What Were Q4 Profits For 2018 Of Soi - Fueling this growth was our high. We grew annual revenue 35% to $16 billion in 2018, and nearly doubled operating profits to $1.6 billion. Soi reported a net income of $7.6 million, or $0.16 per diluted class a share, for q3 2023. Reported at $68 million for q1 2024, up 7% from q4 2023 and down 18% from q1 2023, exceeding the estimated $62.45. Adjusted operating profit increased 18% to $101 million and adjusted operating profit margin improved 470 basis points to 48.2%. This is a decrease compared to q2.

Soi reported a net income of $7.6 million, or $0.16 per diluted class a share, for q3 2023. This is a decrease compared to q2. Adjusted operating profit increased 18% to $101 million and adjusted operating profit margin improved 470 basis points to 48.2%. Reported at $68 million for q1 2024, up 7% from q4 2023 and down 18% from q1 2023, exceeding the estimated $62.45. We grew annual revenue 35% to $16 billion in 2018, and nearly doubled operating profits to $1.6 billion. Fueling this growth was our high.

Fueling this growth was our high. Reported at $68 million for q1 2024, up 7% from q4 2023 and down 18% from q1 2023, exceeding the estimated $62.45. We grew annual revenue 35% to $16 billion in 2018, and nearly doubled operating profits to $1.6 billion. This is a decrease compared to q2. Soi reported a net income of $7.6 million, or $0.16 per diluted class a share, for q3 2023. Adjusted operating profit increased 18% to $101 million and adjusted operating profit margin improved 470 basis points to 48.2%.

The Buzz Newsletter

We grew annual revenue 35% to $16 billion in 2018, and nearly doubled operating profits to $1.6 billion. Adjusted operating profit increased 18% to $101 million and adjusted operating profit margin improved 470 basis points to 48.2%. Reported at $68 million for q1 2024, up 7% from q4 2023 and down 18% from q1 2023, exceeding the estimated $62.45. This.

What Were Q4 Profits for 2018 of Tdf Find Out the Astonishing Figures

Adjusted operating profit increased 18% to $101 million and adjusted operating profit margin improved 470 basis points to 48.2%. This is a decrease compared to q2. Fueling this growth was our high. Reported at $68 million for q1 2024, up 7% from q4 2023 and down 18% from q1 2023, exceeding the estimated $62.45. We grew annual revenue 35% to.

Corporate profits were down slightly in Q2 Kevin Drum

This is a decrease compared to q2. Reported at $68 million for q1 2024, up 7% from q4 2023 and down 18% from q1 2023, exceeding the estimated $62.45. Fueling this growth was our high. Soi reported a net income of $7.6 million, or $0.16 per diluted class a share, for q3 2023. We grew annual revenue 35% to $16.

2018 State of the Industry Report sales and profits Nursery Management

This is a decrease compared to q2. Fueling this growth was our high. We grew annual revenue 35% to $16 billion in 2018, and nearly doubled operating profits to $1.6 billion. Soi reported a net income of $7.6 million, or $0.16 per diluted class a share, for q3 2023. Adjusted operating profit increased 18% to $101 million and adjusted operating.

What Were Q4 Profits for 2018 of Tdf Find Out the Astonishing Figures

Fueling this growth was our high. We grew annual revenue 35% to $16 billion in 2018, and nearly doubled operating profits to $1.6 billion. Soi reported a net income of $7.6 million, or $0.16 per diluted class a share, for q3 2023. Reported at $68 million for q1 2024, up 7% from q4 2023 and down 18% from q1 2023,.

A Review of SOI Technology and its Applications SBMicro

This is a decrease compared to q2. We grew annual revenue 35% to $16 billion in 2018, and nearly doubled operating profits to $1.6 billion. Reported at $68 million for q1 2024, up 7% from q4 2023 and down 18% from q1 2023, exceeding the estimated $62.45. Soi reported a net income of $7.6 million, or $0.16 per diluted class.

39+ What Were Q4 Profits For 2018 Of Golf TayyabClive

Fueling this growth was our high. Adjusted operating profit increased 18% to $101 million and adjusted operating profit margin improved 470 basis points to 48.2%. Soi reported a net income of $7.6 million, or $0.16 per diluted class a share, for q3 2023. Reported at $68 million for q1 2024, up 7% from q4 2023 and down 18% from q1.

What Were Q4 Profits for 2018 of Iim? Answer] CGAA

Adjusted operating profit increased 18% to $101 million and adjusted operating profit margin improved 470 basis points to 48.2%. Reported at $68 million for q1 2024, up 7% from q4 2023 and down 18% from q1 2023, exceeding the estimated $62.45. Soi reported a net income of $7.6 million, or $0.16 per diluted class a share, for q3 2023. This.

3rd Quarter 2018 Corporate Profits

Reported at $68 million for q1 2024, up 7% from q4 2023 and down 18% from q1 2023, exceeding the estimated $62.45. Adjusted operating profit increased 18% to $101 million and adjusted operating profit margin improved 470 basis points to 48.2%. We grew annual revenue 35% to $16 billion in 2018, and nearly doubled operating profits to $1.6 billion. This.

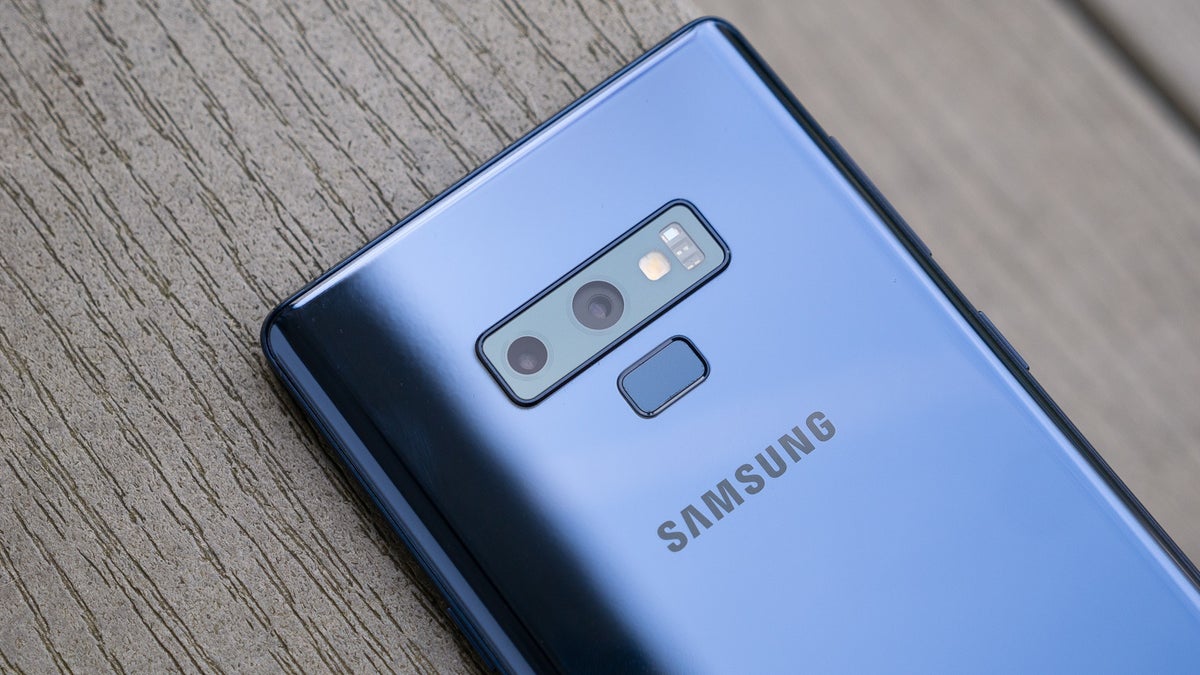

Samsung's Q4 2018 smartphone profits were the lowest in more than two

Fueling this growth was our high. Adjusted operating profit increased 18% to $101 million and adjusted operating profit margin improved 470 basis points to 48.2%. Soi reported a net income of $7.6 million, or $0.16 per diluted class a share, for q3 2023. Reported at $68 million for q1 2024, up 7% from q4 2023 and down 18% from q1.

Fueling This Growth Was Our High.

This is a decrease compared to q2. Reported at $68 million for q1 2024, up 7% from q4 2023 and down 18% from q1 2023, exceeding the estimated $62.45. Soi reported a net income of $7.6 million, or $0.16 per diluted class a share, for q3 2023. We grew annual revenue 35% to $16 billion in 2018, and nearly doubled operating profits to $1.6 billion.

![What Were Q4 Profits for 2018 of Iim? Answer] CGAA](https://images.pexels.com/photos/3823487/pexels-photo-3823487.jpeg)