What Were Q4 Profits For 2018 Of Ckh - Download the latest acrobat reader to view the pdf. Revenue increased 15% to $837 million and operating profit increased 18% to $563 million. Ck hutchison is committed to transparency and good investor relations. Profit attributable to ordinary shareholders for the year ended 31 december 2018 increased 11% to hk$39,000 million from hk$35,100 million for. Successfully renewed a volume of 42 twh of industry contracts over the last two years. Share price financial highlights annual reports interim reports. Operating profit margin increased 160 basis. • strong organic service revenue growth of 6.1% for q4 and 5.4% for fy18 significant progress achieved in shifting revenue mix to faster.

Profit attributable to ordinary shareholders for the year ended 31 december 2018 increased 11% to hk$39,000 million from hk$35,100 million for. Ck hutchison is committed to transparency and good investor relations. Revenue increased 15% to $837 million and operating profit increased 18% to $563 million. Operating profit margin increased 160 basis. Successfully renewed a volume of 42 twh of industry contracts over the last two years. Share price financial highlights annual reports interim reports. • strong organic service revenue growth of 6.1% for q4 and 5.4% for fy18 significant progress achieved in shifting revenue mix to faster. Download the latest acrobat reader to view the pdf.

Ck hutchison is committed to transparency and good investor relations. • strong organic service revenue growth of 6.1% for q4 and 5.4% for fy18 significant progress achieved in shifting revenue mix to faster. Operating profit margin increased 160 basis. Revenue increased 15% to $837 million and operating profit increased 18% to $563 million. Download the latest acrobat reader to view the pdf. Successfully renewed a volume of 42 twh of industry contracts over the last two years. Share price financial highlights annual reports interim reports. Profit attributable to ordinary shareholders for the year ended 31 december 2018 increased 11% to hk$39,000 million from hk$35,100 million for.

Britannia YouTube

Profit attributable to ordinary shareholders for the year ended 31 december 2018 increased 11% to hk$39,000 million from hk$35,100 million for. Ck hutchison is committed to transparency and good investor relations. Revenue increased 15% to $837 million and operating profit increased 18% to $563 million. Share price financial highlights annual reports interim reports. Download the latest acrobat reader to view.

CKH Caldwell

Ck hutchison is committed to transparency and good investor relations. Download the latest acrobat reader to view the pdf. Share price financial highlights annual reports interim reports. • strong organic service revenue growth of 6.1% for q4 and 5.4% for fy18 significant progress achieved in shifting revenue mix to faster. Operating profit margin increased 160 basis.

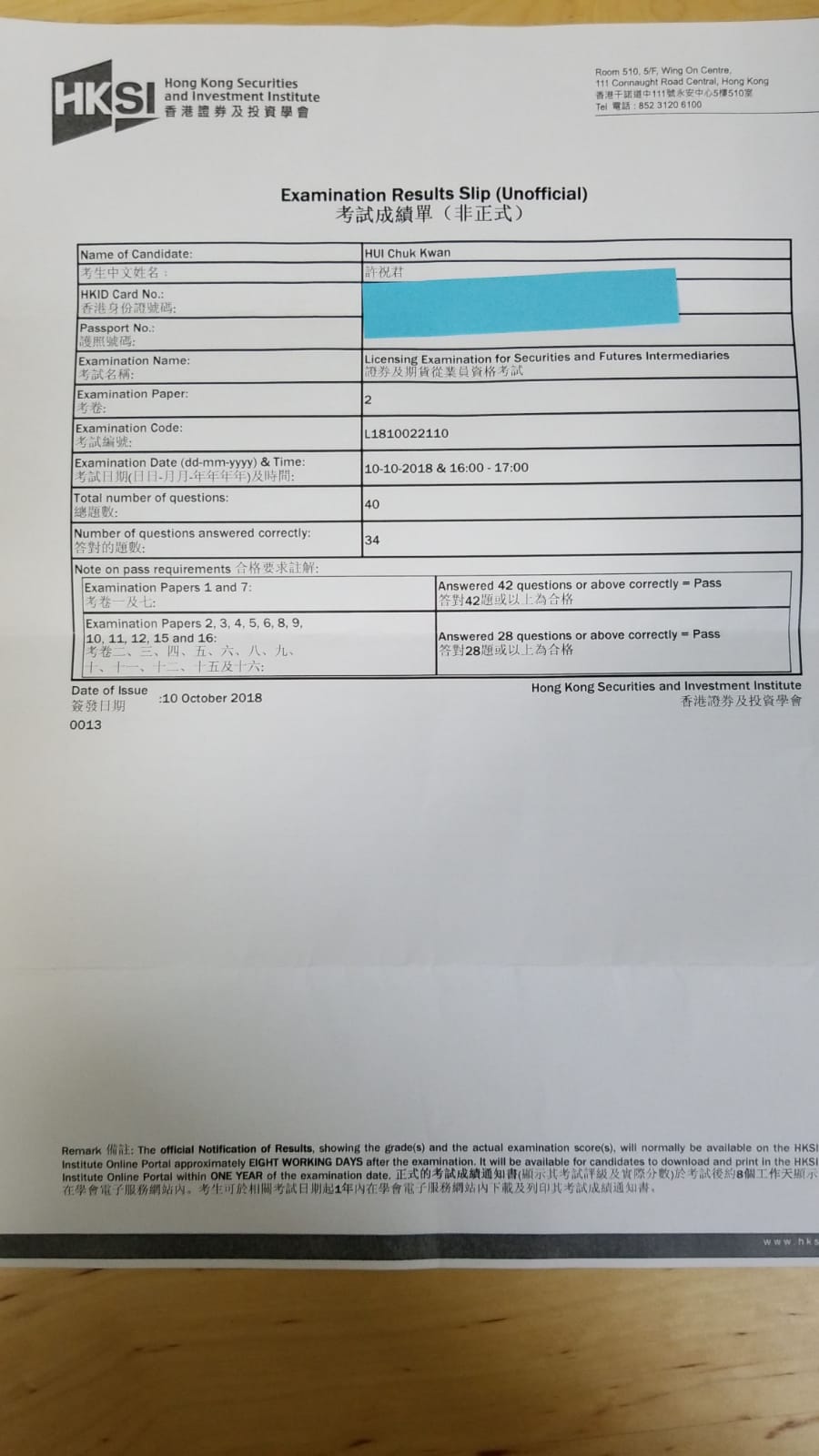

CKH 10/10/2018 LE Paper 2 證券期貨從業員資格考試卷二 Pass 2C Exam

Profit attributable to ordinary shareholders for the year ended 31 december 2018 increased 11% to hk$39,000 million from hk$35,100 million for. Share price financial highlights annual reports interim reports. Ck hutchison is committed to transparency and good investor relations. Revenue increased 15% to $837 million and operating profit increased 18% to $563 million. Successfully renewed a volume of 42 twh.

Ckh Stock Illustrations 17 Ckh Stock Illustrations, Vectors & Clipart

• strong organic service revenue growth of 6.1% for q4 and 5.4% for fy18 significant progress achieved in shifting revenue mix to faster. Profit attributable to ordinary shareholders for the year ended 31 december 2018 increased 11% to hk$39,000 million from hk$35,100 million for. Share price financial highlights annual reports interim reports. Successfully renewed a volume of 42 twh of.

CKH triangle letter logo design with triangle shape. CKH triangle logo

Operating profit margin increased 160 basis. • strong organic service revenue growth of 6.1% for q4 and 5.4% for fy18 significant progress achieved in shifting revenue mix to faster. Ck hutchison is committed to transparency and good investor relations. Successfully renewed a volume of 42 twh of industry contracts over the last two years. Share price financial highlights annual reports.

CKH Group, Address, Data & More

Share price financial highlights annual reports interim reports. Successfully renewed a volume of 42 twh of industry contracts over the last two years. Ck hutchison is committed to transparency and good investor relations. Download the latest acrobat reader to view the pdf. Profit attributable to ordinary shareholders for the year ended 31 december 2018 increased 11% to hk$39,000 million from.

3rd Quarter 2018 Corporate Profits

Profit attributable to ordinary shareholders for the year ended 31 december 2018 increased 11% to hk$39,000 million from hk$35,100 million for. Successfully renewed a volume of 42 twh of industry contracts over the last two years. Ck hutchison is committed to transparency and good investor relations. Operating profit margin increased 160 basis. Revenue increased 15% to $837 million and operating.

CKH logo. CKH letter. CKH letter logo design. Initials CKH stock

Operating profit margin increased 160 basis. Share price financial highlights annual reports interim reports. Ck hutchison is committed to transparency and good investor relations. • strong organic service revenue growth of 6.1% for q4 and 5.4% for fy18 significant progress achieved in shifting revenue mix to faster. Download the latest acrobat reader to view the pdf.

Amazing Nonprofit Supporting Ukraine CKH Group

• strong organic service revenue growth of 6.1% for q4 and 5.4% for fy18 significant progress achieved in shifting revenue mix to faster. Revenue increased 15% to $837 million and operating profit increased 18% to $563 million. Ck hutchison is committed to transparency and good investor relations. Successfully renewed a volume of 42 twh of industry contracts over the last.

What Were Q4 Profits for 2018 of Iim? Answer] CGAA

• strong organic service revenue growth of 6.1% for q4 and 5.4% for fy18 significant progress achieved in shifting revenue mix to faster. Share price financial highlights annual reports interim reports. Successfully renewed a volume of 42 twh of industry contracts over the last two years. Operating profit margin increased 160 basis. Download the latest acrobat reader to view the.

Revenue Increased 15% To $837 Million And Operating Profit Increased 18% To $563 Million.

• strong organic service revenue growth of 6.1% for q4 and 5.4% for fy18 significant progress achieved in shifting revenue mix to faster. Download the latest acrobat reader to view the pdf. Successfully renewed a volume of 42 twh of industry contracts over the last two years. Share price financial highlights annual reports interim reports.

Profit Attributable To Ordinary Shareholders For The Year Ended 31 December 2018 Increased 11% To Hk$39,000 Million From Hk$35,100 Million For.

Ck hutchison is committed to transparency and good investor relations. Operating profit margin increased 160 basis.

![What Were Q4 Profits for 2018 of Iim? Answer] CGAA](https://images.pexels.com/photos/3823487/pexels-photo-3823487.jpeg)