Pa Sales Tax Exempt Form - Institutions seeking exemption from sales and use tax must complete this application. Complete this form to claim exemption on a purchase from the pa sales tax, motor vehicle lease tax, or hotel tax. Please follow the instructions carefully to ensure all. We last updated the sales tax exemption. Section 1 must be completed by all institutions. The vendor must retain this form.

We last updated the sales tax exemption. Please follow the instructions carefully to ensure all. The vendor must retain this form. Institutions seeking exemption from sales and use tax must complete this application. Complete this form to claim exemption on a purchase from the pa sales tax, motor vehicle lease tax, or hotel tax. Section 1 must be completed by all institutions.

The vendor must retain this form. Section 1 must be completed by all institutions. Please follow the instructions carefully to ensure all. Complete this form to claim exemption on a purchase from the pa sales tax, motor vehicle lease tax, or hotel tax. We last updated the sales tax exemption. Institutions seeking exemption from sales and use tax must complete this application.

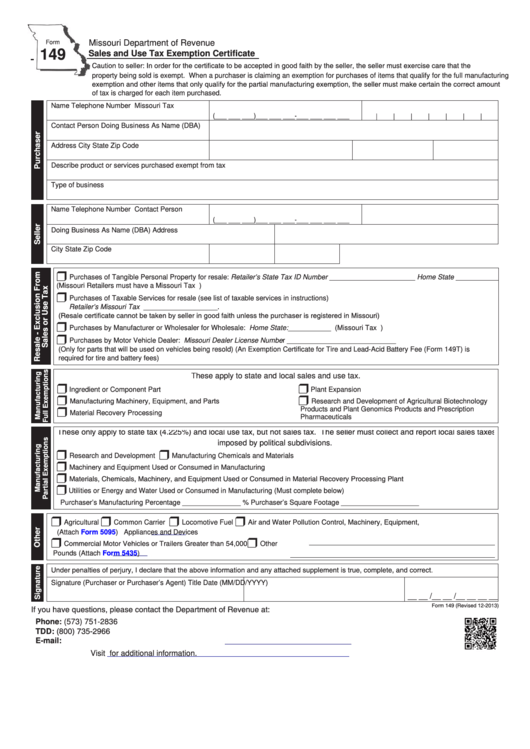

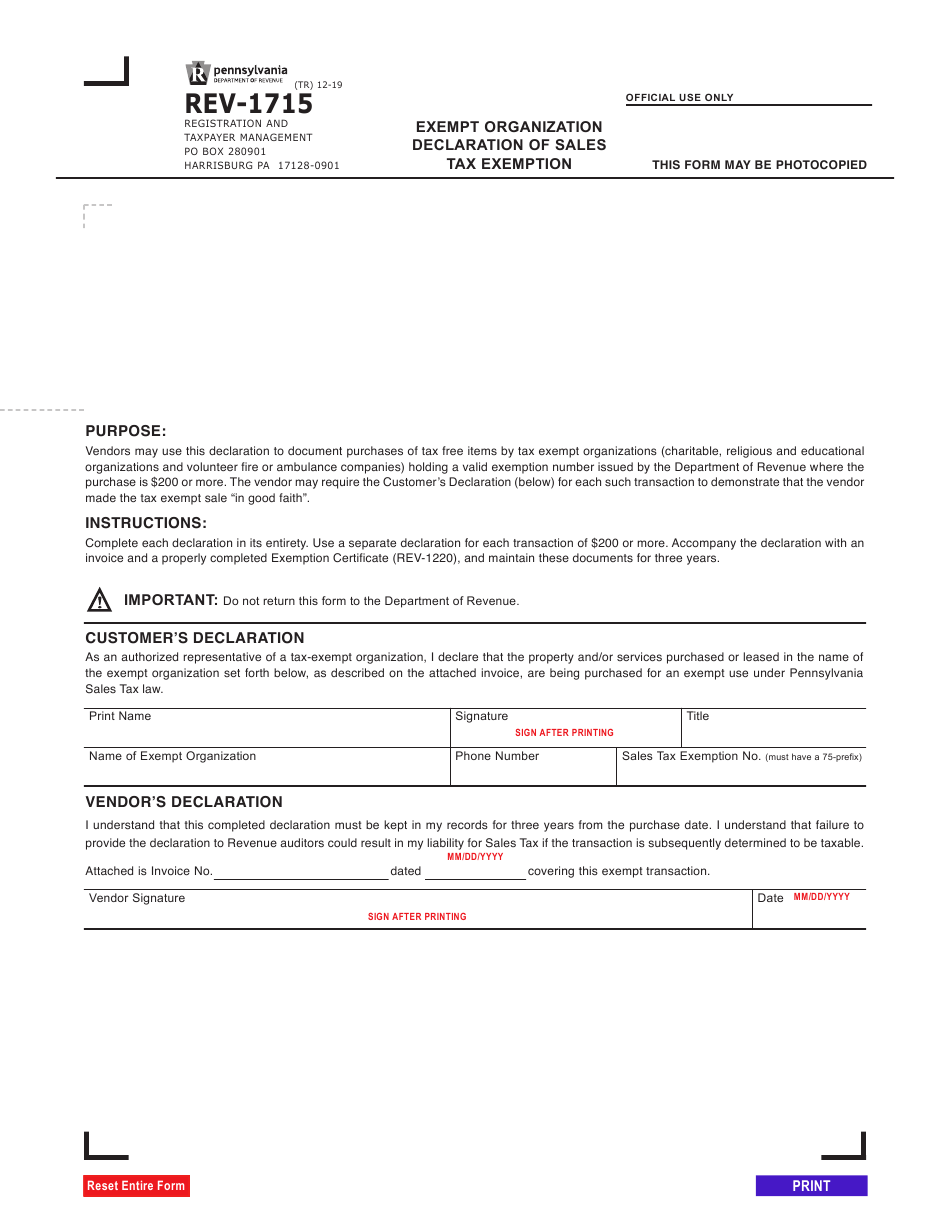

Online Tax Online Tax Exemption Certificate

Institutions seeking exemption from sales and use tax must complete this application. Section 1 must be completed by all institutions. Complete this form to claim exemption on a purchase from the pa sales tax, motor vehicle lease tax, or hotel tax. The vendor must retain this form. Please follow the instructions carefully to ensure all.

Pa Sales Tax Exempt Form 2024 Printable Rhona Cherrita

Complete this form to claim exemption on a purchase from the pa sales tax, motor vehicle lease tax, or hotel tax. Section 1 must be completed by all institutions. We last updated the sales tax exemption. The vendor must retain this form. Please follow the instructions carefully to ensure all.

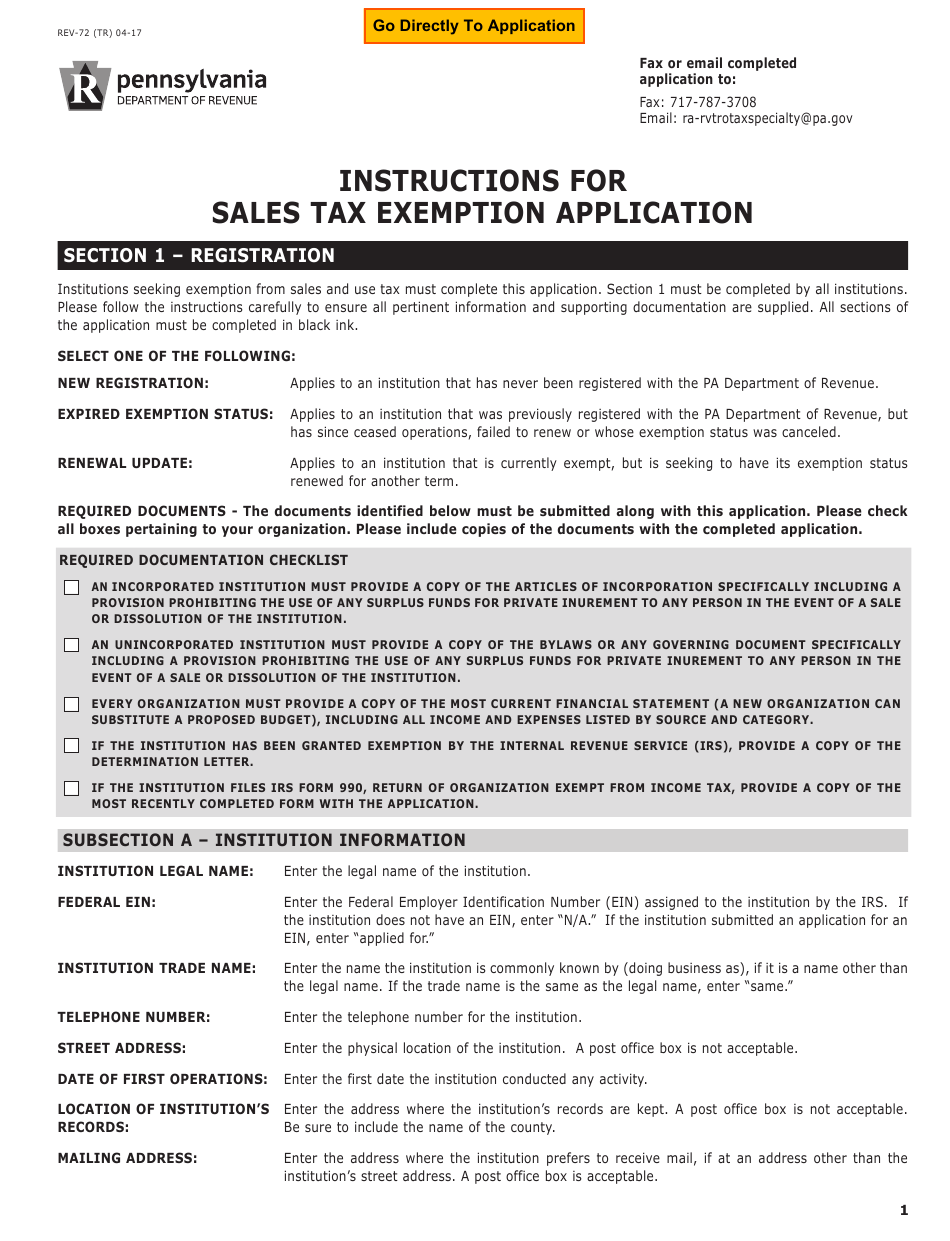

Pa Tax Exempt Form Printable Printable Forms Free Online

We last updated the sales tax exemption. Section 1 must be completed by all institutions. Complete this form to claim exemption on a purchase from the pa sales tax, motor vehicle lease tax, or hotel tax. The vendor must retain this form. Please follow the instructions carefully to ensure all.

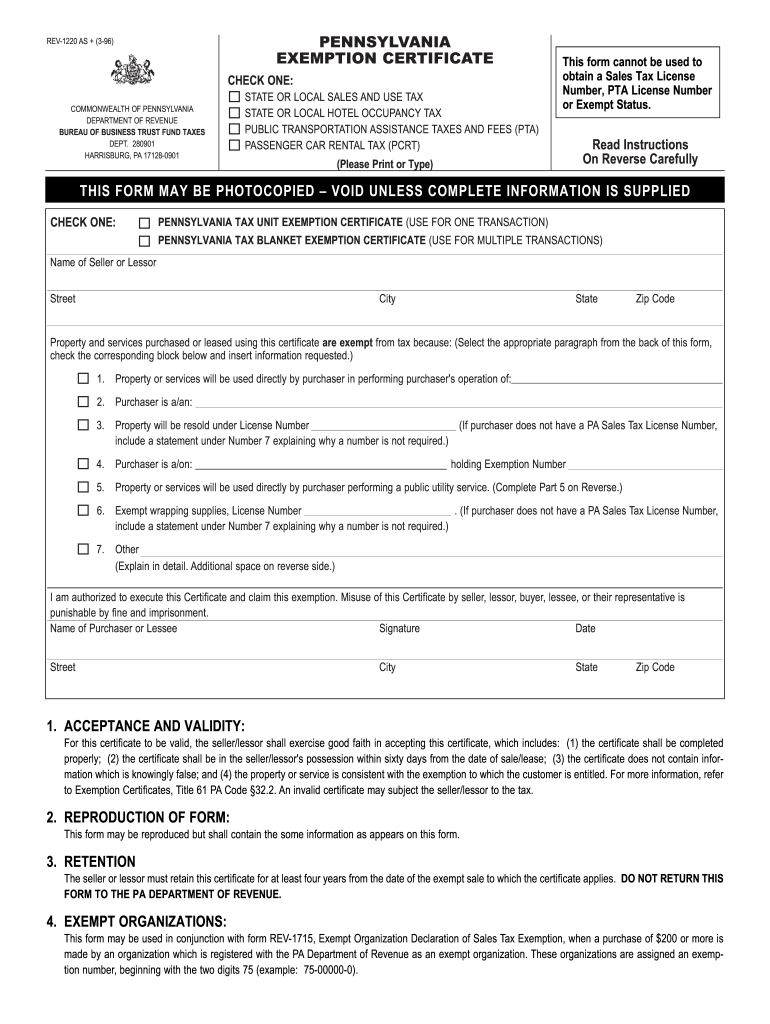

2008 Form PA DoR REV1220 AS Fill Online, Printable, Fillable, Blank

Complete this form to claim exemption on a purchase from the pa sales tax, motor vehicle lease tax, or hotel tax. Section 1 must be completed by all institutions. Institutions seeking exemption from sales and use tax must complete this application. The vendor must retain this form. We last updated the sales tax exemption.

Pa Sales Tax Exempt Request Form

Section 1 must be completed by all institutions. The vendor must retain this form. We last updated the sales tax exemption. Please follow the instructions carefully to ensure all. Complete this form to claim exemption on a purchase from the pa sales tax, motor vehicle lease tax, or hotel tax.

Pennsylvania Estate Tax Exemption 2025 Lorrai Nekaiser

Institutions seeking exemption from sales and use tax must complete this application. Complete this form to claim exemption on a purchase from the pa sales tax, motor vehicle lease tax, or hotel tax. Please follow the instructions carefully to ensure all. We last updated the sales tax exemption. Section 1 must be completed by all institutions.

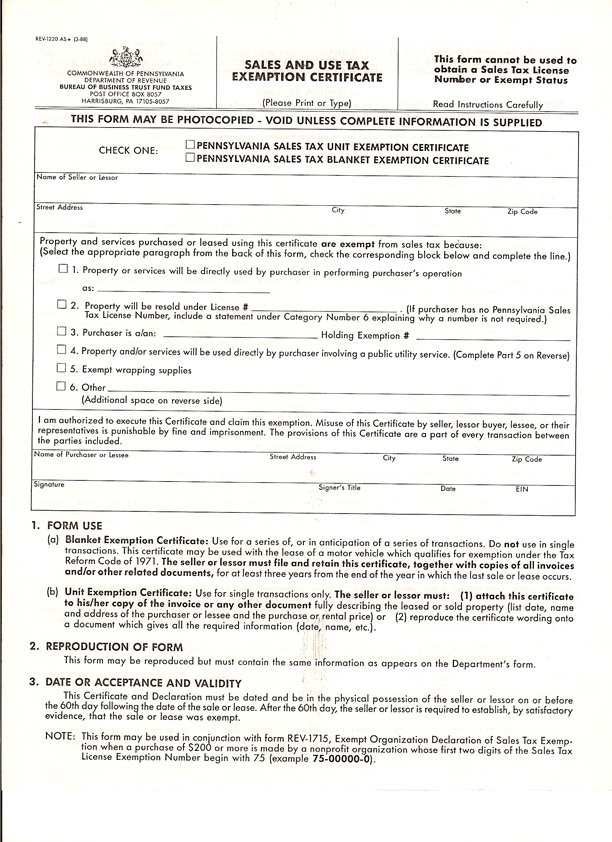

State Sales Tax Pa State Sales Tax Exemption Form

Section 1 must be completed by all institutions. The vendor must retain this form. Complete this form to claim exemption on a purchase from the pa sales tax, motor vehicle lease tax, or hotel tax. Institutions seeking exemption from sales and use tax must complete this application. We last updated the sales tax exemption.

FREE 10 Sample Tax Exemption Forms In PDF

Institutions seeking exemption from sales and use tax must complete this application. Please follow the instructions carefully to ensure all. The vendor must retain this form. We last updated the sales tax exemption. Section 1 must be completed by all institutions.

Pa Tax Exempt Form 2024

Institutions seeking exemption from sales and use tax must complete this application. Please follow the instructions carefully to ensure all. Section 1 must be completed by all institutions. The vendor must retain this form. Complete this form to claim exemption on a purchase from the pa sales tax, motor vehicle lease tax, or hotel tax.

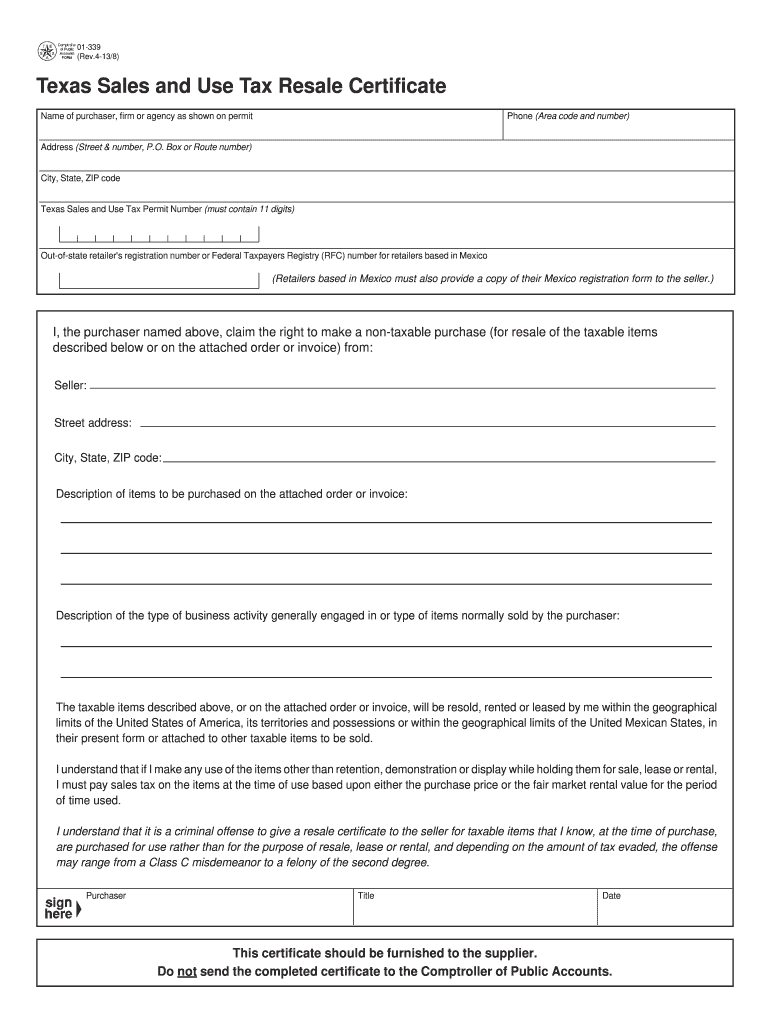

Pa Sales Taxe Exemption Form

Institutions seeking exemption from sales and use tax must complete this application. Please follow the instructions carefully to ensure all. We last updated the sales tax exemption. Complete this form to claim exemption on a purchase from the pa sales tax, motor vehicle lease tax, or hotel tax. The vendor must retain this form.

Institutions Seeking Exemption From Sales And Use Tax Must Complete This Application.

Section 1 must be completed by all institutions. We last updated the sales tax exemption. The vendor must retain this form. Complete this form to claim exemption on a purchase from the pa sales tax, motor vehicle lease tax, or hotel tax.