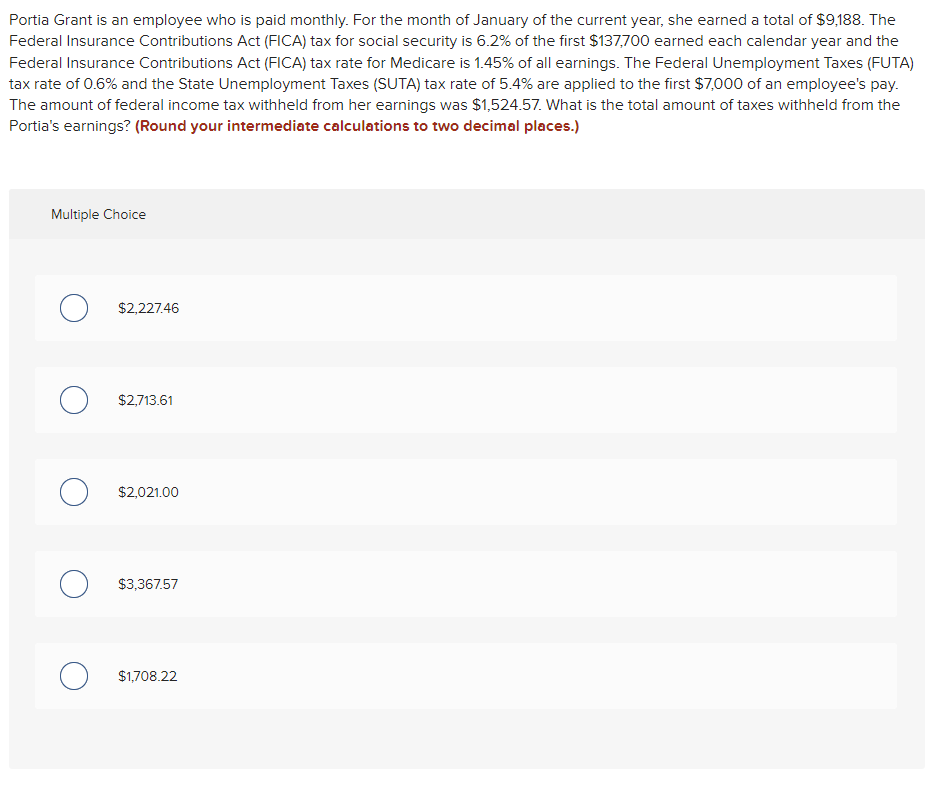

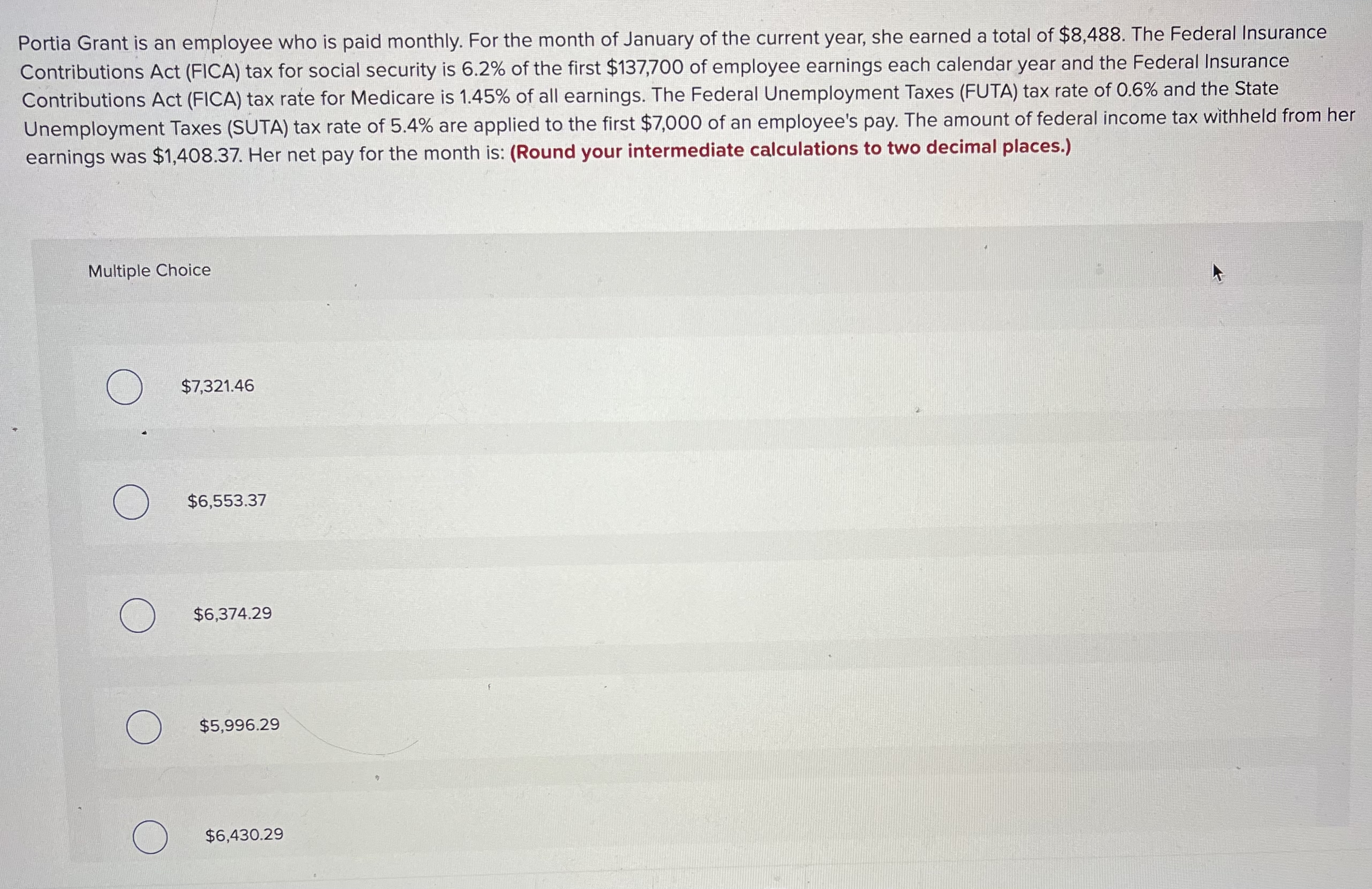

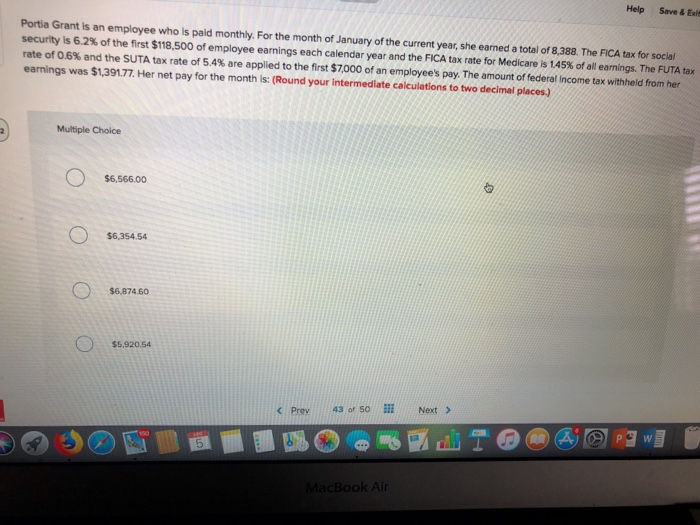

Portia Grant Is An Employee Who Is Paid Monthly - The option d is correct. For the month of january of the current year, she earned a total of $8,260. **fica tax for social security**: Portia grant is an employee who is paid monthly. Portia grant is an employee who is paid monthly. Portia grant is an employee who is paid monthly. For the month of january of the current year, she earned a total of $8,260. To find portia grant's net pay for the month, let's break down the deductions: The total amount of taxes withheld from the portia's earnings equals to $2,106.21. For the month of january of the current year, she earned a total of $8,438.

For the month of january of the current year, she earned a total of $8,260. For the month of january of the current year, she earned a total of $8,260. Portia grant is an employee who is paid monthly. The total amount of taxes withheld from the portia's earnings equals to $2,106.21. Portia grant is an employee who is paid monthly. The option d is correct. **fica tax for social security**: Portia grant is an employee who is paid monthly. To find portia grant's net pay for the month, let's break down the deductions: For the month of january of the current year, she earned a total of $8,438.

For the month of january of the current year, she earned a total of $8,438. To find portia grant's net pay for the month, let's break down the deductions: Portia grant is an employee who is paid monthly. Portia grant is an employee who is paid monthly. For the month of january of the current year, she earned a total of $8,260. The total amount of taxes withheld from the portia's earnings equals to $2,106.21. **fica tax for social security**: The option d is correct. For the month of january of the current year, she earned a total of $8,260. Portia grant is an employee who is paid monthly.

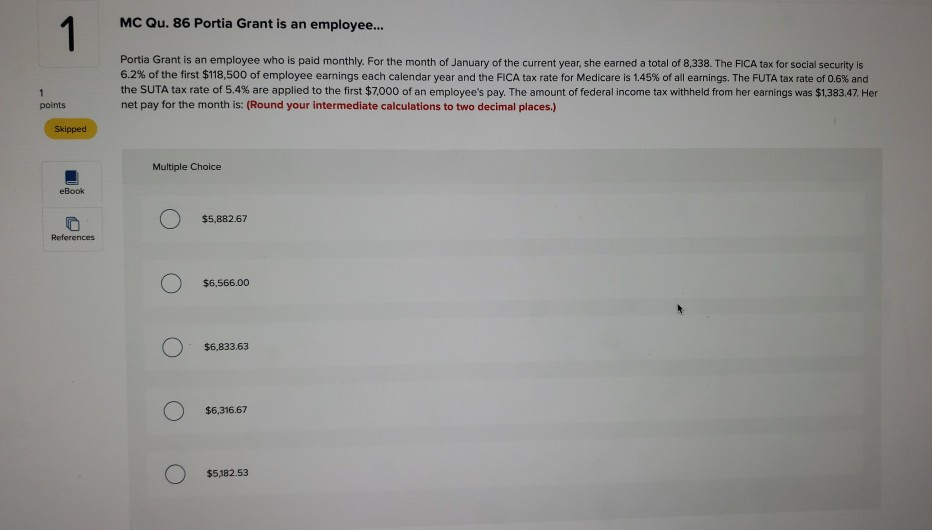

Solved MC Qu. 86 Portia Grant is an employee.... Portia

Portia grant is an employee who is paid monthly. Portia grant is an employee who is paid monthly. To find portia grant's net pay for the month, let's break down the deductions: **fica tax for social security**: For the month of january of the current year, she earned a total of $8,260.

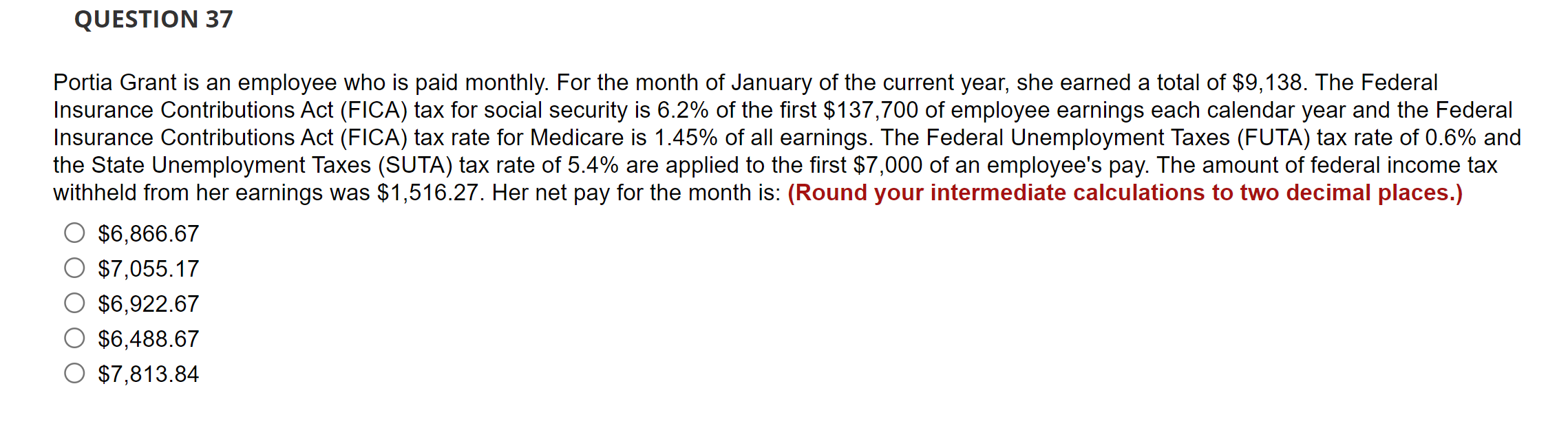

Solved Portia Grant is an employee who is paid monthly. For

For the month of january of the current year, she earned a total of $8,260. For the month of january of the current year, she earned a total of $8,260. The total amount of taxes withheld from the portia's earnings equals to $2,106.21. For the month of january of the current year, she earned a total of $8,438. Portia grant.

Solved Portia Grant is an employee who is paid monthly. For

**fica tax for social security**: Portia grant is an employee who is paid monthly. To find portia grant's net pay for the month, let's break down the deductions: For the month of january of the current year, she earned a total of $8,260. For the month of january of the current year, she earned a total of $8,438.

Solved MC Qu. 86 Portia Grant is an employee...

For the month of january of the current year, she earned a total of $8,260. Portia grant is an employee who is paid monthly. **fica tax for social security**: Portia grant is an employee who is paid monthly. The option d is correct.

Portia Grant Childress Klein

To find portia grant's net pay for the month, let's break down the deductions: **fica tax for social security**: For the month of january of the current year, she earned a total of $8,438. The total amount of taxes withheld from the portia's earnings equals to $2,106.21. For the month of january of the current year, she earned a total.

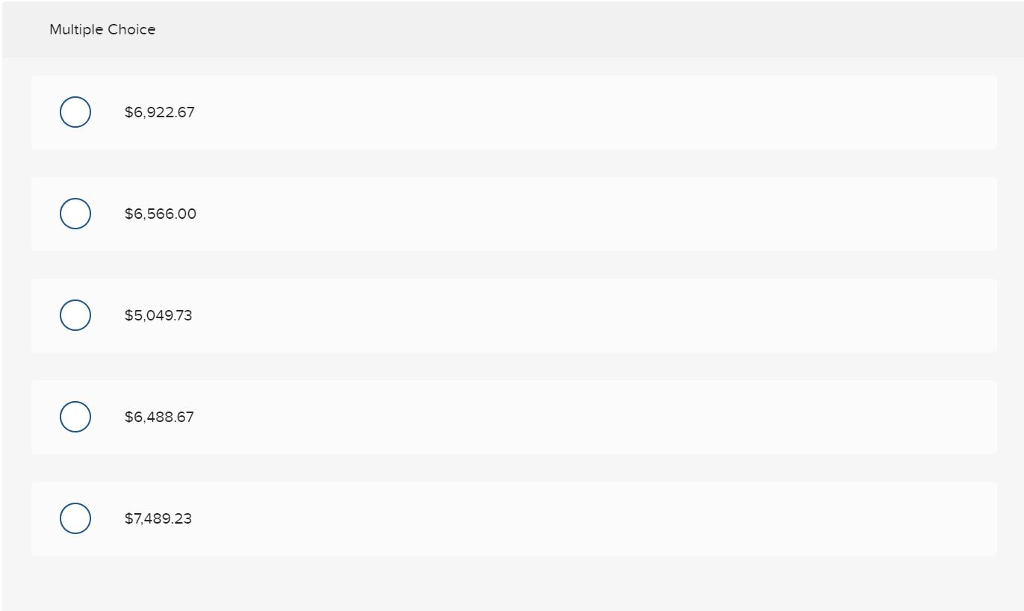

Solved Portia Grant is an employee who is paid monthly. For

The total amount of taxes withheld from the portia's earnings equals to $2,106.21. Portia grant is an employee who is paid monthly. Portia grant is an employee who is paid monthly. The option d is correct. **fica tax for social security**:

Solved Portia Grant is an employee who is paid monthly. For

Portia grant is an employee who is paid monthly. **fica tax for social security**: Portia grant is an employee who is paid monthly. The total amount of taxes withheld from the portia's earnings equals to $2,106.21. Portia grant is an employee who is paid monthly.

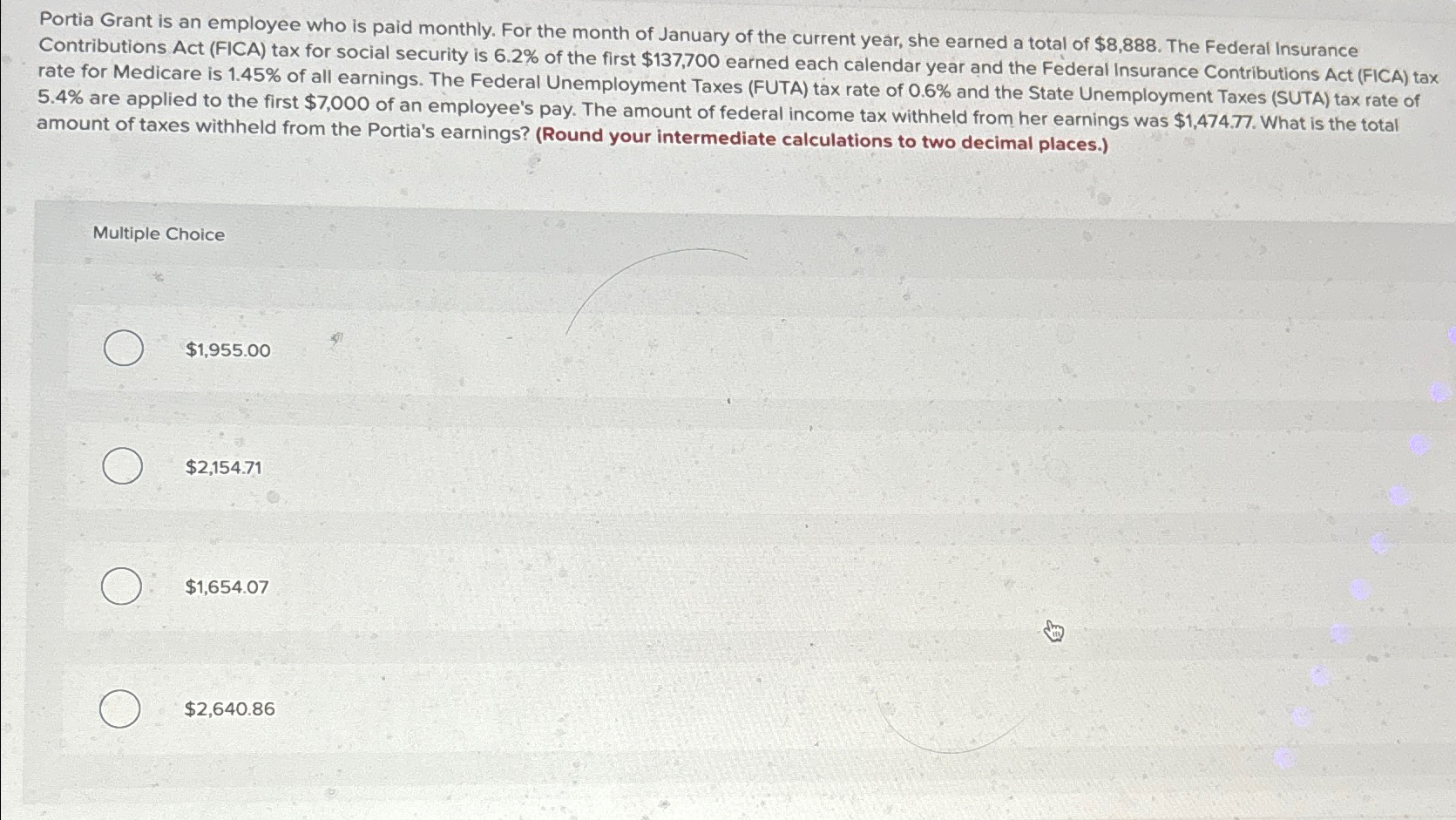

Solved Portia Grant is an employee who is paid monthly. For

**fica tax for social security**: For the month of january of the current year, she earned a total of $8,260. Portia grant is an employee who is paid monthly. Portia grant is an employee who is paid monthly. To find portia grant's net pay for the month, let's break down the deductions:

Portia Grant is an employee who is paid monthly. For

To find portia grant's net pay for the month, let's break down the deductions: For the month of january of the current year, she earned a total of $8,260. Portia grant is an employee who is paid monthly. Portia grant is an employee who is paid monthly. Portia grant is an employee who is paid monthly.

Solved Help Save & Exit Portia Grant is an employee who is

The option d is correct. Portia grant is an employee who is paid monthly. For the month of january of the current year, she earned a total of $8,260. To find portia grant's net pay for the month, let's break down the deductions: For the month of january of the current year, she earned a total of $8,438.

For The Month Of January Of The Current Year, She Earned A Total Of $8,260.

Portia grant is an employee who is paid monthly. For the month of january of the current year, she earned a total of $8,260. Portia grant is an employee who is paid monthly. The option d is correct.

The Total Amount Of Taxes Withheld From The Portia's Earnings Equals To $2,106.21.

For the month of january of the current year, she earned a total of $8,438. To find portia grant's net pay for the month, let's break down the deductions: Portia grant is an employee who is paid monthly. **fica tax for social security**: