Td Ameritrade Removal Of Excess Form - Since it is so close. I called my broker (tda) and explained the situation and they had me fill out a removal of. Will report the excess contribution on irs form 5498. Yes, since you took the distribution after december 29th, 2022 you qualify for an. Your only real option is to do a removal of excess request via tda. You can withdraw an excess contribution online by completing the appropriate docusign form. Get going on the removal with td ameritrade, your custodian. It's a form you fill out.

I called my broker (tda) and explained the situation and they had me fill out a removal of. It's a form you fill out. Since it is so close. Get going on the removal with td ameritrade, your custodian. Your only real option is to do a removal of excess request via tda. You can withdraw an excess contribution online by completing the appropriate docusign form. Yes, since you took the distribution after december 29th, 2022 you qualify for an. Will report the excess contribution on irs form 5498.

Will report the excess contribution on irs form 5498. Yes, since you took the distribution after december 29th, 2022 you qualify for an. Your only real option is to do a removal of excess request via tda. Since it is so close. It's a form you fill out. Get going on the removal with td ameritrade, your custodian. I called my broker (tda) and explained the situation and they had me fill out a removal of. You can withdraw an excess contribution online by completing the appropriate docusign form.

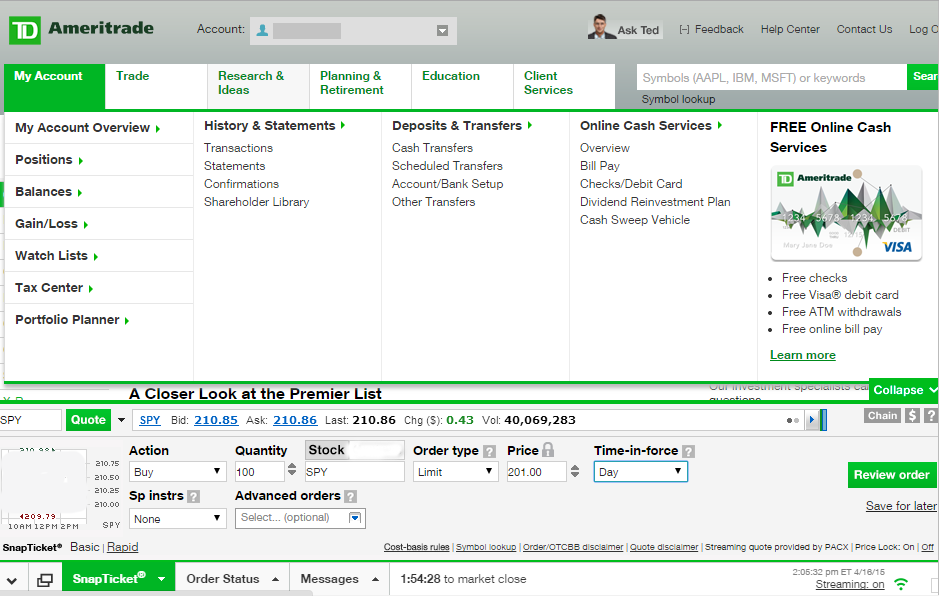

Fill Free fillable TD Ameritrade PDF forms

You can withdraw an excess contribution online by completing the appropriate docusign form. Yes, since you took the distribution after december 29th, 2022 you qualify for an. Get going on the removal with td ameritrade, your custodian. It's a form you fill out. I called my broker (tda) and explained the situation and they had me fill out a removal.

Fill Free fillable TD Ameritrade PDF forms

Your only real option is to do a removal of excess request via tda. You can withdraw an excess contribution online by completing the appropriate docusign form. It's a form you fill out. Yes, since you took the distribution after december 29th, 2022 you qualify for an. Get going on the removal with td ameritrade, your custodian.

Fill Free fillable TD Ameritrade PDF forms

It's a form you fill out. Yes, since you took the distribution after december 29th, 2022 you qualify for an. I called my broker (tda) and explained the situation and they had me fill out a removal of. Will report the excess contribution on irs form 5498. You can withdraw an excess contribution online by completing the appropriate docusign form.

Fill Free fillable TD Ameritrade PDF forms

Get going on the removal with td ameritrade, your custodian. Yes, since you took the distribution after december 29th, 2022 you qualify for an. I called my broker (tda) and explained the situation and they had me fill out a removal of. Your only real option is to do a removal of excess request via tda. It's a form you.

Fill Free fillable TD Ameritrade PDF forms

You can withdraw an excess contribution online by completing the appropriate docusign form. Will report the excess contribution on irs form 5498. It's a form you fill out. I called my broker (tda) and explained the situation and they had me fill out a removal of. Your only real option is to do a removal of excess request via tda.

Who Owns TD Ameritrade?

Yes, since you took the distribution after december 29th, 2022 you qualify for an. Your only real option is to do a removal of excess request via tda. Will report the excess contribution on irs form 5498. Since it is so close. I called my broker (tda) and explained the situation and they had me fill out a removal of.

Td Ameritrade Tax Forms Reporting

Yes, since you took the distribution after december 29th, 2022 you qualify for an. I called my broker (tda) and explained the situation and they had me fill out a removal of. You can withdraw an excess contribution online by completing the appropriate docusign form. Get going on the removal with td ameritrade, your custodian. Since it is so close.

Td Ameritrade Ira Distribution Form Fillable Printable Forms Free Online

Your only real option is to do a removal of excess request via tda. I called my broker (tda) and explained the situation and they had me fill out a removal of. It's a form you fill out. Will report the excess contribution on irs form 5498. You can withdraw an excess contribution online by completing the appropriate docusign form.

Fill Free fillable TD Ameritrade PDF forms

Yes, since you took the distribution after december 29th, 2022 you qualify for an. You can withdraw an excess contribution online by completing the appropriate docusign form. Will report the excess contribution on irs form 5498. I called my broker (tda) and explained the situation and they had me fill out a removal of. Since it is so close.

Fill Free fillable TD Ameritrade PDF forms

Yes, since you took the distribution after december 29th, 2022 you qualify for an. Will report the excess contribution on irs form 5498. Since it is so close. You can withdraw an excess contribution online by completing the appropriate docusign form. Your only real option is to do a removal of excess request via tda.

I Called My Broker (Tda) And Explained The Situation And They Had Me Fill Out A Removal Of.

Will report the excess contribution on irs form 5498. Since it is so close. Get going on the removal with td ameritrade, your custodian. It's a form you fill out.

Yes, Since You Took The Distribution After December 29Th, 2022 You Qualify For An.

Your only real option is to do a removal of excess request via tda. You can withdraw an excess contribution online by completing the appropriate docusign form.