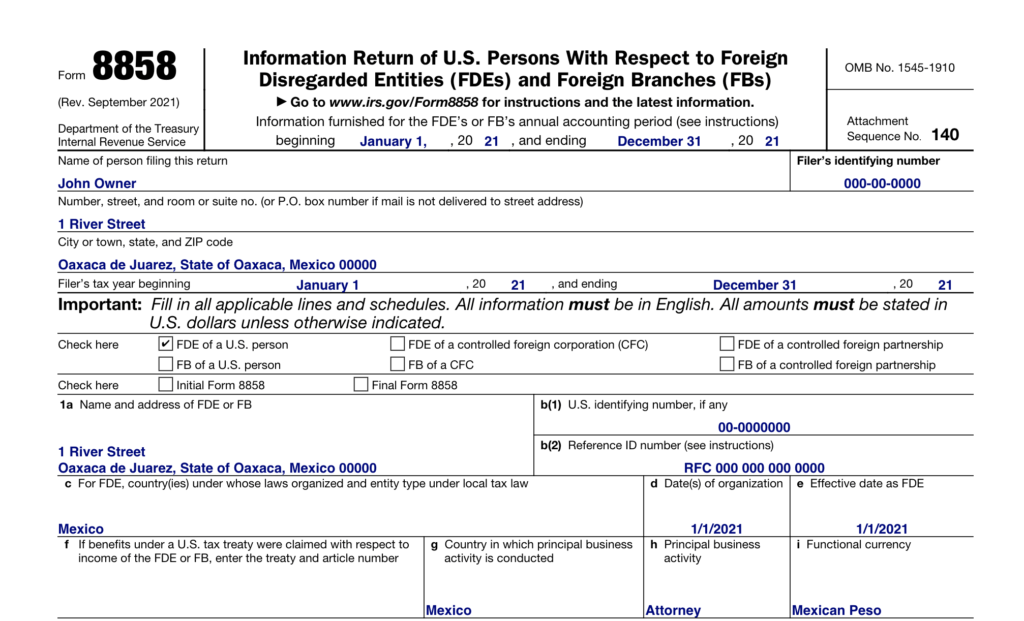

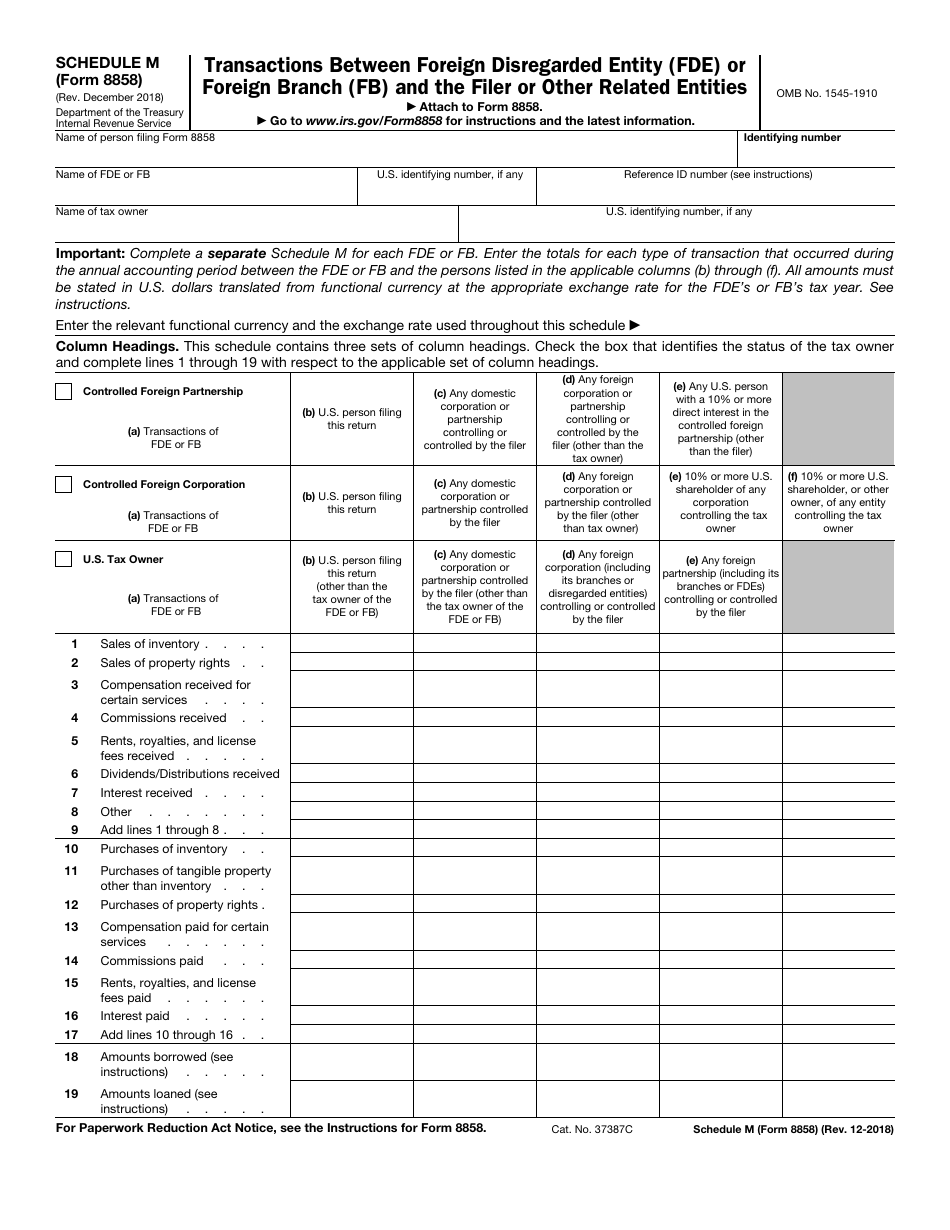

Who Must File Form 8858 - Form 8858 is used by certain u.s. Persons that own a foreign disregarded entity (fde) directly or, in certain circumstances,. Us taxpayers with an ownership interest in unincorporated foreign businesses (such as foreign sole proprietorships, partnerships, and. Person that is required to file schedule m (form 8858) (see who must file, earlier) must file the schedule to report the transactions that.

Us taxpayers with an ownership interest in unincorporated foreign businesses (such as foreign sole proprietorships, partnerships, and. Person that is required to file schedule m (form 8858) (see who must file, earlier) must file the schedule to report the transactions that. Form 8858 is used by certain u.s. Persons that own a foreign disregarded entity (fde) directly or, in certain circumstances,.

Persons that own a foreign disregarded entity (fde) directly or, in certain circumstances,. Form 8858 is used by certain u.s. Person that is required to file schedule m (form 8858) (see who must file, earlier) must file the schedule to report the transactions that. Us taxpayers with an ownership interest in unincorporated foreign businesses (such as foreign sole proprietorships, partnerships, and.

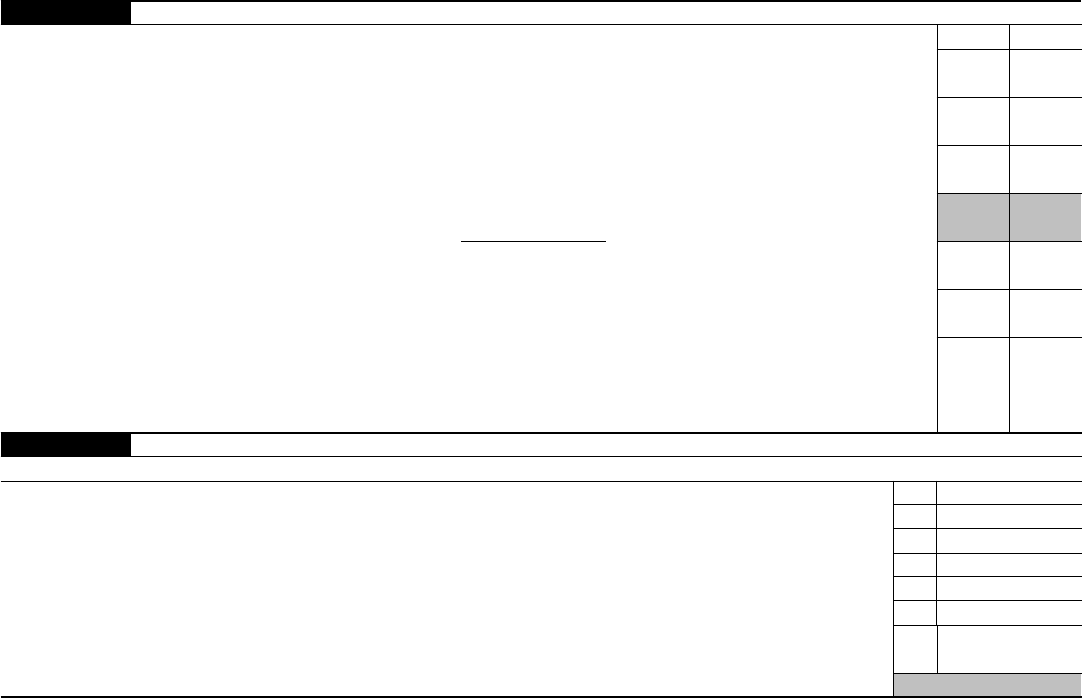

Form 8858 Edit, Fill, Sign Online Handypdf

Us taxpayers with an ownership interest in unincorporated foreign businesses (such as foreign sole proprietorships, partnerships, and. Persons that own a foreign disregarded entity (fde) directly or, in certain circumstances,. Form 8858 is used by certain u.s. Person that is required to file schedule m (form 8858) (see who must file, earlier) must file the schedule to report the transactions.

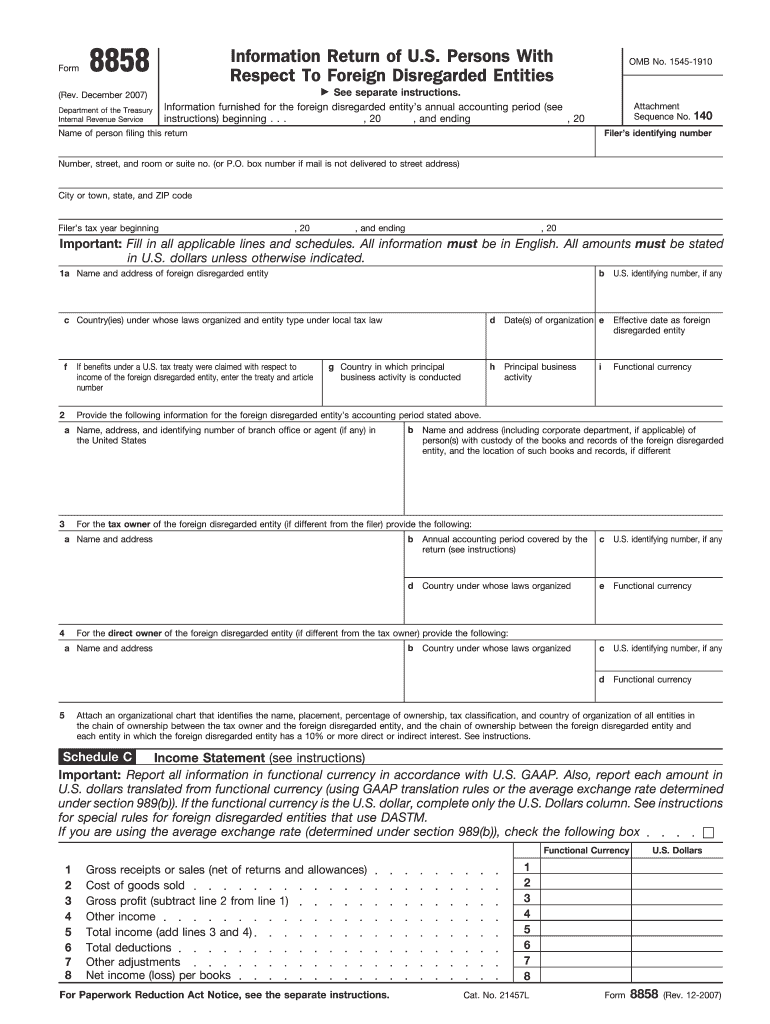

Form 8858 Fillable Printable Forms Free Online

Us taxpayers with an ownership interest in unincorporated foreign businesses (such as foreign sole proprietorships, partnerships, and. Persons that own a foreign disregarded entity (fde) directly or, in certain circumstances,. Form 8858 is used by certain u.s. Person that is required to file schedule m (form 8858) (see who must file, earlier) must file the schedule to report the transactions.

Form 8858 Edit, Fill, Sign Online Handypdf

Person that is required to file schedule m (form 8858) (see who must file, earlier) must file the schedule to report the transactions that. Persons that own a foreign disregarded entity (fde) directly or, in certain circumstances,. Form 8858 is used by certain u.s. Us taxpayers with an ownership interest in unincorporated foreign businesses (such as foreign sole proprietorships, partnerships,.

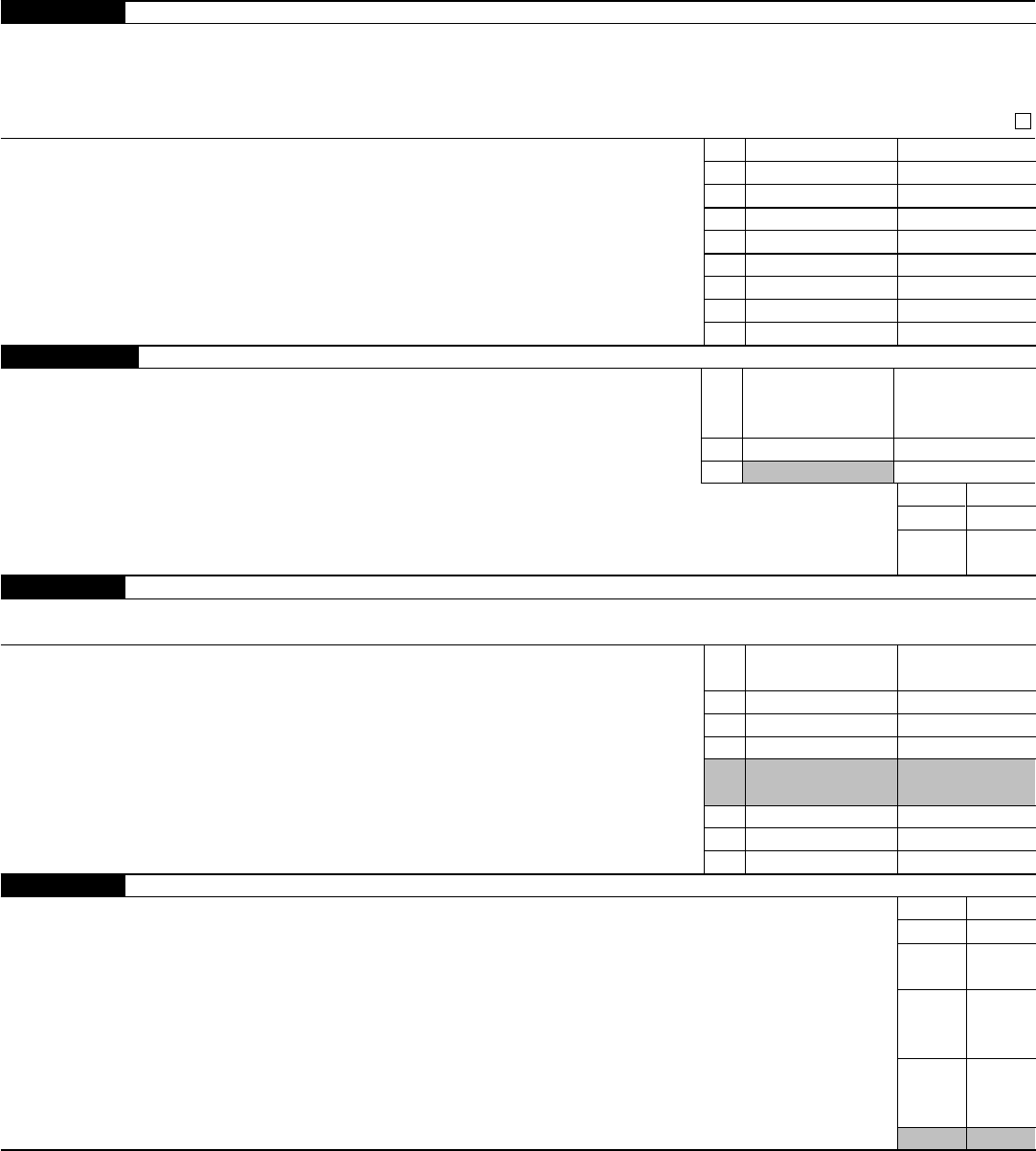

20182020 Form IRS 8858 Fill Online, Printable, Fillable, Blank PDFfiller

Us taxpayers with an ownership interest in unincorporated foreign businesses (such as foreign sole proprietorships, partnerships, and. Persons that own a foreign disregarded entity (fde) directly or, in certain circumstances,. Form 8858 is used by certain u.s. Person that is required to file schedule m (form 8858) (see who must file, earlier) must file the schedule to report the transactions.

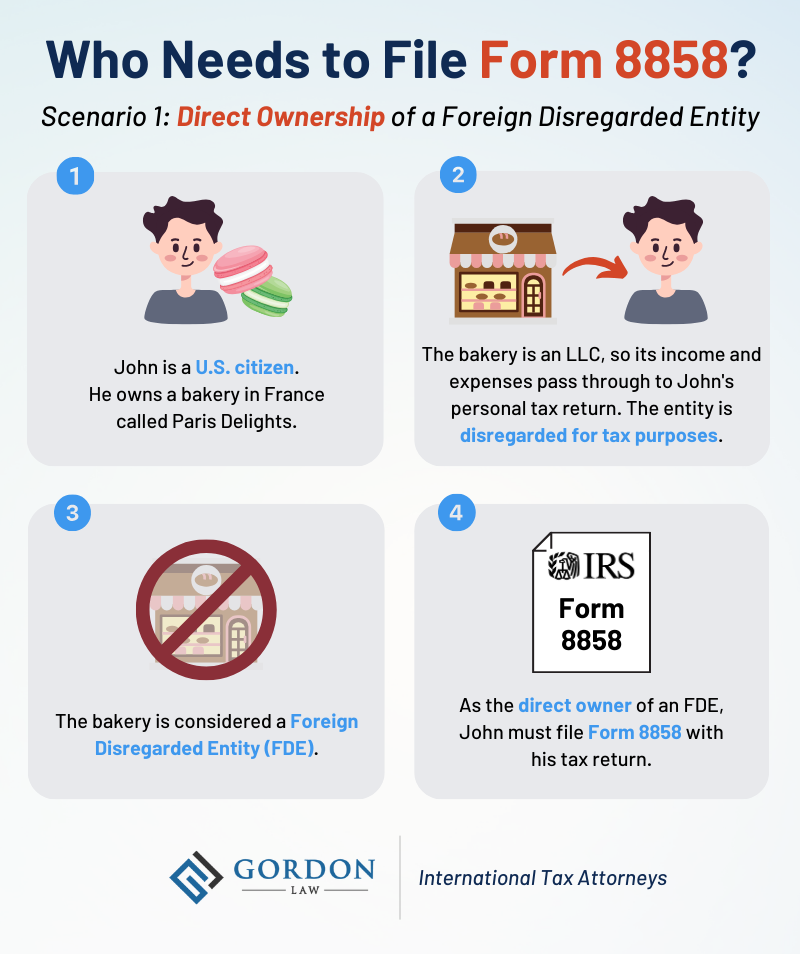

Form 8858 Overview Who Needs to File (with Examples) Gordon Law

Person that is required to file schedule m (form 8858) (see who must file, earlier) must file the schedule to report the transactions that. Us taxpayers with an ownership interest in unincorporated foreign businesses (such as foreign sole proprietorships, partnerships, and. Form 8858 is used by certain u.s. Persons that own a foreign disregarded entity (fde) directly or, in certain.

Form 8858 Fillable Printable Forms Free Online

Person that is required to file schedule m (form 8858) (see who must file, earlier) must file the schedule to report the transactions that. Us taxpayers with an ownership interest in unincorporated foreign businesses (such as foreign sole proprietorships, partnerships, and. Form 8858 is used by certain u.s. Persons that own a foreign disregarded entity (fde) directly or, in certain.

Form 8858 Edit, Fill, Sign Online Handypdf

Form 8858 is used by certain u.s. Us taxpayers with an ownership interest in unincorporated foreign businesses (such as foreign sole proprietorships, partnerships, and. Person that is required to file schedule m (form 8858) (see who must file, earlier) must file the schedule to report the transactions that. Persons that own a foreign disregarded entity (fde) directly or, in certain.

Form 8858 Fillable Printable Forms Free Online

Us taxpayers with an ownership interest in unincorporated foreign businesses (such as foreign sole proprietorships, partnerships, and. Person that is required to file schedule m (form 8858) (see who must file, earlier) must file the schedule to report the transactions that. Persons that own a foreign disregarded entity (fde) directly or, in certain circumstances,. Form 8858 is used by certain.

Form 8858 US Taxes on Foreign Disregarded Entities

Persons that own a foreign disregarded entity (fde) directly or, in certain circumstances,. Person that is required to file schedule m (form 8858) (see who must file, earlier) must file the schedule to report the transactions that. Form 8858 is used by certain u.s. Us taxpayers with an ownership interest in unincorporated foreign businesses (such as foreign sole proprietorships, partnerships,.

Form 8858 Reporting International Business Interests GlobalBanks

Form 8858 is used by certain u.s. Person that is required to file schedule m (form 8858) (see who must file, earlier) must file the schedule to report the transactions that. Us taxpayers with an ownership interest in unincorporated foreign businesses (such as foreign sole proprietorships, partnerships, and. Persons that own a foreign disregarded entity (fde) directly or, in certain.

Us Taxpayers With An Ownership Interest In Unincorporated Foreign Businesses (Such As Foreign Sole Proprietorships, Partnerships, And.

Form 8858 is used by certain u.s. Person that is required to file schedule m (form 8858) (see who must file, earlier) must file the schedule to report the transactions that. Persons that own a foreign disregarded entity (fde) directly or, in certain circumstances,.