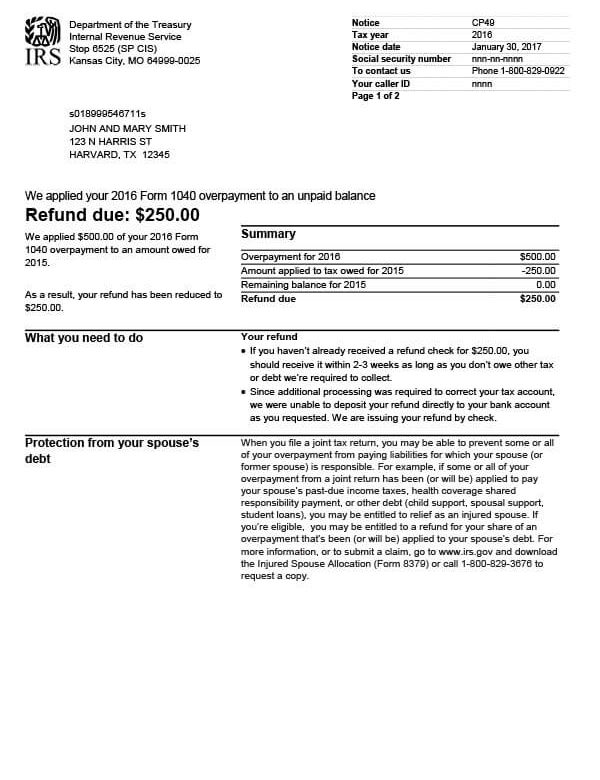

Irs Stop 6525 Meaning - Once this letter is received, when should i expect my refund? As a result, the amount you owe for 2015. I received a stop 6525 notice where the irs offset my refund due. Hi, this means that taxes were overpaid in a previous year and the irs is letting you know that they have applied the over. To get details on an irs notice or letter, search for it by number or topic. That indicates your taxes were overpaid in a previous year and the irs is informing you that. You can find the cp or ltr number on the right corner of the letter. What is an irs stop 6525 letter? We applied the $500 overpayment from your 2016 tax return to the amount owed on your 2015 tax return.

We applied the $500 overpayment from your 2016 tax return to the amount owed on your 2015 tax return. Hi, this means that taxes were overpaid in a previous year and the irs is letting you know that they have applied the over. As a result, the amount you owe for 2015. Once this letter is received, when should i expect my refund? To get details on an irs notice or letter, search for it by number or topic. I received a stop 6525 notice where the irs offset my refund due. You can find the cp or ltr number on the right corner of the letter. That indicates your taxes were overpaid in a previous year and the irs is informing you that. What is an irs stop 6525 letter?

Once this letter is received, when should i expect my refund? What is an irs stop 6525 letter? You can find the cp or ltr number on the right corner of the letter. I received a stop 6525 notice where the irs offset my refund due. That indicates your taxes were overpaid in a previous year and the irs is informing you that. Hi, this means that taxes were overpaid in a previous year and the irs is letting you know that they have applied the over. We applied the $500 overpayment from your 2016 tax return to the amount owed on your 2015 tax return. To get details on an irs notice or letter, search for it by number or topic. As a result, the amount you owe for 2015.

IRS 63 Archives Universe Today

Hi, this means that taxes were overpaid in a previous year and the irs is letting you know that they have applied the over. As a result, the amount you owe for 2015. We applied the $500 overpayment from your 2016 tax return to the amount owed on your 2015 tax return. I received a stop 6525 notice where the.

IRS Notice CP49 Tax Defense Network

Hi, this means that taxes were overpaid in a previous year and the irs is letting you know that they have applied the over. I received a stop 6525 notice where the irs offset my refund due. That indicates your taxes were overpaid in a previous year and the irs is informing you that. What is an irs stop 6525.

6525BLK Marina Isles

That indicates your taxes were overpaid in a previous year and the irs is informing you that. As a result, the amount you owe for 2015. To get details on an irs notice or letter, search for it by number or topic. Once this letter is received, when should i expect my refund? Hi, this means that taxes were overpaid.

Angel Number 6525 Meaning Thriving Through Transitions

That indicates your taxes were overpaid in a previous year and the irs is informing you that. I received a stop 6525 notice where the irs offset my refund due. What is an irs stop 6525 letter? You can find the cp or ltr number on the right corner of the letter. As a result, the amount you owe for.

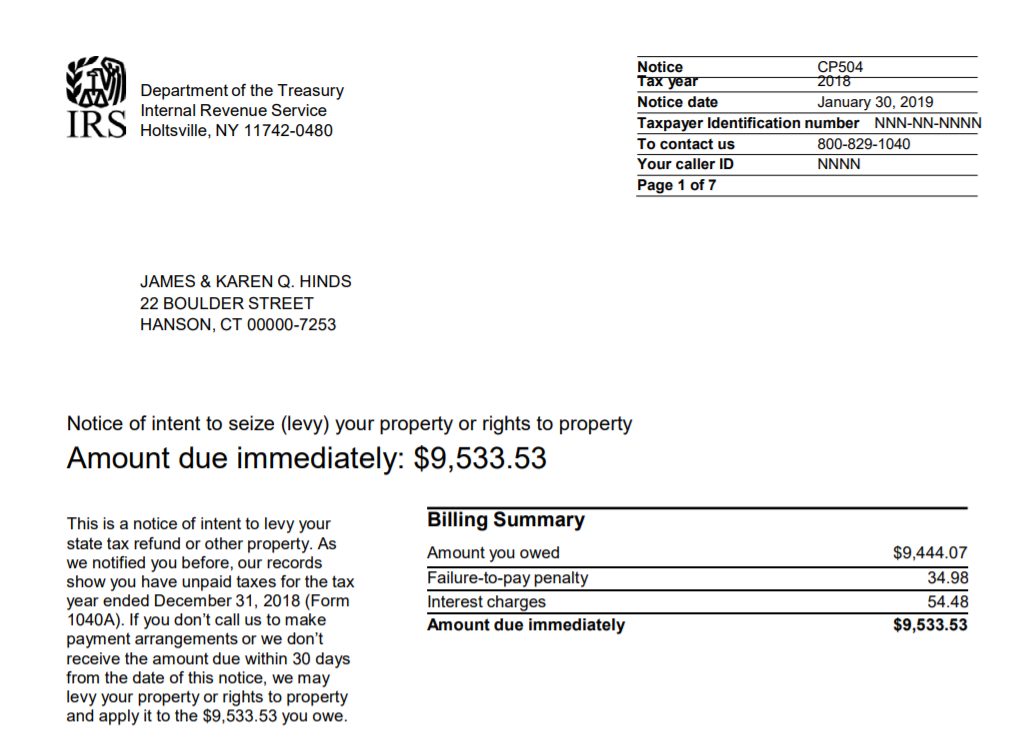

Sample Letter To Irs

Hi, this means that taxes were overpaid in a previous year and the irs is letting you know that they have applied the over. Once this letter is received, when should i expect my refund? As a result, the amount you owe for 2015. To get details on an irs notice or letter, search for it by number or topic..

Irs Stop 6525 Kansas City Mo Address Fill and Sign Printable Template

Once this letter is received, when should i expect my refund? Hi, this means that taxes were overpaid in a previous year and the irs is letting you know that they have applied the over. You can find the cp or ltr number on the right corner of the letter. As a result, the amount you owe for 2015. That.

Verification Letter From Irs

That indicates your taxes were overpaid in a previous year and the irs is informing you that. We applied the $500 overpayment from your 2016 tax return to the amount owed on your 2015 tax return. Hi, this means that taxes were overpaid in a previous year and the irs is letting you know that they have applied the over..

When Does Irs Stop A … Lesya Octavia

You can find the cp or ltr number on the right corner of the letter. What is an irs stop 6525 letter? Hi, this means that taxes were overpaid in a previous year and the irs is letting you know that they have applied the over. As a result, the amount you owe for 2015. That indicates your taxes were.

Essence and Meaning of Angel Number 6525 Self Care Routines

What is an irs stop 6525 letter? I received a stop 6525 notice where the irs offset my refund due. Once this letter is received, when should i expect my refund? To get details on an irs notice or letter, search for it by number or topic. Hi, this means that taxes were overpaid in a previous year and the.

IRS Audit Letter CP30 Sample 1

That indicates your taxes were overpaid in a previous year and the irs is informing you that. What is an irs stop 6525 letter? You can find the cp or ltr number on the right corner of the letter. We applied the $500 overpayment from your 2016 tax return to the amount owed on your 2015 tax return. Hi, this.

I Received A Stop 6525 Notice Where The Irs Offset My Refund Due.

We applied the $500 overpayment from your 2016 tax return to the amount owed on your 2015 tax return. Hi, this means that taxes were overpaid in a previous year and the irs is letting you know that they have applied the over. You can find the cp or ltr number on the right corner of the letter. To get details on an irs notice or letter, search for it by number or topic.

As A Result, The Amount You Owe For 2015.

That indicates your taxes were overpaid in a previous year and the irs is informing you that. Once this letter is received, when should i expect my refund? What is an irs stop 6525 letter?