What Should I Claim On My W4 If Single With No Child - Claim zero for the maximum amount withheld, one if you are single with one job. If you are single and do not have any children, as well as don’t have anyone else claiming you as a dependent, then you should claim a maximum of 1.

Claim zero for the maximum amount withheld, one if you are single with one job. If you are single and do not have any children, as well as don’t have anyone else claiming you as a dependent, then you should claim a maximum of 1.

Claim zero for the maximum amount withheld, one if you are single with one job. If you are single and do not have any children, as well as don’t have anyone else claiming you as a dependent, then you should claim a maximum of 1.

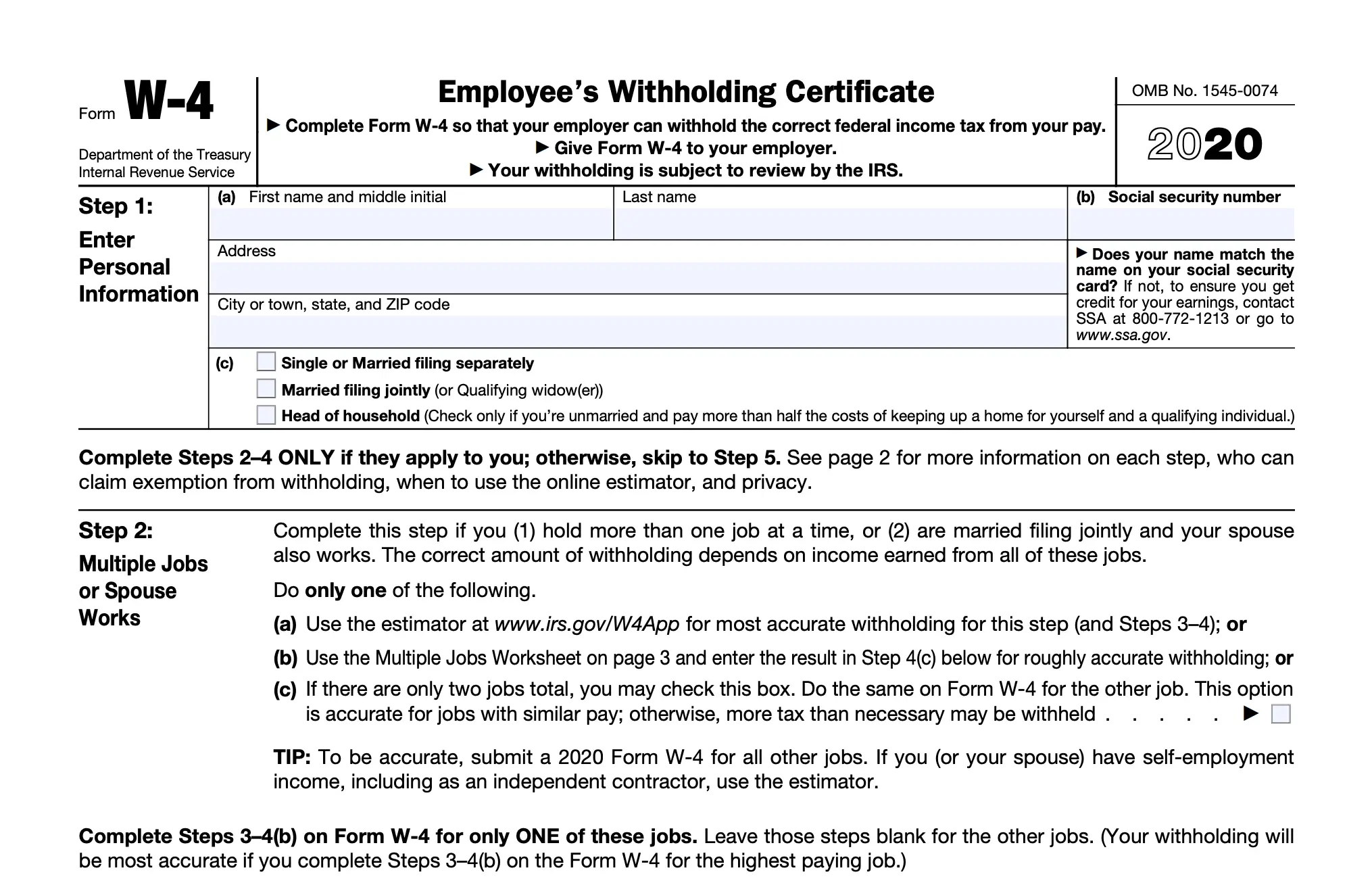

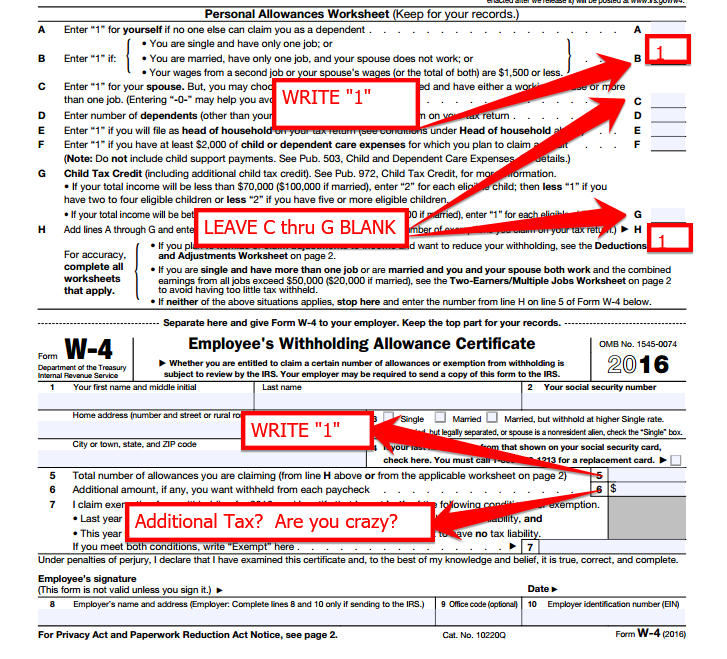

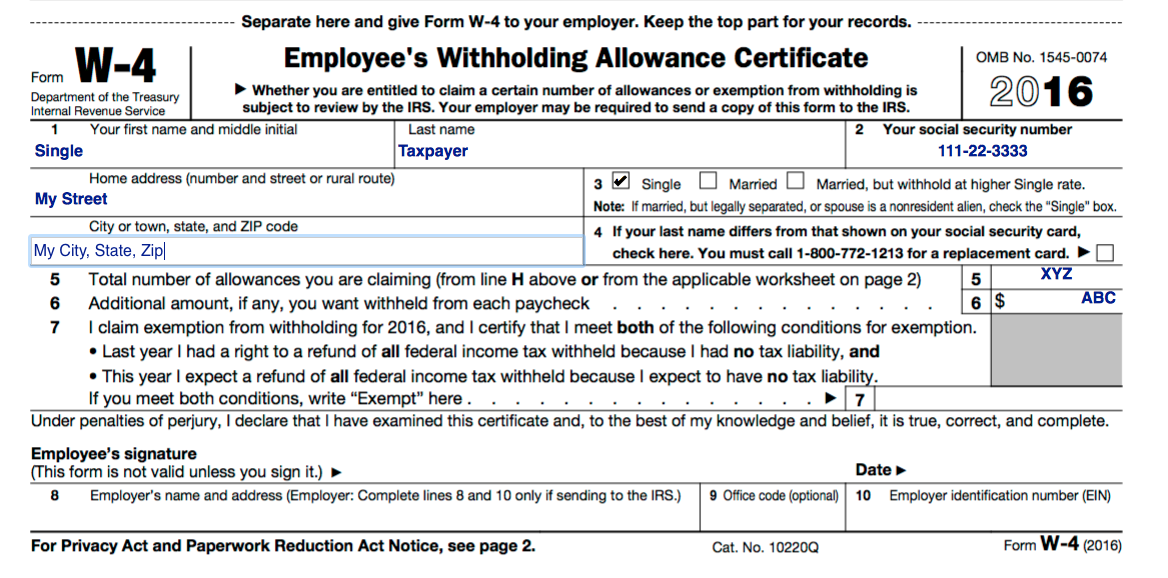

how to claim single zero on w4 Astar Tutorial

Claim zero for the maximum amount withheld, one if you are single with one job. If you are single and do not have any children, as well as don’t have anyone else claiming you as a dependent, then you should claim a maximum of 1.

W4 Form 2024 Single No Dependents Reena Simona

If you are single and do not have any children, as well as don’t have anyone else claiming you as a dependent, then you should claim a maximum of 1. Claim zero for the maximum amount withheld, one if you are single with one job.

How To Fill Out 2024 W4 Single No Dependents Meris Malissa

Claim zero for the maximum amount withheld, one if you are single with one job. If you are single and do not have any children, as well as don’t have anyone else claiming you as a dependent, then you should claim a maximum of 1.

Is it better to claim 0 or 1 on W4 if married? Leia aqui What is the

Claim zero for the maximum amount withheld, one if you are single with one job. If you are single and do not have any children, as well as don’t have anyone else claiming you as a dependent, then you should claim a maximum of 1.

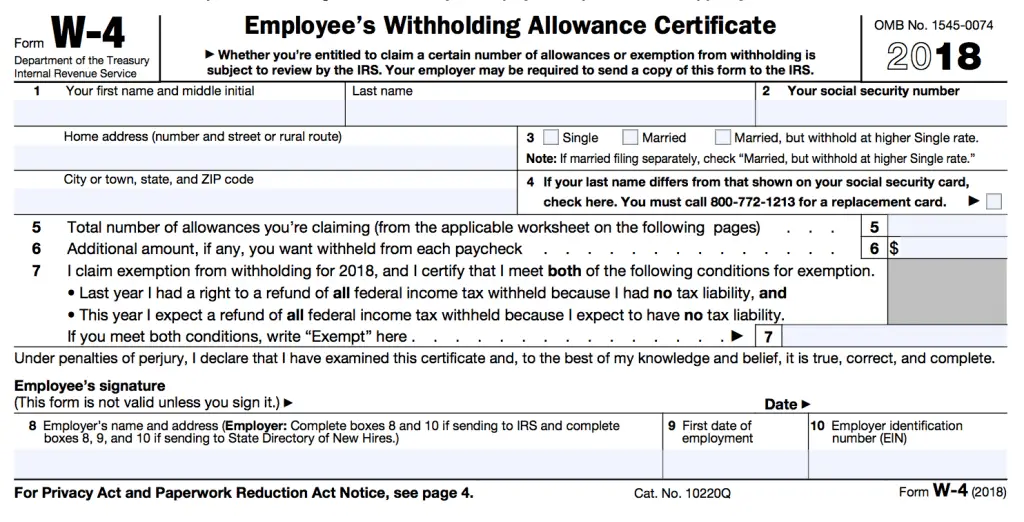

W14 Form Single No Dependents W14 Form Single No Dependents Will Be A

Claim zero for the maximum amount withheld, one if you are single with one job. If you are single and do not have any children, as well as don’t have anyone else claiming you as a dependent, then you should claim a maximum of 1.

IRS Form W4 2021 Single One Job No Dependents Irs forms, One job, Irs

Claim zero for the maximum amount withheld, one if you are single with one job. If you are single and do not have any children, as well as don’t have anyone else claiming you as a dependent, then you should claim a maximum of 1.

how to claim single zero on w4 Astar Tutorial

Claim zero for the maximum amount withheld, one if you are single with one job. If you are single and do not have any children, as well as don’t have anyone else claiming you as a dependent, then you should claim a maximum of 1.

How Do I Claim Exempt On W4 2024 Nicol Anabelle

Claim zero for the maximum amount withheld, one if you are single with one job. If you are single and do not have any children, as well as don’t have anyone else claiming you as a dependent, then you should claim a maximum of 1.

How To Fill Out 2024 W4 Single No Dependents Meris Malissa

Claim zero for the maximum amount withheld, one if you are single with one job. If you are single and do not have any children, as well as don’t have anyone else claiming you as a dependent, then you should claim a maximum of 1.

Claim Zero For The Maximum Amount Withheld, One If You Are Single With One Job.

If you are single and do not have any children, as well as don’t have anyone else claiming you as a dependent, then you should claim a maximum of 1.