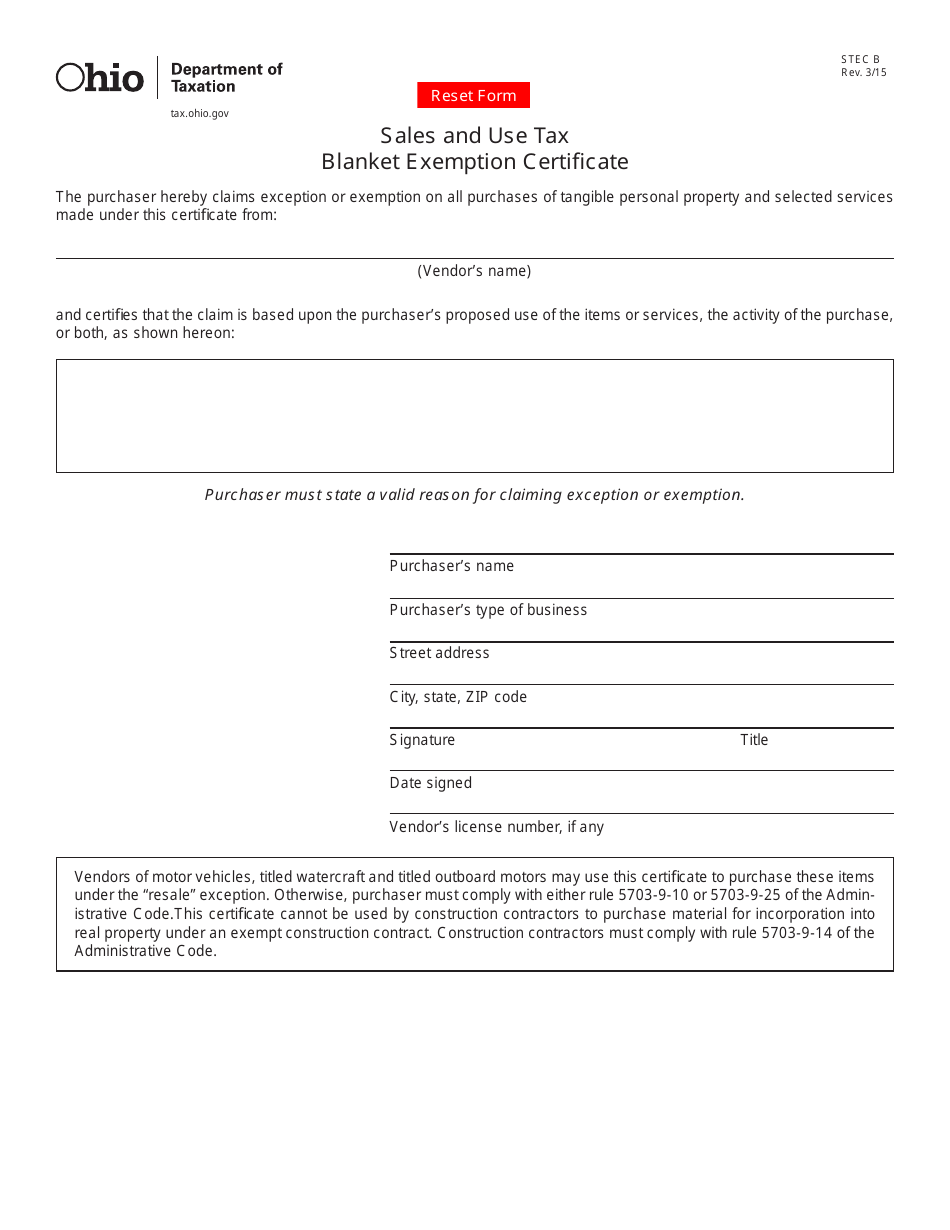

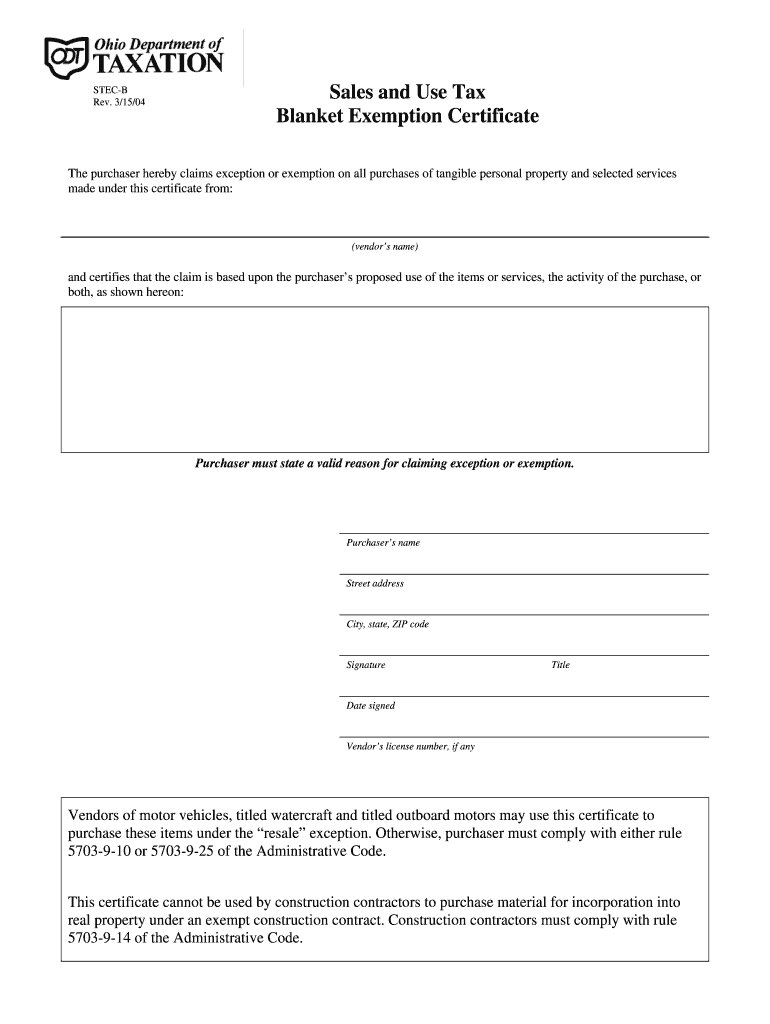

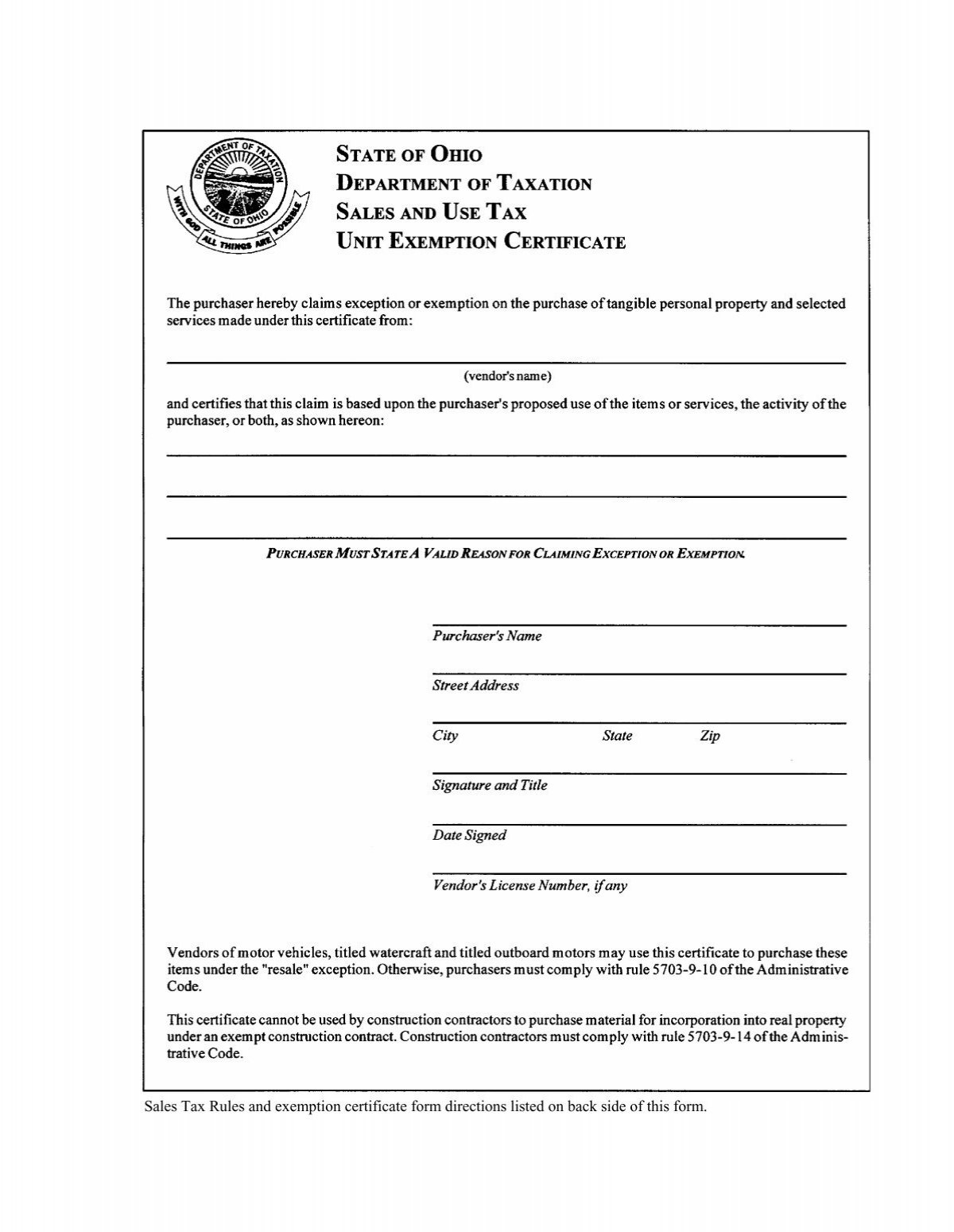

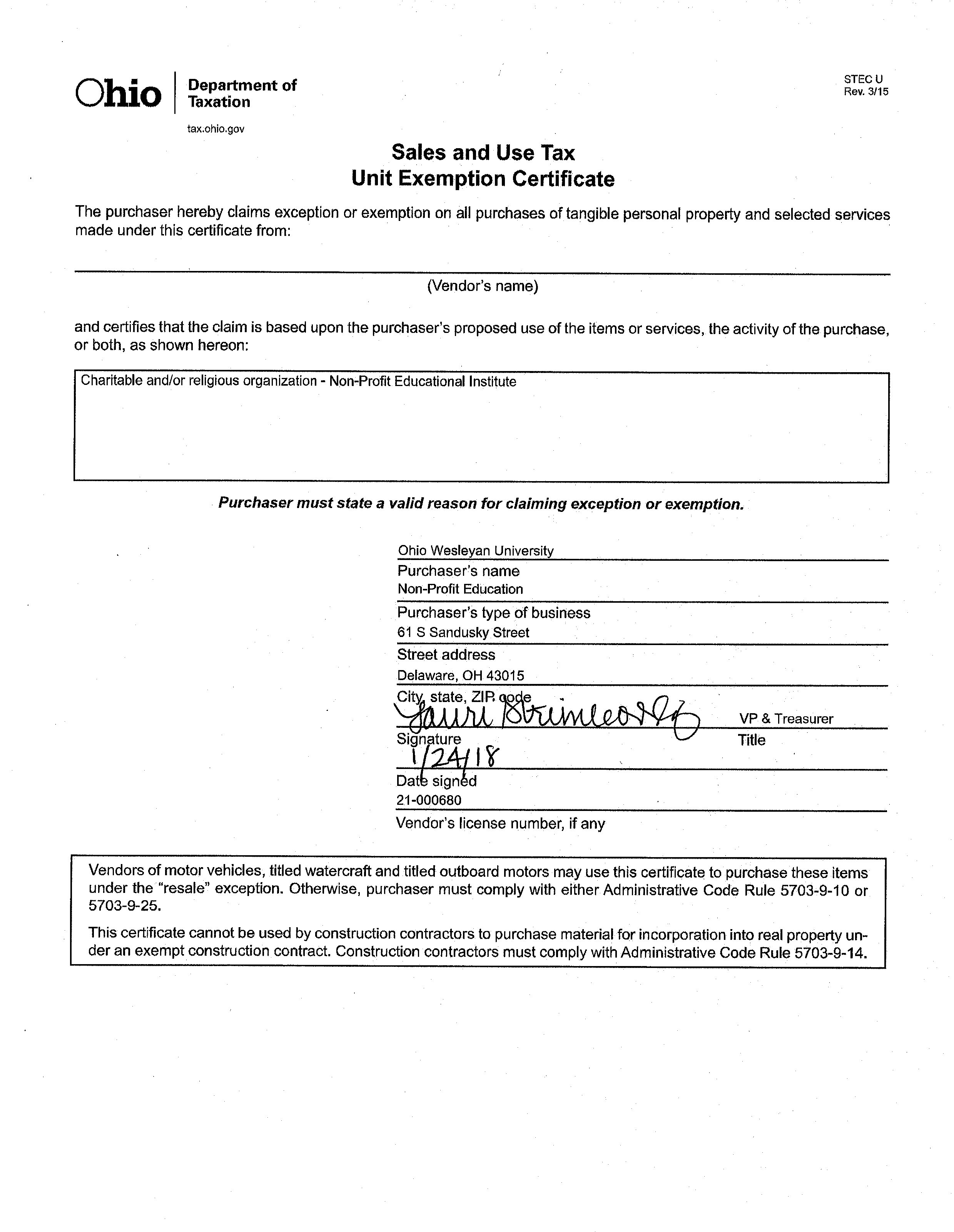

Ohio Sales Tax Exemption Form - Vendors of motor vehicles, titled watercraft and titled outboard motors may use this certifi cate to purchase. If a purchaser claims that tax does not apply to a transaction, the purchaser must provide a fully completed exemption certificate to the vendor or seller. Purchaser must state a valid reason for claiming exception or exemption. Purchaser must state a valid reason for claiming exception or exemption. By its terms, this certificate may be used only for. Ohio accepts the uniform sales and use tax certificate created by the multistate tax commission as a valid exemption certificate. Vendors of motor vehicles, titled watercraft and titled outboard motors may use this certificate to purchase.

If a purchaser claims that tax does not apply to a transaction, the purchaser must provide a fully completed exemption certificate to the vendor or seller. Purchaser must state a valid reason for claiming exception or exemption. By its terms, this certificate may be used only for. Vendors of motor vehicles, titled watercraft and titled outboard motors may use this certifi cate to purchase. Purchaser must state a valid reason for claiming exception or exemption. Vendors of motor vehicles, titled watercraft and titled outboard motors may use this certificate to purchase. Ohio accepts the uniform sales and use tax certificate created by the multistate tax commission as a valid exemption certificate.

Vendors of motor vehicles, titled watercraft and titled outboard motors may use this certifi cate to purchase. By its terms, this certificate may be used only for. Purchaser must state a valid reason for claiming exception or exemption. Vendors of motor vehicles, titled watercraft and titled outboard motors may use this certificate to purchase. Ohio accepts the uniform sales and use tax certificate created by the multistate tax commission as a valid exemption certificate. Purchaser must state a valid reason for claiming exception or exemption. If a purchaser claims that tax does not apply to a transaction, the purchaser must provide a fully completed exemption certificate to the vendor or seller.

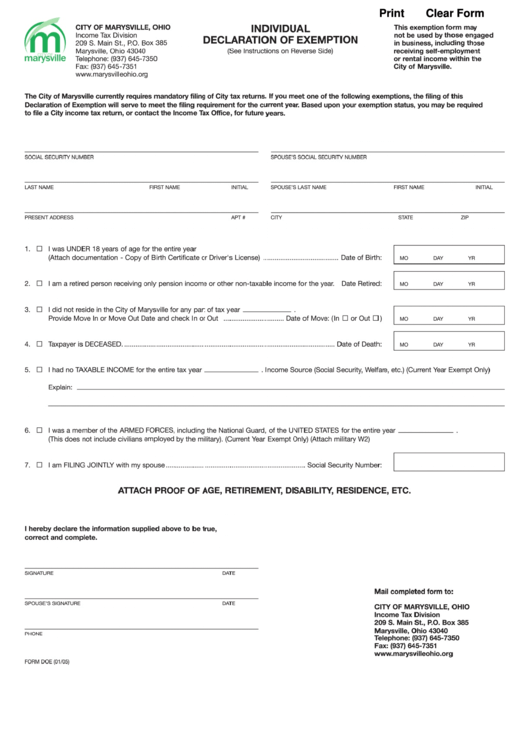

Tax Exemption Form Printable Ohio Printable Forms Free Online

By its terms, this certificate may be used only for. Ohio accepts the uniform sales and use tax certificate created by the multistate tax commission as a valid exemption certificate. If a purchaser claims that tax does not apply to a transaction, the purchaser must provide a fully completed exemption certificate to the vendor or seller. Vendors of motor vehicles,.

Ohio Sales Tax Blanket Exemption Form 2021

Vendors of motor vehicles, titled watercraft and titled outboard motors may use this certifi cate to purchase. If a purchaser claims that tax does not apply to a transaction, the purchaser must provide a fully completed exemption certificate to the vendor or seller. Purchaser must state a valid reason for claiming exception or exemption. By its terms, this certificate may.

Ohio Sales Tax Exemption Form 2025 Piers Clark

By its terms, this certificate may be used only for. Vendors of motor vehicles, titled watercraft and titled outboard motors may use this certificate to purchase. Ohio accepts the uniform sales and use tax certificate created by the multistate tax commission as a valid exemption certificate. Vendors of motor vehicles, titled watercraft and titled outboard motors may use this certifi.

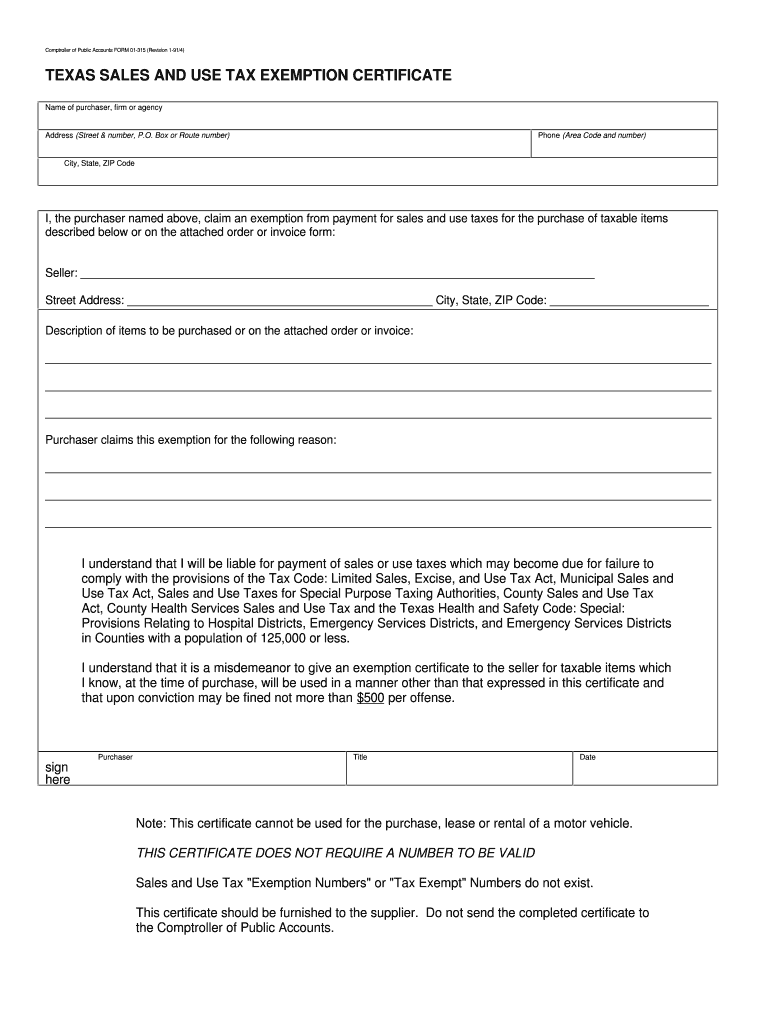

Blanket Certificate Of Exemption Ohio Form Fill Out A vrogue.co

Vendors of motor vehicles, titled watercraft and titled outboard motors may use this certificate to purchase. Purchaser must state a valid reason for claiming exception or exemption. Vendors of motor vehicles, titled watercraft and titled outboard motors may use this certifi cate to purchase. Ohio accepts the uniform sales and use tax certificate created by the multistate tax commission as.

Types Of Sales Tax Exemption Certificates Free Printable Templates

Vendors of motor vehicles, titled watercraft and titled outboard motors may use this certifi cate to purchase. If a purchaser claims that tax does not apply to a transaction, the purchaser must provide a fully completed exemption certificate to the vendor or seller. Purchaser must state a valid reason for claiming exception or exemption. Ohio accepts the uniform sales and.

Ohio Sales And Use Tax Blanket Exemption Certificate Instructions

Vendors of motor vehicles, titled watercraft and titled outboard motors may use this certifi cate to purchase. Purchaser must state a valid reason for claiming exception or exemption. If a purchaser claims that tax does not apply to a transaction, the purchaser must provide a fully completed exemption certificate to the vendor or seller. Vendors of motor vehicles, titled watercraft.

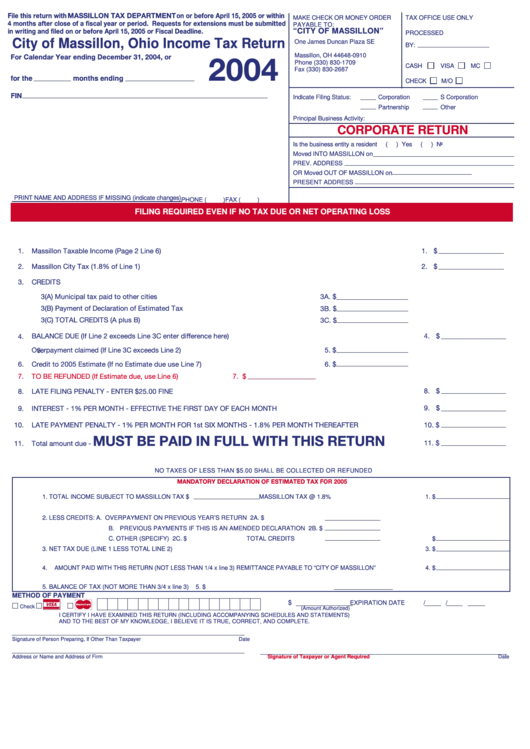

Ohio Sales Tax Exemption Form 2025 Piers Clark

By its terms, this certificate may be used only for. Purchaser must state a valid reason for claiming exception or exemption. If a purchaser claims that tax does not apply to a transaction, the purchaser must provide a fully completed exemption certificate to the vendor or seller. Vendors of motor vehicles, titled watercraft and titled outboard motors may use this.

Ohio Sales Tax Exemption Form 2024 Tax Exemption Storm Sibley

Purchaser must state a valid reason for claiming exception or exemption. Ohio accepts the uniform sales and use tax certificate created by the multistate tax commission as a valid exemption certificate. Vendors of motor vehicles, titled watercraft and titled outboard motors may use this certifi cate to purchase. If a purchaser claims that tax does not apply to a transaction,.

Fillable Online Ohio sales tax exemption form pdf. Ohio sales tax

Ohio accepts the uniform sales and use tax certificate created by the multistate tax commission as a valid exemption certificate. Vendors of motor vehicles, titled watercraft and titled outboard motors may use this certificate to purchase. Purchaser must state a valid reason for claiming exception or exemption. Purchaser must state a valid reason for claiming exception or exemption. If a.

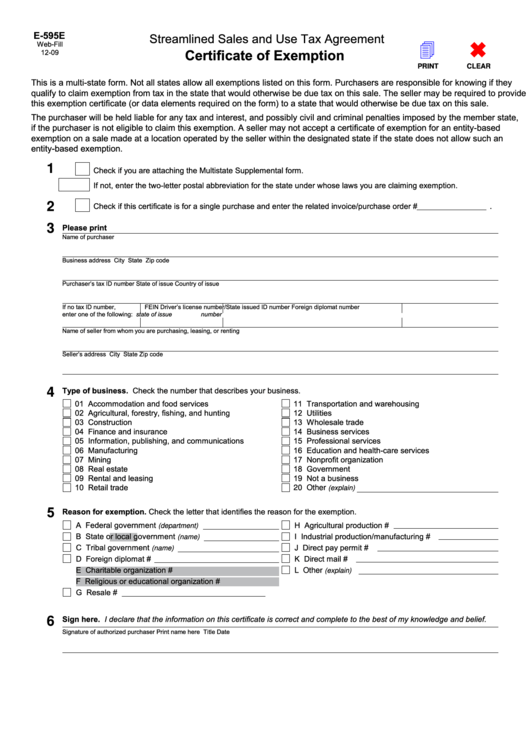

Ohio Sales Tax Exemption Form 2024 Tax Exemption Storm Sibley

Ohio accepts the uniform sales and use tax certificate created by the multistate tax commission as a valid exemption certificate. Purchaser must state a valid reason for claiming exception or exemption. Purchaser must state a valid reason for claiming exception or exemption. Vendors of motor vehicles, titled watercraft and titled outboard motors may use this certifi cate to purchase. Vendors.

By Its Terms, This Certificate May Be Used Only For.

Purchaser must state a valid reason for claiming exception or exemption. Purchaser must state a valid reason for claiming exception or exemption. Ohio accepts the uniform sales and use tax certificate created by the multistate tax commission as a valid exemption certificate. If a purchaser claims that tax does not apply to a transaction, the purchaser must provide a fully completed exemption certificate to the vendor or seller.

Vendors Of Motor Vehicles, Titled Watercraft And Titled Outboard Motors May Use This Certifi Cate To Purchase.

Vendors of motor vehicles, titled watercraft and titled outboard motors may use this certificate to purchase.