Arkansas Tax Withholding Form - File this form with your employer. Adobe reader may be required for your browser or you. Some internet browsers have a built in pdf viewer that may not be compatible with our forms. Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. File this form with your employer. Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. Combined registration p o box 8123 little. File this form with your employer. Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. If you obtain a new ein, please close the old account and complete a.

Combined registration p o box 8123 little. File this form with your employer. Adobe reader may be required for your browser or you. File this form with your employer. Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. File this form with your employer. Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. If you obtain a new ein, please close the old account and complete a. Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. Some internet browsers have a built in pdf viewer that may not be compatible with our forms.

File this form with your employer. File this form with your employer. Combined registration p o box 8123 little. Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. Some internet browsers have a built in pdf viewer that may not be compatible with our forms. Adobe reader may be required for your browser or you. If you obtain a new ein, please close the old account and complete a. Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. File this form with your employer.

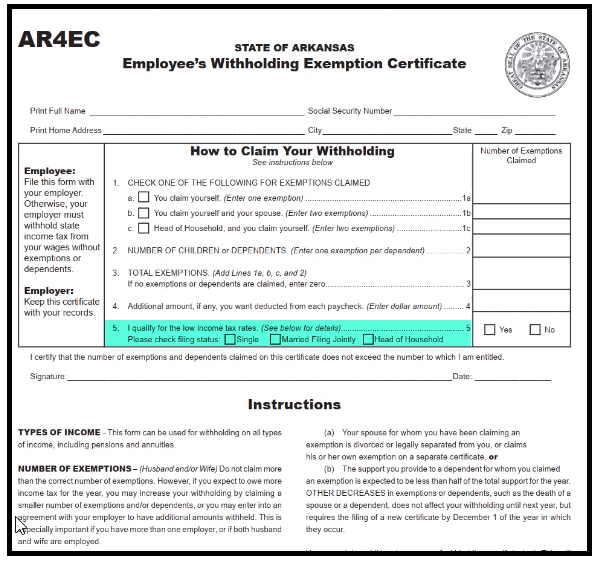

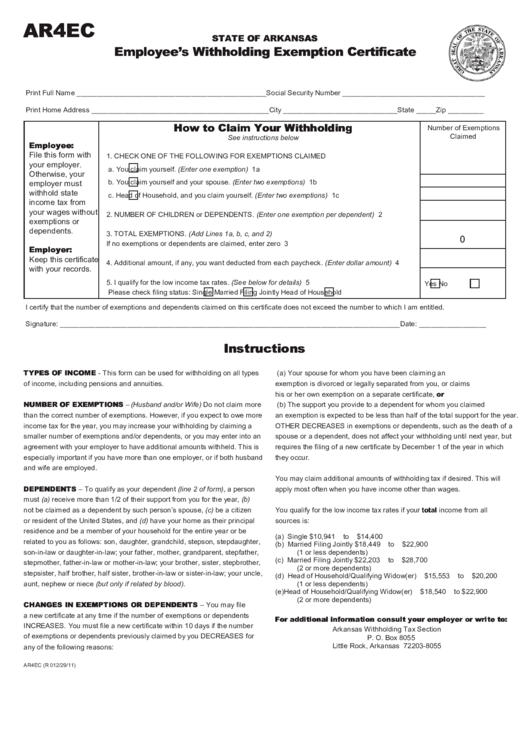

Employee's Withholding Exemption Certificate Arkansas Free Download

If you obtain a new ein, please close the old account and complete a. File this form with your employer. Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. Combined registration p o box 8123 little. File this form with your employer.

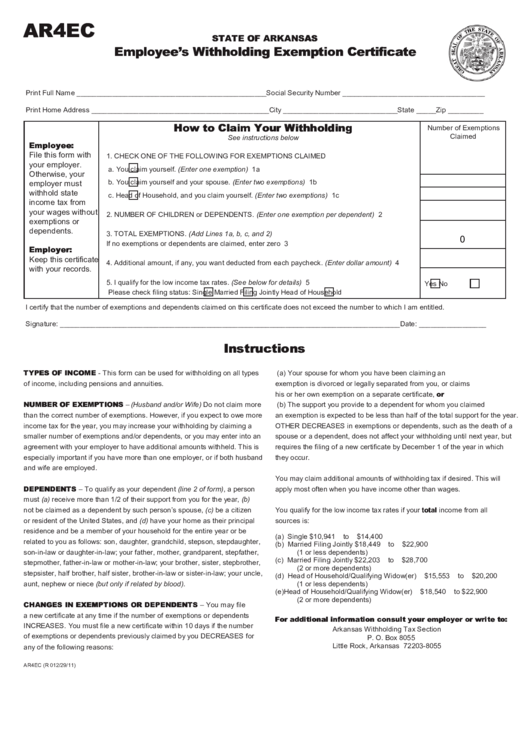

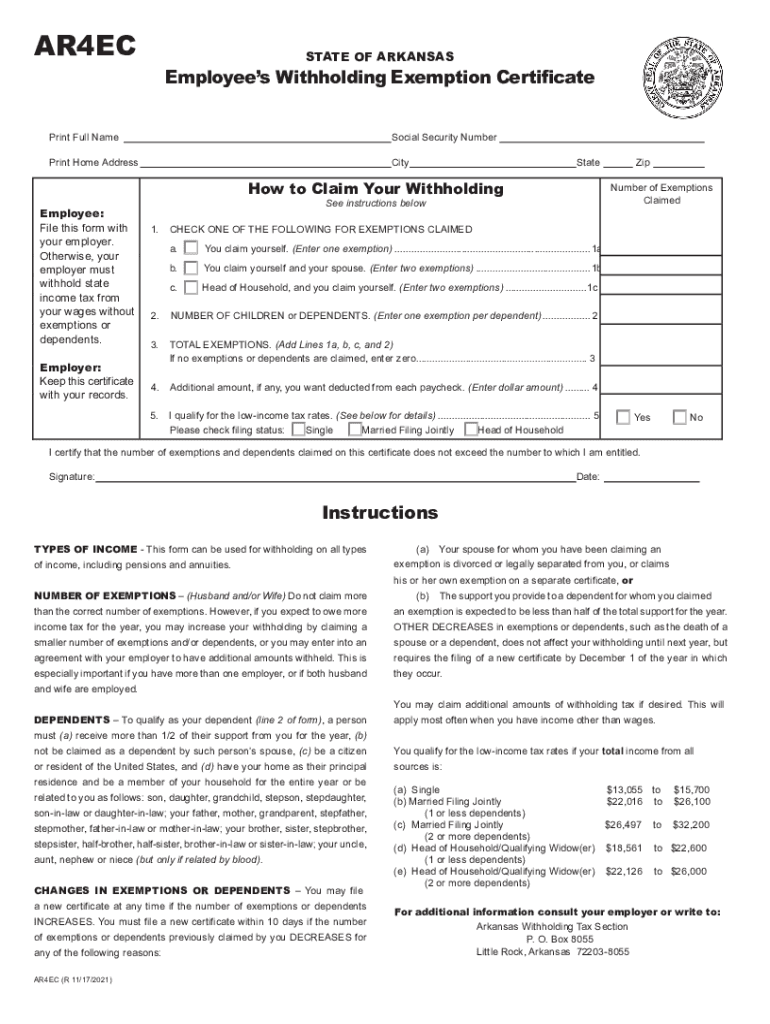

2023 Arkansas Withholding Form Printable Forms Free Online

Some internet browsers have a built in pdf viewer that may not be compatible with our forms. File this form with your employer. If you obtain a new ein, please close the old account and complete a. Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. Adobe reader may be required for your browser.

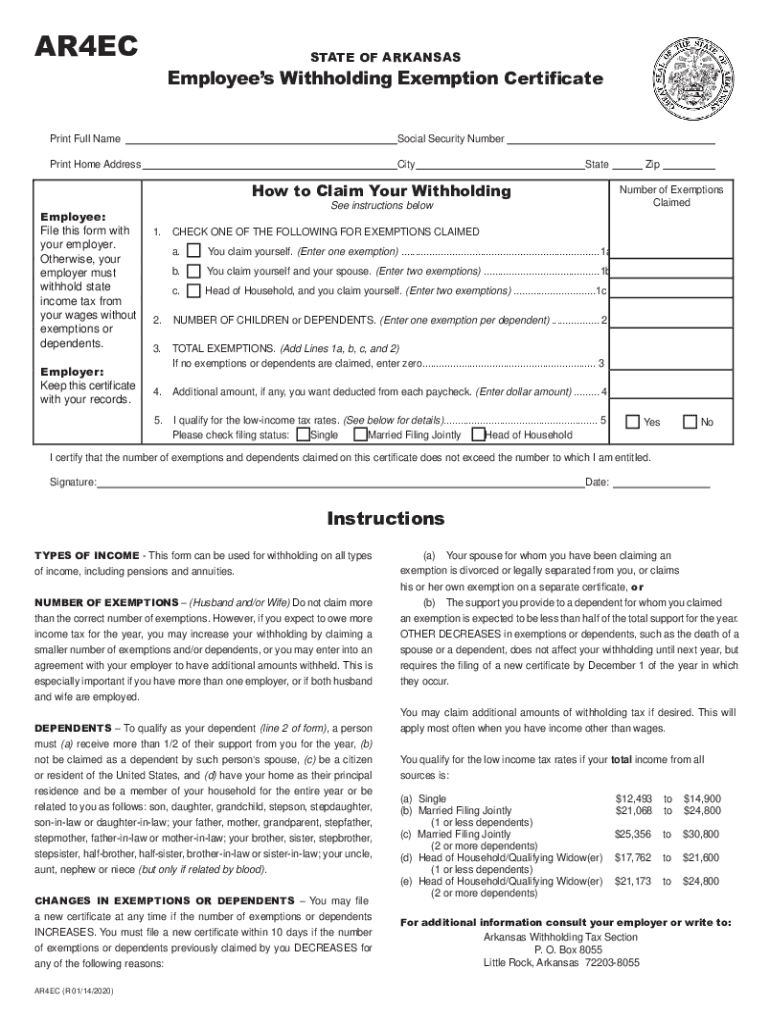

Arkansas Withholding Tax Form 2022

Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. File this form with your employer. Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. File this form with your employer. Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents.

Fillable State Of Arkansas Employee's Withholding Exemption Certificate

If you obtain a new ein, please close the old account and complete a. Combined registration p o box 8123 little. File this form with your employer. Adobe reader may be required for your browser or you. Some internet browsers have a built in pdf viewer that may not be compatible with our forms.

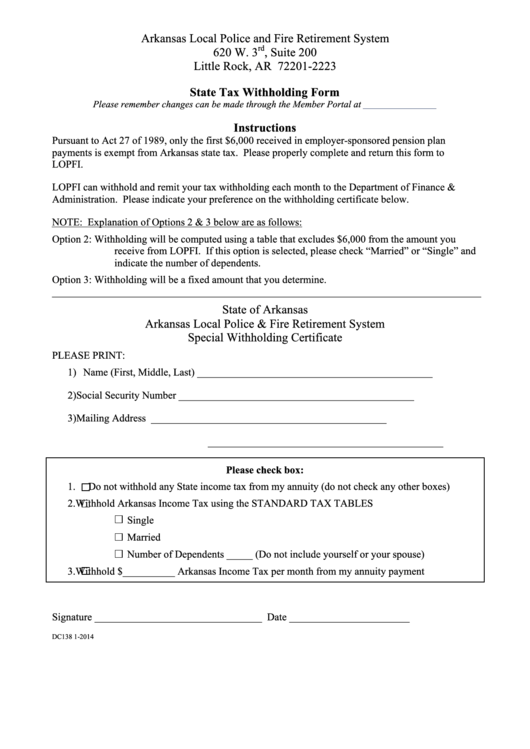

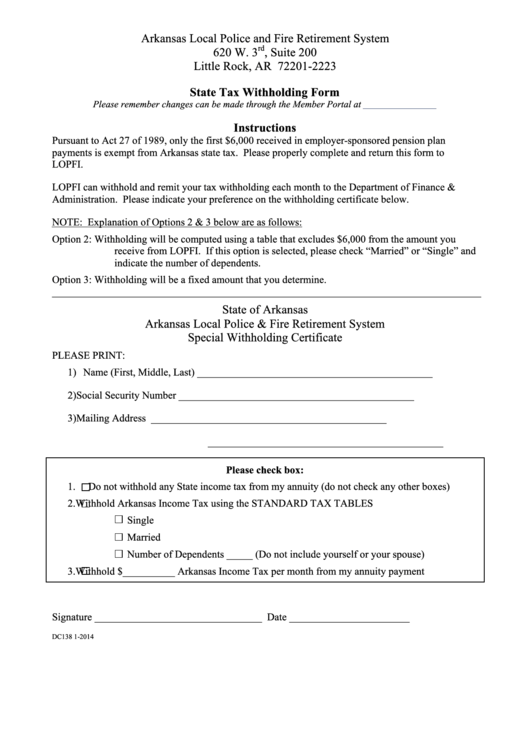

Fillable Arkansas State Tax Withholding Form printable pdf download

Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. Adobe reader may be required for your browser or you. Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. File this form with your.

Ar State Tax Forms Printable Printable Forms Free Online

Some internet browsers have a built in pdf viewer that may not be compatible with our forms. File this form with your employer. Adobe reader may be required for your browser or you. Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. Otherwise, your employer must withhold state income tax from your wages without.

Arkansas Withholding Tax Form 2022

Combined registration p o box 8123 little. File this form with your employer. Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. File this form with your employer. If you obtain a new ein, please close the old account and complete a.

Arkansas State Withholding Tables 2024 Aggi Kizzee

Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. Adobe reader may be required for your browser or you. Some internet browsers have a built in pdf viewer that may not be compatible with our forms. File this form with your employer. Combined registration p o box 8123 little.

Arkansas Withholding Form 2023 Printable Forms Free Online

File this form with your employer. Adobe reader may be required for your browser or you. Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. Combined registration p o box 8123 little. Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents.

Arkansas State Tax Withholding Form 2023 Printable Forms Free Online

Adobe reader may be required for your browser or you. If you obtain a new ein, please close the old account and complete a. Combined registration p o box 8123 little. Some internet browsers have a built in pdf viewer that may not be compatible with our forms. Otherwise, your employer must withhold state income tax from your wages without.

File This Form With Your Employer.

Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. Combined registration p o box 8123 little. File this form with your employer. If you obtain a new ein, please close the old account and complete a.

Otherwise, Your Employer Must Withhold State Income Tax From Your Wages Without Exemptions Or Dependents.

Adobe reader may be required for your browser or you. File this form with your employer. Some internet browsers have a built in pdf viewer that may not be compatible with our forms. Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents.