Washington State Exempt Employee Laws - • be paid a minimum wage; For classified employees and those employees exempt from civil service. (1) when does this section apply? • state law requires workers: Deductions for salaried, exempt employees. With the state salary thresholds for exempt employees now a multiplier of the state. • receive overtime for time worked over.

• state law requires workers: • be paid a minimum wage; Deductions for salaried, exempt employees. For classified employees and those employees exempt from civil service. With the state salary thresholds for exempt employees now a multiplier of the state. (1) when does this section apply? • receive overtime for time worked over.

For classified employees and those employees exempt from civil service. With the state salary thresholds for exempt employees now a multiplier of the state. Deductions for salaried, exempt employees. (1) when does this section apply? • state law requires workers: • be paid a minimum wage; • receive overtime for time worked over.

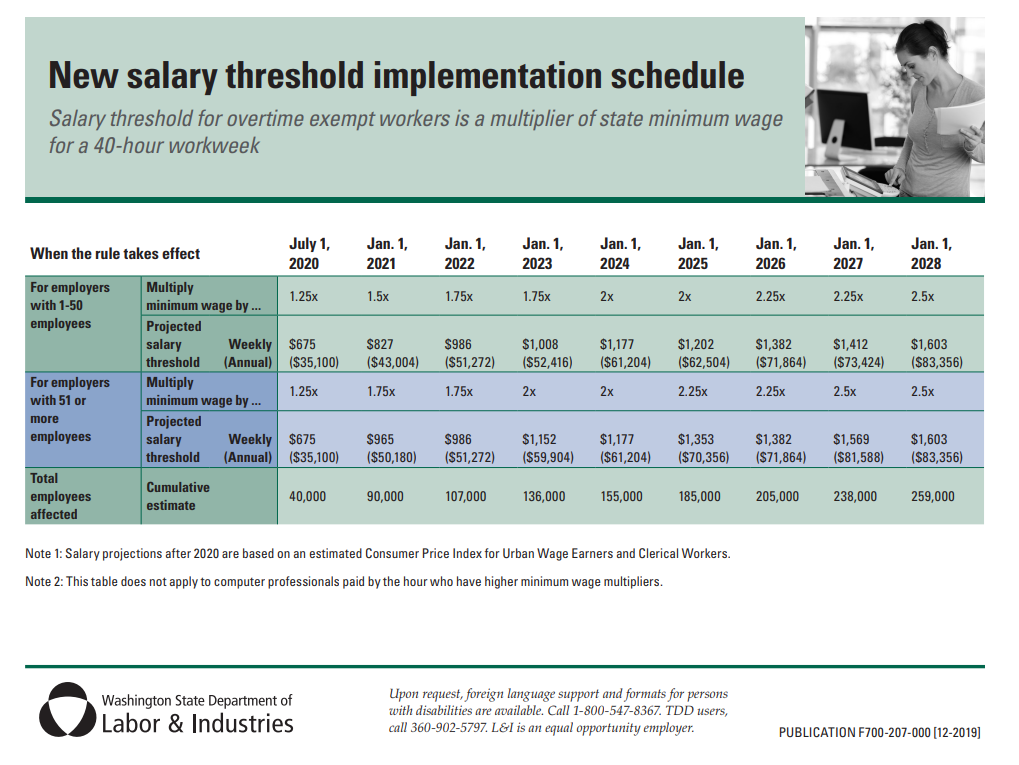

Exempt Salary Threshold 2024 Washington State Abbe Mariam

(1) when does this section apply? With the state salary thresholds for exempt employees now a multiplier of the state. Deductions for salaried, exempt employees. • state law requires workers: For classified employees and those employees exempt from civil service.

Washington State Minimum Salary Exempt 2024 Kit Sallyanne

• be paid a minimum wage; • receive overtime for time worked over. With the state salary thresholds for exempt employees now a multiplier of the state. (1) when does this section apply? For classified employees and those employees exempt from civil service.

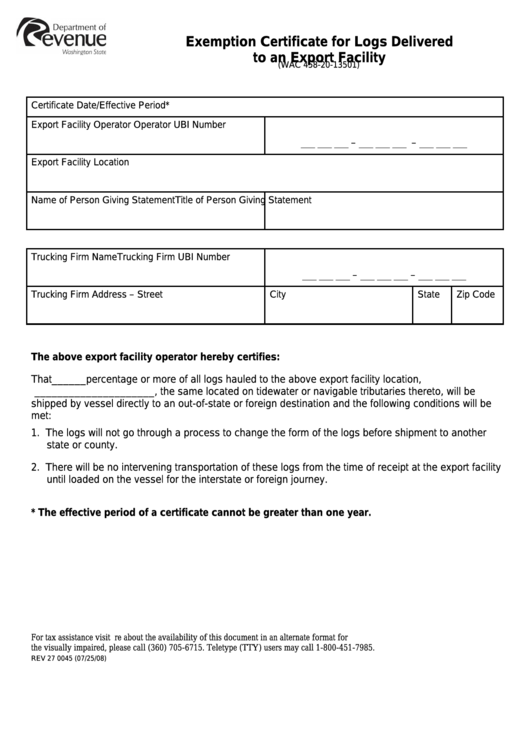

Washington State Certificate Of Exemption Form

(1) when does this section apply? With the state salary thresholds for exempt employees now a multiplier of the state. For classified employees and those employees exempt from civil service. • be paid a minimum wage; • state law requires workers:

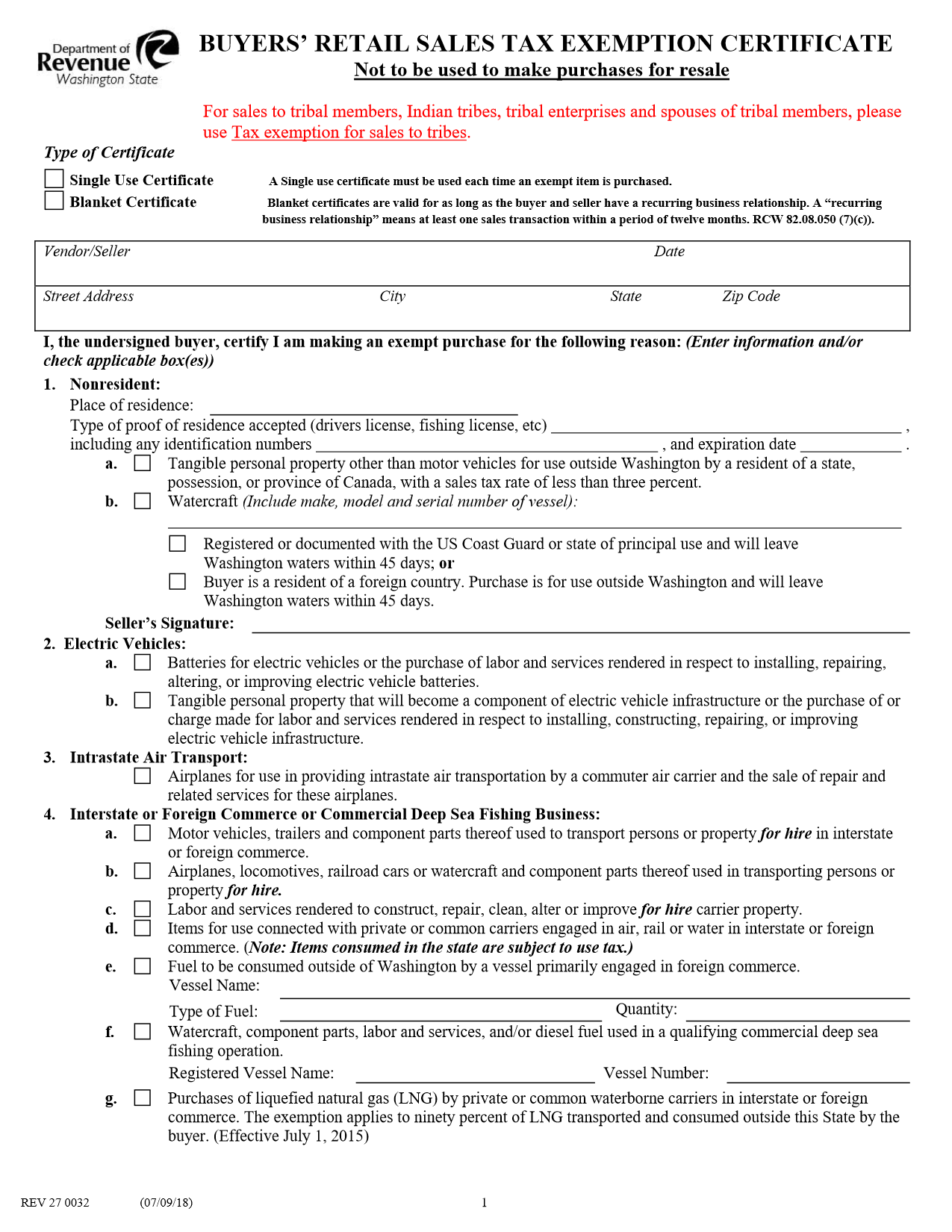

Washington State Federal Tax Exempt Form

(1) when does this section apply? • be paid a minimum wage; With the state salary thresholds for exempt employees now a multiplier of the state. Deductions for salaried, exempt employees. • state law requires workers:

What is an Exempt Employee in Washington State? HireQuotient

(1) when does this section apply? With the state salary thresholds for exempt employees now a multiplier of the state. • be paid a minimum wage; • receive overtime for time worked over. • state law requires workers:

What is an Exempt Employee in Washington State? HireQuotient

(1) when does this section apply? With the state salary thresholds for exempt employees now a multiplier of the state. Deductions for salaried, exempt employees. For classified employees and those employees exempt from civil service. • be paid a minimum wage;

Washington State Exempt Salary Threshold 2024 Dori Philomena

• receive overtime for time worked over. • be paid a minimum wage; For classified employees and those employees exempt from civil service. Deductions for salaried, exempt employees. With the state salary thresholds for exempt employees now a multiplier of the state.

Washington State Exempt Salary Threshold 2024 Paige Laurella

• receive overtime for time worked over. • state law requires workers: (1) when does this section apply? • be paid a minimum wage; Deductions for salaried, exempt employees.

What Is an Exempt Employee? AIHR HR Glossary

For classified employees and those employees exempt from civil service. • state law requires workers: • receive overtime for time worked over. Deductions for salaried, exempt employees. With the state salary thresholds for exempt employees now a multiplier of the state.

Deductions For Salaried, Exempt Employees.

With the state salary thresholds for exempt employees now a multiplier of the state. • state law requires workers: For classified employees and those employees exempt from civil service. • receive overtime for time worked over.

• Be Paid A Minimum Wage;

(1) when does this section apply?