What Is The Sales Tax In San Diego California - 547 rows for a list of your current and historical rates, go to the california city & county sales & use tax rates webpage. Click for sales tax rates, san diego sales tax calculator, and printable sales tax table. The minimum combined 2025 sales tax rate for san diego, california is 7.75%. The current sales tax rate in san diego county, ca is 8.75%. This is the total of state, county, and city sales tax rates. The statewide state sales tax rate in california is 7.25%, but since the county district tax sp is 0.5%, the. The 7.75% sales tax rate in san diego consists of 6% california state sales tax, 0.25% san diego county sales tax and 1.5% special tax. 72 rows california has a 6% sales tax and san diego county collects an additional 0.25%, so the minimum sales tax rate in san diego county is. The san diego county, california sales tax is 7.75%, consisting of 6.00% california state sales tax and 1.75% san diego county local sales. Click for sales tax rates, san diego county sales tax calculator, and printable sales.

Click for sales tax rates, san diego county sales tax calculator, and printable sales. Click for sales tax rates, san diego sales tax calculator, and printable sales tax table. 547 rows for a list of your current and historical rates, go to the california city & county sales & use tax rates webpage. What is the sales tax in san diego? This is the total of state, county, and city sales tax rates. The san diego county, california sales tax is 7.75%, consisting of 6.00% california state sales tax and 1.75% san diego county local sales. The current sales tax rate in san diego county, ca is 8.75%. The current sales tax rate in san diego, ca is 7.75%. The minimum combined 2025 sales tax rate for san diego, california is 7.75%. The 7.75% sales tax rate in san diego consists of 6% california state sales tax, 0.25% san diego county sales tax and 1.5% special tax.

Click for sales tax rates, san diego county sales tax calculator, and printable sales. Click for sales tax rates, san diego sales tax calculator, and printable sales tax table. What is the sales tax in san diego? The 7.75% sales tax rate in san diego consists of 6% california state sales tax, 0.25% san diego county sales tax and 1.5% special tax. 72 rows california has a 6% sales tax and san diego county collects an additional 0.25%, so the minimum sales tax rate in san diego county is. The san diego county, california sales tax is 7.75%, consisting of 6.00% california state sales tax and 1.75% san diego county local sales. The minimum combined 2025 sales tax rate for san diego, california is 7.75%. 547 rows for a list of your current and historical rates, go to the california city & county sales & use tax rates webpage. This is the total of state, county, and city sales tax rates. The statewide state sales tax rate in california is 7.25%, but since the county district tax sp is 0.5%, the.

Everything You Need To Know About San Diego Sales Tax Salestaxcel

72 rows california has a 6% sales tax and san diego county collects an additional 0.25%, so the minimum sales tax rate in san diego county is. The san diego county, california sales tax is 7.75%, consisting of 6.00% california state sales tax and 1.75% san diego county local sales. The statewide state sales tax rate in california is 7.25%,.

San Diego Sales Tax 2024 Marga Salaidh

547 rows for a list of your current and historical rates, go to the california city & county sales & use tax rates webpage. What is the sales tax in san diego? This is the total of state, county, and city sales tax rates. The current sales tax rate in san diego, ca is 7.75%. 72 rows california has a.

San Diego Sales Tax 2024 Marga Salaidh

The statewide state sales tax rate in california is 7.25%, but since the county district tax sp is 0.5%, the. The minimum combined 2025 sales tax rate for san diego, california is 7.75%. 547 rows for a list of your current and historical rates, go to the california city & county sales & use tax rates webpage. The current sales.

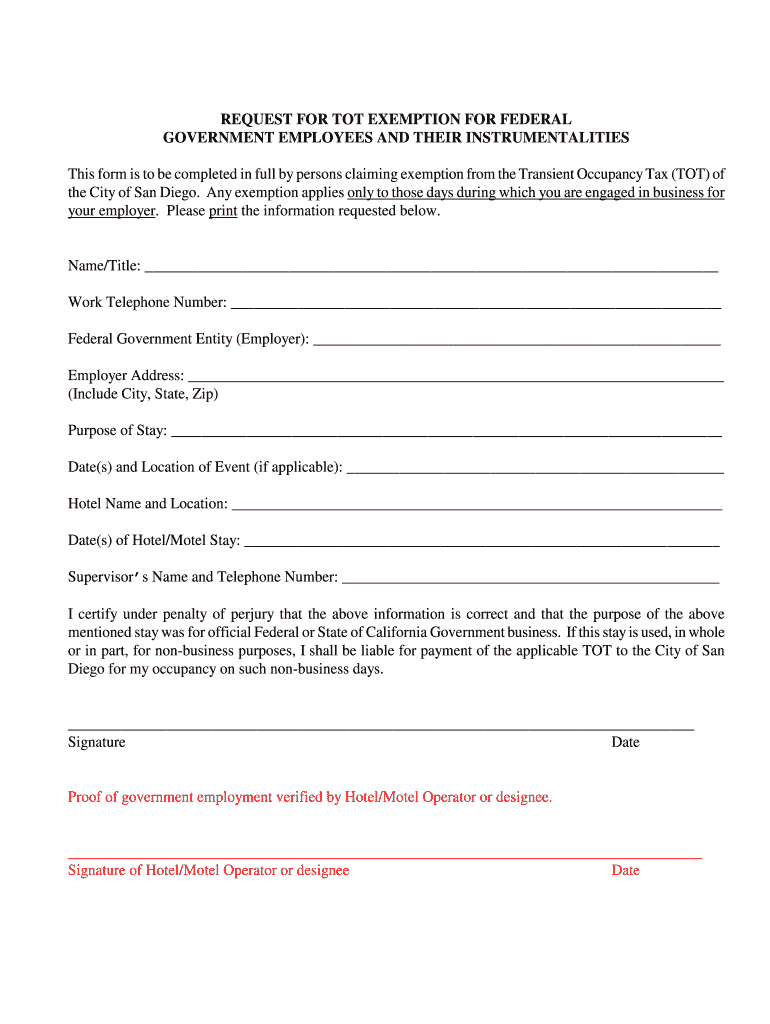

HomeOwners Exemption Form Homeowner Property Tax San Diego County

Click for sales tax rates, san diego sales tax calculator, and printable sales tax table. The 7.75% sales tax rate in san diego consists of 6% california state sales tax, 0.25% san diego county sales tax and 1.5% special tax. The current sales tax rate in san diego, ca is 7.75%. The statewide state sales tax rate in california is.

San Diego Sales Tax Rate 2024 Jody Rosina

Click for sales tax rates, san diego county sales tax calculator, and printable sales. 72 rows california has a 6% sales tax and san diego county collects an additional 0.25%, so the minimum sales tax rate in san diego county is. The statewide state sales tax rate in california is 7.25%, but since the county district tax sp is 0.5%,.

San Diego Sales Tax Rate 2024 Jody Rosina

The minimum combined 2025 sales tax rate for san diego, california is 7.75%. Click for sales tax rates, san diego sales tax calculator, and printable sales tax table. What is the sales tax in san diego? The current sales tax rate in san diego, ca is 7.75%. Click for sales tax rates, san diego county sales tax calculator, and printable.

San Diego Sales Tax Rate 2024 Jody Rosina

The current sales tax rate in san diego, ca is 7.75%. Click for sales tax rates, san diego sales tax calculator, and printable sales tax table. 547 rows for a list of your current and historical rates, go to the california city & county sales & use tax rates webpage. The minimum combined 2025 sales tax rate for san diego,.

California Sales Tax Guide for Businesses

The san diego county, california sales tax is 7.75%, consisting of 6.00% california state sales tax and 1.75% san diego county local sales. Click for sales tax rates, san diego county sales tax calculator, and printable sales. The current sales tax rate in san diego county, ca is 8.75%. 547 rows for a list of your current and historical rates,.

San Diego Ca Sales Tax 2024 Tami Phylys

The 7.75% sales tax rate in san diego consists of 6% california state sales tax, 0.25% san diego county sales tax and 1.5% special tax. The current sales tax rate in san diego, ca is 7.75%. 72 rows california has a 6% sales tax and san diego county collects an additional 0.25%, so the minimum sales tax rate in san.

Sales Tax San Jose, California Regulations and Guidelines

Click for sales tax rates, san diego sales tax calculator, and printable sales tax table. The minimum combined 2025 sales tax rate for san diego, california is 7.75%. The current sales tax rate in san diego, ca is 7.75%. The san diego county, california sales tax is 7.75%, consisting of 6.00% california state sales tax and 1.75% san diego county.

547 Rows For A List Of Your Current And Historical Rates, Go To The California City & County Sales & Use Tax Rates Webpage.

The minimum combined 2025 sales tax rate for san diego, california is 7.75%. The 7.75% sales tax rate in san diego consists of 6% california state sales tax, 0.25% san diego county sales tax and 1.5% special tax. What is the sales tax in san diego? The statewide state sales tax rate in california is 7.25%, but since the county district tax sp is 0.5%, the.

Click For Sales Tax Rates, San Diego County Sales Tax Calculator, And Printable Sales.

The current sales tax rate in san diego, ca is 7.75%. The current sales tax rate in san diego county, ca is 8.75%. 72 rows california has a 6% sales tax and san diego county collects an additional 0.25%, so the minimum sales tax rate in san diego county is. Click for sales tax rates, san diego sales tax calculator, and printable sales tax table.

The San Diego County, California Sales Tax Is 7.75%, Consisting Of 6.00% California State Sales Tax And 1.75% San Diego County Local Sales.

This is the total of state, county, and city sales tax rates.