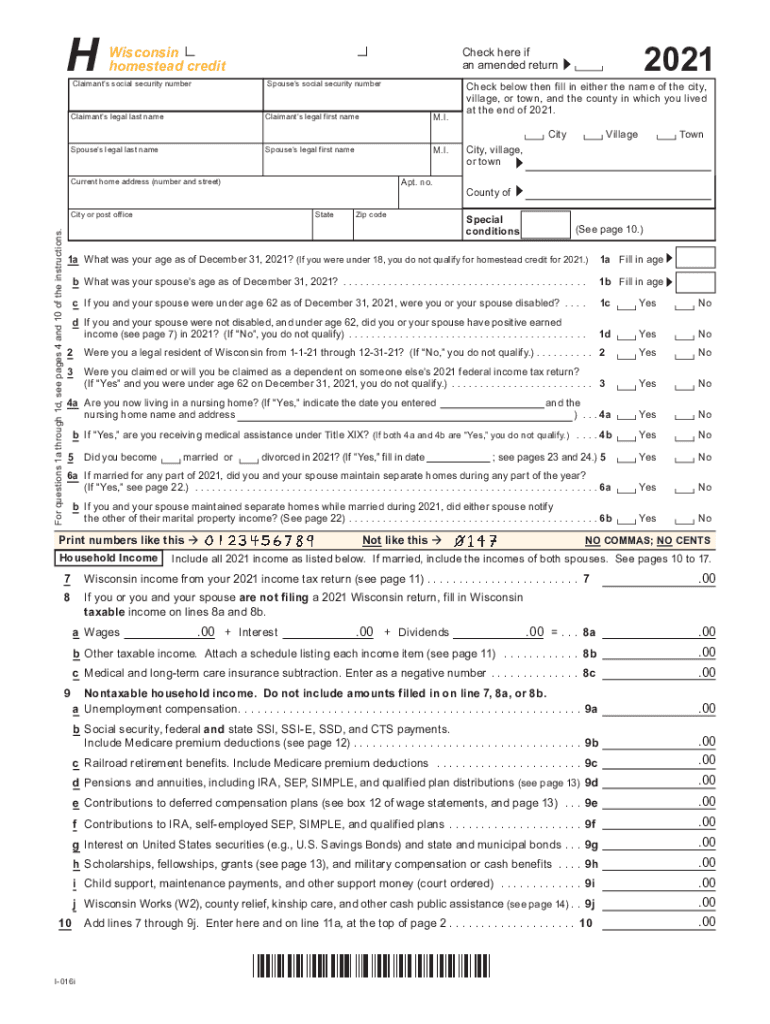

Wisconsin Homestead Credit Form 2021 - You may be able to claim homestead credit if: The wisconsin homestead credit is designed to lessen the impact of property taxes by providing a credit on the wisconsin state income tax. • you occupied and owned or rented a home, apartment, or other dwelling that is. • you owned or rented your home in 2021 • you were a legal resident of wisconsin from january 1. You can upload the pdf of your 2021 property tax bill (if you owned. You are a legal resident of wisconsin for all of 2021, from. The credit is based on property tax paid. In order to claim the homestead credit, you or your spouse must meet certain qualifications, including one of the following: To qualify for homestead credit for 2021 y ou must meet the following requirements: You may be able to claim homestead credit if:

To qualify for homestead credit for 2021 y ou must meet the following requirements: The wisconsin homestead credit is designed to lessen the impact of property taxes by providing a credit on the wisconsin state income tax. The credit is based on property tax paid. In order to claim the homestead credit, you or your spouse must meet certain qualifications, including one of the following: • you occupied and owned or rented a home, apartment, or other dwelling that is. You may be able to claim homestead credit if: You can upload the pdf of your 2021 property tax bill (if you owned. You are a legal resident of wisconsin for all of 2021, from. • you owned or rented your home in 2021 • you were a legal resident of wisconsin from january 1. You may be able to claim homestead credit if:

To qualify for homestead credit for 2021 y ou must meet the following requirements: You can upload the pdf of your 2021 property tax bill (if you owned. In order to claim the homestead credit, you or your spouse must meet certain qualifications, including one of the following: • you occupied and owned or rented a home, apartment, or other dwelling that is. You are a legal resident of wisconsin for all of 2021, from. • you owned or rented your home in 2021 • you were a legal resident of wisconsin from january 1. You may be able to claim homestead credit if: You may be able to claim homestead credit if: The wisconsin homestead credit is designed to lessen the impact of property taxes by providing a credit on the wisconsin state income tax. The credit is based on property tax paid.

2022 homestead form Fill out & sign online DocHub

You are a legal resident of wisconsin for all of 2021, from. • you occupied and owned or rented a home, apartment, or other dwelling that is. The wisconsin homestead credit is designed to lessen the impact of property taxes by providing a credit on the wisconsin state income tax. The credit is based on property tax paid. In order.

Fillable Online Provider Homestead Tax Credit Wisconsin Dept. Of

You are a legal resident of wisconsin for all of 2021, from. To qualify for homestead credit for 2021 y ou must meet the following requirements: You may be able to claim homestead credit if: In order to claim the homestead credit, you or your spouse must meet certain qualifications, including one of the following: You can upload the pdf.

2023 Wisconsin Tax Form Printable Forms Free Online

The credit is based on property tax paid. You are a legal resident of wisconsin for all of 2021, from. • you occupied and owned or rented a home, apartment, or other dwelling that is. To qualify for homestead credit for 2021 y ou must meet the following requirements: In order to claim the homestead credit, you or your spouse.

Fill Free fillable Form I016 Wisconsin homestead credit form 2019

In order to claim the homestead credit, you or your spouse must meet certain qualifications, including one of the following: The wisconsin homestead credit is designed to lessen the impact of property taxes by providing a credit on the wisconsin state income tax. • you owned or rented your home in 2021 • you were a legal resident of wisconsin.

Wisconsin homestead credit calculator Fill out & sign online DocHub

You may be able to claim homestead credit if: To qualify for homestead credit for 2021 y ou must meet the following requirements: The credit is based on property tax paid. The wisconsin homestead credit is designed to lessen the impact of property taxes by providing a credit on the wisconsin state income tax. In order to claim the homestead.

20132021 Form WI Rent Certificate Fill Online, Printable, Fillable

You may be able to claim homestead credit if: You can upload the pdf of your 2021 property tax bill (if you owned. The credit is based on property tax paid. • you owned or rented your home in 2021 • you were a legal resident of wisconsin from january 1. In order to claim the homestead credit, you or.

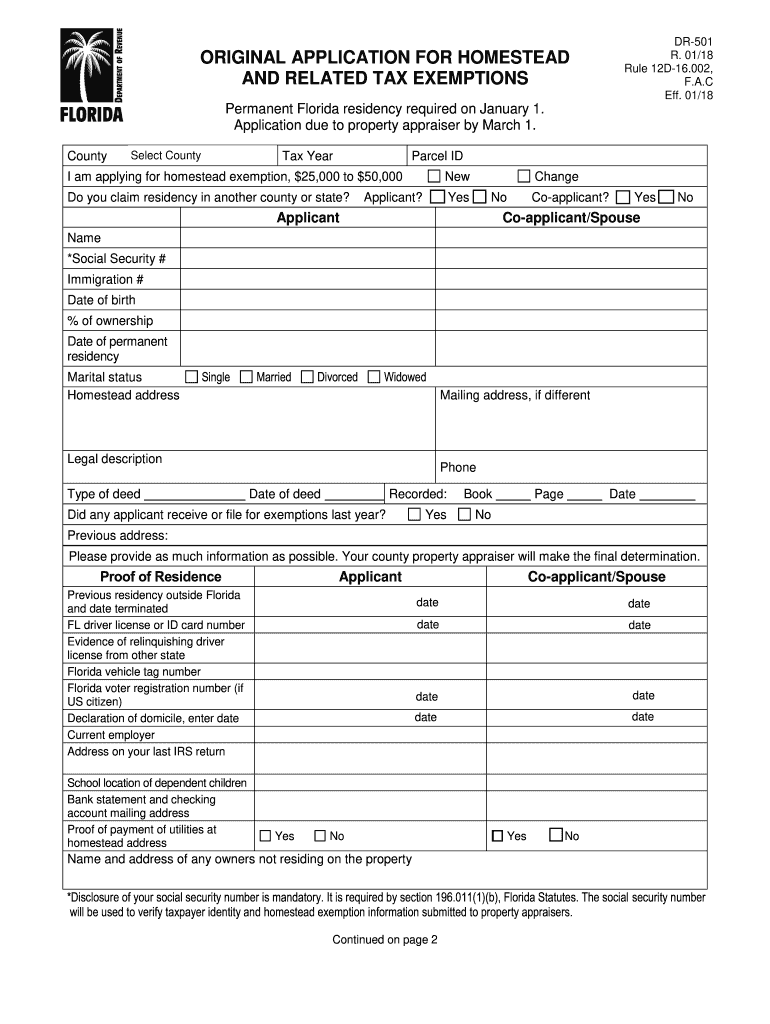

Hillsborough County Homestead Application 20182024 Form Fill Out and

You are a legal resident of wisconsin for all of 2021, from. You may be able to claim homestead credit if: The wisconsin homestead credit is designed to lessen the impact of property taxes by providing a credit on the wisconsin state income tax. In order to claim the homestead credit, you or your spouse must meet certain qualifications, including.

Wisconsin Homestead Credit PDF Form FormsPal

You may be able to claim homestead credit if: You can upload the pdf of your 2021 property tax bill (if you owned. In order to claim the homestead credit, you or your spouse must meet certain qualifications, including one of the following: • you occupied and owned or rented a home, apartment, or other dwelling that is. • you.

2018 Form WI I016a Fill Online, Printable, Fillable, Blank pdfFiller

• you owned or rented your home in 2021 • you were a legal resident of wisconsin from january 1. You may be able to claim homestead credit if: To qualify for homestead credit for 2021 y ou must meet the following requirements: You may be able to claim homestead credit if: You can upload the pdf of your 2021.

Fill Free fillable forms for the state of Wisconsin

• you occupied and owned or rented a home, apartment, or other dwelling that is. The wisconsin homestead credit is designed to lessen the impact of property taxes by providing a credit on the wisconsin state income tax. To qualify for homestead credit for 2021 y ou must meet the following requirements: The credit is based on property tax paid..

You May Be Able To Claim Homestead Credit If:

In order to claim the homestead credit, you or your spouse must meet certain qualifications, including one of the following: You may be able to claim homestead credit if: To qualify for homestead credit for 2021 y ou must meet the following requirements: • you occupied and owned or rented a home, apartment, or other dwelling that is.

You Are A Legal Resident Of Wisconsin For All Of 2021, From.

The credit is based on property tax paid. The wisconsin homestead credit is designed to lessen the impact of property taxes by providing a credit on the wisconsin state income tax. You can upload the pdf of your 2021 property tax bill (if you owned. • you owned or rented your home in 2021 • you were a legal resident of wisconsin from january 1.