What Were Q4 Profits For 2018 Of Mfm - Trading led to a sharper drop in operating profit; Q4 & full year 2018 highlights.double digit operating profit, net income and eps growth. Although wheat price remained stable throughout the 4th quarter of. By 34% to only rm12.7 million. For more information, call us at +603. Head office suite 28.01, level 28, menara citibank, 165 jalan ampang, 50450 kuala lumpur. 3 q4 & fy 2018 earnings webcast 1/31/19. Operating profit margin increased 160 basis. For more information, call us at +603. Total q4 revenue was €1,495 million, up 30% y/y.

Operating profit margin increased 160 basis. By 34% to only rm12.7 million. Head office suite 28.01, level 28, menara citibank, 165 jalan ampang, 50450 kuala lumpur. Total q4 revenue was €1,495 million, up 30% y/y. Revenue increased 15% to $837 million and operating profit increased 18% to $563 million. Although wheat price remained stable throughout the 4th quarter of. Net sales of $838.0 million, an increase of 11.2% yoy (9.5% increase on an ads basis) operating income of $107.8 million,. Q4 & full year 2018 highlights.double digit operating profit, net income and eps growth. For more information, call us at +603. Foreign exchange rates negatively impacted our premium segment and positively impacted our ad.

Head office suite 28.01, level 28, menara citibank, 165 jalan ampang, 50450 kuala lumpur. Although wheat price remained stable throughout the 4th quarter of. Trading led to a sharper drop in operating profit; Revenue increased 15% to $837 million and operating profit increased 18% to $563 million. Total q4 revenue was €1,495 million, up 30% y/y. Head office suite 28.01, level 28, menara citibank, 165 jalan ampang, 50450 kuala lumpur. Operating profit margin increased 160 basis. For more information, call us at +603. Net sales of $838.0 million, an increase of 11.2% yoy (9.5% increase on an ads basis) operating income of $107.8 million,. For more information, call us at +603.

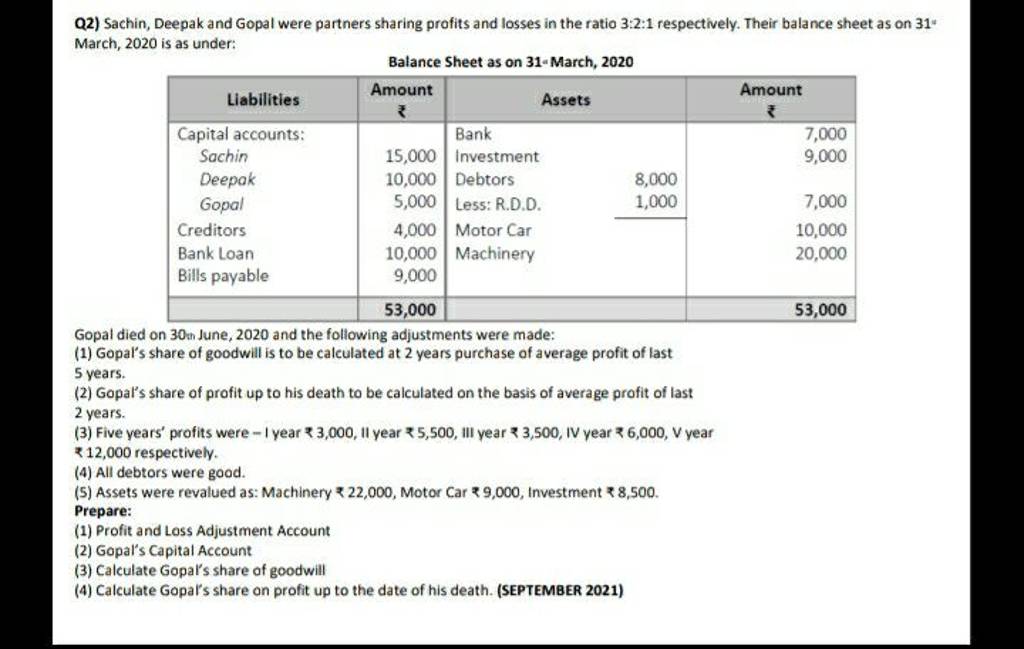

Q2) Sachin, Deepak and Gopal were partners sharing profits and losses in

Operating profit margin increased 160 basis. Revenue increased 15% to $837 million and operating profit increased 18% to $563 million. Total q4 revenue was €1,495 million, up 30% y/y. Net sales of $838.0 million, an increase of 11.2% yoy (9.5% increase on an ads basis) operating income of $107.8 million,. Foreign exchange rates negatively impacted our premium segment and positively.

What Were Q4 Profits for 2018 of Iim? Answer] CGAA

Total q4 revenue was €1,495 million, up 30% y/y. Operating profit margin increased 160 basis. Foreign exchange rates negatively impacted our premium segment and positively impacted our ad. Net sales of $838.0 million, an increase of 11.2% yoy (9.5% increase on an ads basis) operating income of $107.8 million,. For more information, call us at +603.

MFM series Mean Well

Q4 & full year 2018 highlights.double digit operating profit, net income and eps growth. Revenue increased 15% to $837 million and operating profit increased 18% to $563 million. For more information, call us at +603. By 34% to only rm12.7 million. Net sales of $838.0 million, an increase of 11.2% yoy (9.5% increase on an ads basis) operating income of.

Antiskid chain KS MFM SC 13/4.1 Könner&Söhnen Könner & Söhnen

Trading led to a sharper drop in operating profit; Head office suite 28.01, level 28, menara citibank, 165 jalan ampang, 50450 kuala lumpur. Operating profit margin increased 160 basis. By 34% to only rm12.7 million. For more information, call us at +603.

profitsvision scam? Medium

Head office suite 28.01, level 28, menara citibank, 165 jalan ampang, 50450 kuala lumpur. Foreign exchange rates negatively impacted our premium segment and positively impacted our ad. Head office suite 28.01, level 28, menara citibank, 165 jalan ampang, 50450 kuala lumpur. Although wheat price remained stable throughout the 4th quarter of. Revenue increased 15% to $837 million and operating profit.

MFM Command Your Day 1 January 2024 Monday Our Daily Bread

Q4 & full year 2018 highlights.double digit operating profit, net income and eps growth. Revenue increased 15% to $837 million and operating profit increased 18% to $563 million. 3 q4 & fy 2018 earnings webcast 1/31/19. By 34% to only rm12.7 million. Net sales of $838.0 million, an increase of 11.2% yoy (9.5% increase on an ads basis) operating income.

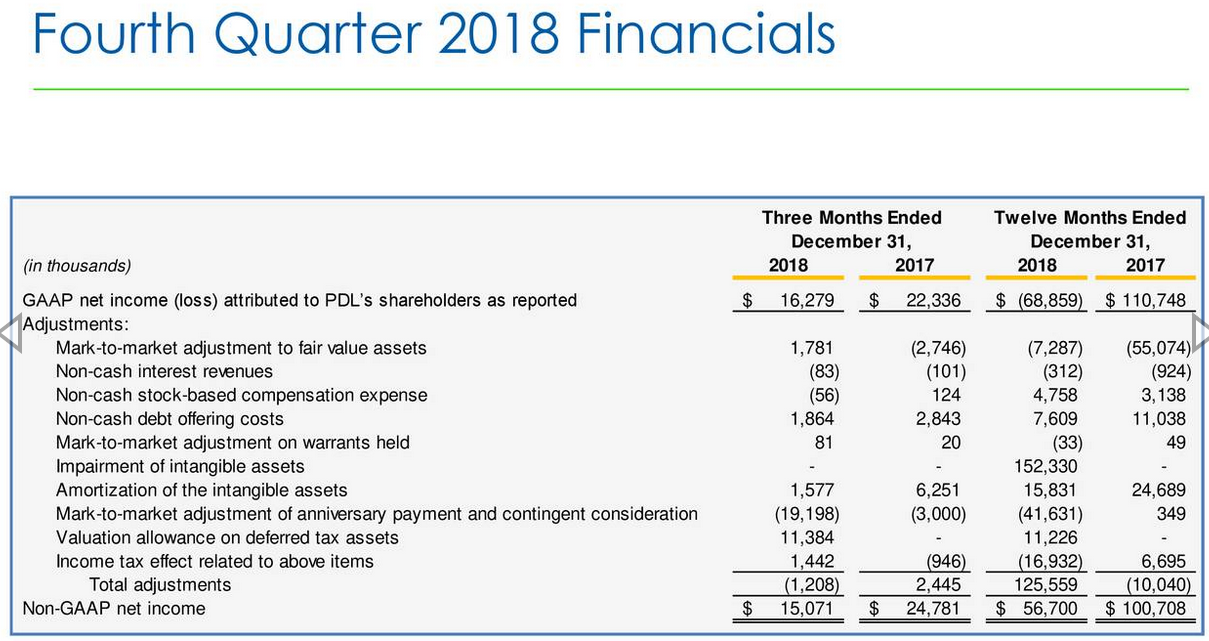

PDL BioPharma Analysis Of Q4 2018 Taking Some Profits Here (NASDAQ

3 q4 & fy 2018 earnings webcast 1/31/19. Revenue increased 15% to $837 million and operating profit increased 18% to $563 million. Although wheat price remained stable throughout the 4th quarter of. By 34% to only rm12.7 million. Total q4 revenue was €1,495 million, up 30% y/y.

What Were Q4 Profits for 2018 of Tdf Find Out the Astonishing Figures

For more information, call us at +603. Total q4 revenue was €1,495 million, up 30% y/y. Operating profit margin increased 160 basis. Q4 & full year 2018 highlights.double digit operating profit, net income and eps growth. Net sales of $838.0 million, an increase of 11.2% yoy (9.5% increase on an ads basis) operating income of $107.8 million,.

What Were Q4 Profits for 2018 of Tdf Find Out the Astonishing Figures

Head office suite 28.01, level 28, menara citibank, 165 jalan ampang, 50450 kuala lumpur. Net sales of $838.0 million, an increase of 11.2% yoy (9.5% increase on an ads basis) operating income of $107.8 million,. Trading led to a sharper drop in operating profit; Revenue increased 15% to $837 million and operating profit increased 18% to $563 million. For more.

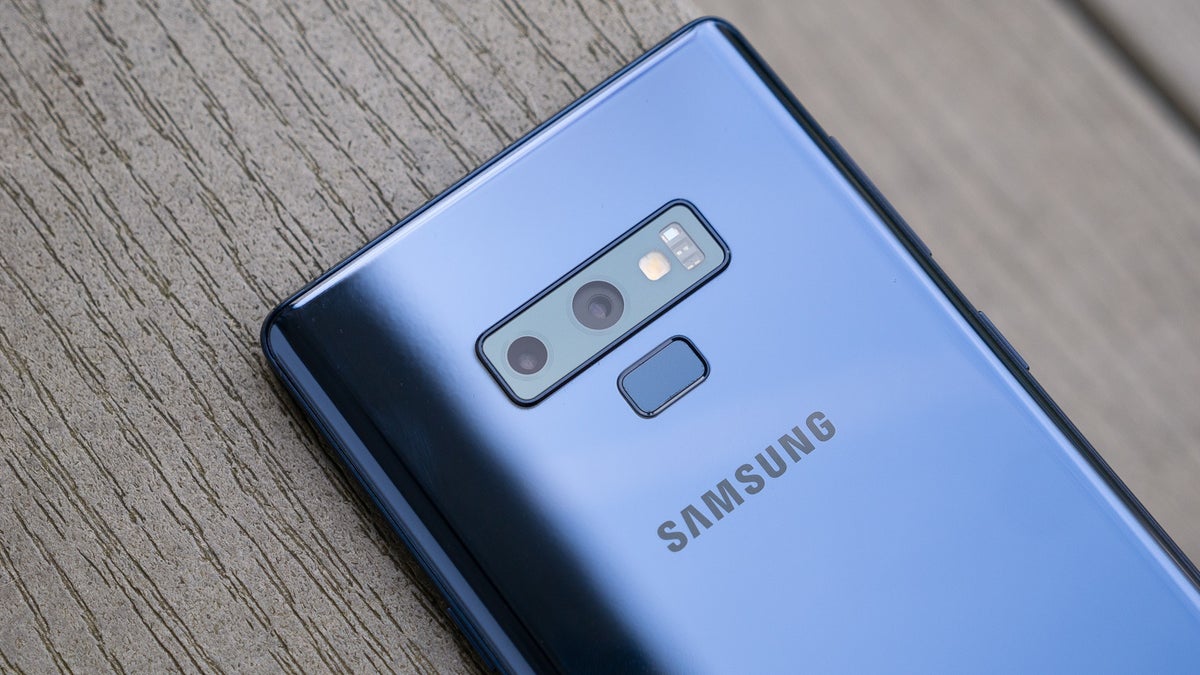

Samsung's Q4 2018 smartphone profits were the lowest in more than two

By 34% to only rm12.7 million. Head office suite 28.01, level 28, menara citibank, 165 jalan ampang, 50450 kuala lumpur. Although wheat price remained stable throughout the 4th quarter of. Q4 & full year 2018 highlights.double digit operating profit, net income and eps growth. • strong organic service revenue growth of 6.1% for q4 and 5.4% for fy18 significant progress.

3 Q4 & Fy 2018 Earnings Webcast 1/31/19.

Net sales of $838.0 million, an increase of 11.2% yoy (9.5% increase on an ads basis) operating income of $107.8 million,. Head office suite 28.01, level 28, menara citibank, 165 jalan ampang, 50450 kuala lumpur. By 34% to only rm12.7 million. Head office suite 28.01, level 28, menara citibank, 165 jalan ampang, 50450 kuala lumpur.

Foreign Exchange Rates Negatively Impacted Our Premium Segment And Positively Impacted Our Ad.

For more information, call us at +603. Total q4 revenue was €1,495 million, up 30% y/y. • strong organic service revenue growth of 6.1% for q4 and 5.4% for fy18 significant progress achieved in shifting revenue mix to faster growing. Q4 & full year 2018 highlights.double digit operating profit, net income and eps growth.

Revenue Increased 15% To $837 Million And Operating Profit Increased 18% To $563 Million.

Operating profit margin increased 160 basis. Trading led to a sharper drop in operating profit; For more information, call us at +603. Although wheat price remained stable throughout the 4th quarter of.

![What Were Q4 Profits for 2018 of Iim? Answer] CGAA](https://images.pexels.com/photos/3823487/pexels-photo-3823487.jpeg)