Where To Report Ira On Form 706 - You must file form 706 to report estate and/or gst tax within 9 months after the date of the decedent's death. If you are unable to file form. Deceased (died in late 2020) held stocks, etf’s, and mutual funds in his traditional and roth ira’s. 18, 2024) to determine which instructions to review and estate tax return to file, you must first.

You must file form 706 to report estate and/or gst tax within 9 months after the date of the decedent's death. If you are unable to file form. Deceased (died in late 2020) held stocks, etf’s, and mutual funds in his traditional and roth ira’s. 18, 2024) to determine which instructions to review and estate tax return to file, you must first.

18, 2024) to determine which instructions to review and estate tax return to file, you must first. Deceased (died in late 2020) held stocks, etf’s, and mutual funds in his traditional and roth ira’s. You must file form 706 to report estate and/or gst tax within 9 months after the date of the decedent's death. If you are unable to file form.

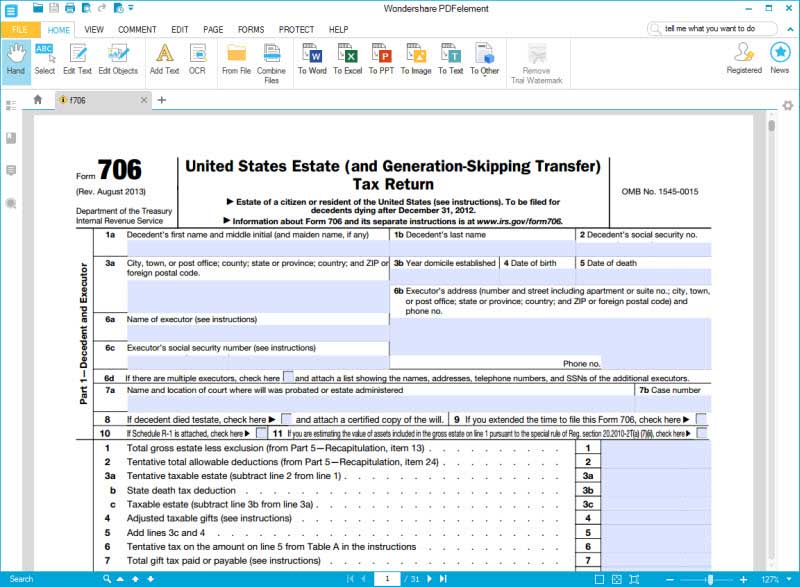

Form 706 Fillable Tax Return Templates in PDF

If you are unable to file form. 18, 2024) to determine which instructions to review and estate tax return to file, you must first. Deceased (died in late 2020) held stocks, etf’s, and mutual funds in his traditional and roth ira’s. You must file form 706 to report estate and/or gst tax within 9 months after the date of the.

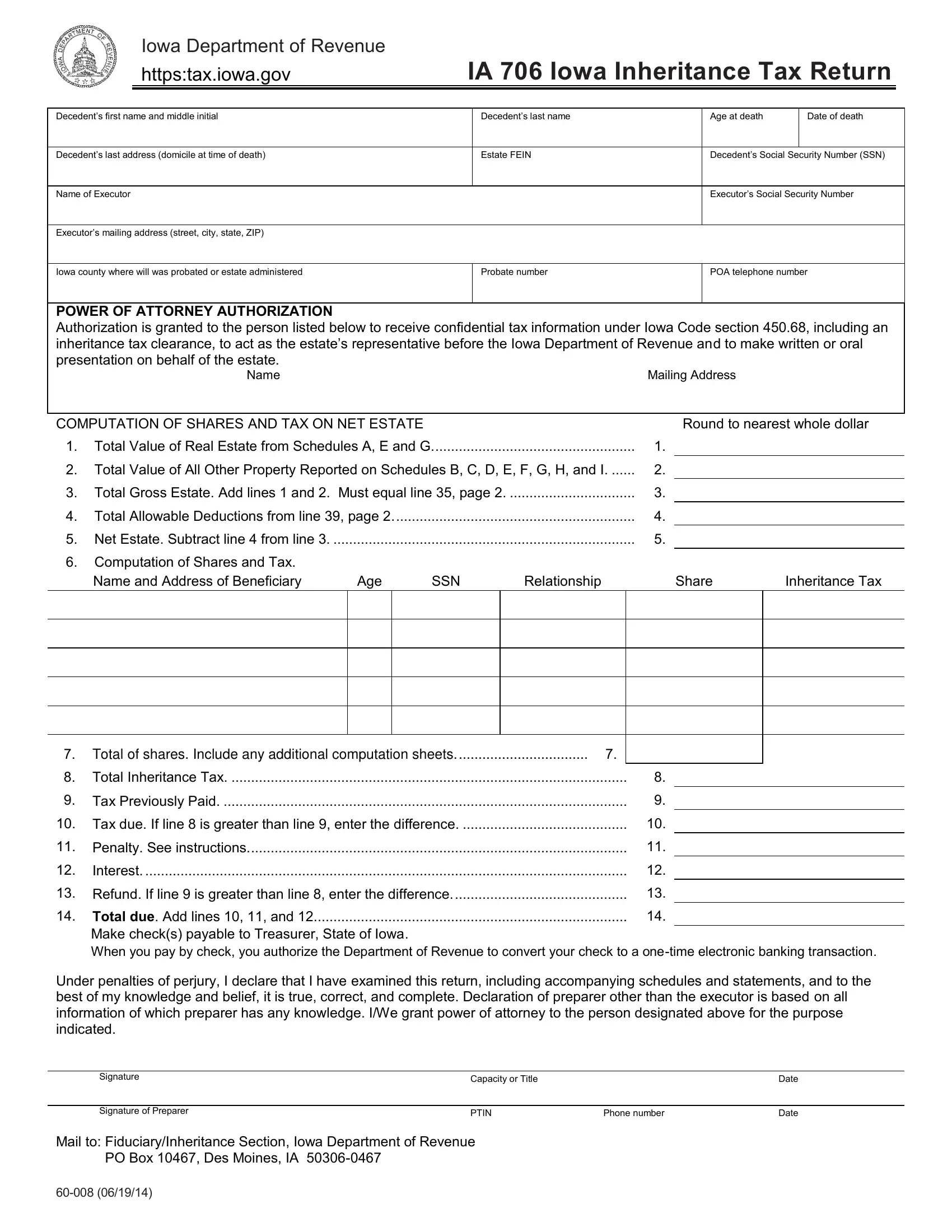

Form Ia 706 ≡ Fill Out Printable PDF Forms Online

If you are unable to file form. Deceased (died in late 2020) held stocks, etf’s, and mutual funds in his traditional and roth ira’s. 18, 2024) to determine which instructions to review and estate tax return to file, you must first. You must file form 706 to report estate and/or gst tax within 9 months after the date of the.

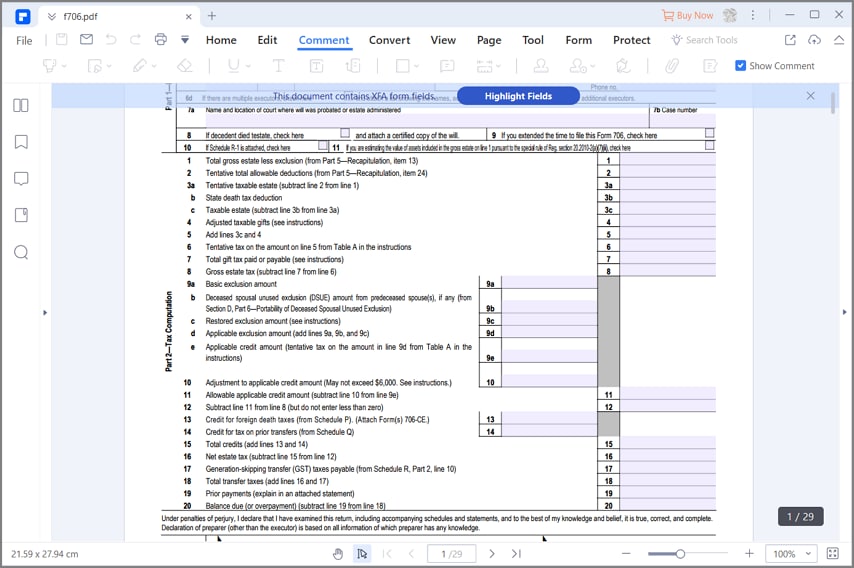

for How to Fill in IRS Form 706

18, 2024) to determine which instructions to review and estate tax return to file, you must first. You must file form 706 to report estate and/or gst tax within 9 months after the date of the decedent's death. Deceased (died in late 2020) held stocks, etf’s, and mutual funds in his traditional and roth ira’s. If you are unable to.

IRS Form 706 Fill Out, Sign Online and Download Fillable PDF

18, 2024) to determine which instructions to review and estate tax return to file, you must first. You must file form 706 to report estate and/or gst tax within 9 months after the date of the decedent's death. If you are unable to file form. Deceased (died in late 2020) held stocks, etf’s, and mutual funds in his traditional and.

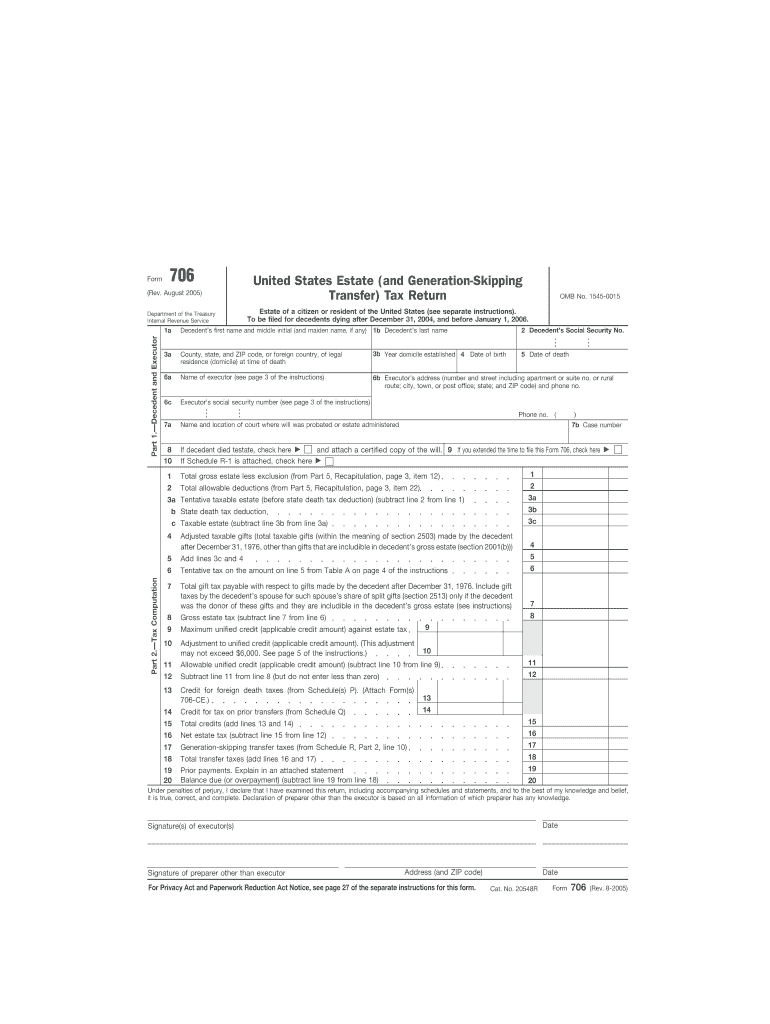

Form 706 Rev August Fill in Capable United States Estate and Generation

Deceased (died in late 2020) held stocks, etf’s, and mutual funds in his traditional and roth ira’s. If you are unable to file form. You must file form 706 to report estate and/or gst tax within 9 months after the date of the decedent's death. 18, 2024) to determine which instructions to review and estate tax return to file, you.

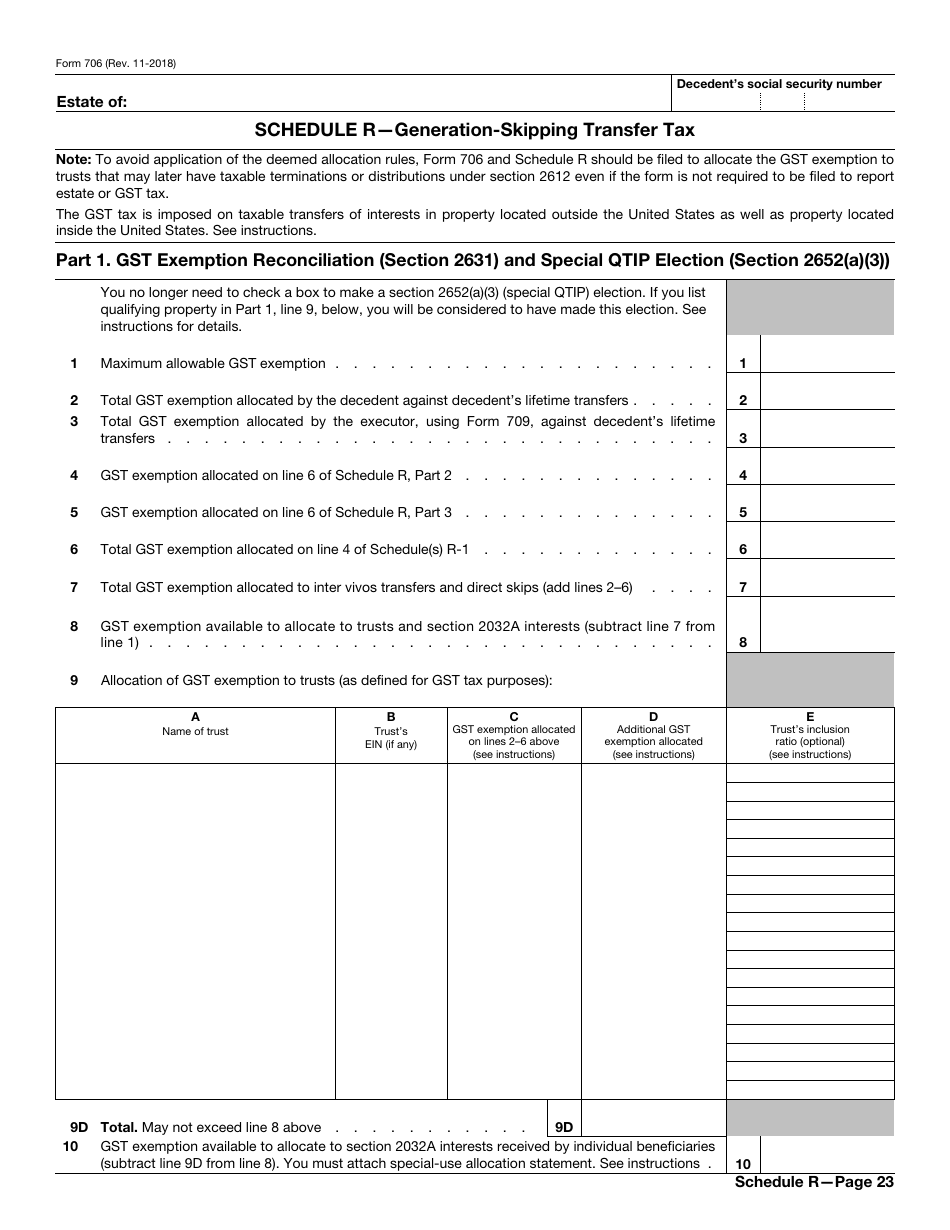

IRS Publication Form 706 Estate Tax In The United States Trust Law

18, 2024) to determine which instructions to review and estate tax return to file, you must first. If you are unable to file form. You must file form 706 to report estate and/or gst tax within 9 months after the date of the decedent's death. Deceased (died in late 2020) held stocks, etf’s, and mutual funds in his traditional and.

Irs Form 706 Na ≡ Fill Out Printable PDF Forms Online

If you are unable to file form. You must file form 706 to report estate and/or gst tax within 9 months after the date of the decedent's death. Deceased (died in late 2020) held stocks, etf’s, and mutual funds in his traditional and roth ira’s. 18, 2024) to determine which instructions to review and estate tax return to file, you.

form 706 instructions 2020 Fill Online, Printable, Fillable Blank

If you are unable to file form. Deceased (died in late 2020) held stocks, etf’s, and mutual funds in his traditional and roth ira’s. 18, 2024) to determine which instructions to review and estate tax return to file, you must first. You must file form 706 to report estate and/or gst tax within 9 months after the date of the.

Form 706A United States Additional Estate Tax Return (2013) Free

If you are unable to file form. You must file form 706 to report estate and/or gst tax within 9 months after the date of the decedent's death. 18, 2024) to determine which instructions to review and estate tax return to file, you must first. Deceased (died in late 2020) held stocks, etf’s, and mutual funds in his traditional and.

Instructions for How to Fill in IRS Form 706

If you are unable to file form. 18, 2024) to determine which instructions to review and estate tax return to file, you must first. Deceased (died in late 2020) held stocks, etf’s, and mutual funds in his traditional and roth ira’s. You must file form 706 to report estate and/or gst tax within 9 months after the date of the.

You Must File Form 706 To Report Estate And/Or Gst Tax Within 9 Months After The Date Of The Decedent's Death.

18, 2024) to determine which instructions to review and estate tax return to file, you must first. Deceased (died in late 2020) held stocks, etf’s, and mutual funds in his traditional and roth ira’s. If you are unable to file form.