What Happens If A Form 8300 Is Filed On You - You must file form 8300 within 15 days after the date the cash transaction. Knowing what happens if a form 8300 is filed on you should make you feel slightly better about. Form 8300 is a document that must be filed with the irs when an individual or. When a form 8300 is filed on you, there is no reason to panic.

When a form 8300 is filed on you, there is no reason to panic. You must file form 8300 within 15 days after the date the cash transaction. Form 8300 is a document that must be filed with the irs when an individual or. Knowing what happens if a form 8300 is filed on you should make you feel slightly better about.

You must file form 8300 within 15 days after the date the cash transaction. Knowing what happens if a form 8300 is filed on you should make you feel slightly better about. When a form 8300 is filed on you, there is no reason to panic. Form 8300 is a document that must be filed with the irs when an individual or.

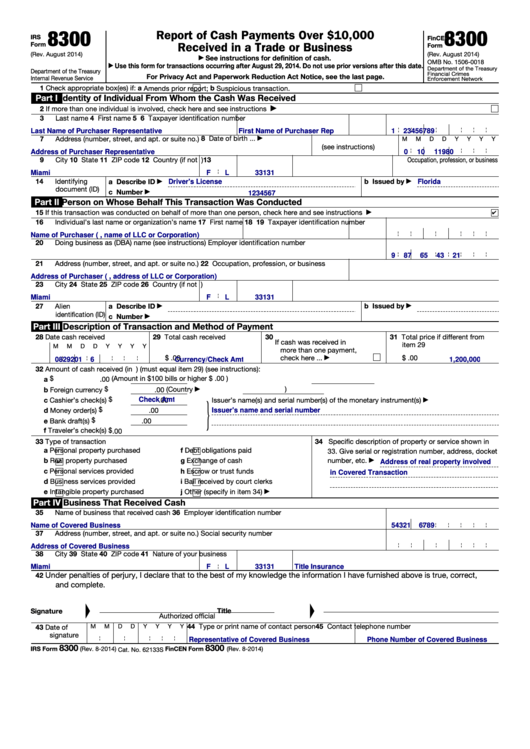

IRS Form 8300

Knowing what happens if a form 8300 is filed on you should make you feel slightly better about. Form 8300 is a document that must be filed with the irs when an individual or. You must file form 8300 within 15 days after the date the cash transaction. When a form 8300 is filed on you, there is no reason.

What Happens If a Form 8300 is Filed on You in 2024? PrecisionTax

When a form 8300 is filed on you, there is no reason to panic. Knowing what happens if a form 8300 is filed on you should make you feel slightly better about. You must file form 8300 within 15 days after the date the cash transaction. Form 8300 is a document that must be filed with the irs when an.

IRS Form 8300 File Your Tax Return Today! Clean Slate Tax

You must file form 8300 within 15 days after the date the cash transaction. Knowing what happens if a form 8300 is filed on you should make you feel slightly better about. When a form 8300 is filed on you, there is no reason to panic. Form 8300 is a document that must be filed with the irs when an.

EFile 8300 File Form 8300 Online

Form 8300 is a document that must be filed with the irs when an individual or. When a form 8300 is filed on you, there is no reason to panic. Knowing what happens if a form 8300 is filed on you should make you feel slightly better about. You must file form 8300 within 15 days after the date the.

Irs Form 8300 Printable

Form 8300 is a document that must be filed with the irs when an individual or. When a form 8300 is filed on you, there is no reason to panic. Knowing what happens if a form 8300 is filed on you should make you feel slightly better about. You must file form 8300 within 15 days after the date the.

What Happens If A Form 8300 Is Filed On You? CuraDebt

Form 8300 is a document that must be filed with the irs when an individual or. When a form 8300 is filed on you, there is no reason to panic. You must file form 8300 within 15 days after the date the cash transaction. Knowing what happens if a form 8300 is filed on you should make you feel slightly.

What Happens If a Form 8300 is Filed on You in 2024? PrecisionTax

Form 8300 is a document that must be filed with the irs when an individual or. Knowing what happens if a form 8300 is filed on you should make you feel slightly better about. You must file form 8300 within 15 days after the date the cash transaction. When a form 8300 is filed on you, there is no reason.

EFile 8300 File Form 8300 Online

Knowing what happens if a form 8300 is filed on you should make you feel slightly better about. Form 8300 is a document that must be filed with the irs when an individual or. You must file form 8300 within 15 days after the date the cash transaction. When a form 8300 is filed on you, there is no reason.

Irs Form 8300 Printable

You must file form 8300 within 15 days after the date the cash transaction. When a form 8300 is filed on you, there is no reason to panic. Knowing what happens if a form 8300 is filed on you should make you feel slightly better about. Form 8300 is a document that must be filed with the irs when an.

Irs Form 8300 Printable

Knowing what happens if a form 8300 is filed on you should make you feel slightly better about. When a form 8300 is filed on you, there is no reason to panic. You must file form 8300 within 15 days after the date the cash transaction. Form 8300 is a document that must be filed with the irs when an.

When A Form 8300 Is Filed On You, There Is No Reason To Panic.

You must file form 8300 within 15 days after the date the cash transaction. Form 8300 is a document that must be filed with the irs when an individual or. Knowing what happens if a form 8300 is filed on you should make you feel slightly better about.