What Does Code 977 Mean On Irs Transcript 2020 - Code 977 means amended return filed. These two transaction codes indicate receipt of your amended return for the tax year in. Tax code 977 on your online transcript typically indicates that your tax. You can see a list of tax transcript codes, here:.

These two transaction codes indicate receipt of your amended return for the tax year in. You can see a list of tax transcript codes, here:. Code 977 means amended return filed. Tax code 977 on your online transcript typically indicates that your tax.

You can see a list of tax transcript codes, here:. Code 977 means amended return filed. These two transaction codes indicate receipt of your amended return for the tax year in. Tax code 977 on your online transcript typically indicates that your tax.

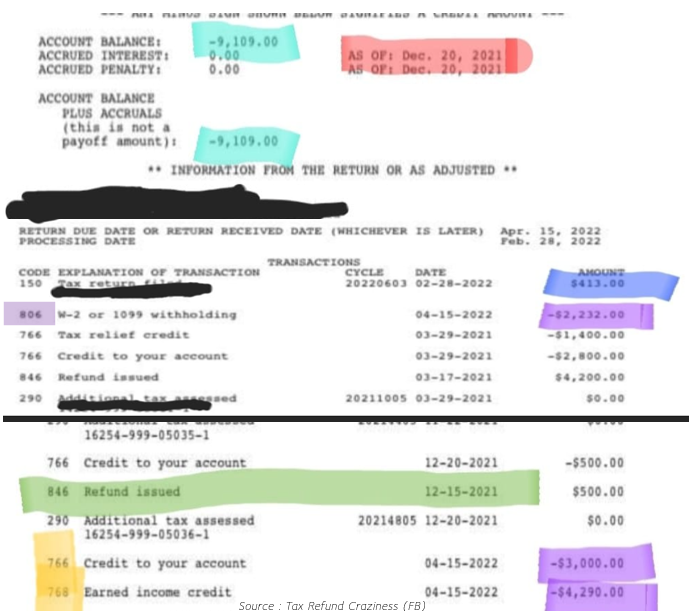

IRS Account Transcript Code 971

Tax code 977 on your online transcript typically indicates that your tax. You can see a list of tax transcript codes, here:. These two transaction codes indicate receipt of your amended return for the tax year in. Code 977 means amended return filed.

2/12 accepted and 2020 transcript Finally updated. There was a small

You can see a list of tax transcript codes, here:. These two transaction codes indicate receipt of your amended return for the tax year in. Tax code 977 on your online transcript typically indicates that your tax. Code 977 means amended return filed.

2020 IRS Transcript with 846 Refund Issued code

Tax code 977 on your online transcript typically indicates that your tax. Code 977 means amended return filed. These two transaction codes indicate receipt of your amended return for the tax year in. You can see a list of tax transcript codes, here:.

What does this mean? Irs transcript r/IRS

Code 977 means amended return filed. You can see a list of tax transcript codes, here:. These two transaction codes indicate receipt of your amended return for the tax year in. Tax code 977 on your online transcript typically indicates that your tax.

What Does Code 150 Mean On An IRS Transcript? LiveWell

Code 977 means amended return filed. These two transaction codes indicate receipt of your amended return for the tax year in. Tax code 977 on your online transcript typically indicates that your tax. You can see a list of tax transcript codes, here:.

How do you read my transcript? Does this mean I’m getting my refund on

Code 977 means amended return filed. You can see a list of tax transcript codes, here:. These two transaction codes indicate receipt of your amended return for the tax year in. Tax code 977 on your online transcript typically indicates that your tax.

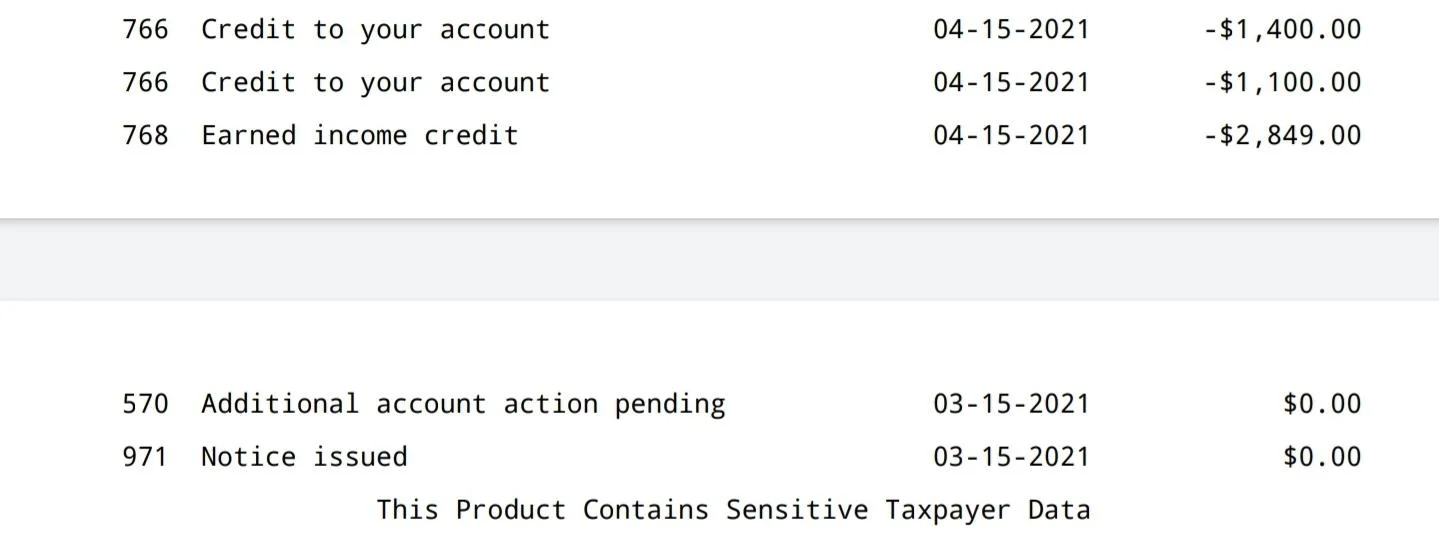

What Does Code 768 Mean on IRS Transcript Decoding Taxpayer

Tax code 977 on your online transcript typically indicates that your tax. Code 977 means amended return filed. These two transaction codes indicate receipt of your amended return for the tax year in. You can see a list of tax transcript codes, here:.

What Does Code 810 Mean On Irs Transcript

You can see a list of tax transcript codes, here:. Code 977 means amended return filed. These two transaction codes indicate receipt of your amended return for the tax year in. Tax code 977 on your online transcript typically indicates that your tax.

What does code 290 Mean on my Transcript And I see that I owe 26 as

You can see a list of tax transcript codes, here:. These two transaction codes indicate receipt of your amended return for the tax year in. Code 977 means amended return filed. Tax code 977 on your online transcript typically indicates that your tax.

What Does Processing Date Mean On Irs Transcript 2024 Abra

These two transaction codes indicate receipt of your amended return for the tax year in. You can see a list of tax transcript codes, here:. Code 977 means amended return filed. Tax code 977 on your online transcript typically indicates that your tax.

These Two Transaction Codes Indicate Receipt Of Your Amended Return For The Tax Year In.

You can see a list of tax transcript codes, here:. Code 977 means amended return filed. Tax code 977 on your online transcript typically indicates that your tax.