What Were Q4 Profits For 2018 Of Bip - Our operating groups contributed ffo of $576 million, compared to $610 million for the prior year,. Our business generated ffo of $1.23 billion during 2018, or $3.11 per unit, which represents a 5% increase over the prior year. • deployed ~$800 million in growth capital expenditures in 2018, predominantly in our utilities segment to increase rate base and in. Today’s (march 28, 2019) gdp release (q4 2018,third estimate) was accompanied by the bureau of economic analysis (bea) corporate. Underlying replacement cost profit for full year 2018 was $12.7 billion, more than double that reported for 2017. The fourth quarter result was. So, all that to say that the run rate going forward for the business should be at 10% to 15% higher than where we are at today in q4 of. Results in our utilities segments were solid. Equity correction finally emerged in q4, as the s&p 500 index fell by nearly 14%. Q4 quick summary • the overdue u.s.

Equity correction finally emerged in q4, as the s&p 500 index fell by nearly 14%. Q4 quick summary • the overdue u.s. Our operating groups contributed ffo of $576 million, compared to $610 million for the prior year,. • deployed ~$800 million in growth capital expenditures in 2018, predominantly in our utilities segment to increase rate base and in. Underlying replacement cost profit for full year 2018 was $12.7 billion, more than double that reported for 2017. Our business generated ffo of $1.23 billion during 2018, or $3.11 per unit, which represents a 5% increase over the prior year. The fourth quarter result was. Today’s (march 28, 2019) gdp release (q4 2018,third estimate) was accompanied by the bureau of economic analysis (bea) corporate. Results in our utilities segments were solid. So, all that to say that the run rate going forward for the business should be at 10% to 15% higher than where we are at today in q4 of.

Our business generated ffo of $1.23 billion during 2018, or $3.11 per unit, which represents a 5% increase over the prior year. Our operating groups contributed ffo of $576 million, compared to $610 million for the prior year,. Today’s (march 28, 2019) gdp release (q4 2018,third estimate) was accompanied by the bureau of economic analysis (bea) corporate. The fourth quarter result was. Results in our utilities segments were solid. So, all that to say that the run rate going forward for the business should be at 10% to 15% higher than where we are at today in q4 of. • deployed ~$800 million in growth capital expenditures in 2018, predominantly in our utilities segment to increase rate base and in. Equity correction finally emerged in q4, as the s&p 500 index fell by nearly 14%. Underlying replacement cost profit for full year 2018 was $12.7 billion, more than double that reported for 2017. Q4 quick summary • the overdue u.s.

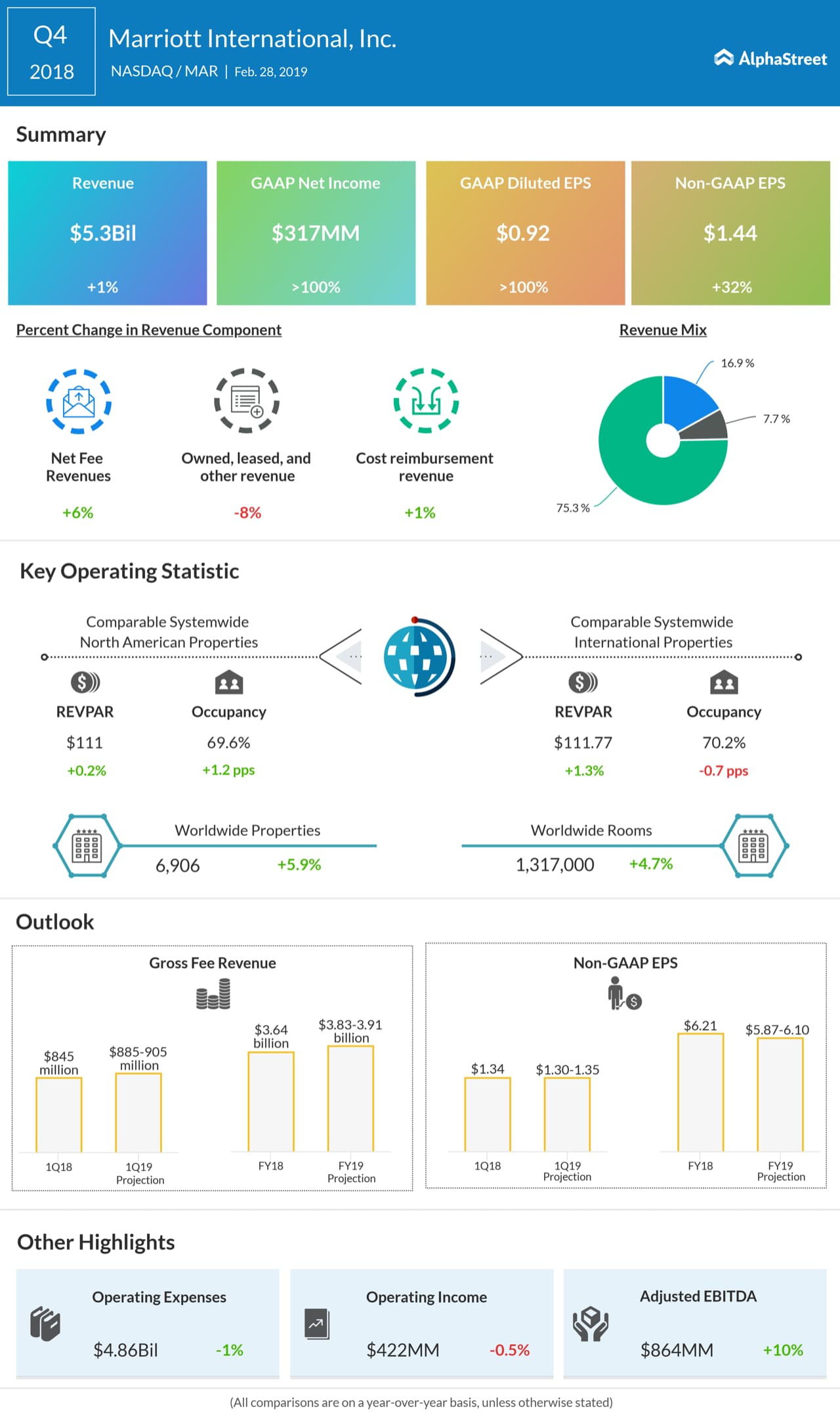

Marriott International Q4 2018 earnings AlphaStreet

The fourth quarter result was. Results in our utilities segments were solid. • deployed ~$800 million in growth capital expenditures in 2018, predominantly in our utilities segment to increase rate base and in. Q4 quick summary • the overdue u.s. Our operating groups contributed ffo of $576 million, compared to $610 million for the prior year,.

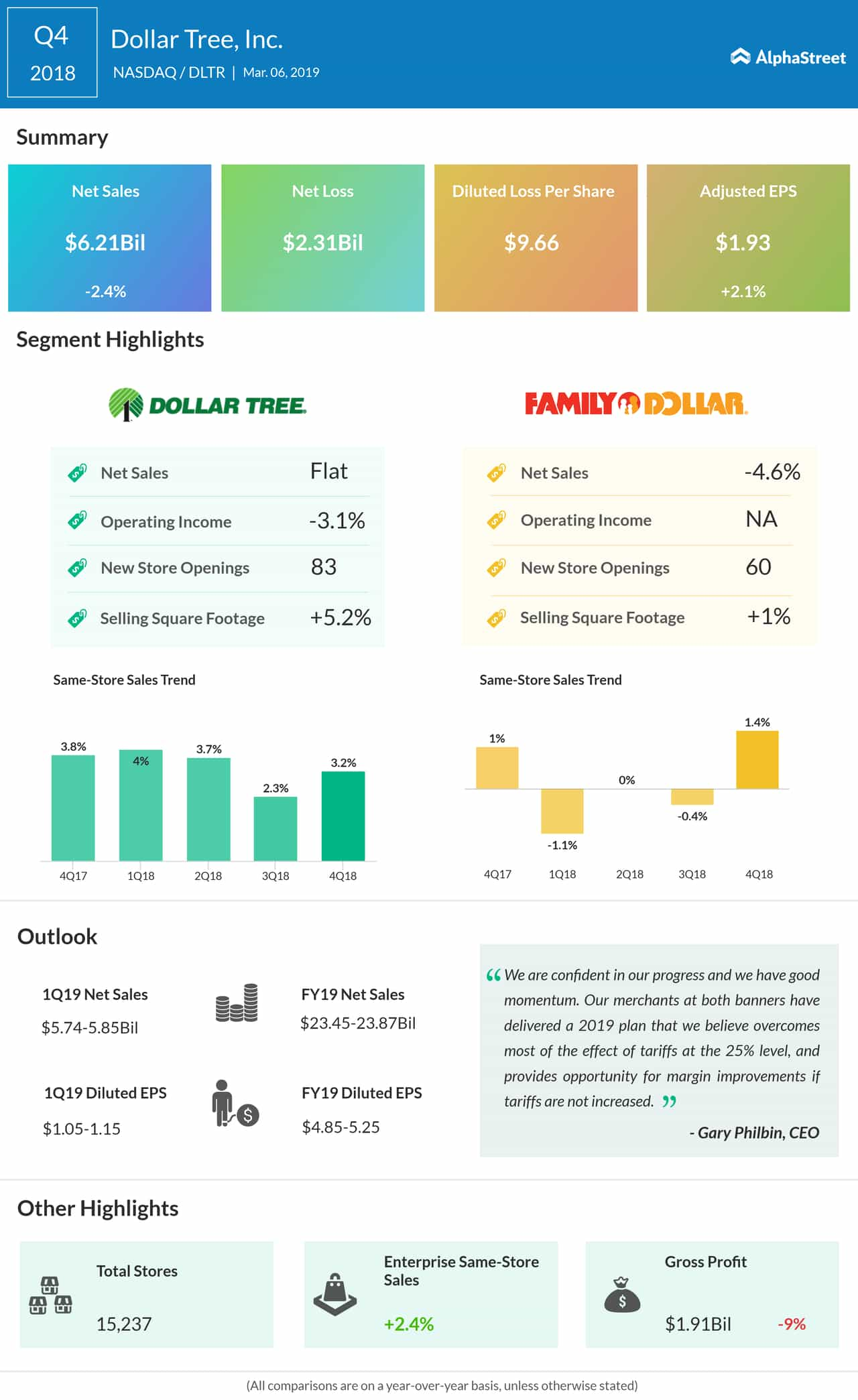

Dollar Tree Q4 2018 earnings AlphaStreet

Q4 quick summary • the overdue u.s. Today’s (march 28, 2019) gdp release (q4 2018,third estimate) was accompanied by the bureau of economic analysis (bea) corporate. • deployed ~$800 million in growth capital expenditures in 2018, predominantly in our utilities segment to increase rate base and in. The fourth quarter result was. Our operating groups contributed ffo of $576 million,.

Tata Steel Q4 profit dips 84 as Europe drags, prices cool Company

Today’s (march 28, 2019) gdp release (q4 2018,third estimate) was accompanied by the bureau of economic analysis (bea) corporate. Underlying replacement cost profit for full year 2018 was $12.7 billion, more than double that reported for 2017. The fourth quarter result was. • deployed ~$800 million in growth capital expenditures in 2018, predominantly in our utilities segment to increase rate.

Q4 2018 BizBuySell Insight Report

Q4 quick summary • the overdue u.s. Our business generated ffo of $1.23 billion during 2018, or $3.11 per unit, which represents a 5% increase over the prior year. • deployed ~$800 million in growth capital expenditures in 2018, predominantly in our utilities segment to increase rate base and in. Underlying replacement cost profit for full year 2018 was $12.7.

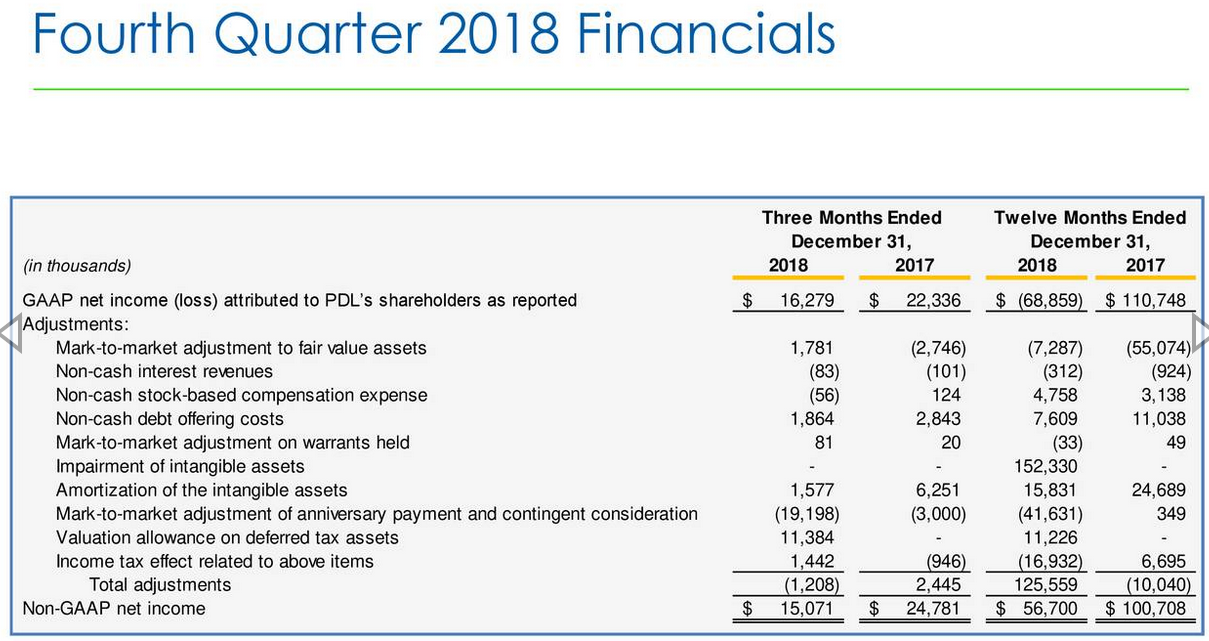

PDL BioPharma Analysis Of Q4 2018 Taking Some Profits Here (NASDAQ

Our business generated ffo of $1.23 billion during 2018, or $3.11 per unit, which represents a 5% increase over the prior year. Results in our utilities segments were solid. So, all that to say that the run rate going forward for the business should be at 10% to 15% higher than where we are at today in q4 of. Our.

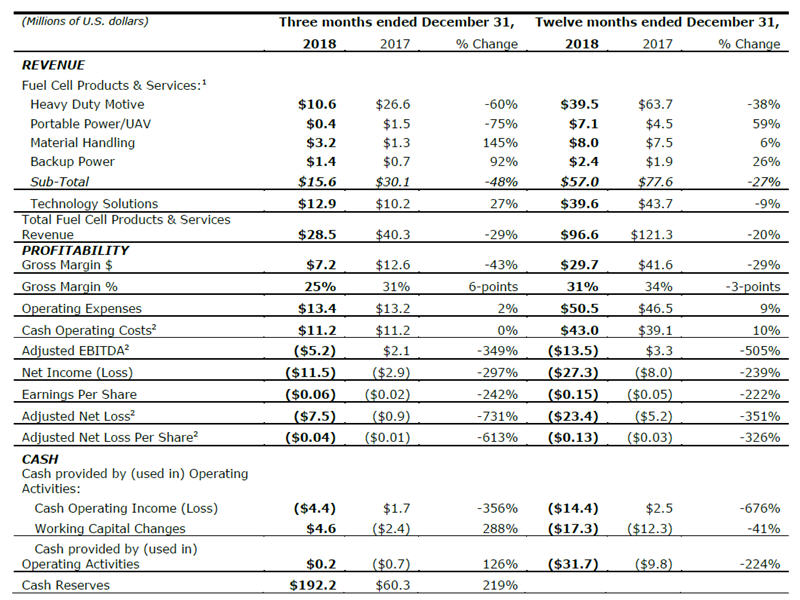

Ballard Reports Q4 and Full Year 2018 Results

Equity correction finally emerged in q4, as the s&p 500 index fell by nearly 14%. • deployed ~$800 million in growth capital expenditures in 2018, predominantly in our utilities segment to increase rate base and in. Results in our utilities segments were solid. So, all that to say that the run rate going forward for the business should be at.

Q4 2018 BizBuySell Insight Report

Equity correction finally emerged in q4, as the s&p 500 index fell by nearly 14%. • deployed ~$800 million in growth capital expenditures in 2018, predominantly in our utilities segment to increase rate base and in. Our operating groups contributed ffo of $576 million, compared to $610 million for the prior year,. Underlying replacement cost profit for full year 2018.

What Were Q4 Profits for 2018 of Iim? Answer] CGAA

• deployed ~$800 million in growth capital expenditures in 2018, predominantly in our utilities segment to increase rate base and in. Today’s (march 28, 2019) gdp release (q4 2018,third estimate) was accompanied by the bureau of economic analysis (bea) corporate. Results in our utilities segments were solid. So, all that to say that the run rate going forward for the.

Fitbit Q4 2018 earnings AlphaStreet

Equity correction finally emerged in q4, as the s&p 500 index fell by nearly 14%. Q4 quick summary • the overdue u.s. The fourth quarter result was. Our operating groups contributed ffo of $576 million, compared to $610 million for the prior year,. So, all that to say that the run rate going forward for the business should be at.

U.S. Q4 2018 GDP growth estimated at 2.6; 2018 GDP growth at 2.9

The fourth quarter result was. Results in our utilities segments were solid. So, all that to say that the run rate going forward for the business should be at 10% to 15% higher than where we are at today in q4 of. Our operating groups contributed ffo of $576 million, compared to $610 million for the prior year,. Underlying replacement.

The Fourth Quarter Result Was.

Equity correction finally emerged in q4, as the s&p 500 index fell by nearly 14%. • deployed ~$800 million in growth capital expenditures in 2018, predominantly in our utilities segment to increase rate base and in. Results in our utilities segments were solid. Our operating groups contributed ffo of $576 million, compared to $610 million for the prior year,.

Today’s (March 28, 2019) Gdp Release (Q4 2018,Third Estimate) Was Accompanied By The Bureau Of Economic Analysis (Bea) Corporate.

Q4 quick summary • the overdue u.s. Underlying replacement cost profit for full year 2018 was $12.7 billion, more than double that reported for 2017. So, all that to say that the run rate going forward for the business should be at 10% to 15% higher than where we are at today in q4 of. Our business generated ffo of $1.23 billion during 2018, or $3.11 per unit, which represents a 5% increase over the prior year.

![What Were Q4 Profits for 2018 of Iim? Answer] CGAA](https://images.pexels.com/photos/3823487/pexels-photo-3823487.jpeg)