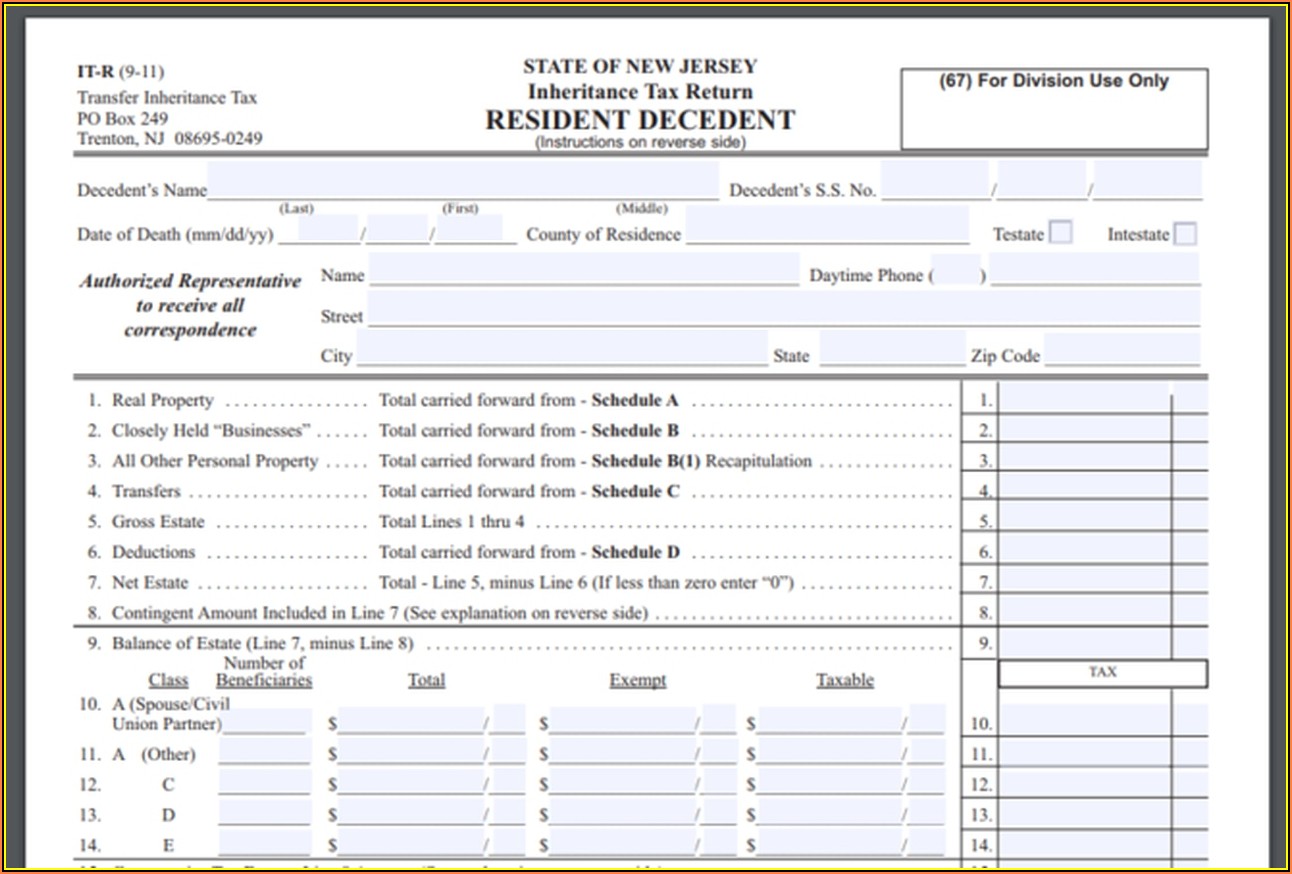

Ohio Inheritance Tax Waiver Form - Changes to the estate tax filing requirements are in effect. The ohio department of taxation (the department) no longer requires a tax release or a tax waiver form (et 12/13/14) before certain. Please direct 12 and 14 to the county. The ohio department of taxation (the department) no longer requires a tax release or inheritance tax waiver form (et 12/13/14). Please note that the local court. To obtain a release, take the completed estate tax forms from date of death to date of actual transfer. To obtain a release, take the completed estate tax forms from date of death to date of actual transfer. Please direct 12 and 14 to the county. Although these forms are provided by the supreme court of ohio, they should be filed in the local county court. Ohio estate tax returns and tax release/inheritance tax waivers are.

To obtain a release, take the completed estate tax forms from date of death to date of actual transfer. Please direct 12 and 14 to the county. Although these forms are provided by the supreme court of ohio, they should be filed in the local county court. Ohio estate tax returns and tax release/inheritance tax waivers are. To obtain a release, take the completed estate tax forms from date of death to date of actual transfer. Please note that the local court. The ohio department of taxation (the department) no longer requires a tax release or a tax waiver form (et 12/13/14) before certain. The ohio department of taxation (the department) no longer requires a tax release or inheritance tax waiver form (et 12/13/14). Changes to the estate tax filing requirements are in effect. Please direct 12 and 14 to the county.

The ohio department of taxation (the department) no longer requires a tax release or a tax waiver form (et 12/13/14) before certain. To obtain a release, take the completed estate tax forms from date of death to date of actual transfer. Ohio estate tax returns and tax release/inheritance tax waivers are. To obtain a release, take the completed estate tax forms from date of death to date of actual transfer. Please note that the local court. Although these forms are provided by the supreme court of ohio, they should be filed in the local county court. Changes to the estate tax filing requirements are in effect. The ohio department of taxation (the department) no longer requires a tax release or inheritance tax waiver form (et 12/13/14). Please direct 12 and 14 to the county. Please direct 12 and 14 to the county.

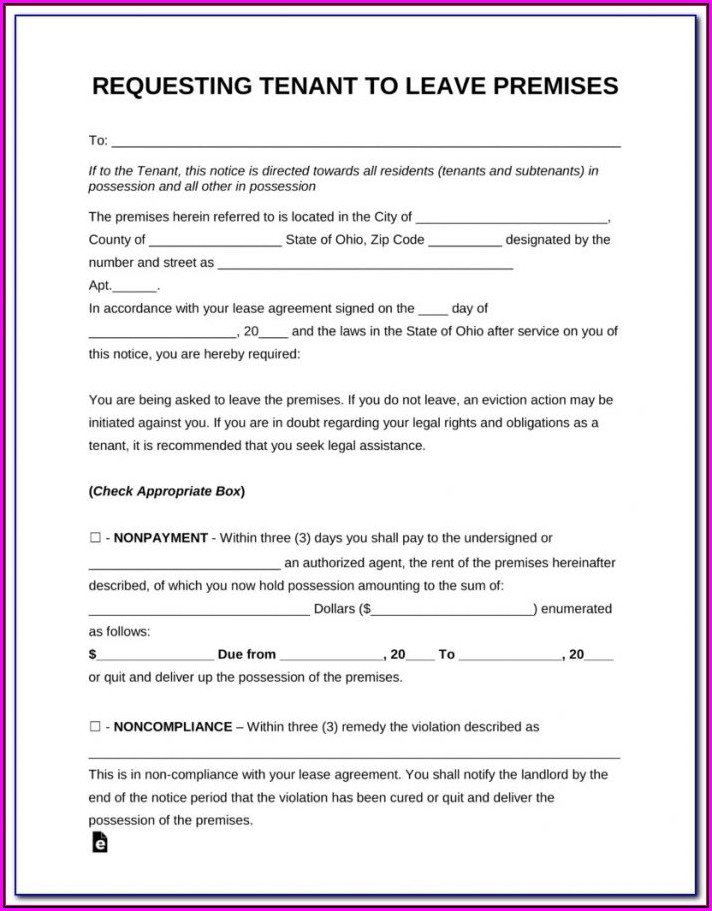

Illinois Inheritance Tax Waiver Form Form Resume Examples v19xN16AV7

Please direct 12 and 14 to the county. The ohio department of taxation (the department) no longer requires a tax release or a tax waiver form (et 12/13/14) before certain. Changes to the estate tax filing requirements are in effect. To obtain a release, take the completed estate tax forms from date of death to date of actual transfer. To.

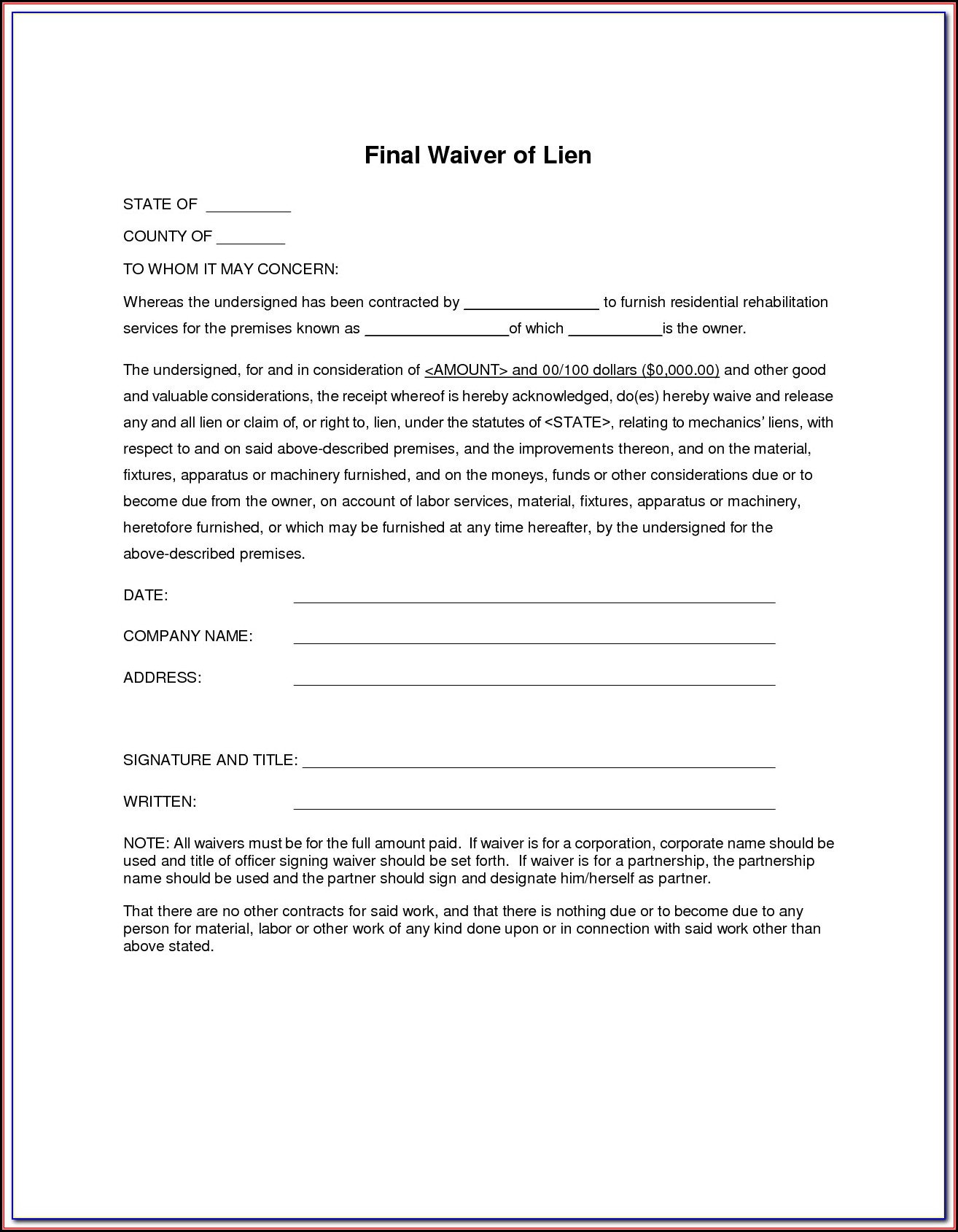

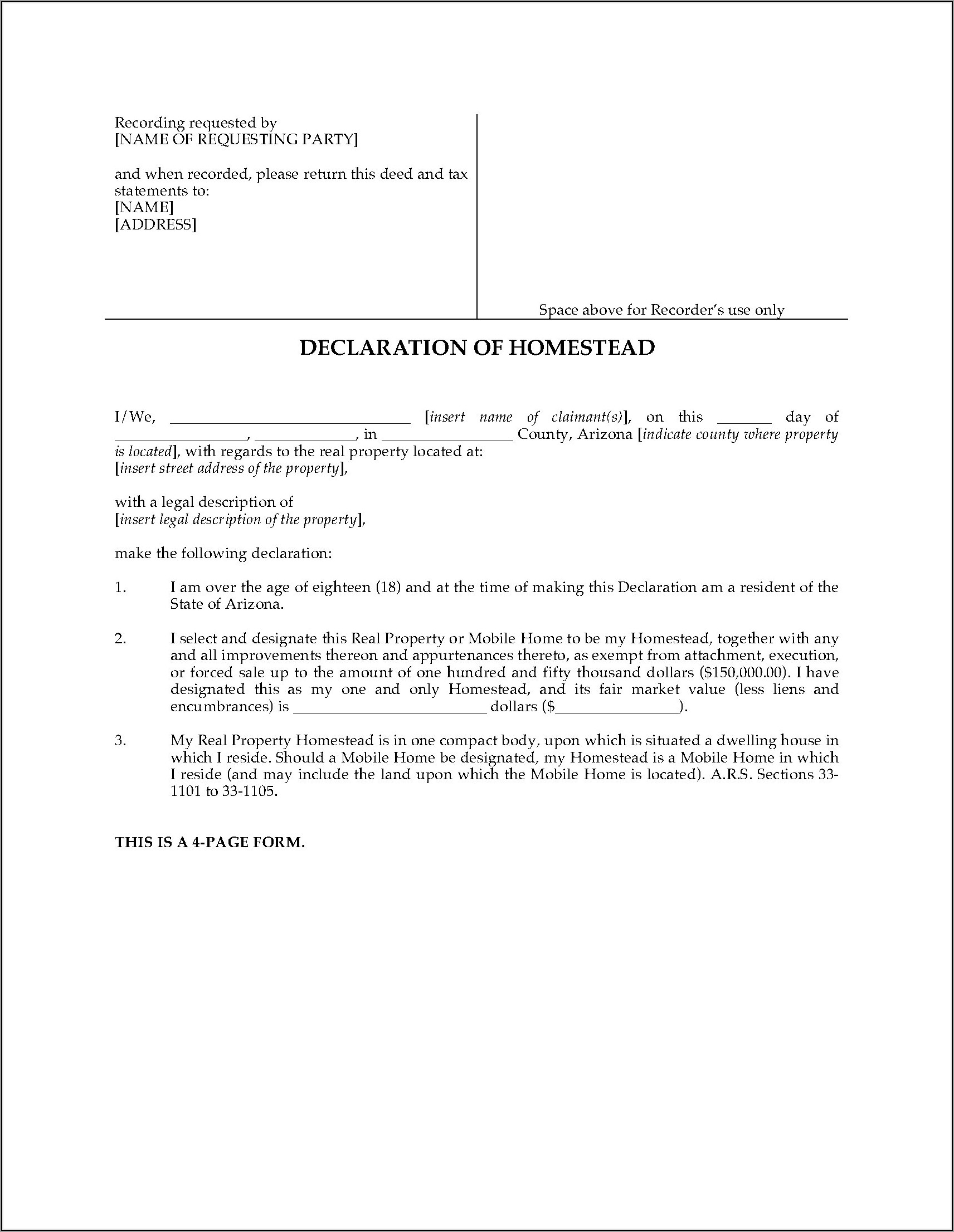

Waiver of Inheritance PDF Inheritance Notary Public

To obtain a release, take the completed estate tax forms from date of death to date of actual transfer. Please direct 12 and 14 to the county. Changes to the estate tax filing requirements are in effect. The ohio department of taxation (the department) no longer requires a tax release or inheritance tax waiver form (et 12/13/14). Although these forms.

Inheritance Tax Waiver Form Ohio Form Resume Examples v19xB3bV7E

Please direct 12 and 14 to the county. Please note that the local court. Changes to the estate tax filing requirements are in effect. To obtain a release, take the completed estate tax forms from date of death to date of actual transfer. Please direct 12 and 14 to the county.

Inheritance Tax Waiver Form Ohio Form Resume Examples v19xB3bV7E

Ohio estate tax returns and tax release/inheritance tax waivers are. Changes to the estate tax filing requirements are in effect. The ohio department of taxation (the department) no longer requires a tax release or inheritance tax waiver form (et 12/13/14). Please note that the local court. To obtain a release, take the completed estate tax forms from date of death.

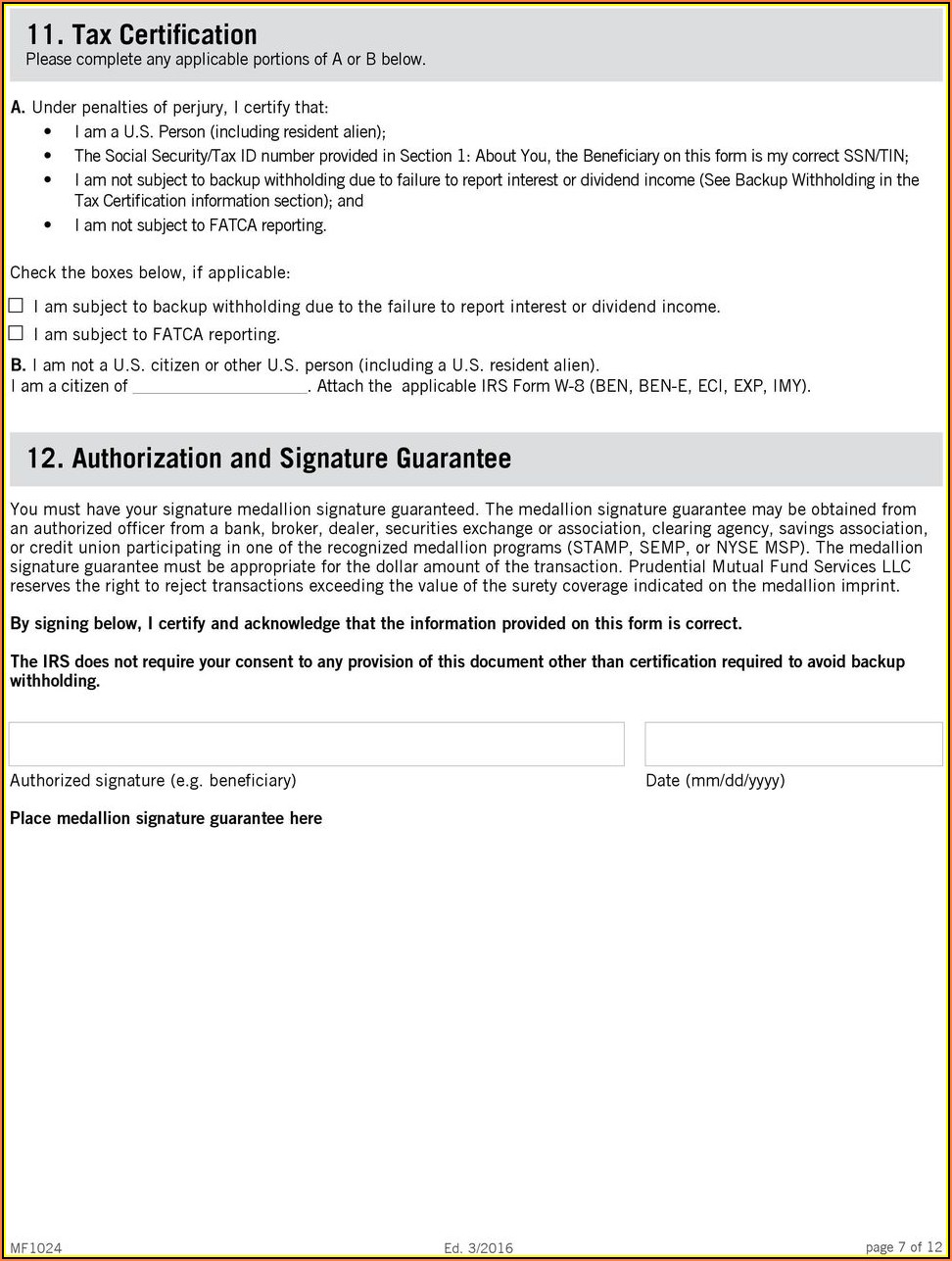

Fillable Online Ohio Inheritance Tax Waiver Form. Ohio Inheritance Tax

Although these forms are provided by the supreme court of ohio, they should be filed in the local county court. Please direct 12 and 14 to the county. The ohio department of taxation (the department) no longer requires a tax release or a tax waiver form (et 12/13/14) before certain. To obtain a release, take the completed estate tax forms.

Inheritance Tax Waiver Form Ohio Form Resume Examples v19xB3bV7E

To obtain a release, take the completed estate tax forms from date of death to date of actual transfer. The ohio department of taxation (the department) no longer requires a tax release or a tax waiver form (et 12/13/14) before certain. Although these forms are provided by the supreme court of ohio, they should be filed in the local county.

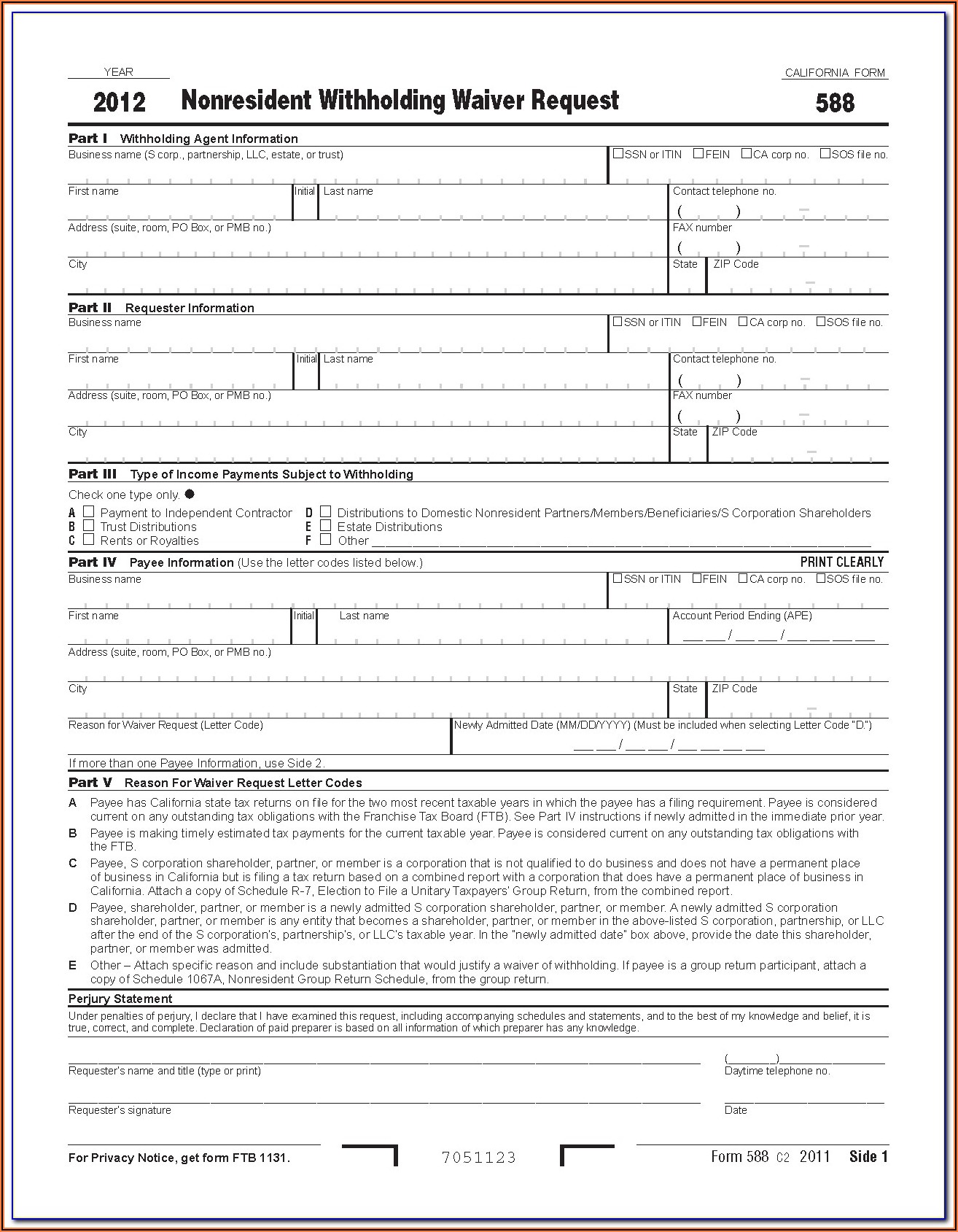

Inheritance Tax Waiver Form California Form Resume Examples Mj1vGyBKwy

The ohio department of taxation (the department) no longer requires a tax release or a tax waiver form (et 12/13/14) before certain. Ohio estate tax returns and tax release/inheritance tax waivers are. The ohio department of taxation (the department) no longer requires a tax release or inheritance tax waiver form (et 12/13/14). Please direct 12 and 14 to the county..

Inheritance Tax Waiver Form Ohio Form Resume Examples v19xB3bV7E

To obtain a release, take the completed estate tax forms from date of death to date of actual transfer. Please direct 12 and 14 to the county. The ohio department of taxation (the department) no longer requires a tax release or a tax waiver form (et 12/13/14) before certain. Please note that the local court. The ohio department of taxation.

Inheritance Tax Waiver Form Ohio Form Resume Examples v19xB3bV7E

Ohio estate tax returns and tax release/inheritance tax waivers are. Changes to the estate tax filing requirements are in effect. The ohio department of taxation (the department) no longer requires a tax release or a tax waiver form (et 12/13/14) before certain. The ohio department of taxation (the department) no longer requires a tax release or inheritance tax waiver form.

Inheritance Tax Waiver Form California Form Resume Examples 3q9JWRvYAr

Changes to the estate tax filing requirements are in effect. Although these forms are provided by the supreme court of ohio, they should be filed in the local county court. Ohio estate tax returns and tax release/inheritance tax waivers are. Please direct 12 and 14 to the county. Please direct 12 and 14 to the county.

Changes To The Estate Tax Filing Requirements Are In Effect.

To obtain a release, take the completed estate tax forms from date of death to date of actual transfer. Although these forms are provided by the supreme court of ohio, they should be filed in the local county court. The ohio department of taxation (the department) no longer requires a tax release or inheritance tax waiver form (et 12/13/14). To obtain a release, take the completed estate tax forms from date of death to date of actual transfer.

Please Direct 12 And 14 To The County.

Please note that the local court. Please direct 12 and 14 to the county. The ohio department of taxation (the department) no longer requires a tax release or a tax waiver form (et 12/13/14) before certain. Ohio estate tax returns and tax release/inheritance tax waivers are.