What Is The Difference Between 1231 And 1245 Property - What’s the difference between section 1231 and section 1245 property? All property used in a trade or business is considered section 1231 property and, for taxation purposes, either section 1245 or. All property used in a trade or business is considered section 1231 property and, for taxation purposes, either section 1245 or. In a nutshell, sections 1231, 1245, and 1250 of the internal revenue code spell out whether a gain or loss on the sale of business. Plainly stated, both refer to different sections of the.

What’s the difference between section 1231 and section 1245 property? All property used in a trade or business is considered section 1231 property and, for taxation purposes, either section 1245 or. All property used in a trade or business is considered section 1231 property and, for taxation purposes, either section 1245 or. Plainly stated, both refer to different sections of the. In a nutshell, sections 1231, 1245, and 1250 of the internal revenue code spell out whether a gain or loss on the sale of business.

All property used in a trade or business is considered section 1231 property and, for taxation purposes, either section 1245 or. Plainly stated, both refer to different sections of the. What’s the difference between section 1231 and section 1245 property? In a nutshell, sections 1231, 1245, and 1250 of the internal revenue code spell out whether a gain or loss on the sale of business. All property used in a trade or business is considered section 1231 property and, for taxation purposes, either section 1245 or.

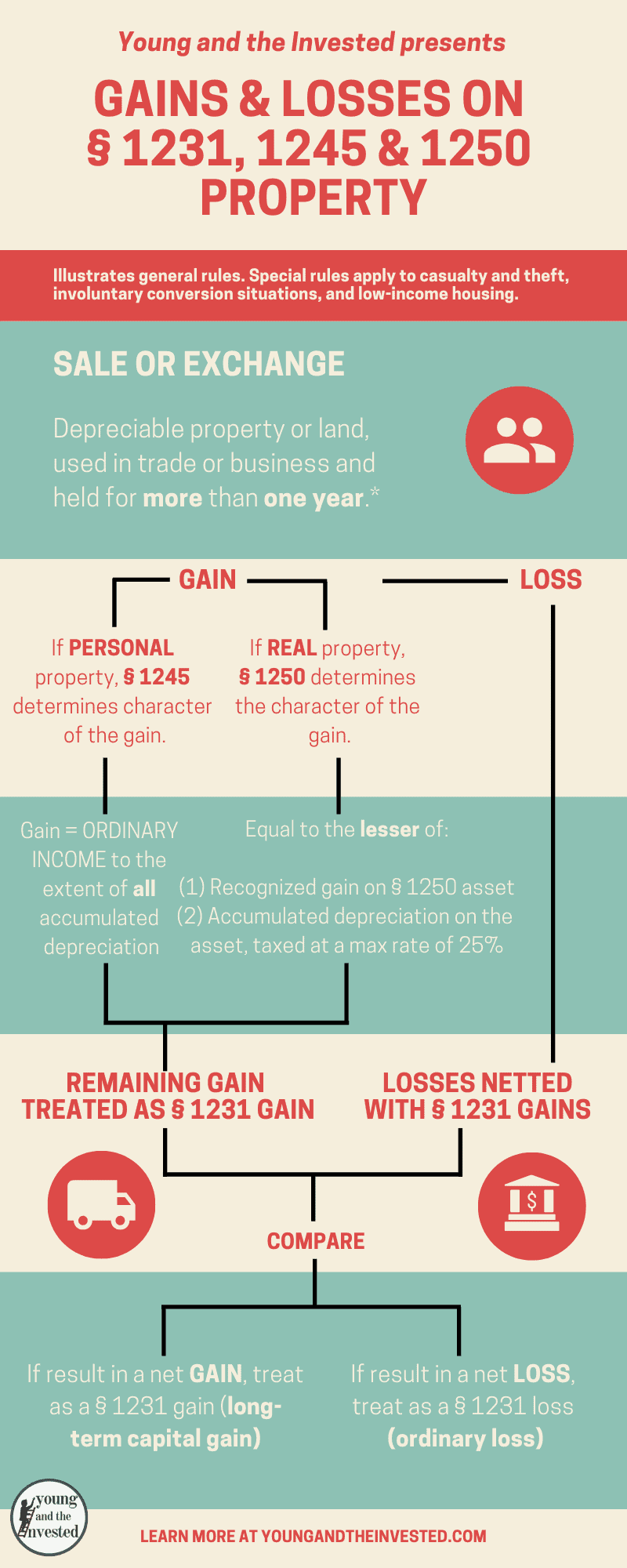

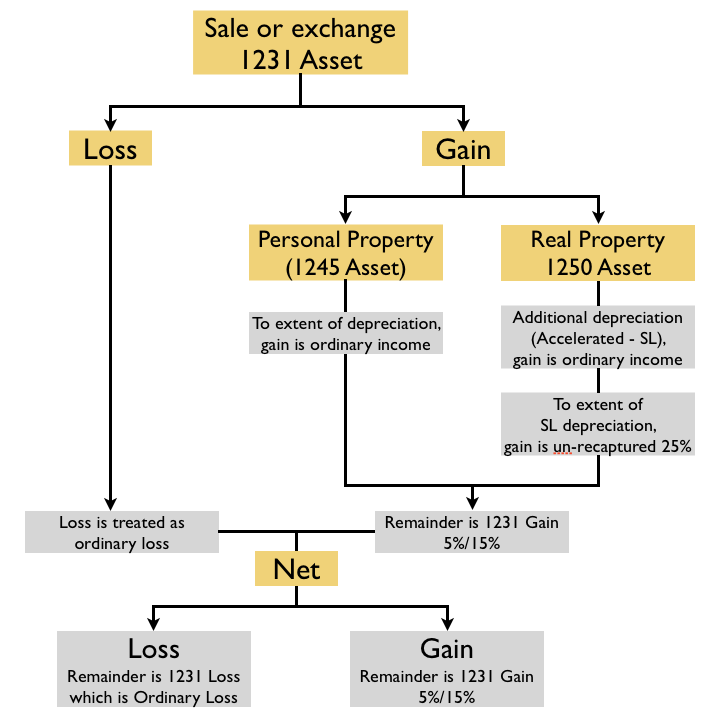

Capital Gains and Losses + Sections 1231, 1245 and 1250

What’s the difference between section 1231 and section 1245 property? All property used in a trade or business is considered section 1231 property and, for taxation purposes, either section 1245 or. All property used in a trade or business is considered section 1231 property and, for taxation purposes, either section 1245 or. In a nutshell, sections 1231, 1245, and 1250.

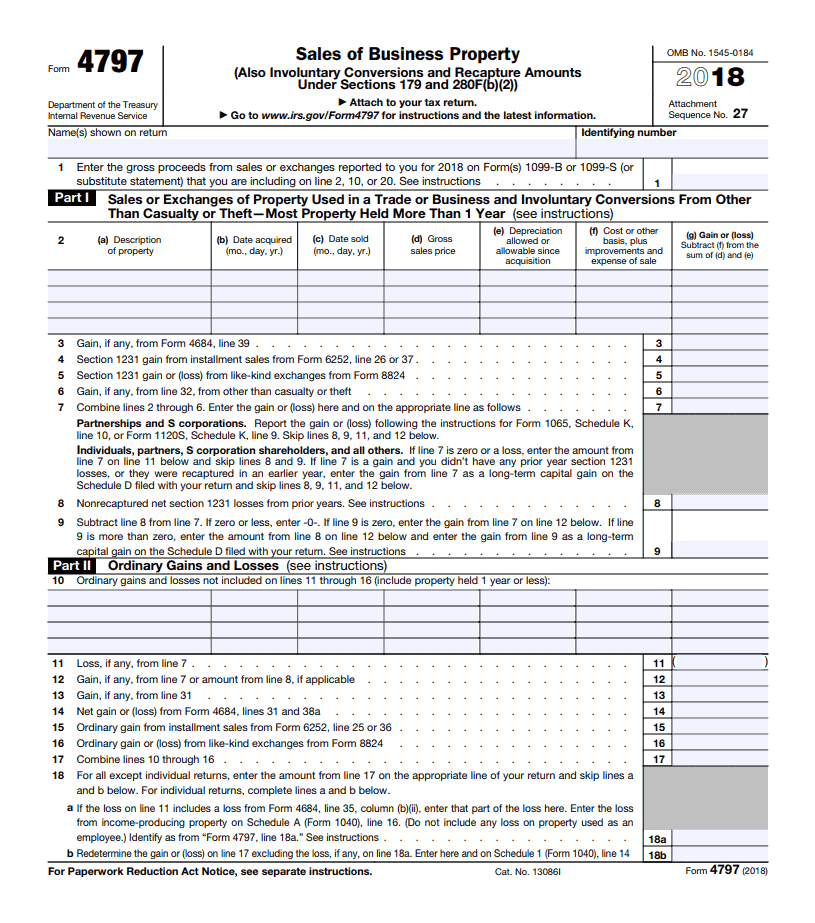

Section 1231 vs. 1245 vs. 1250 Sales of Business Property

All property used in a trade or business is considered section 1231 property and, for taxation purposes, either section 1245 or. What’s the difference between section 1231 and section 1245 property? In a nutshell, sections 1231, 1245, and 1250 of the internal revenue code spell out whether a gain or loss on the sale of business. Plainly stated, both refer.

Section 1231 1245 1250 Property College Aftermath

All property used in a trade or business is considered section 1231 property and, for taxation purposes, either section 1245 or. Plainly stated, both refer to different sections of the. What’s the difference between section 1231 and section 1245 property? All property used in a trade or business is considered section 1231 property and, for taxation purposes, either section 1245.

What is the difference between 1245, 1231, and 1250 properties?

What’s the difference between section 1231 and section 1245 property? In a nutshell, sections 1231, 1245, and 1250 of the internal revenue code spell out whether a gain or loss on the sale of business. All property used in a trade or business is considered section 1231 property and, for taxation purposes, either section 1245 or. Plainly stated, both refer.

Section 1231 vs. 1245 vs. 1250 Sales of Business Property

All property used in a trade or business is considered section 1231 property and, for taxation purposes, either section 1245 or. In a nutshell, sections 1231, 1245, and 1250 of the internal revenue code spell out whether a gain or loss on the sale of business. All property used in a trade or business is considered section 1231 property and,.

What is the difference between 1245, 1231, and 1250 properties?

In a nutshell, sections 1231, 1245, and 1250 of the internal revenue code spell out whether a gain or loss on the sale of business. All property used in a trade or business is considered section 1231 property and, for taxation purposes, either section 1245 or. All property used in a trade or business is considered section 1231 property and,.

What is the difference between 1245, 1231, and 1250 properties?

Plainly stated, both refer to different sections of the. In a nutshell, sections 1231, 1245, and 1250 of the internal revenue code spell out whether a gain or loss on the sale of business. All property used in a trade or business is considered section 1231 property and, for taxation purposes, either section 1245 or. What’s the difference between section.

What is the difference between 1245, 1231, and 1250 properties?

In a nutshell, sections 1231, 1245, and 1250 of the internal revenue code spell out whether a gain or loss on the sale of business. What’s the difference between section 1231 and section 1245 property? All property used in a trade or business is considered section 1231 property and, for taxation purposes, either section 1245 or. Plainly stated, both refer.

1231 1245 1250 property chart section 1245 vs 1250 G4G5

What’s the difference between section 1231 and section 1245 property? Plainly stated, both refer to different sections of the. All property used in a trade or business is considered section 1231 property and, for taxation purposes, either section 1245 or. All property used in a trade or business is considered section 1231 property and, for taxation purposes, either section 1245.

Section 1231 vs. 1245 vs. 1250 Sales of Business Property

In a nutshell, sections 1231, 1245, and 1250 of the internal revenue code spell out whether a gain or loss on the sale of business. All property used in a trade or business is considered section 1231 property and, for taxation purposes, either section 1245 or. Plainly stated, both refer to different sections of the. All property used in a.

In A Nutshell, Sections 1231, 1245, And 1250 Of The Internal Revenue Code Spell Out Whether A Gain Or Loss On The Sale Of Business.

All property used in a trade or business is considered section 1231 property and, for taxation purposes, either section 1245 or. Plainly stated, both refer to different sections of the. What’s the difference between section 1231 and section 1245 property? All property used in a trade or business is considered section 1231 property and, for taxation purposes, either section 1245 or.