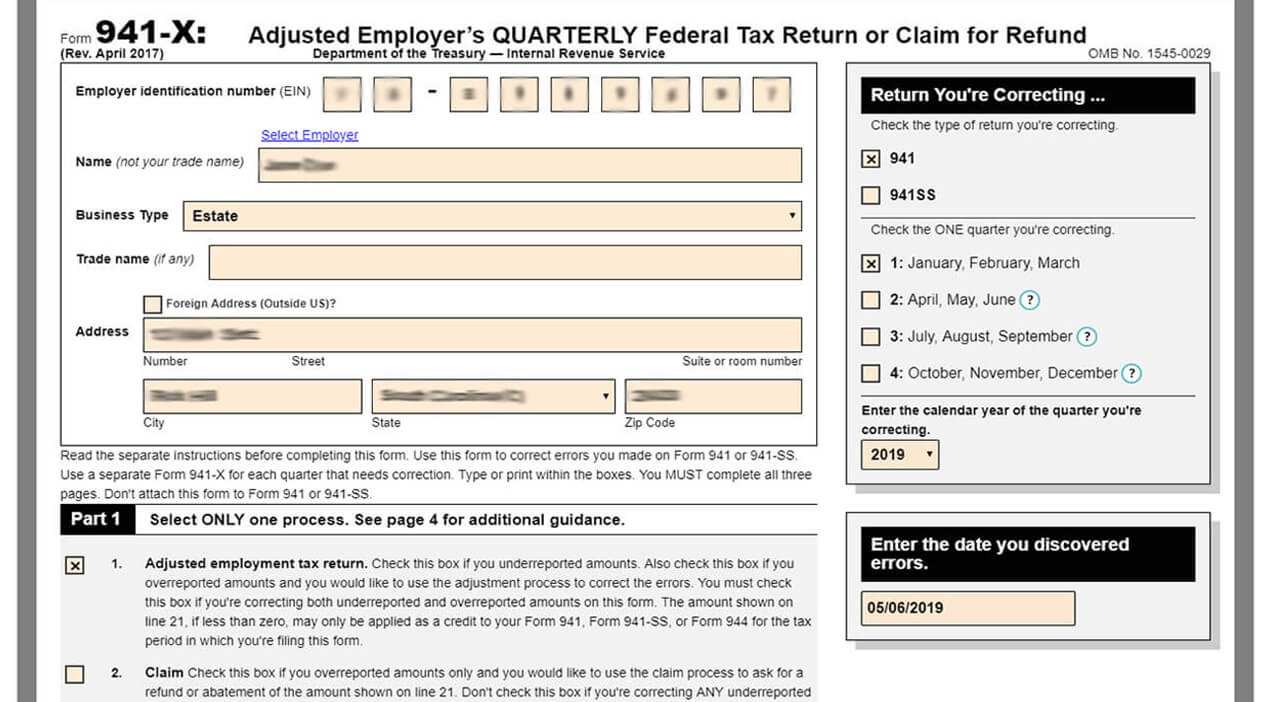

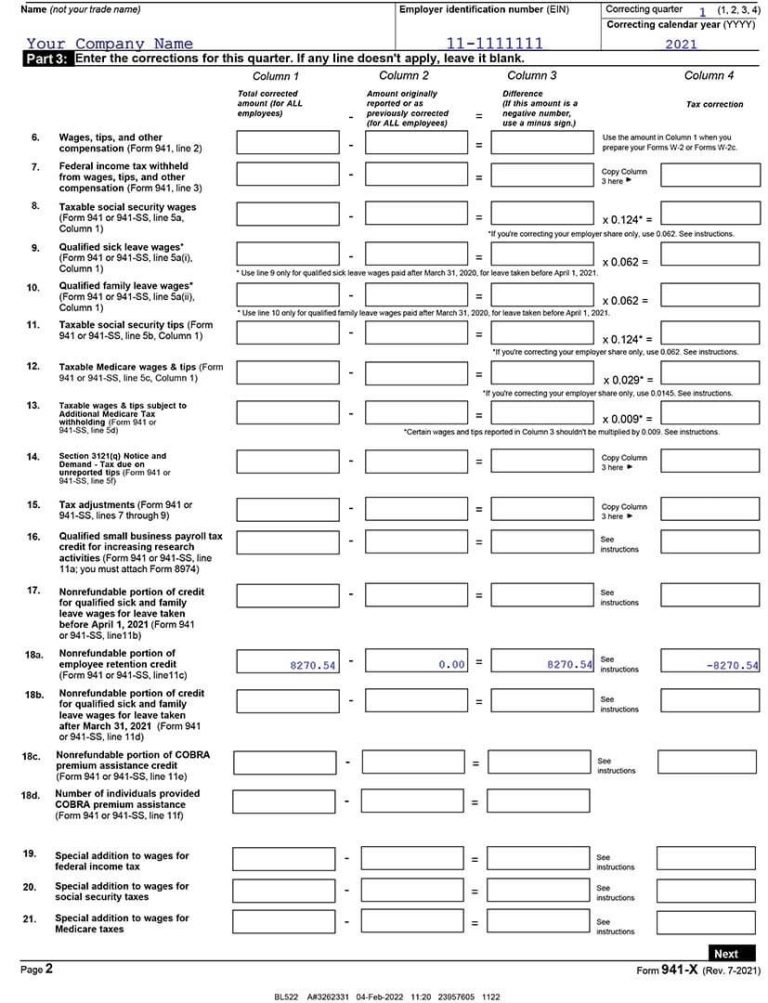

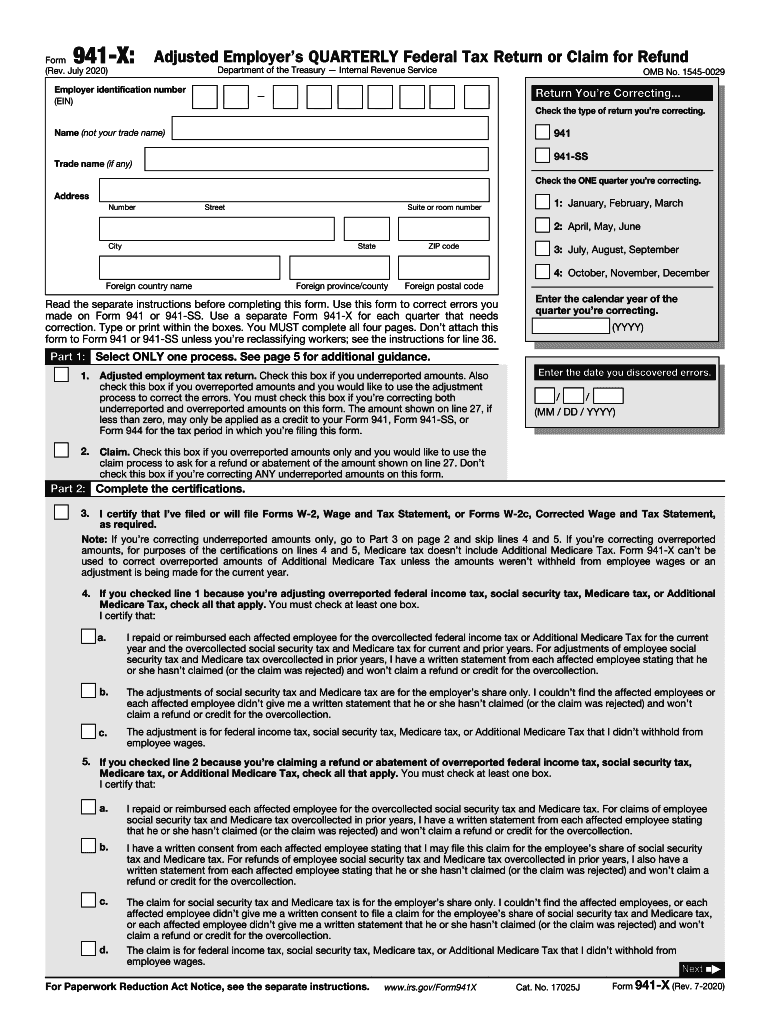

Form 941 X Erc Example - You determined that your company is eligible for the employee retention credit (“erc”). Complete the company name and corresponding information on each page, including your employee identification number. Download the 941 worksheet 1 here. When reporting a negative amount in columns 3 and 4, use a minus sign instead of parentheses.

You determined that your company is eligible for the employee retention credit (“erc”). Complete the company name and corresponding information on each page, including your employee identification number. Download the 941 worksheet 1 here. When reporting a negative amount in columns 3 and 4, use a minus sign instead of parentheses.

When reporting a negative amount in columns 3 and 4, use a minus sign instead of parentheses. Download the 941 worksheet 1 here. Complete the company name and corresponding information on each page, including your employee identification number. You determined that your company is eligible for the employee retention credit (“erc”).

Form 941 Erc Worksheet 1 Fillable Form

When reporting a negative amount in columns 3 and 4, use a minus sign instead of parentheses. Download the 941 worksheet 1 here. You determined that your company is eligible for the employee retention credit (“erc”). Complete the company name and corresponding information on each page, including your employee identification number.

941 X Worksheet 2 Fillable Form Fillable Form 2024

Complete the company name and corresponding information on each page, including your employee identification number. You determined that your company is eligible for the employee retention credit (“erc”). Download the 941 worksheet 1 here. When reporting a negative amount in columns 3 and 4, use a minus sign instead of parentheses.

Form 941 Erc Worksheet 1 Fillable Form

When reporting a negative amount in columns 3 and 4, use a minus sign instead of parentheses. You determined that your company is eligible for the employee retention credit (“erc”). Complete the company name and corresponding information on each page, including your employee identification number. Download the 941 worksheet 1 here.

941 X Fill Online, Printable, Fillable, Blank pdfFiller

Download the 941 worksheet 1 here. You determined that your company is eligible for the employee retention credit (“erc”). When reporting a negative amount in columns 3 and 4, use a minus sign instead of parentheses. Complete the company name and corresponding information on each page, including your employee identification number.

Fillable IRS Form 941X Printable PDF Sample FormSwift

Download the 941 worksheet 1 here. You determined that your company is eligible for the employee retention credit (“erc”). When reporting a negative amount in columns 3 and 4, use a minus sign instead of parentheses. Complete the company name and corresponding information on each page, including your employee identification number.

Sample Form 941x For Erc

You determined that your company is eligible for the employee retention credit (“erc”). When reporting a negative amount in columns 3 and 4, use a minus sign instead of parentheses. Download the 941 worksheet 1 here. Complete the company name and corresponding information on each page, including your employee identification number.

Update on IRS’s Backlog of Unprocessed ERC Claims

Complete the company name and corresponding information on each page, including your employee identification number. Download the 941 worksheet 1 here. When reporting a negative amount in columns 3 and 4, use a minus sign instead of parentheses. You determined that your company is eligible for the employee retention credit (“erc”).

Maximizing Erc Tips For Filing Form 941X ERC Services

When reporting a negative amount in columns 3 and 4, use a minus sign instead of parentheses. You determined that your company is eligible for the employee retention credit (“erc”). Complete the company name and corresponding information on each page, including your employee identification number. Download the 941 worksheet 1 here.

How To Fill Out Form 941X For The ERC Merchant Maverick

Download the 941 worksheet 1 here. You determined that your company is eligible for the employee retention credit (“erc”). When reporting a negative amount in columns 3 and 4, use a minus sign instead of parentheses. Complete the company name and corresponding information on each page, including your employee identification number.

For Retro ERC, Use Form 941X Crippen

You determined that your company is eligible for the employee retention credit (“erc”). Complete the company name and corresponding information on each page, including your employee identification number. When reporting a negative amount in columns 3 and 4, use a minus sign instead of parentheses. Download the 941 worksheet 1 here.

You Determined That Your Company Is Eligible For The Employee Retention Credit (“Erc”).

Download the 941 worksheet 1 here. When reporting a negative amount in columns 3 and 4, use a minus sign instead of parentheses. Complete the company name and corresponding information on each page, including your employee identification number.