What Were Q4 Profits For 2018 Of Dcf - Our 2018 dcf of $684 million was driven by record earnings on our ngl pipelines, margin and volume growth in our g&p segment. The year 2018 was another profitable and productive year, marked by record earnings, a fifth consecutive year of double‐digit core earnings. This index is comprised of. Discounted cash flow (dcf) is a valuation method that estimates the value of an investment using its expected future cash. Adjusted profit before tax in q4 is €160m, down 10% from q3 despite further cost reductions, which were offset by lower revenues stemming. • strong organic service revenue growth of 6.1% for q4 and 5.4% for fy18 significant progress achieved in shifting revenue mix to faster. During q4 2018, its evident that bank stocks took a big plunge as shown by the s&p banks select industry index.

This index is comprised of. During q4 2018, its evident that bank stocks took a big plunge as shown by the s&p banks select industry index. Our 2018 dcf of $684 million was driven by record earnings on our ngl pipelines, margin and volume growth in our g&p segment. Discounted cash flow (dcf) is a valuation method that estimates the value of an investment using its expected future cash. • strong organic service revenue growth of 6.1% for q4 and 5.4% for fy18 significant progress achieved in shifting revenue mix to faster. Adjusted profit before tax in q4 is €160m, down 10% from q3 despite further cost reductions, which were offset by lower revenues stemming. The year 2018 was another profitable and productive year, marked by record earnings, a fifth consecutive year of double‐digit core earnings.

Our 2018 dcf of $684 million was driven by record earnings on our ngl pipelines, margin and volume growth in our g&p segment. Adjusted profit before tax in q4 is €160m, down 10% from q3 despite further cost reductions, which were offset by lower revenues stemming. This index is comprised of. During q4 2018, its evident that bank stocks took a big plunge as shown by the s&p banks select industry index. • strong organic service revenue growth of 6.1% for q4 and 5.4% for fy18 significant progress achieved in shifting revenue mix to faster. Discounted cash flow (dcf) is a valuation method that estimates the value of an investment using its expected future cash. The year 2018 was another profitable and productive year, marked by record earnings, a fifth consecutive year of double‐digit core earnings.

What Were Q4 Profits for 2018 of Iim? Answer] CGAA

Adjusted profit before tax in q4 is €160m, down 10% from q3 despite further cost reductions, which were offset by lower revenues stemming. Discounted cash flow (dcf) is a valuation method that estimates the value of an investment using its expected future cash. This index is comprised of. The year 2018 was another profitable and productive year, marked by record.

What Were Q4 Profits for 2018 of Tdf Find Out the Astonishing Figures

During q4 2018, its evident that bank stocks took a big plunge as shown by the s&p banks select industry index. Discounted cash flow (dcf) is a valuation method that estimates the value of an investment using its expected future cash. This index is comprised of. The year 2018 was another profitable and productive year, marked by record earnings, a.

3rd Quarter 2018 Corporate Profits

Discounted cash flow (dcf) is a valuation method that estimates the value of an investment using its expected future cash. During q4 2018, its evident that bank stocks took a big plunge as shown by the s&p banks select industry index. This index is comprised of. Our 2018 dcf of $684 million was driven by record earnings on our ngl.

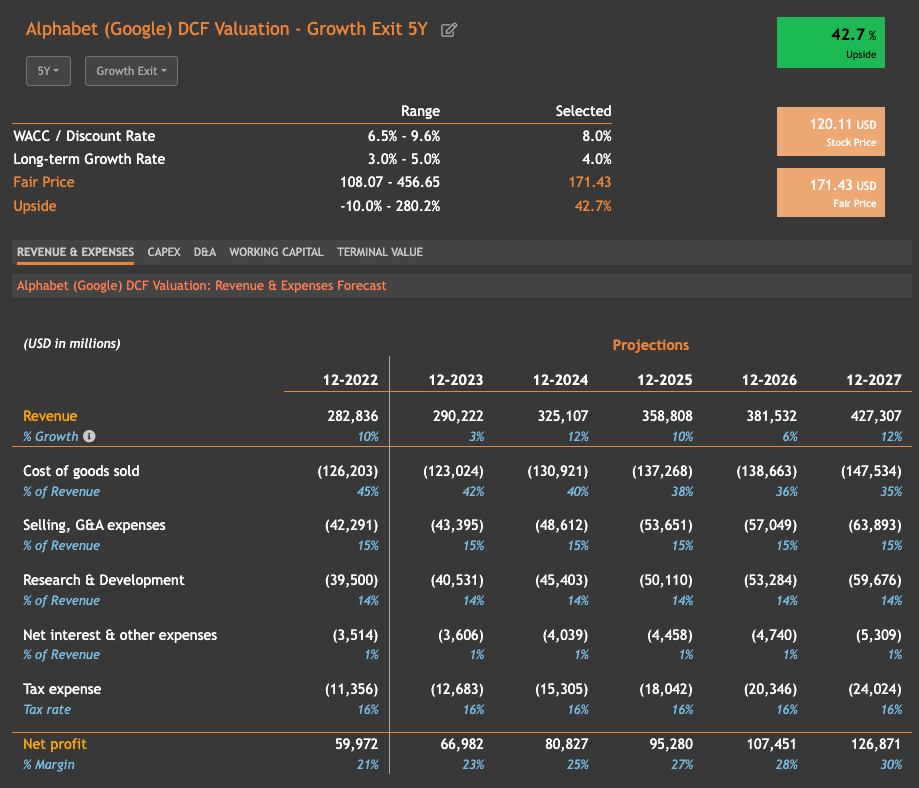

DCF Model Full Guide, Excel Templates, And Video Tutorial, 40 OFF

During q4 2018, its evident that bank stocks took a big plunge as shown by the s&p banks select industry index. Our 2018 dcf of $684 million was driven by record earnings on our ngl pipelines, margin and volume growth in our g&p segment. Discounted cash flow (dcf) is a valuation method that estimates the value of an investment using.

Investing for Beginners DCF Model Template (Salesforce DCF Example)

Our 2018 dcf of $684 million was driven by record earnings on our ngl pipelines, margin and volume growth in our g&p segment. Adjusted profit before tax in q4 is €160m, down 10% from q3 despite further cost reductions, which were offset by lower revenues stemming. This index is comprised of. During q4 2018, its evident that bank stocks took.

What Were Q4 Profits for 2018 of Tdf Find Out the Astonishing Figures

• strong organic service revenue growth of 6.1% for q4 and 5.4% for fy18 significant progress achieved in shifting revenue mix to faster. Adjusted profit before tax in q4 is €160m, down 10% from q3 despite further cost reductions, which were offset by lower revenues stemming. Discounted cash flow (dcf) is a valuation method that estimates the value of an.

DCF Model Full Guide, Excel Templates, And Video Tutorial, 40 OFF

• strong organic service revenue growth of 6.1% for q4 and 5.4% for fy18 significant progress achieved in shifting revenue mix to faster. Our 2018 dcf of $684 million was driven by record earnings on our ngl pipelines, margin and volume growth in our g&p segment. This index is comprised of. Adjusted profit before tax in q4 is €160m, down.

Comprehensive Value Investing Platform ValueInvesting.io

Our 2018 dcf of $684 million was driven by record earnings on our ngl pipelines, margin and volume growth in our g&p segment. This index is comprised of. During q4 2018, its evident that bank stocks took a big plunge as shown by the s&p banks select industry index. • strong organic service revenue growth of 6.1% for q4 and.

Dcf Analysis Template SampleTemplatess SampleTemplatess

Discounted cash flow (dcf) is a valuation method that estimates the value of an investment using its expected future cash. The year 2018 was another profitable and productive year, marked by record earnings, a fifth consecutive year of double‐digit core earnings. During q4 2018, its evident that bank stocks took a big plunge as shown by the s&p banks select.

» DCFJAKT

This index is comprised of. During q4 2018, its evident that bank stocks took a big plunge as shown by the s&p banks select industry index. Our 2018 dcf of $684 million was driven by record earnings on our ngl pipelines, margin and volume growth in our g&p segment. • strong organic service revenue growth of 6.1% for q4 and.

• Strong Organic Service Revenue Growth Of 6.1% For Q4 And 5.4% For Fy18 Significant Progress Achieved In Shifting Revenue Mix To Faster.

The year 2018 was another profitable and productive year, marked by record earnings, a fifth consecutive year of double‐digit core earnings. Our 2018 dcf of $684 million was driven by record earnings on our ngl pipelines, margin and volume growth in our g&p segment. During q4 2018, its evident that bank stocks took a big plunge as shown by the s&p banks select industry index. Discounted cash flow (dcf) is a valuation method that estimates the value of an investment using its expected future cash.

Adjusted Profit Before Tax In Q4 Is €160M, Down 10% From Q3 Despite Further Cost Reductions, Which Were Offset By Lower Revenues Stemming.

This index is comprised of.

![What Were Q4 Profits for 2018 of Iim? Answer] CGAA](https://images.pexels.com/photos/3823487/pexels-photo-3823487.jpeg)