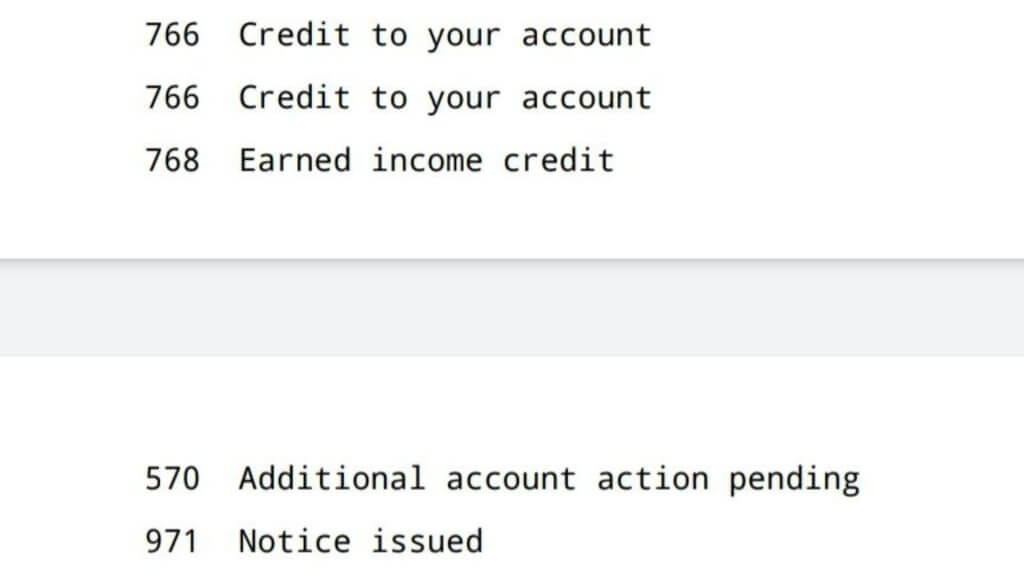

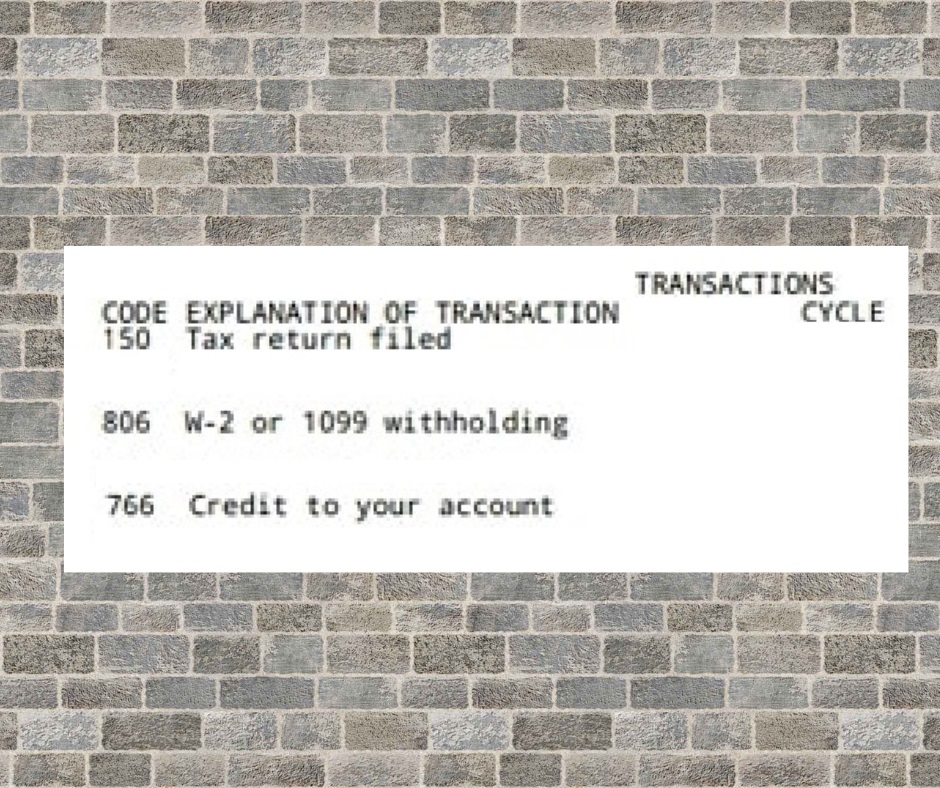

What Is Irs Code 766 - An irs code 766 on your account means that you have received a credit on your account from the irs. What is irs code 766? When an irs code 766 appears on your 2021 or 2022 tax transcript, that means there is a tax credit on your account from the irs, which is good. Irs transaction code 766 on your tax transcript signifies a credit to your account. This usually means the irs has applied a refundable credit.

This usually means the irs has applied a refundable credit. An irs code 766 on your account means that you have received a credit on your account from the irs. Irs transaction code 766 on your tax transcript signifies a credit to your account. When an irs code 766 appears on your 2021 or 2022 tax transcript, that means there is a tax credit on your account from the irs, which is good. What is irs code 766?

When an irs code 766 appears on your 2021 or 2022 tax transcript, that means there is a tax credit on your account from the irs, which is good. An irs code 766 on your account means that you have received a credit on your account from the irs. What is irs code 766? Irs transaction code 766 on your tax transcript signifies a credit to your account. This usually means the irs has applied a refundable credit.

What does IRS Code 766 credit to your account mean? Leia aqui What

An irs code 766 on your account means that you have received a credit on your account from the irs. Irs transaction code 766 on your tax transcript signifies a credit to your account. This usually means the irs has applied a refundable credit. When an irs code 766 appears on your 2021 or 2022 tax transcript, that means there.

Help! Code 766, 767, 290, 971!! r/IRS

This usually means the irs has applied a refundable credit. When an irs code 766 appears on your 2021 or 2022 tax transcript, that means there is a tax credit on your account from the irs, which is good. An irs code 766 on your account means that you have received a credit on your account from the irs. Irs.

IRS Code 766

When an irs code 766 appears on your 2021 or 2022 tax transcript, that means there is a tax credit on your account from the irs, which is good. This usually means the irs has applied a refundable credit. What is irs code 766? An irs code 766 on your account means that you have received a credit on your.

IRS Transcript Code 766 Understanding the Credit to Your Account ⋆

Irs transaction code 766 on your tax transcript signifies a credit to your account. This usually means the irs has applied a refundable credit. When an irs code 766 appears on your 2021 or 2022 tax transcript, that means there is a tax credit on your account from the irs, which is good. An irs code 766 on your account.

The IRS Code 766 What Does it Mean on IRS Transcript?

An irs code 766 on your account means that you have received a credit on your account from the irs. Irs transaction code 766 on your tax transcript signifies a credit to your account. What is irs code 766? This usually means the irs has applied a refundable credit. When an irs code 766 appears on your 2021 or 2022.

What does code 766 mean on IRS transcript?

When an irs code 766 appears on your 2021 or 2022 tax transcript, that means there is a tax credit on your account from the irs, which is good. Irs transaction code 766 on your tax transcript signifies a credit to your account. This usually means the irs has applied a refundable credit. What is irs code 766? An irs.

IRS Code 766 All You Need to Know in 2024 + FAQs

An irs code 766 on your account means that you have received a credit on your account from the irs. What is irs code 766? When an irs code 766 appears on your 2021 or 2022 tax transcript, that means there is a tax credit on your account from the irs, which is good. This usually means the irs has.

What Does IRS Code 766 Mean?

What is irs code 766? This usually means the irs has applied a refundable credit. Irs transaction code 766 on your tax transcript signifies a credit to your account. An irs code 766 on your account means that you have received a credit on your account from the irs. When an irs code 766 appears on your 2021 or 2022.

What Does Code 766 and 768 Mean on IRS Transcript? Calm CFO

What is irs code 766? This usually means the irs has applied a refundable credit. Irs transaction code 766 on your tax transcript signifies a credit to your account. An irs code 766 on your account means that you have received a credit on your account from the irs. When an irs code 766 appears on your 2021 or 2022.

What Is Code 766 on an IRS Transcript?

An irs code 766 on your account means that you have received a credit on your account from the irs. Irs transaction code 766 on your tax transcript signifies a credit to your account. This usually means the irs has applied a refundable credit. When an irs code 766 appears on your 2021 or 2022 tax transcript, that means there.

An Irs Code 766 On Your Account Means That You Have Received A Credit On Your Account From The Irs.

Irs transaction code 766 on your tax transcript signifies a credit to your account. This usually means the irs has applied a refundable credit. When an irs code 766 appears on your 2021 or 2022 tax transcript, that means there is a tax credit on your account from the irs, which is good. What is irs code 766?