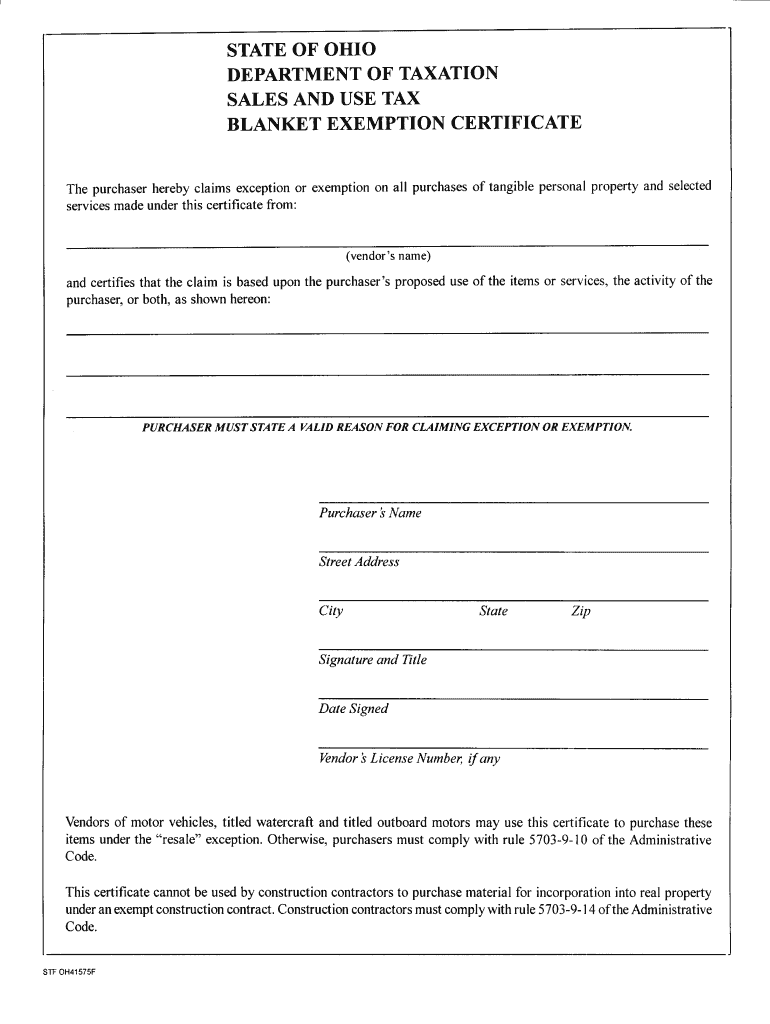

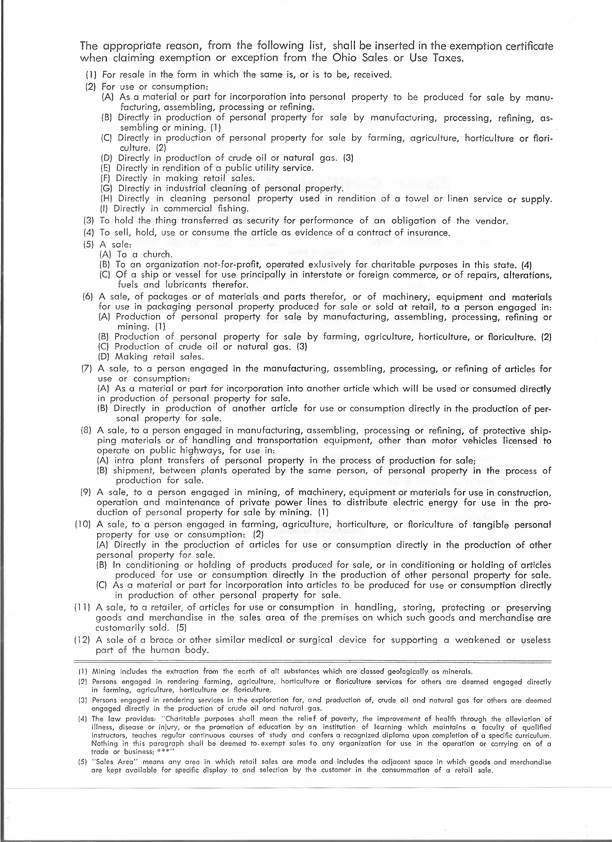

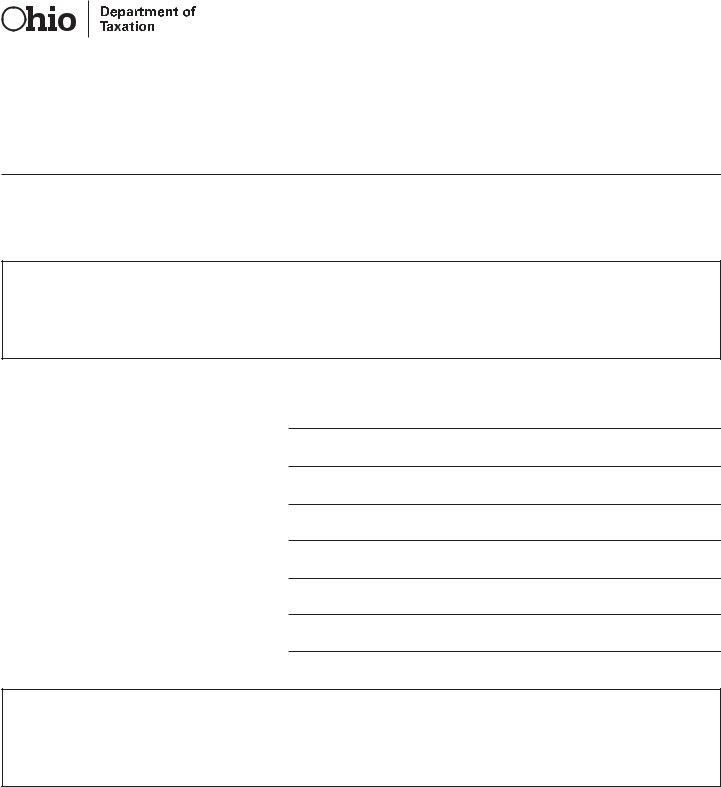

Sales Tax Exempt Form Ohio - A taxable sale includes any transaction in which title or possession of tangible personal property. Ohio accepts the uniform sales and use tax certificate created by the multistate tax. A hospital facility entitled to exemption under r.c. The purchaser hereby claims exception or exemption on all purchases of tangible personal. The following forms are authorized. Download and fill out this form to claim exception or exemption on purchases of tangible personal.

A taxable sale includes any transaction in which title or possession of tangible personal property. The following forms are authorized. A hospital facility entitled to exemption under r.c. The purchaser hereby claims exception or exemption on all purchases of tangible personal. Download and fill out this form to claim exception or exemption on purchases of tangible personal. Ohio accepts the uniform sales and use tax certificate created by the multistate tax.

The following forms are authorized. Download and fill out this form to claim exception or exemption on purchases of tangible personal. A taxable sale includes any transaction in which title or possession of tangible personal property. A hospital facility entitled to exemption under r.c. The purchaser hereby claims exception or exemption on all purchases of tangible personal. Ohio accepts the uniform sales and use tax certificate created by the multistate tax.

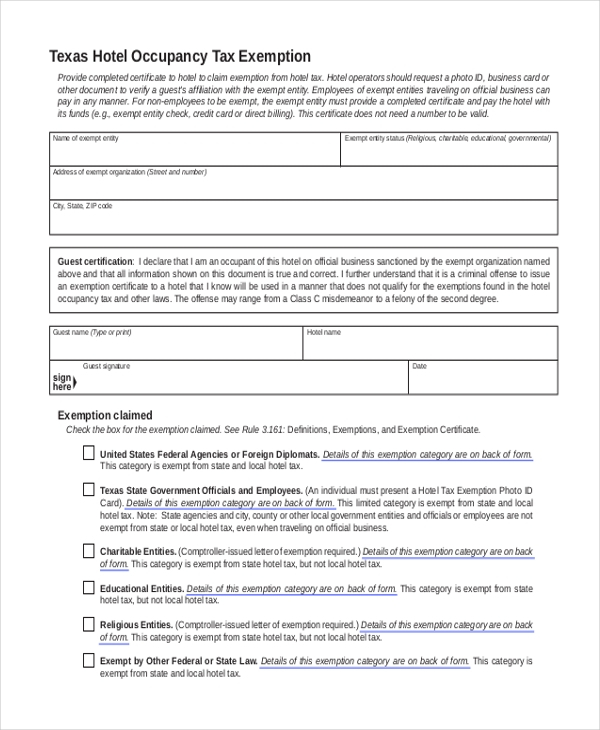

Tax Exempt Lodging Form

Ohio accepts the uniform sales and use tax certificate created by the multistate tax. A taxable sale includes any transaction in which title or possession of tangible personal property. Download and fill out this form to claim exception or exemption on purchases of tangible personal. The purchaser hereby claims exception or exemption on all purchases of tangible personal. A hospital.

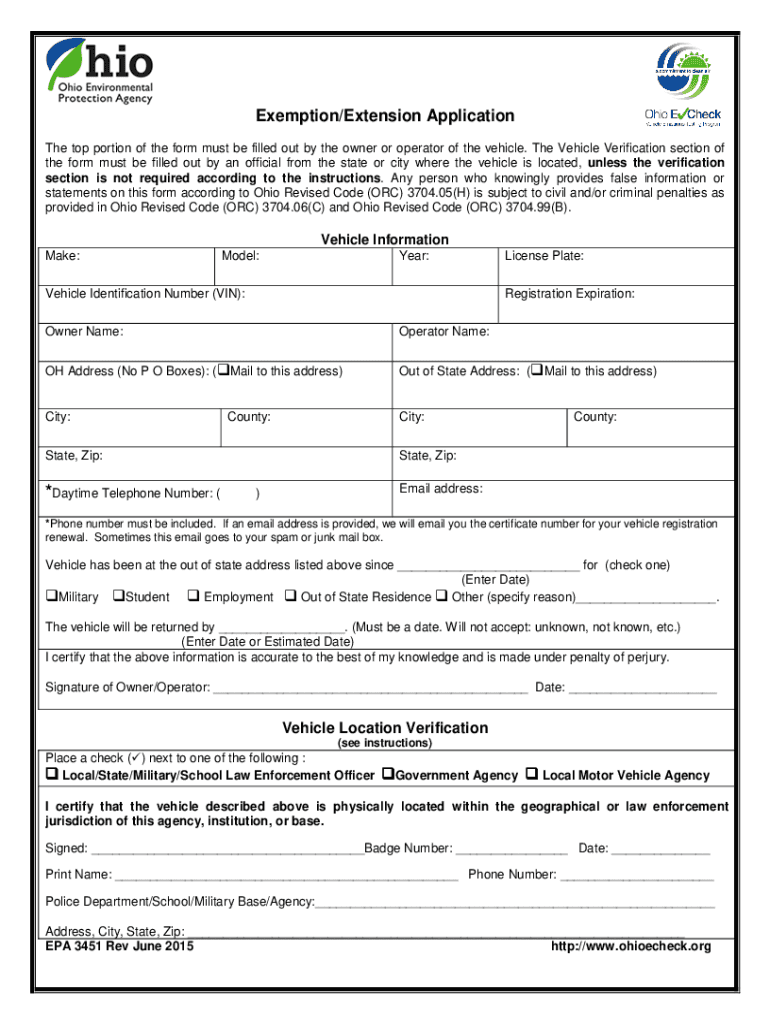

For the Tax Exempt in Ohio 20152024 Form Fill Out and Sign Printable

Download and fill out this form to claim exception or exemption on purchases of tangible personal. Ohio accepts the uniform sales and use tax certificate created by the multistate tax. The purchaser hereby claims exception or exemption on all purchases of tangible personal. A hospital facility entitled to exemption under r.c. The following forms are authorized.

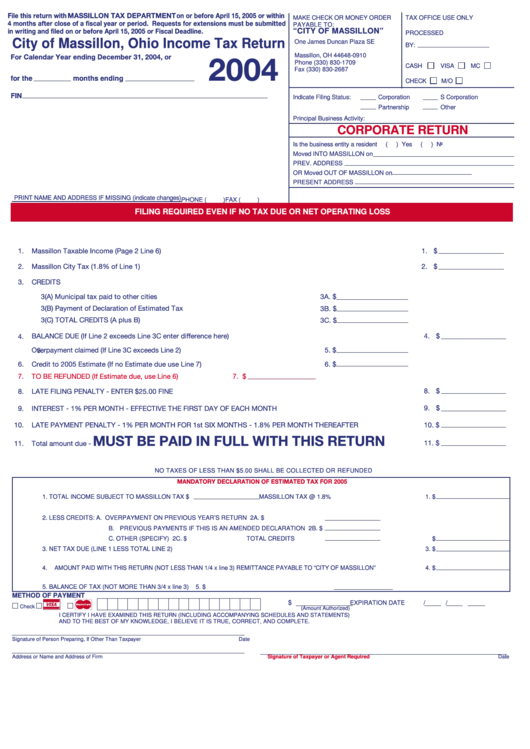

Icc Mc Sales Tax Exemption Form Ohio

The purchaser hereby claims exception or exemption on all purchases of tangible personal. A taxable sale includes any transaction in which title or possession of tangible personal property. Download and fill out this form to claim exception or exemption on purchases of tangible personal. Ohio accepts the uniform sales and use tax certificate created by the multistate tax. A hospital.

State Of Ohio Sales Tax Exempt Form 2024 Lina Shelby

Download and fill out this form to claim exception or exemption on purchases of tangible personal. A hospital facility entitled to exemption under r.c. A taxable sale includes any transaction in which title or possession of tangible personal property. The purchaser hereby claims exception or exemption on all purchases of tangible personal. The following forms are authorized.

Ohio Sales Tax Exemption Form 2024 Eddy Nerita

A taxable sale includes any transaction in which title or possession of tangible personal property. The purchaser hereby claims exception or exemption on all purchases of tangible personal. A hospital facility entitled to exemption under r.c. Download and fill out this form to claim exception or exemption on purchases of tangible personal. Ohio accepts the uniform sales and use tax.

Ohio Tax Exempt

The purchaser hereby claims exception or exemption on all purchases of tangible personal. A taxable sale includes any transaction in which title or possession of tangible personal property. The following forms are authorized. A hospital facility entitled to exemption under r.c. Ohio accepts the uniform sales and use tax certificate created by the multistate tax.

Ohio Sales Tax Exemption ≡ Fill Out Printable PDF Forms Online

The following forms are authorized. The purchaser hereby claims exception or exemption on all purchases of tangible personal. A taxable sale includes any transaction in which title or possession of tangible personal property. A hospital facility entitled to exemption under r.c. Ohio accepts the uniform sales and use tax certificate created by the multistate tax.

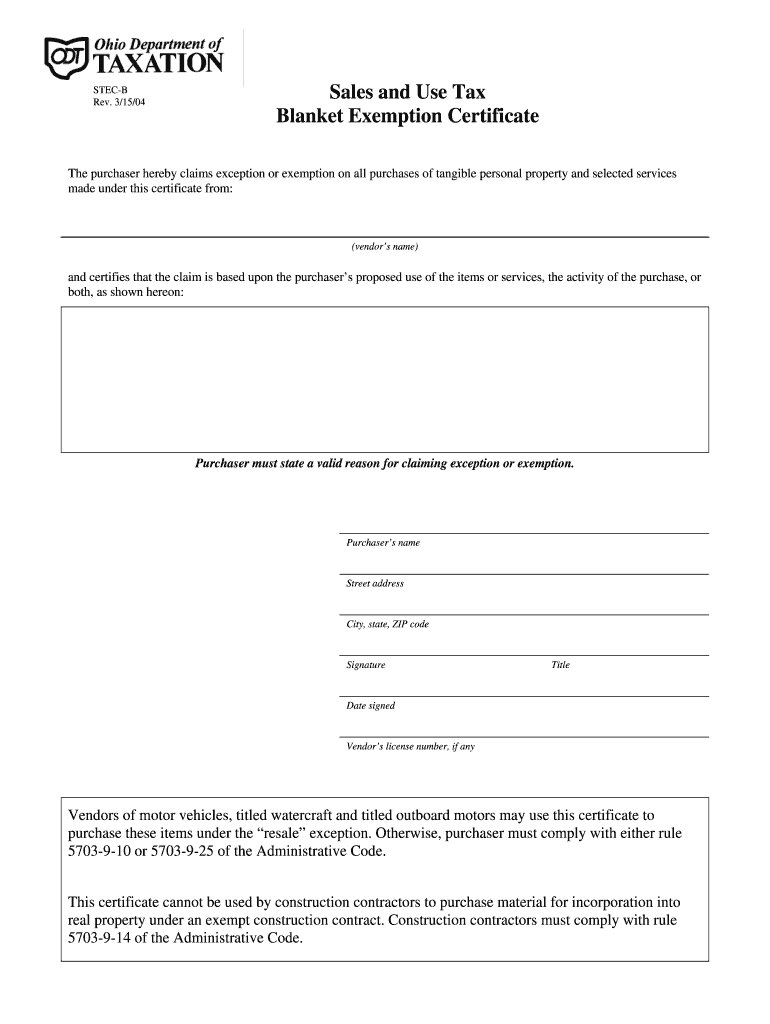

Oh Sales Tax Blanket Exemption Form

A hospital facility entitled to exemption under r.c. The following forms are authorized. Ohio accepts the uniform sales and use tax certificate created by the multistate tax. The purchaser hereby claims exception or exemption on all purchases of tangible personal. Download and fill out this form to claim exception or exemption on purchases of tangible personal.

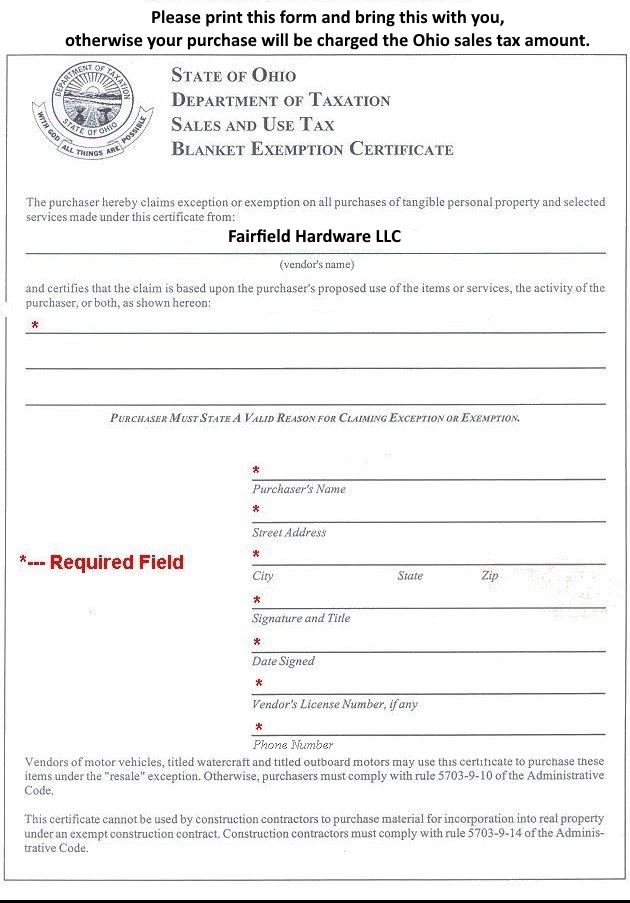

Fairfield Hardware Ohio Tax Exemption Form

Ohio accepts the uniform sales and use tax certificate created by the multistate tax. Download and fill out this form to claim exception or exemption on purchases of tangible personal. A hospital facility entitled to exemption under r.c. A taxable sale includes any transaction in which title or possession of tangible personal property. The purchaser hereby claims exception or exemption.

Ohio Sales Tax Exempt Form 2024 Eddy Nerita

The following forms are authorized. Ohio accepts the uniform sales and use tax certificate created by the multistate tax. Download and fill out this form to claim exception or exemption on purchases of tangible personal. A taxable sale includes any transaction in which title or possession of tangible personal property. A hospital facility entitled to exemption under r.c.

The Following Forms Are Authorized.

A hospital facility entitled to exemption under r.c. The purchaser hereby claims exception or exemption on all purchases of tangible personal. Ohio accepts the uniform sales and use tax certificate created by the multistate tax. Download and fill out this form to claim exception or exemption on purchases of tangible personal.